22 İşbank

Annual Report 2015

İşbank, the sector leader in terms of

shareholders’ equity, maintained its leading

position in terms of total assets, total loans,

total deposits and number of branches

among private banks.

As of end-2015, İşbank’s total assets

increased to TL 275.7 billion, total loans

expanded to TL 177.0 billion and total

deposits went up to TL 153.8 billion.

During the year, İşbank continued to

expand its services network. In 2015, The

Bank increased the number of branches by

19, bringing the total number of the Bank’s

operational branches up to 1,354. İşbank

also operates with its 23 foreign branches

abroad.

In 2015, İşbank increased its total assets

by 16.0% compared to the previous year,

reaching to TL 275.7 billion.

İşbank’s total loans increased by 14.0% in

2015 and amounted to TL 177.0 billion. As

of year end, 26.4% of İşbank’s total loan

portfolio is comprised of retail loans while

73.6% of the total loans is comprised of

corporate, commercial and SME loans.

Share of loans in total assets accounted for

64.2% as of year’s end.

By the end of 2015, the Bank’s NPL ratio

continued to remain below the sector

average, at 2.0%.

İşbank increased its total deposits by 15.2%

year-on-year, to TL 153.8 billion in 2015.

İşbank maintained its leading position

among private banks in TL-denominated,

FC-denominated, demand and total

deposits as of end-2015. The Bank is also

the market leader among private banks

in terms of Turkish Lira savings deposits,

amounting to TL 52.6 billion.

In 2015, İşbank’s total assets increased by

16.0% to TL 275.7 billion.

