TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements for the Year Ended

31 December 2014

114

İŞBANK

ANNUAL REPORT 2014

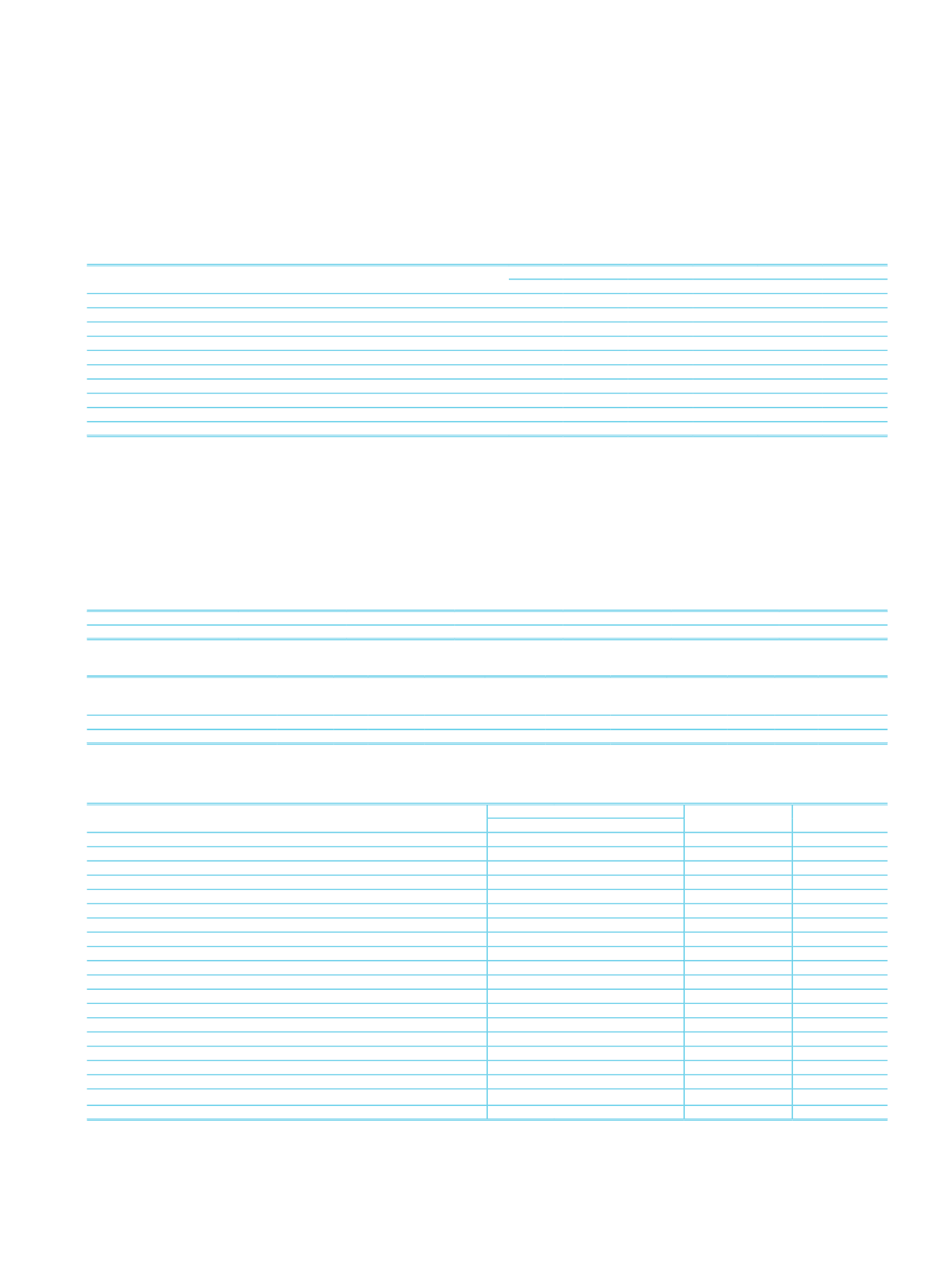

14. Analysis of maturity-bearing exposures according to remainingmaturities:

RiskGroups

TimetoMaturity

1Month 1-3Months 3-6Months 6-12Months Over1Year

Total

Contingent and Non-Contingent Receivables fromCentral Governments or Central Banks

490,220 782,747 1,392,539 1,264,085 37,572,830 41,502,421

Contingent and Non-Contingent Receivables fromRegional Governments or Domestic Governments

