5

Introduction

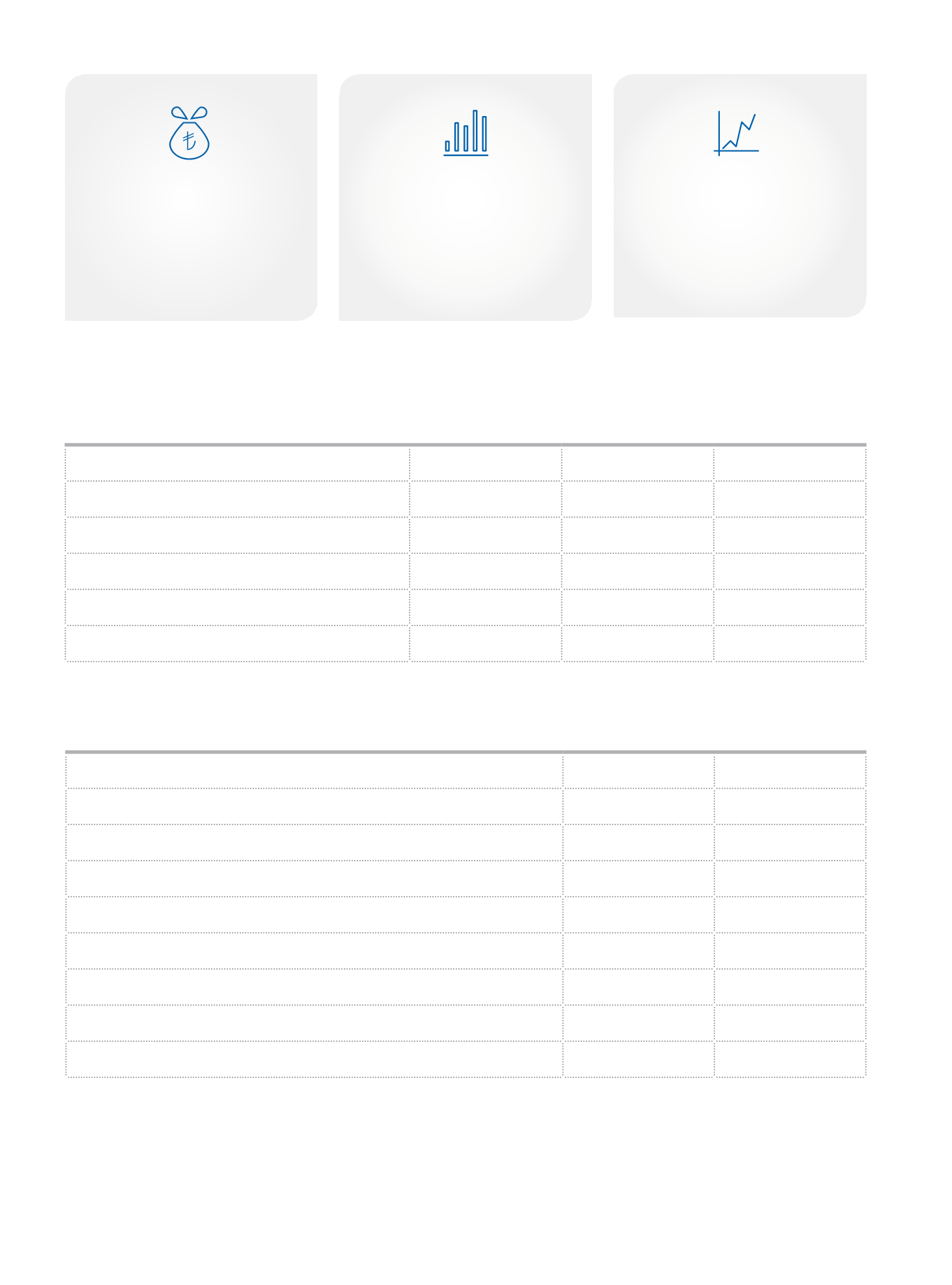

Key Financial Highlights

(TL million)

31.12.2015

31.12.2014

Change (%)

Total Assets

275,718

237,772

16.0

Loans

177,037

155,315

14.0

Deposits

153,802

133,551

15.2

Shareholders’ Equity

32,035

29,311

9.3

Net Profit

3,083

3,382

-8.9

Key Financial Ratios

(%)

31.12.2015

31.12.2014

Interest Earning Assets

(*)

/Total Assets

91.3

92.3

Loans/Total Assets

64.2

65.3

Loans/Deposits

115.1

116.3

NPL Ratio

2.0

1.5

NPL Coverage Ratio

75.1

76.9

Demand Deposits/Total Deposits

22.6

22.0

Shareholders’ Equity/Total Liabilities

11.6

12.3

Capital Adequacy Ratio

15.6

16.0

(*)

Interest earning assets include TL and FC legal reserves.

32,035

In 2015, İşbank’s

shareholders’ equity

amounted to TL 32,035 million.

275,718

In 2015, İşbank’s total

assets reached

TL 275,718 million

3,083

İşbank posted total net

profit for 2015 of

TL 3,083 million.