17

Activities

continued. In 2015, the current account

deficit decreased by US Dollar 11.4 billion

year-on-year to US Dollar 32.2 billion. The

share of direct investments in financing of

the current account deficit reached 36%.

Turkey maintained fiscal discipline.

Fiscal discipline continued to be the

strong feature of the Turkish economy in

2015. During the year, budget revenues

and expenditures increased by a similar

percentage. In 2015, the fiscal deficit

contracted by 3.3% to TL 22.6 billion,

remaining below the year-end projection of

the Medium Term Program.

Inflation came in above its

year-end target.

While increases in food prices continued to

affect the consumer price index in 2015,

the cumulative effect of the depreciation

in the Turkish lira resulted in an inflation

that was significantly above the medium

term target throughout the year. On the

other hand, low energy prices eased the

upward pressures on the inflation to some

extent. In light of these developments, the

annual inflation rate was at 8.81%, above

the medium term target of 5% set by the

Central Bank of the Republic of Turkey

(CBRT).

The CBRT keeps its cautious

monetary policy stance.

In parallel to commodity prices supporting

the fall in the inflation rate at the beginning

of 2015, the CBRT decided for moderate

cuts in the one-week repo interest

(the policy interest rate), in January and

February. As a result, the policy interest

rate which was at 8.25% at end-2014,

was lowered to 7.5% as of February 2015.

The CBRT also reduced the floor and

ceiling levels of the interest rate corridor

with decreasing the lending interest rate

from 11.25% to 10.75% and lowering the

overnight borrowing interest rate from

7.5% to 7.25%. In the following period, as

the depreciation in the Turkish lira limited

the improvement in inflation indicators, the

CBRT decided not to change interest rates.

Instead, the CBRT preserved its cautious

monetary policy stance by effectively

utilizing the flexibility offered by the

interest rate corridor via liquidity policy in

response to the increase in volatility in the

domestic market throughout the year.

The CBRT announced in its roadmap in

August that it would simplify its monetary

policies in line with normalization in global

monetary policies. Following the interest

rate hike decision of the Fed, the CBRT

signaled, at its meeting in December, that

it could begin taking steps in this direction

within 2016.

