159

İŞBANK

ANNUAL REPORT 2014

FINANCIAL INFORMATION AND

RISK MANAGEMENT

TÜRKİYE İŞ BANKASI A.Ş.

Consolidated Financial Statements (Statement of Financial Position)

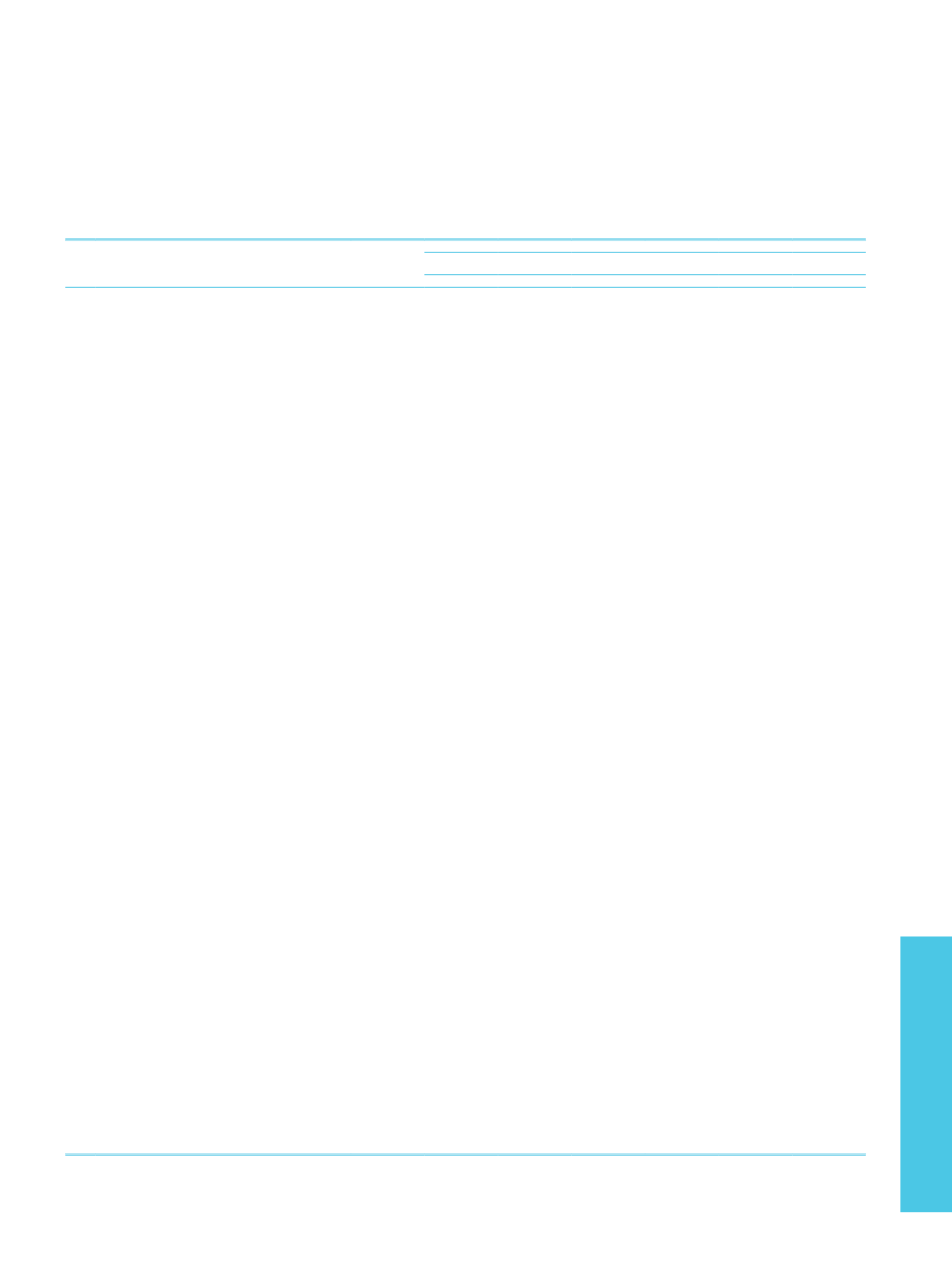

LIABILITIES

Footnotes

THOUSANDTL

CURRENTPERIOD

(31/12/2014)

PRIORPERIOD

(31/12/2013)

TL

FC

Total

TL

FC

Total

I.

DEPOSITS

V-II-a

72,045,192

62,456,034

134,501,226

65,359,750

56,478,048

121,837,798

1.1

Deposits from the Bank's Risk Group

560,159

2,639,078

3,199,237

892,591

1,476,460

2,369,051

1.2 Other

71,485,033

59,816,956

131,301,989

64,467,159

55,001,588

119,468,747

II.

DERIVATIVEFINANCIALLIABILITIESHELDFORTRADING

V-II-b

260,929

488,912

749,841

696,001

501,344

1,197,345

III.

FUNDSBORROWED

V-II-c

5,094,210

28,965,797

34,060,007

3,111,333

24,112,363

27,223,696

IV.

MONEYMARKETFUNDS

19,104,474

3,200,295

22,304,769

20,823,398

4,176,477

24,999,875

4.1

Interbank Money Market Funds

-

-

-

-

-

-

4.2 Istanbul Stock Exchange Money Market Funds

2,291,363

-

2,291,363

2,403,976

-

2,403,976

4.3 Funds Provided Under Repurchase Agreements

16,813,111

3,200,295

20,013,406

18,419,422

4,176,477

22,595,899

V.

