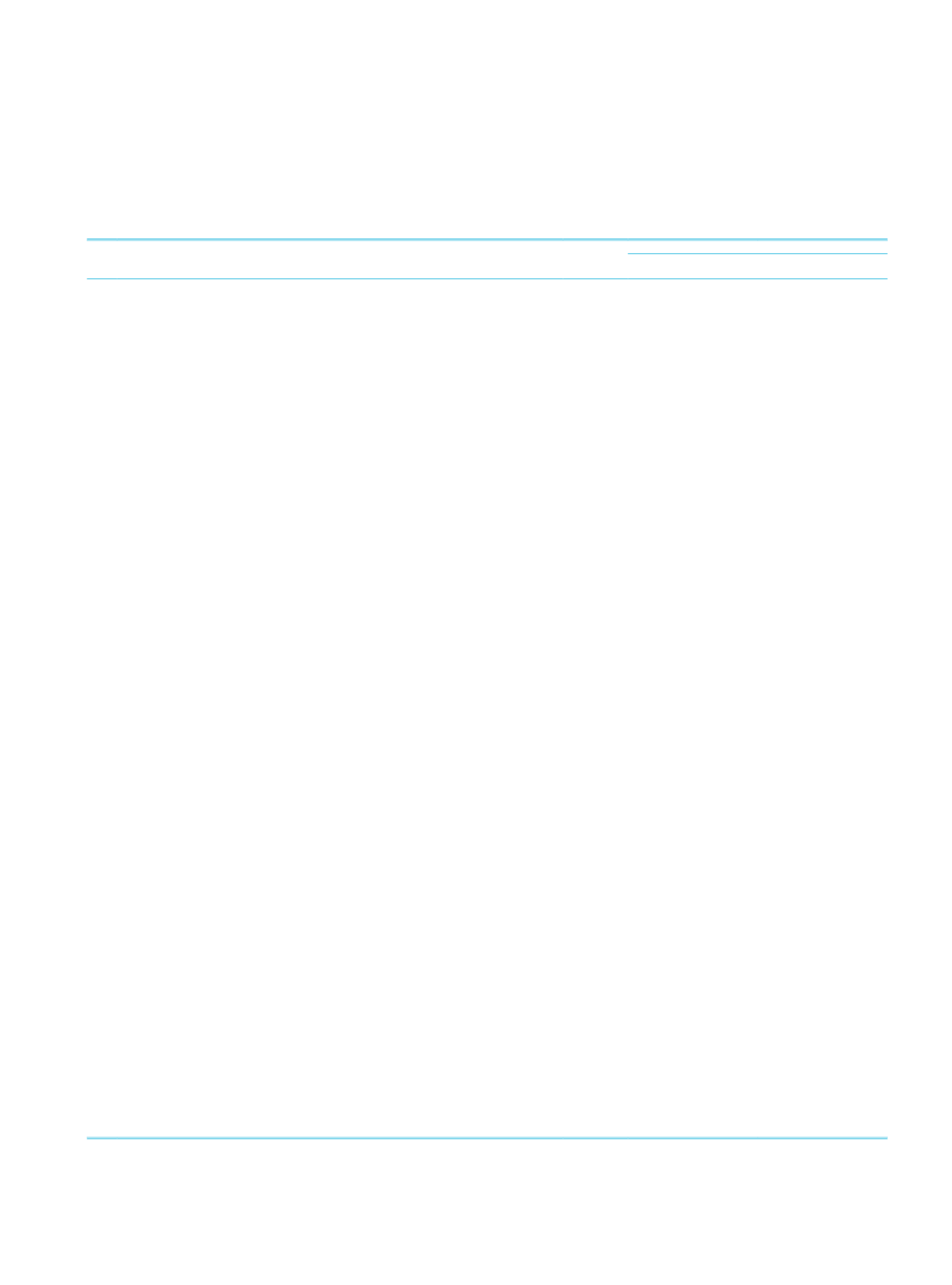

162

İŞBANK

ANNUAL REPORT 2014

TÜRKİYE İŞ BANKASI A.Ş.

Consolidated Income Statement

INCOME STATEMENT

Footnotes

THOUSAND TL

CURRENT PERIOD

(01/01-31/12/2014)

PRIOR PERIOD

(01/01-31/12/2013)

I.

INTEREST INCOME

V-IV-a

17,752,690

14,853,908

1.1 Interest Income on Loans

13,311,666

10,879,785

1.2 Interest Income on Reserve Deposits

-

-

1.3 Interest Income on Banks

200,486

162,261

1.4 Interest Income on Money Market Placements

15,067

14,374

1.5 Interest Income on Marketable Securities Portfolio

3,931,245

3,570,864

1.5.1 Financial Assets Held for Trading

127,104

55,878

1.5.2 Financial Assets at Fair Value Through Profit and Loss

-

-

1.5.3 Financial Assets Available for Sale

3,118,955

2,277,936

1.5.4 Held to Maturity Investments

685,186

1,237,050

1.6 Finance Lease Income

186,632

126,046

1.7 Other Interest Income

107,594

100,578

II.