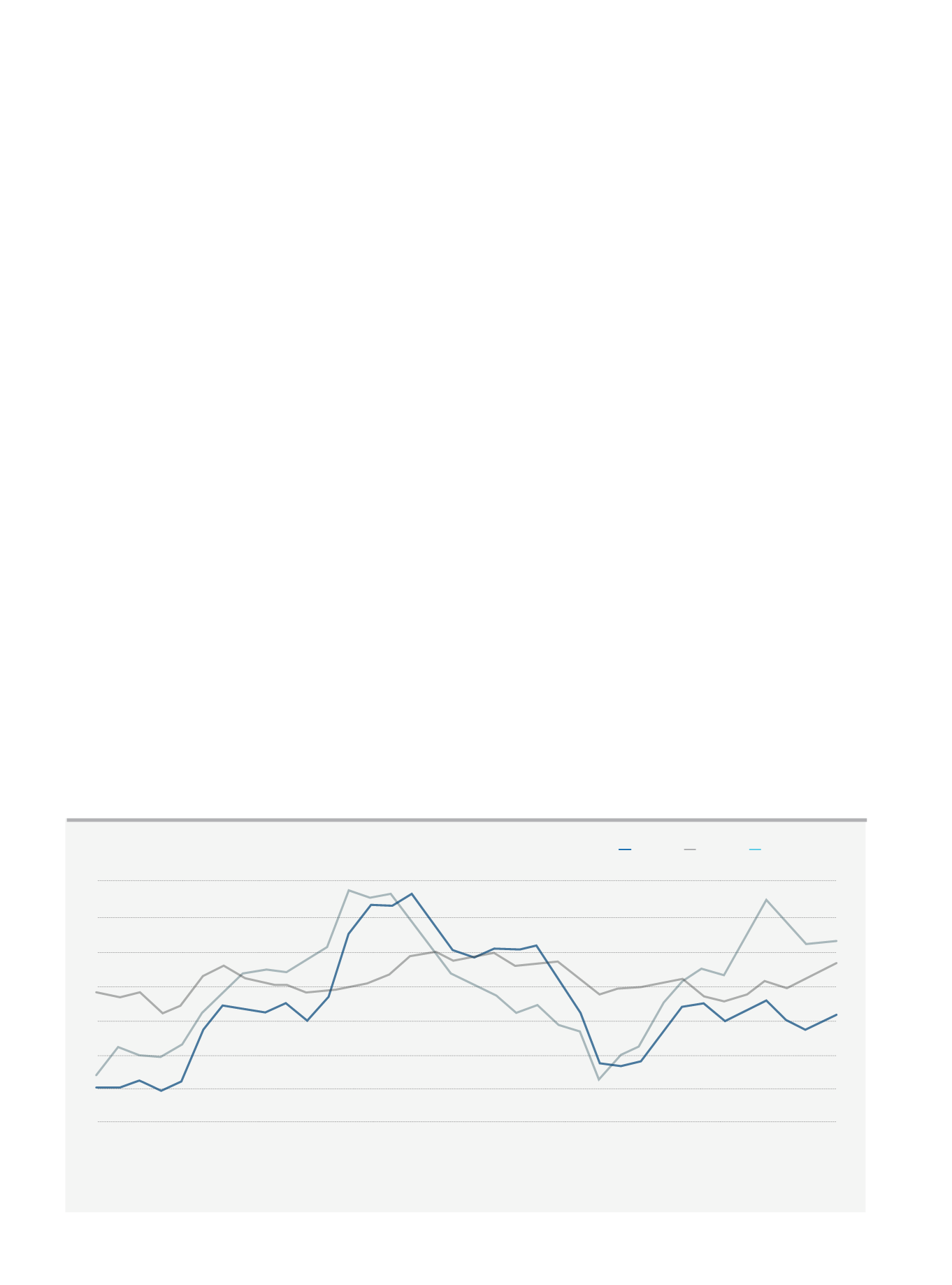

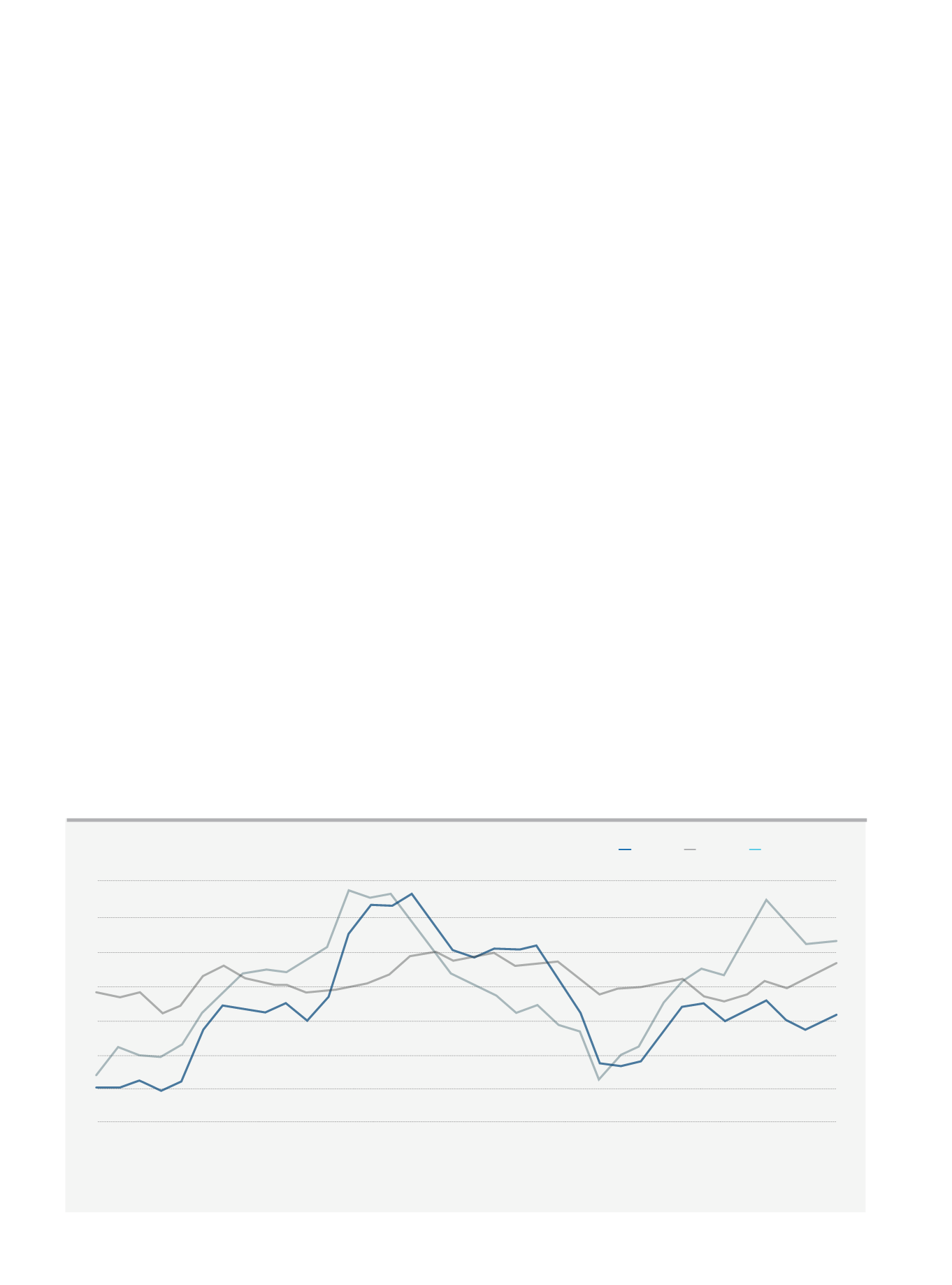

Inflation and FC Basket

(*)

(Annual Change) (%)

14

12

10

8

6

4

2

0

30

25

20

15

10

5

0

-5

-10

PPI

CPI

FC Basket (right axis)

January 13

February 13

April 13

March 13

May 13

June 13

July 13

August 13

September 13

October 13

November 13

January 14

April 14

July 14

October 14

August 14

May 14

February 14

December 13

March 14

June 14

September 14

November 14

January 15

April 15

July 15

October 15

August 15

May 15

February 15

December 14

March 15

June 15

September 15

December 15

November 15

(*)

Currency Basket (0.5*

€

+0.5*USD) is calculated using monthly average currency rates of CBRT.