MARKETABLESECURITIES ISSUED (Net)

V-II-d

6,146,268

12,450,824

18,597,092

5,134,330

4,942,514

10,076,844

5.1

Bills

4,561,693

2,339,748

6,901,441

3,896,072

158,658

4,054,730

5.2 Asset-backed Securities

-

-

-

-

-

-

5.3 Bonds

1,584,575

10,111,076

11,695,651

1,238,258

4,783,856

6,022,114

VI.

FUNDS

623

38,458

39,081

946

5,008

5,954

6.1

Borrower funds

623

38,458

39,081

946

5,008

5,954

6.2 Other

-

-

-

-

-

-

VII.

MISCELLANEOUSPAYABLES

13,547,566

847,934

14,395,500

10,448,283

701,857

11,150,140

VIII.

OTHERLIABILITIES

V-II-e

1,483,272

1,714,707

3,197,979

1,508,917

3,308,205

4,817,122

IX.

FACTORINGPAYABLES

-

-

-

-

-

-

X.

LEASEPAYABLES (Net)

V-II-f

-

-

-

-

-

-

10.1 Finance Lease Payables

-

-

-

-

-

-

10.2 Operating Lease Payables

-

-

-

-

-

-

10.3 Other

-

-

-

-

-

-

10.4 Deferred Financial Lease Expenses (-)

-

-

-

-

-

-

XI.

DERIVATIVEFINANCIALLIABILITIESHELDFORRISKMANAGEMENT

V-II-g

-

-

-

-

-

-

11.1 Fair Value Hedges

-

-

-

-

-

-

11.2 Cash Flow Hedges

-

-

-

-

-

-

11.3 Net Foreign Investment Hedges

-

-

-

-

-

-

XII.

PROVISIONS

V-II-h

11,272,580

810,935

12,083,515

10,094,287

824,681

10,918,968

12.1 General Loan Loss Provisions

2,447,646

32,124

2,479,770

2,073,263

27,339

2,100,602

12.2 Provision for Restructuring

-

-

-

-

-

-

12.3 Reserves for Employee Benefits

522,159

1,817

523,976

411,438

2,058

413,496

12.4 Insurance Technical Reserves (Net)

4,533,412

753,987

5,287,399

4,029,494

771,746

4,801,240

12.5 Other Provisions

3,769,363

23,007

3,792,370

3,580,092

23,538

3,603,630

XIII.

TAXLIABILITIES

V-II-i

747,557

2,556

750,113

402,334

3,536

405,870

13.1 Current Tax Liabilities

745,675

2,556

748,231

399,735

3,536

403,271

13.2 Deferred Tax Liabilities

1,882

-

1,882

2,599

-

2,599

XIV.

LIABILITIESRELATEDTOASSETSHELDFORSALEANDDISCONTINUED

OPERATIONS

V-II-j

-

-

-

-

-

-

14.1 Held for Sale

-

-

-

-

-

-

14.2 Discontinued Operations

-

-

-

-

-

-

XV.

SUBORDINATEDDEBT

V-II-k

-

3,384,849

3,384,849

-

3,090,902

3,090,902

XVI.

SHAREHOLDERS'EQUITY

V-II-l

31,326,547

385,914

31,712,461

25,809,518

85,108

25,894,626

16.1 Paid-in Capital

4,500,000

-

4,500,000

4,500,000

-

4,500,000

16.2 Capital Reserves

4,746,508

331,840

5,078,348

2,393,782

(31,790)

2,361,992

16.2.1 Share premium

33,941

-

33,941

33,940

-

33,940

16.2.2 Share Cancellation Profits

-

-

-

-

-

-

16.2.3 Marketable Securities Value Increase Fund

3,107,282

331,840

3,439,122

712,187

(31,790)

680,397

16.2.4 Tangible Assets Revaluation Reserve

-

-

-

-

-

-

16.2.5 Intangible Assets Revaluation Reserve

-

-

-

-

-

-

16.2.6 Investment Property Revaluation Reserve

-

-

-

-

-

-

16.2.7 Bonus Shares Obtained from Associates, Subsidiaries and Jointly Controlled

Entities (Joint Ventures)

(1,179)

-

(1,179)

(1,179)

-

(1,179)

16.2.8 Hedging Reserves (Effective Portion)

-

-

-

-

-

-

16.2.9 Accumulated Revaluation Reserves on Assets Held for Sale and

Discontinued Operations

-

-

-

-

-

-

16.2.10 Other Capital Reserves

1,606,464

-

1,606,464

1,648,834

-

1,648,834

16.3 Profit Reserves

15,811,864

113,192

15,925,056

13,120,588

157,434

13,278,022

16.3.1 Legal Reserves

2,510,521

1,106

2,511,627

2,286,486

-

2,286,486

16.3.2 Statutory Reserves

64,234

-

64,234

59,539

-

59,539

16.3.3 Extraordinary Reserves

13,278,217

22,129

13,300,346

10,792,384

20,360

10,812,744

16.3.4 Other Profit Reserves

(41,108)

89,957

48,849

(17,821)

137,074

119,253

16.4 Profit or Loss

2,790,336

(87,426)

2,702,910

2,672,230

(51,068)

2,621,162

16.4.1 Prior Years' Profit/Loss

(594,975)

(53,943)

(648,918)

(621,726)

6,967

(614,759)

16.4.2 Current Period Profit/Loss

3,385,311

(33,483)

3,351,828

3,293,956

(58,035)

3,235,921

16.5 Non-controlling Interest

V-II-m

3,477,839

28,308

3,506,147

3,122,918

10,532

3,133,450

TOTALLIABILITIESANDSHAREHOLDERS'EQUITY

161,029,218

114,747,215

275,776,433

143,389,097

98,230,043

241,619,140