800

1,851

1,502

1,851

32,237

38,241

ContingentandNon-ContingentReceivablesfromAdministrativeUnitsandNon-CommercialEnterprises

1,542

5,752

9,143

57,372

65,424 139,233

Themultilateral development banks and non-contingent receivables

266

694

174

526

1,660

Contingent and Non-Contingent Receivables fromBanks and Intermediaries

2,627,181

530,185 704,954 538,497 3,662,718 8,063,535

Contingent and Non-Contingent Corporate Receivables

6,182,528 8,574,737 10,246,622 19,891,360 59,434,518 104,329,765

Contingent and Non-Contingent Retail Receivables

7,941,549 5,583,696 6,005,987 9,332,720 9,376,627 38,240,579

Contingent and Non-Contingent Collateralized Receivables with Real EstateMortgages

275,730 421,449 604,964 1,184,214 10,582,337 13,068,694

Receivables are identified as High Risk by the Board

620,828 1,061,824 1,564,111 3,700,559 10,798,982 17,746,304

Total

18,140,378 16,962,507 20,530,516 35,970,832 131,526,199 223,130,432

15. Information on Risk Classes

In the calculation of the amount subject to credit risk, determining the risk weights related to risk classes stated on the sixth article of “Regulation on Measurement and Evaluation

of Capital Adequacy of Banks”, is based on the Fitch Ratings’ international rating with the Banking Regulation and Supervision Board’s decision numbered 4577 dated 10 February

2012. While receivables from resident banks in abroad which is assessed in the risk class of “Contingent and Non-Contingent Receivables from Banks and Brokerage Agencies” and

receivables from central governments which is assessed in the risk class of “Contingent and Non-Contingent Receivables from Central Governments or Central Banks” will be subjected

to risk weights with the scope of ratings; therefore domestic resident banks accepted as unrated, the risk weight is applied according to receivables from relevant banks , type of

exchange and remaining maturity.

If a receivable-specific rating is performed, risk weights to be applied on the receivable are determined by the relevant credit rating.

The table related to mapping the ratings used in the calculations and credit quality grades, which is stated in the Annex of Regulation on Measurement and Evaluation of Capital

Adequacy of Banks, is given below

Credit Quality Grades

1

2

3

4

5

6

Risk Rating

AAA via AA-

A+ via A-

BBB+ via BBB-

BB+ via BB-

B+ via B-

CCC+ and lower

There is no credit rating and credit export agency has been assigned for the items that are not included to trading accounts.

Risk Weight

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Mitigation in

Shareholders’

Equity

Amount Before Credit Risk Mitigation

59,143,565

3,430,603 28,387,352 42,125,054 120,274,837 4,331,036 13,312,898 757,328

424,076

Amount After Credit Risk Mitigation

61,296,055

3,424,975 28,367,558 41,748,895 118,544,918 4,325,984 13,296,960 757,328

424,076

There is no credit rating and credit export agency has been assigned for the items that are not included to trading accounts.

16. Miscellaneous Information According to Type of Counterparty or Major Sectors

Significant Sectors/Counterparty

Loans

Value

Adjustment

(2)

Provisions

(3)

Impaired

Non-Performing

(1)

Agricultural

38,191

19,501

450

31,045

Farming and Raising Livestock

31,044

18,048

404

24,899

Forestry

5,304

1,295

31

4,596

Fishing

1,843

158

15

1,550

Industry

399,812

93,033

3,540

338,724

Mining

61,738

4,038

112

59,116

Production

334,749

86,219

3,364

277,294

Electricity, gas, and water

3,325

2,776

64

2,314

Construction

343,581

72,576

2,602

304,295

Services

650,702

174,240

9,330

492,182

Wholesale and Retail Trade

423,559

102,926

4,723

321,396

Hotel, Food and Beverage Services

21,211

9,197

583

17,672

Transportation and Telecommunication

60,686

26,878

2,347

47,416

Financial Institutions

8,407

1,016

23

7,404

Real Estate and Renting Services

88,355

12,466

785

61,511

Self-Employment Services

35,451

13,613

467

28,133

Education Services

4,609

5,065

152

2,861

Health and Social Services

8,424

3,079

250

5,789

Other

988,285

777,657

91,659

695,545

Total

2,420,571

1,137,007

107,581

1,861,791

(1)

Refers to loans overdue up to 90 days. Related Items included in the commercial installment loans and installment consumer loans are given only in the overdue amounts, the payment of these loans outstanding

principal amounts of TL 724,441 and TL 1,391,473 respectively.

(2)

Refers to the general provisions for non-performing loans.

(3)

Refers to specific provision for impaired loans.