12 İşbank

Annual Report 2015

Supporting the economy and the real

sector for 91 years

Since its founding, İşbank has been the most

important supporter of Turkey’s economy

and the real sector. Our Bank retained its

understanding in this regard even in times of

economic crises and supported artisans, micro

businesses, SMEs, commercial and corporate

companies, large-scale investments and in

brief, every type of tradesman.

Our commercial loans volume totaled TL 130.2

billion at end-2015, and we achieved a market

share of 12.5% in this segment, sustaining our

leading position among private banks. Besides,

the total amount of loans provided to SMEs,

which drive the Turkish economy, amounted to

TL 42.2 billion. These results are the outcome

of our business understanding that is based on

our commercial identity, vision and mission.

Our approach in this regard also covers the

financing needs of individual households. We

continue to effectively respond to the needs

of our customers by providing themwith cash,

housing and auto loans. Our Bank’s consumer

loans portfolio expanded by 9.3% to TL 36.4

billion in 2015.

Esteemed shareholders, customers, employees

and business partners of İşbank,

İşbank successfully concluded fiscal

year 2015, a period dominated by

uncertainties.

İşbank once again achieved its targets to a

great extent in 2015, a year of fluctuations in

financial markets and domestic uncertainty.

During this period, our Bank continued to

pursue a problem-free and sustainable growth

policy, thus maintaining its standing as Turkey’s

largest private bank. In 2015, İşbank’s total

assets increased 16% to TL 275.7 billion

compared to the same period of the previous

year, while the Bank’s shareholders’ equity rose

to TL 32 billion.

İşbank achieved an increase of 14% in total

loans as of end-2015, increasing its total loans

to TL 177 billion. While the Bank did grow its

loans during 2015, a relatively difficult year in

terms of economic outlook, it did not sacrifice

asset quality. The non-performing loan ratio

of the Bank as of the end of the year was at

2.0%, considerably below the sector average.

As a result, İşbank continued to outperform the

sector in 2015 in terms of NPL ratio in all loan

types.