INTEREST EXPENSE

V-IV-b

9,282,281

7,172,014

2.1 Interest on Deposits

5,603,036

4,797,189

2.2 Interest on Funds Borrowed

780,549

528,881

2.3 Interest on Money Market Funds

1,762,400

1,165,751

2.4 Interest on Securities Issued

1,071,177

595,555

2.5 Other Interest Expense

65,119

84,638

III.

NET INTEREST INCOME / EXPENSE (I - II)

8,470,409

7,681,894

IV.

NET FEES AND COMMISSIONS INCOME / EXPENSE

1,505,183

1,468,946

4.1 Fees and Commissions Received

2,434,577

2,400,210

4.1.1 Non-cash Loans

301,802

236,835

4.1.2 Other

2,132,775

2,163,375

4.2 Fees and Commissions Paid

929,394

931,264

4.2.1 Non-cash Loans

8,117

8,659

4.2.2 Other

921,277

922,605

V.

DIVIDEND INCOME

V-IV-c

292,047

238,057

VI.

TRADING INCOME / LOSS (NET)

V-IV-d

664,128

378,591

6.1 Gains/Losses on Securities Trading

570,339

181,749

6.2 Derivative Financial Transactions Gains/Losses

(614,744)

(500,764)

6.3 Foreign Exchange Gains/Losses

708,533

697,606

VII.

OTHER OPERATING INCOME

V-IV-e

4,836,167

4,615,411

VIII.

TOTAL OPERATING INCOME / EXPENSE (III+IV+V+VI+VII)

15,767,934

14,382,899

IX.

PROVISION FOR LOSSES ON LOANS AND OTHER RECEIVABLES (-)

V-IV-f

1,530,113

1,654,701

X.

OTHER OPERATING EXPENSES (-)

V-IV-g

9,515,404

8,308,239

XI.

NET OPERATING INCOME (VIII-IX-X)

4,722,417

4,419,959

XII.

AMOUNT IN EXCESS RECORDED AS GAIN AFTER MERGER

-

-

XIII.

PROFIT/LOSS FROM ASSOCIATES ACCOUNTED FOR USING THE EQUITY METHOD

14,778

9,922

XIV.

NET MONETARY POSITION GAIN/LOSS

-

-

XV.

PROFIT/LOSS ON CONTINUING OPERATIONS BEFORE TAX (XI+…+XIV)

V-IV-h

4,737,195

4,429,881

XVI.

TAX PROVISION FOR CONTINUING OPERATIONS (±)

V-IV-i

1,005,159

823,022

16.1 Current Tax Provision

1,293,016

472,907

16.2 Deferred Tax Provision

(287,857)

350,115

XVII. NET PERIOD PROFIT/LOSS FROM CONTUNUING OPERATIONS (XV±XVI)

V-IV-j

3,732,036

3,606,859

XVIII. INCOME ON DISCONTINUED OPERATIONS

-

-

18.1 Income on Assets Held for Sale

-

-

18.2 Gain on Sale of Associates, Subsidiaries and Jointly Controlled Entities (Joint Ventures)

-

-

18.3 Other Income on Discontinued Operations

-

-

XIX.

EXPENSE ON DISCONTINUED OPERATIONS(-)

-

-

19.1 Expense on Assets Held for Sale

-

-

19.2 Loss on Sale of Associates, Subsidiaries and Jointly Controlled Entities (Joint Ventures)

-

-

19.3 Other Expense on Discontinued Operations

-

-

XX.

PROFIT/LOSS ON DISCONTINUED OPERATIONS BEFORE TAX (XVIII-XIX)

V-IV-h

-

-

XXI.

TAX PROVISION FOR DISCONTINUED OPERATIONS (±)

V-IV-i

-

-

21.1 Current Tax Provision

-

-

21.2 Deferred Tax Provision

-

-

XXII. NET PERIOD PROFIT/LOSS FROM DISCONTINUED OPERATIONS (XX±XXI)

V-IV-j

-

-

XXIII. NET PERIOD PROFIT/LOSS (XVII+XXII)

V-IV-k

3,732,036

3,606,859

23.1 Group’s Profit / Loss

3,351,828

3,235,921

23.2 Non-controlling Interest (-)

380,208

370,938

Earnings per Share (in full TL)

0.029793431

0.028763167