18 İşbank

Annual Report 2015

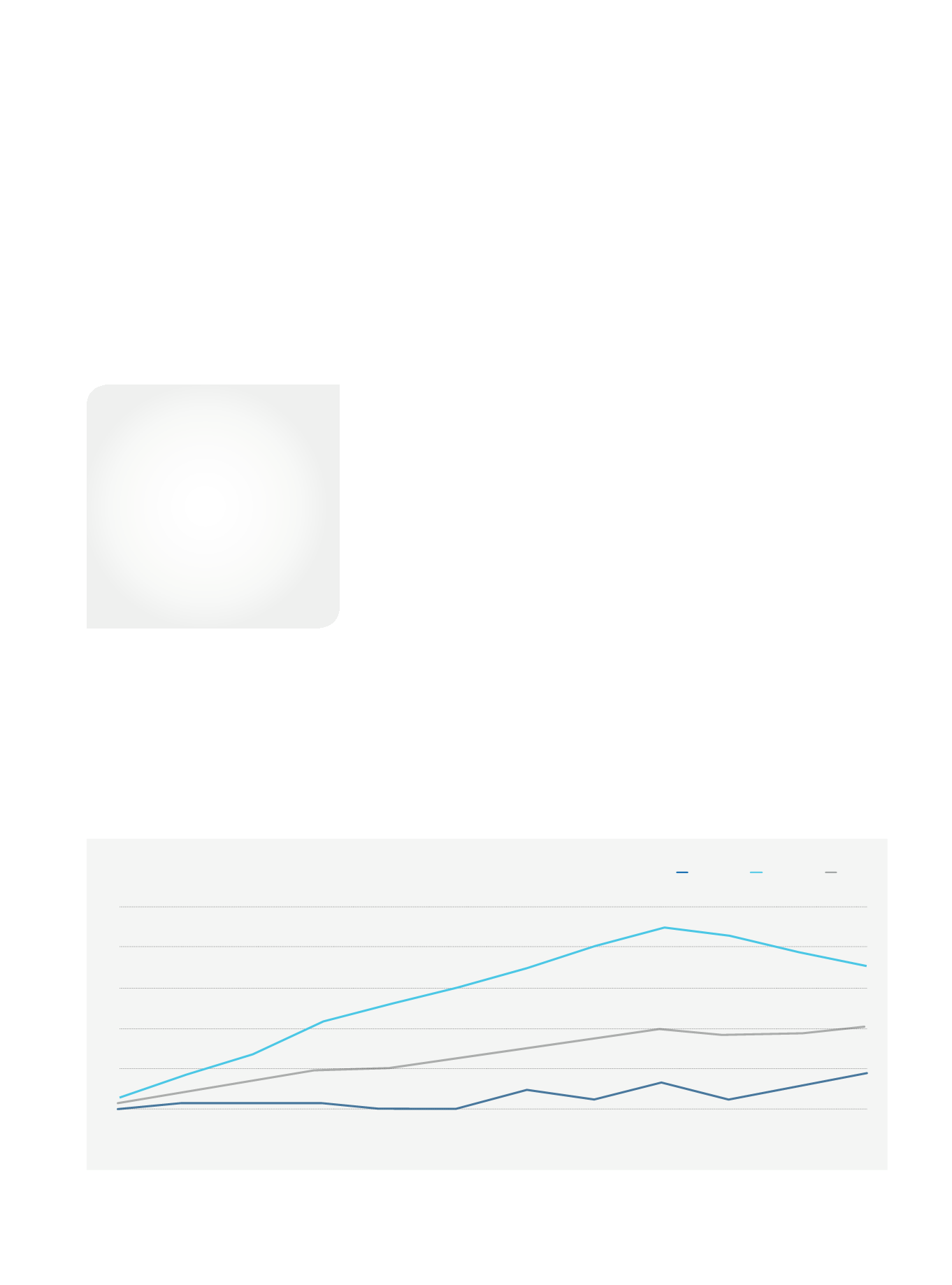

Developments in the foreign currency

exchange rates had a significant

impact on loan growth.

In 2015, the banking sector continued to

grow in terms of total assets, branch number

and personnel. The total assets of the

banking sector increased by 18.4% year-on-

year in 2015, amounting to TL 2,237

(*)

billion.

Interest rate reductions undertaken at

the start of the year had a positive impact

on funding costs of the banking sector.

However, in the following period, in parallel

to the depreciation in the Turkish lira, the

CBRT maintained its cautious monetary

policy stance resulting in a rise in the

weighted average cost of funding. In

addition to these developments, growth

in loan volume was limited also due to

political uncertainties. On the other hand,

the increase in foreign currency loans in TL

terms due to high increases in exchange

rates was an important driving force behind

the expansion in the total loan volume.

Banking sector continued to diversify

Banking sector continued to diversify

its funding sources.

Banking sector in 2015 continued to meet

its financing needs through deposits, the

main funding source, as well as domestic

and foreign securities issues, and funds

borrowed from foreign markets. Despite large

fluctuations in international markets, the

sector did not face any problems in acquiring

funds from abroad. Hence, in 2015, the long-

term debt roll-over ratio of the banking sector

was 327%.

The banking sector sustained its strong

outlook.

The capital adequacy ratio fell from 16.4%

(*)

at end-2014 to 15.6%

(*)

at end-2015 mainly

due to the rises in the foreign exchange

rates and the increase in value at credit risk.

Meanwhile, sector’s net profit increased by

4.9% compared to the previous year, rising to

TL 25.7

(*)

billion.

Banking Sector

Despite fluctuations in international markets in 2015,

the sector did not face any problems in raising funds

from abroad.

Deposits and Loans in 2015

(*)

(Change Compared to Year-end) (%)

0

10

20

30

40

50

(*)

Calculated using monthly sector data published by the Banking Regulation and Supervision Agency. Interest accruals and rediscounts are not taken into

account. Participation banks are excluded from sector numbers.

FC Deposits

Loans

TL Deposits

January

February

March

April

May

June

July

August

September

October

November

December

Source: BRSA Monthly Bulletin

(*)

2,237

The total assets of the

banking sector rose to

TL 2,237

(*)

billion in 2015.