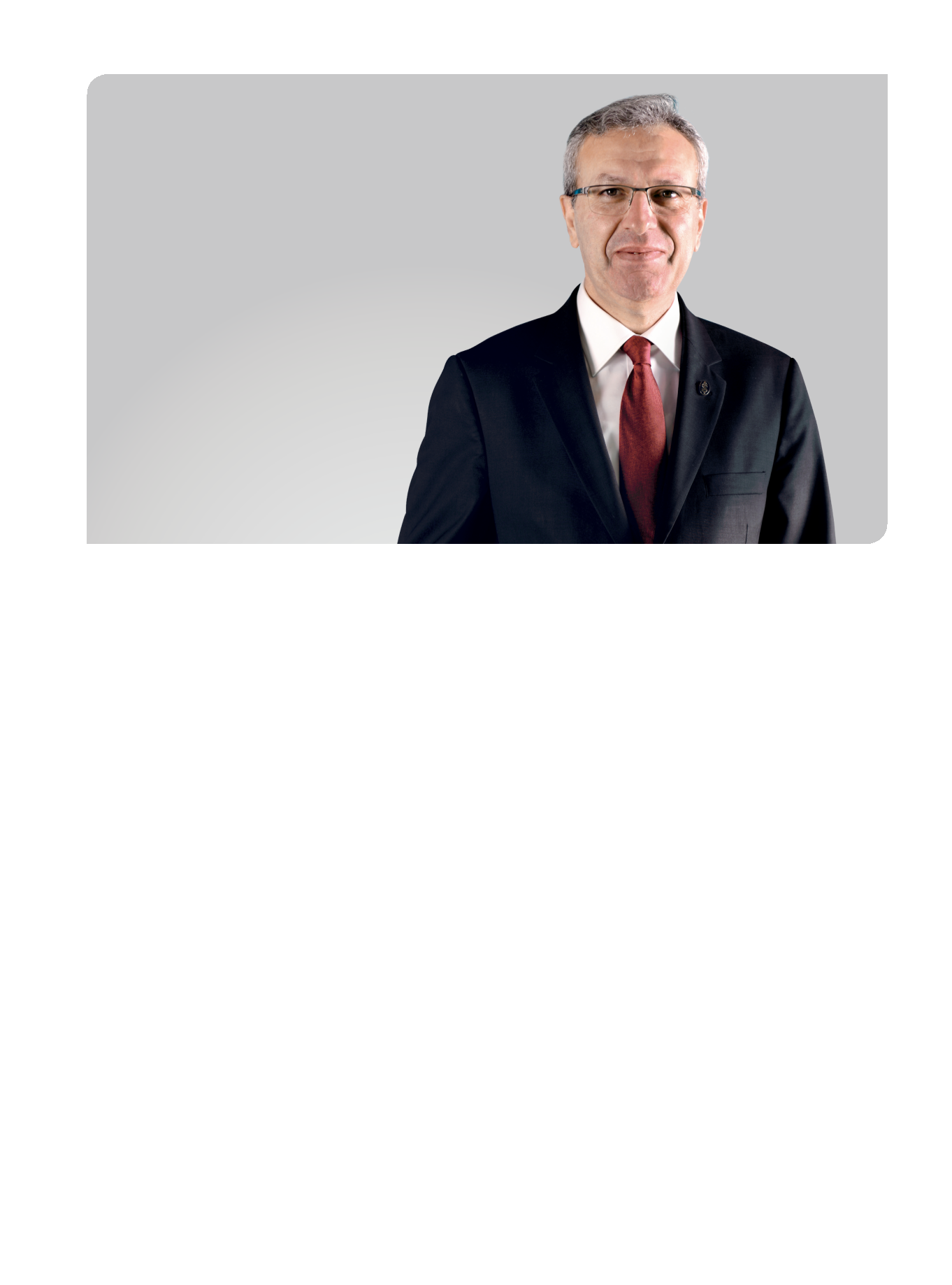

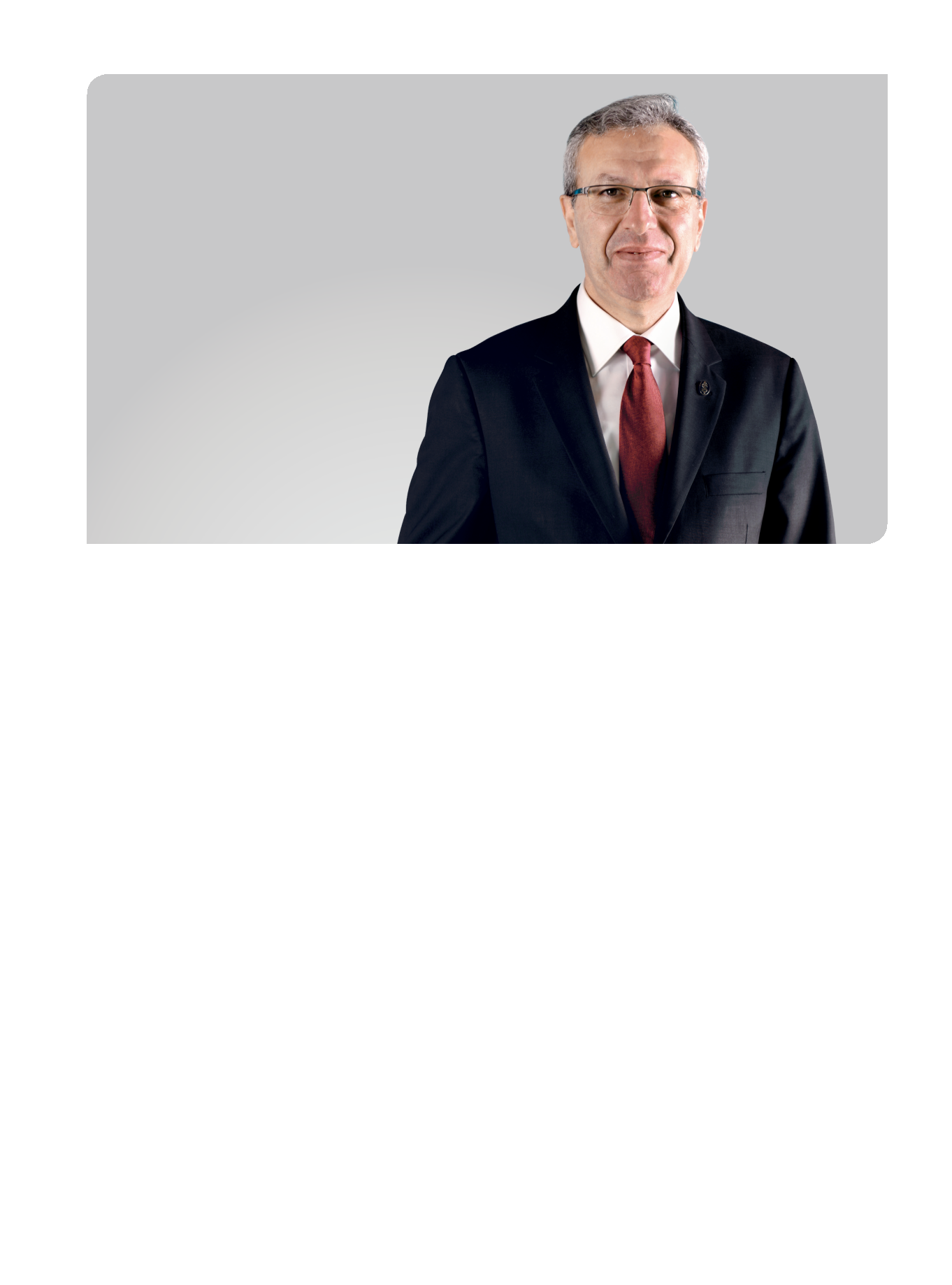

CEO’s

Message

For the upcoming three

years, the Bank’s former

target of becoming

“Turkey’s Best Multi

Channel Bank” has been

expanded to “Turkey’s

Best Digital Bank” by

moving a step further.