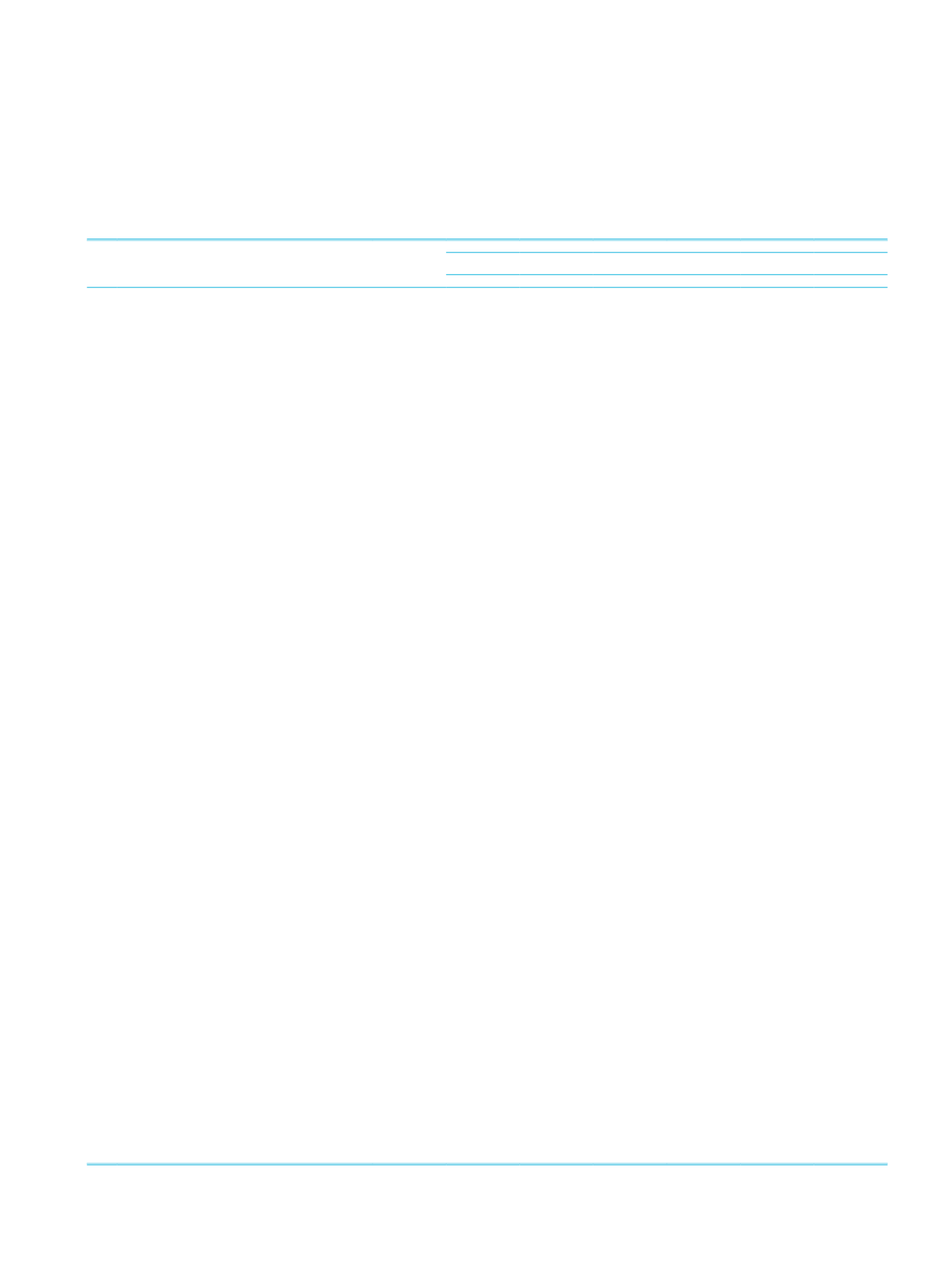

88

İŞBANK

ANNUAL REPORT 2014

TÜRKİYE İŞ BANKASI A.Ş.

Unconsolidated Financial Statements (Statement of Financial Position)

ASSETS

Footnotes

THOUSANDTL

CURRENTPERIOD

(31/12/2014)

PRIORPERIOD

(31/12/2013)

TL

FC

Total

TL

FC

Total

I.

CASHANDBALANCESWITHTHECENTRALBANK

V-I-a

4,730,670

19,876,036

24,606,706

5,223,115

17,804,420

23,027,535

II.

FINANCIALASSETSATFAIRVALUETHROUGHPROFITANDLOSS (Net)

V-I-b-c

437,771

800,484

1,238,255

917,552

1,286,006

2,203,558

2.1

Financial Assets Held for Trading

437,771

800,484

1,238,255

917,552

1,286,006

2,203,558

2.1.1 Government Debt Securities

253,812

10,254

264,066

883,996

5,901

889,897

2.1.2 Equity Securities

-

-

-

2

-

2

2.1.3 Derivative Financial Assets Held for Trading

183,079

790,230

973,309

32,468

1,280,105

1,312,573

2.1.4 Other Marketable Securities

880

-

880

1,086

-

1,086

2.2 Financial Assets at Fair Value Through Profit and Loss

-

-

-

-

-

-

2.2.1 Government Debt Securities

-

-

-

-

-

-

2.2.2 Equity Securities

-

-

-

-

-

-

2.2.3 Loans

-

-

-

-

-

-

2.2.4 Other Marketable Securities

-

-

-

-

-

-

III.

