266

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

e.12. Explanations on write-off policy:

When the failure to obtain due to lack of legal follow-up, because of the absence of redeemable assets of debtors or although

conversion of all the assets of debtors with the scope of legal follow-up, there is a remaining receivable balance, receivable, by such

evidence is available on borrowers, reduced to one. Such evidence cannot be obtained, uncollectible receivables are written-off by

the destruction

f.

Held to Maturity Investments:

f.1. Information on held to maturity investments, which are given as collateral or blocked:

As of 31 December 2013, held to maturity investments, which are given as collateral or blocked amount to TL 1,205,865

(31 December 2012: TL 1,813,422).

f.2. Information on held to maturity investments, which are subject to repurchase agreements:

As of 31 December 2013, assets held to maturity, which are subject to repurchase agreements amount to TL 5,492,696

(31 December 2012: TL 4,200,685).

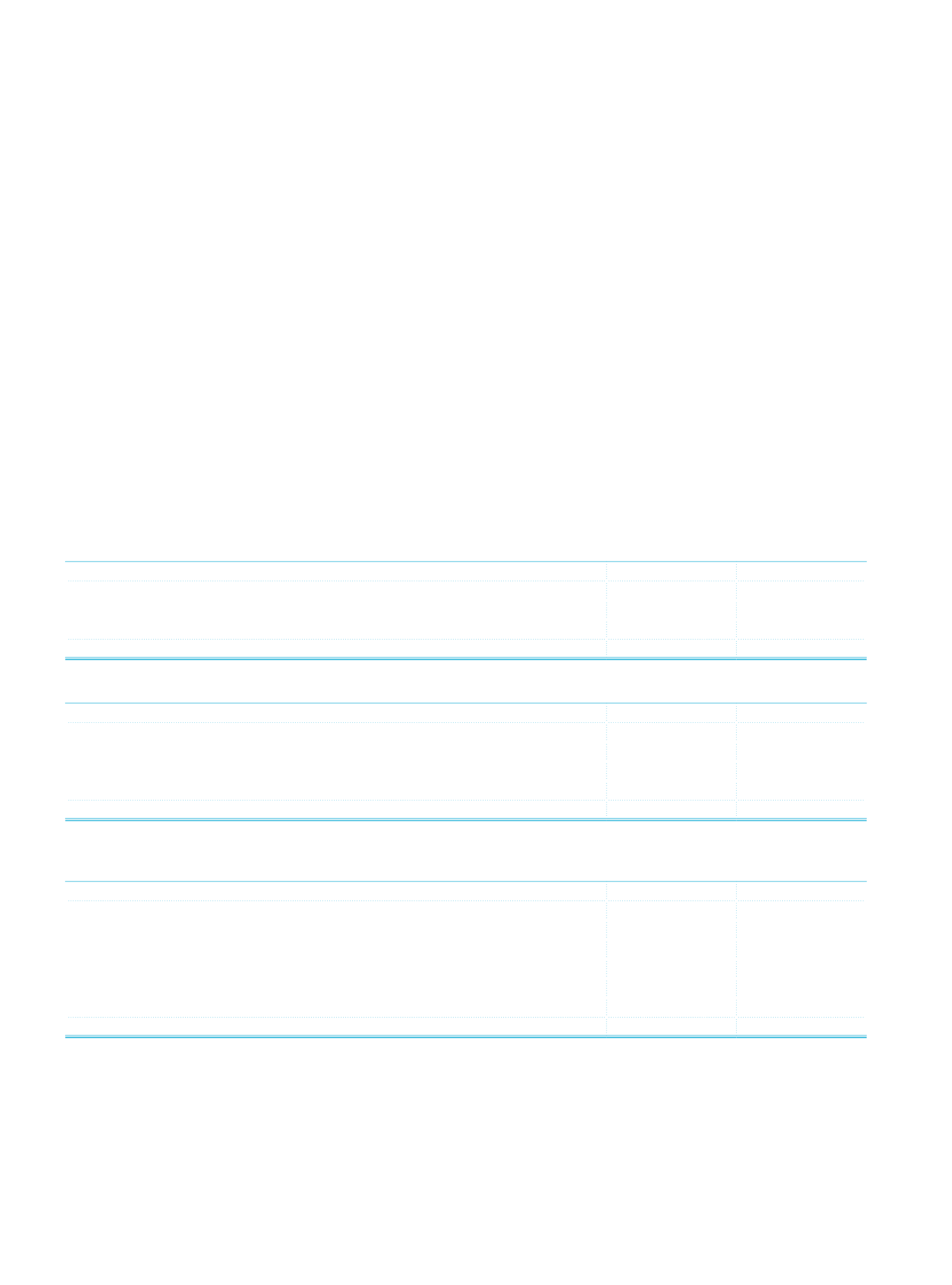

f.3. Information on government securities held to maturity:

Current Period

Prior Period

Government Bonds

7,704,816

11,033,267

Treasury Bills

Other Public Debt Securities

Total

7,704,816

11,033,267

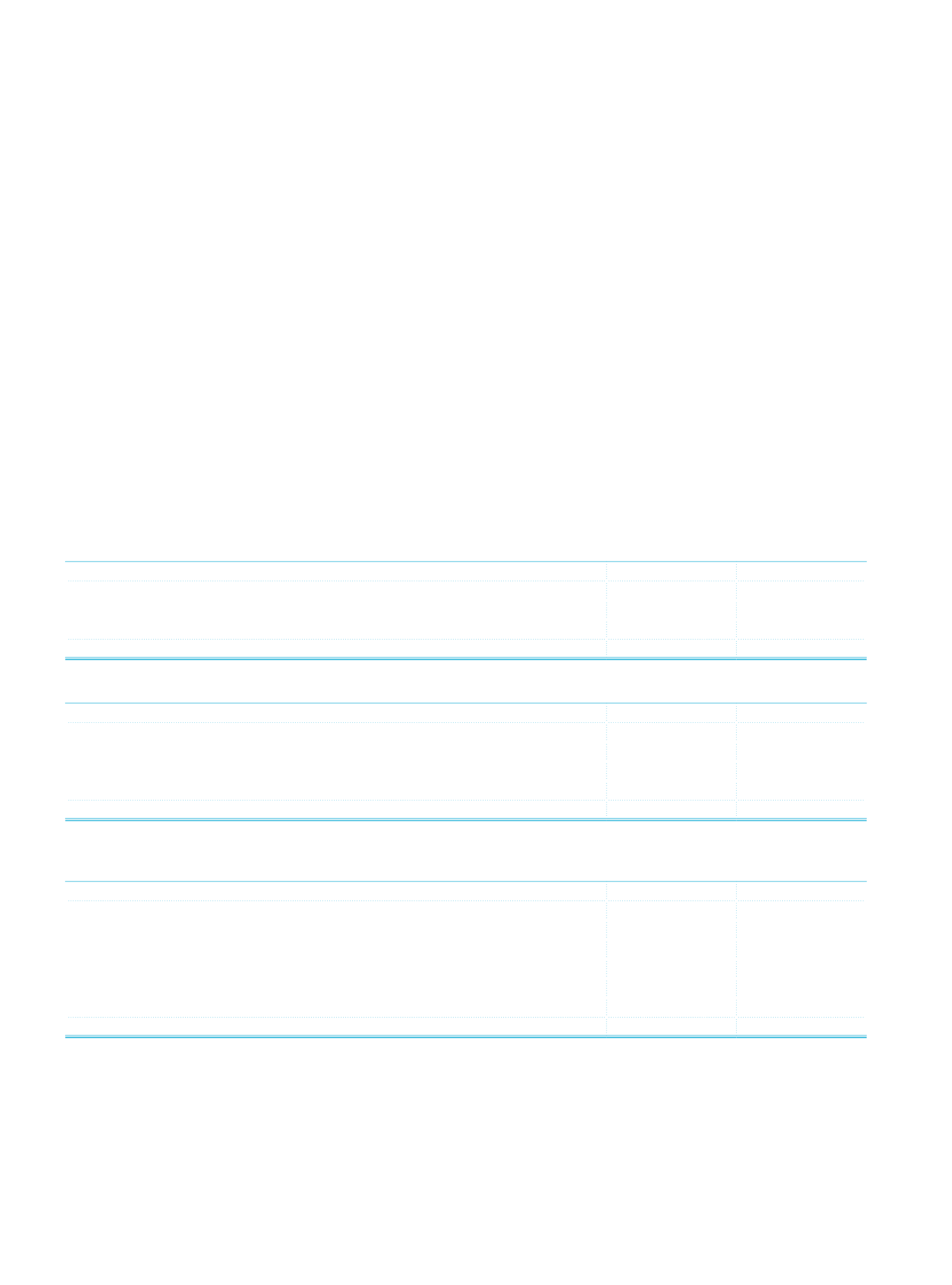

f.4. Information on held-to-maturity investments:

Current Period

Prior Period

Debt Securities

7,728,447

11,048,779

Quoted on a Stock Exchange

7,704,816

11,033,267

Not Quoted

(1)

23,631

15,512

Impairment Losses (-)

Total

7,728,447

11,048,779

(1)

Indicates unlisted debt securities, and debt securities that have not been traded at the end of the related periods although they are listed.

f.5. Movement of held to maturity investments within the period

Current Period

Prior Period

Beginning Balance

11,048,779

13,707,432

Foreign Exchange Differences Arising on Monetary Assets

2,601

346

Purchases During the Year

24,953

14,913

Disposals through Sales and Redemption

(3,673,498)

(3,064,247)

Impairment Losses (-)

Valuation Effect

325,612

390,335

Balance at the End of the Period

7,728,447

11,048,779