İşbank and its Activities in 2015

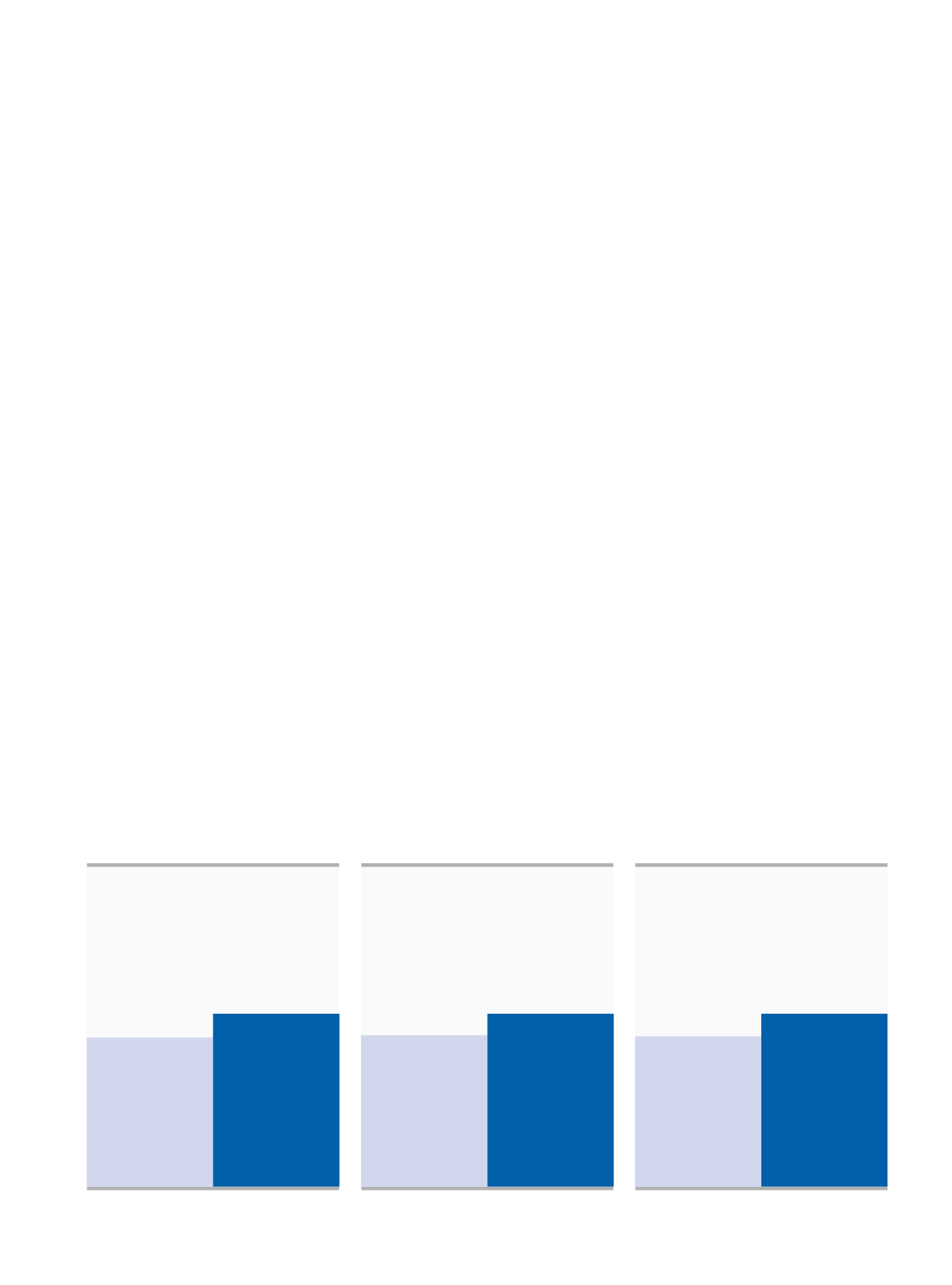

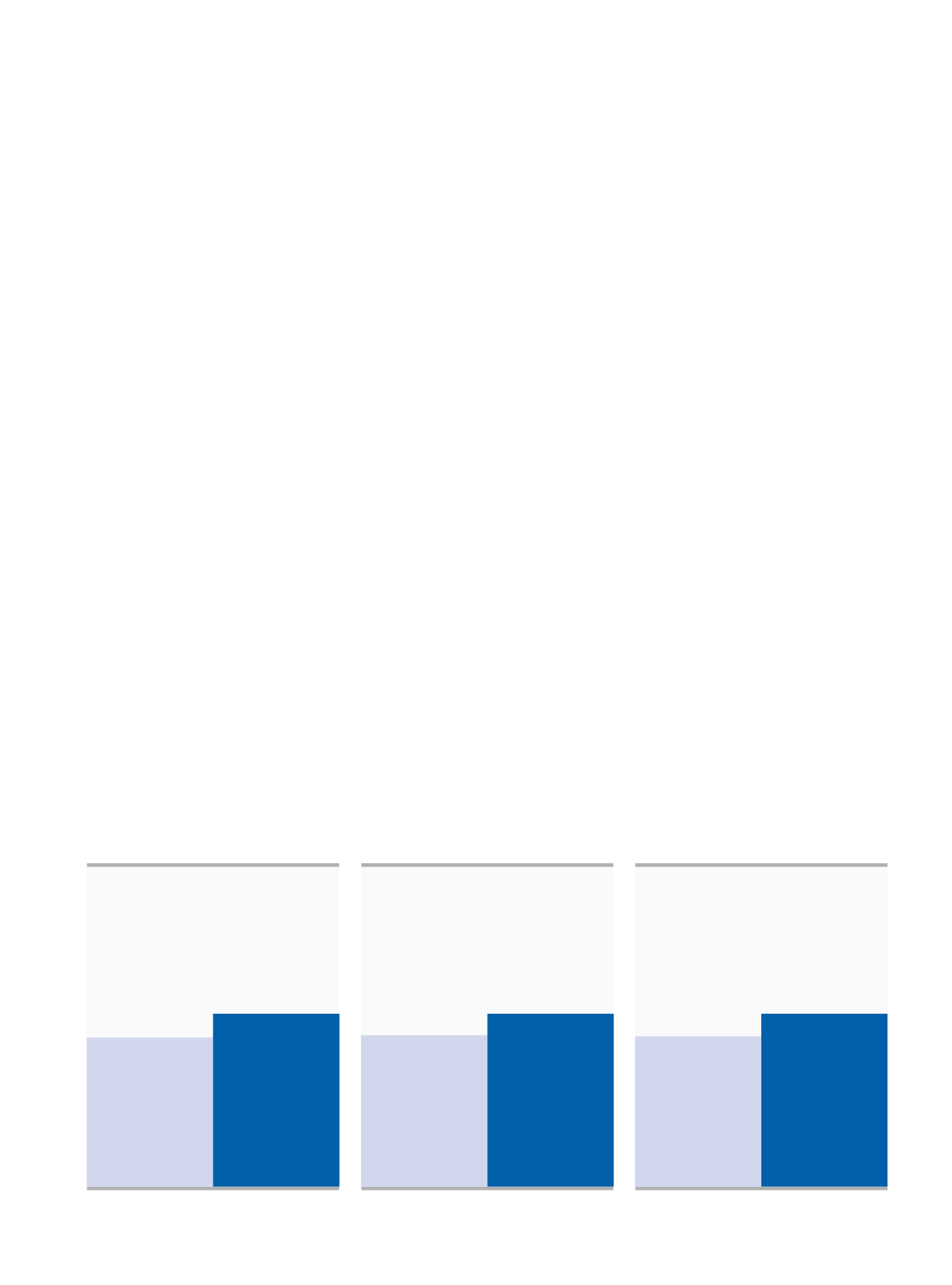

15.2%

INCREASE

TOTAL DEPOSITS

(TL MILLION)

2014

2015

133,551

153,802

TOTAL LOANS

(TL MILLION)

2014

2015

14.0%

INCREASE

155,315

177,037

TOTAL ASSETS

(TL MILLION)

2014

2015

16.0%

INCREASE

237,772

275,718