BANKS

V-I-d

131,918

1,261,303

1,393,221

115,202

1,412,408

1,527,610

IV.

MONEYMARKETPLACEMENTS

-

-

-

-

-

-

4.1

Interbank Money Market Placements

-

-

-

-

-

-

4.2 Istanbul Stock Exchange Money Market Placements

-

-

-

-

-

-

4.3 Receivables from Reverse Repurchase Agreements

-

-

-

-

-

-

V.

FINANCIALASSETSAVAILABLE-FOR-SALE (Net)

V-I-e-f

32,068,270

7,221,691

39,289,961

21,947,541

6,400,289

28,347,830

5.1

Equity Securities

33,663

252

33,915

27,833

252

28,085

5.2 Government Debt Securities

32,029,799

6,268,448

38,298,247

21,908,184

5,147,066

27,055,250

5.3 Other Marketable Securities

4,808

952,991

957,799

11,524

1,252,971

1,264,495

VI.

LOANSANDRECEIVABLES

V-I-g

100,962,900

54,911,378

155,874,278

87,553,358

47,727,663

135,281,021

6.1

Loans and Receivables

100,404,120

54,911,378

155,315,498

87,115,711

47,727,663

134,843,374

6.1.1 Loans to the Bank's Risk Group

719,854

728,773

1,448,627

737,844

783,201

1,521,045

6.1.2 Government Debt Securities

-

-

-

-

-

-

6.1.3 Other

99,684,266

54,182,605

153,866,871

86,377,867

46,944,462

133,322,329

6.2 Non-Performing Loans

2,419,720

851

2,420,571

2,236,248

1,544

2,237,792

6.3 Specific Provisions (-)

1,860,940

851

1,861,791

1,798,601

1,544

1,800,145

VII.

FACTORINGRECEIVABLES

-

-

-

-

-

-

VIII.

HELDTOMATURITY INVESTMENTS (Net)

V-I-h

1,250,097

51,007

1,301,104

7,611,751

15,697

7,627,448

8.1

Government Debt Securities

1,226,442

-

1,226,442

7,603,817

-

7,603,817

8.2 Other Marketable Securities

23,655

51,007

74,662

7,934

15,697

23,631

IX.

INVESTMENTS INASSOCIATES (Net)

V-I-i

783,195

-

783,195

743,915

-

743,915

9.1

Associates Accounted for Using the Equity Method

-

-

-

-

-

-

9.2 Unconsolidated Associates

783,195

-

783,195

743,915

-

743,915

9.2.1 Financial Investments

124,575

-

124,575

85,295

-

85,295

9.2.2 Non-Financial Investments

658,620

-

658,620

658,620

-

658,620

X.

INVESTMENTS INSUBSIDIARIES (Net)

V-I-j

8,425,466

416,311

8,841,777

6,600,545

416,311

7,016,856

10.1 Unconsolidated Financial Subsidiaries

3,705,844

416,311

4,122,155

3,278,397

416,311

3,694,708

10.2 Unconsolidated Non-Financial Subsidiaries

4,719,622

-

4,719,622

3,322,148

-

3,322,148

XI.

JOINTLYCONTROLLEDENTITIES (JOINTVENTURES) (Net)

V-I-k

-

-

-

-

-

-

11.1 Jointly Controlled Entities Accounted for Using the Equity Method

-

-

-

-

-

-

11.2 Unconsolidated Jointly Controlled Entities

-

-

-

-

-

-

11.2.1 Jointly Controlled Financial Entities

-

-

-

-

-

-

11.2.2 Jointly Controlled Non-Financial Entities

-

-

-

-

-

-

XII.

LEASERECEIVABLES

V-I-l

-

-

-

-

-

-

12.1 Finance Lease Receivables

-

-

-

-

-

-

12.2 Operating Lease Receivables

-

-

-

-

-

-

12.3 Other

-

-

-

-

-

-

12.4 Unearned Income (-)

-

-

-

-

-

-

XIII.

DERIVATIVEFINANCIALASSETSHELDFORHEDGING

V-I-m

-

-

-

-

-

-

13.1 Fair Value Hedges

-

-

-

-

-

-

13.2 Cash Flow Hedges

-

-

-

-

-

-

13.3 Net Foreign Investment Hedges

-

-

-

-

-

-

XIV.

TANGIBLEASSETS (Net)

V-I-n

1,890,082

11,708

1,901,790

1,825,513

6,093

1,831,606

XV.

INTANGIBLEASSETS (Net)

V-I-o

273,221

886

274,107

195,168

791

195,959

15.1 Goodwill

-

-

-

-

-

-

15.2 Other

273,221

886

274,107

195,168

791

195,959

XVI.

INVESTMENTPROPERTY (Net)

V-I-p

-

-

-

-

-

-

XVII.

TAXASSETS

V-I-r

526,236

478

526,714

538,521

71

538,592

17.1 Current Tax Assets

-

-

-

-

-

-

17.2 Deferred Tax Assets

526,236

478

526,714

538,521

71

538,592

XVIII.

ASSETSHELDFORSALEANDDISCONTINUEDOPERATIONS (Net)

V-I-s

60,361

-

60,361

62,639

-

62,639

18.1 Held for Sale

60,361

-

60,361

62,639

-

62,639

18.2 Discontinued Operations

-

-

-

-

-

-

XIX.

OTHERASSETS

V-I-t

1,214,494

466,012

1,680,506

1,122,096

973,372

2,095,468

TOTALASSETS

152,754,681

85,017,294

237,771,975

134,456,916

76,043,121

210,500,037