269

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

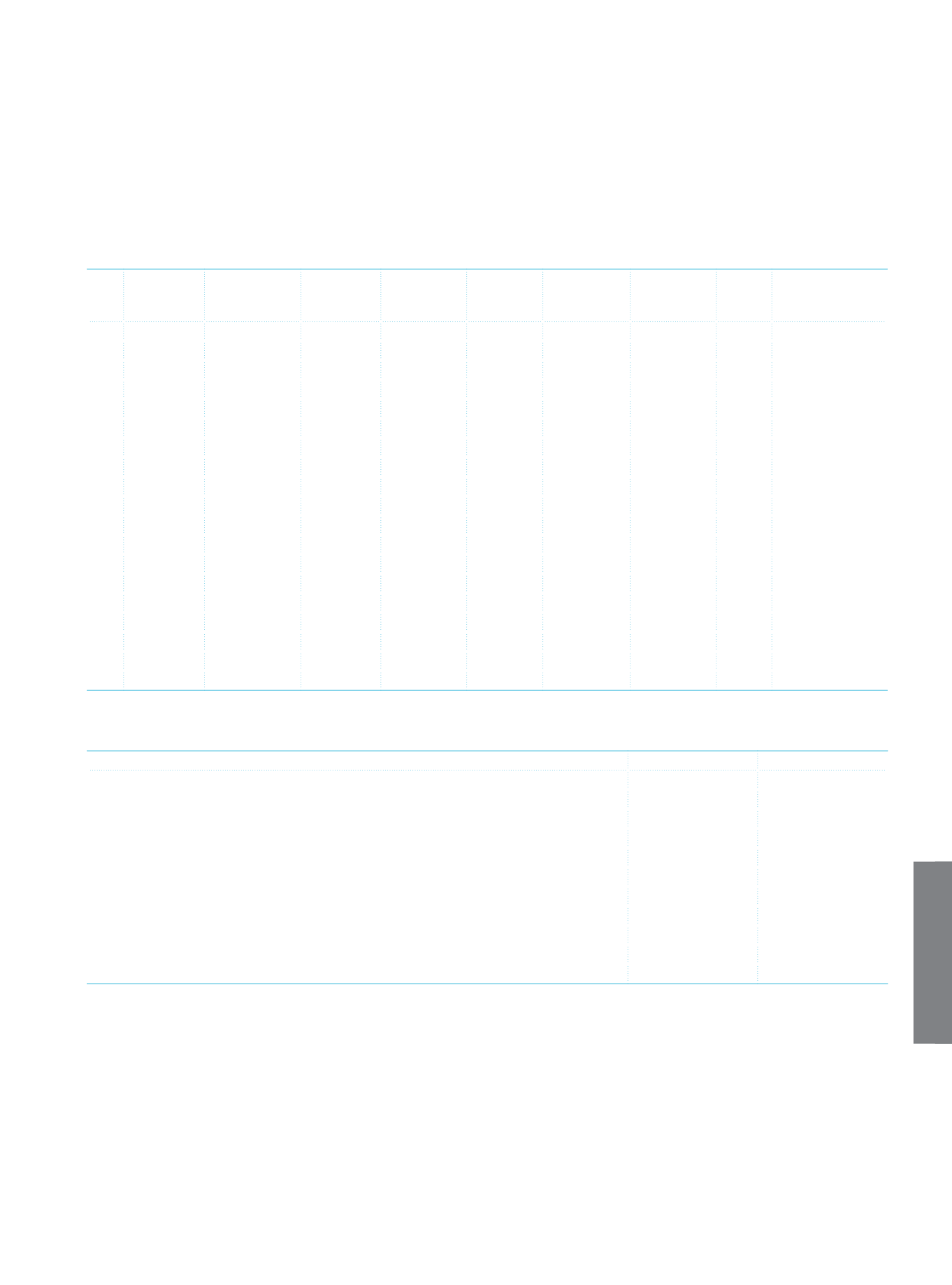

Financial statement information related to consolidated subsidiaries in the above order:

Total

Assets

Shareholder’

Equity

Total

Tangible

Assets

Interest

Income

(1)

Securities

Income

Current

Period

Profit/Loss

Prior Period

Profit/Loss

Fair

Value

Additional

Shareholders’

Equity Required

1-

2,992,599 652,845 97,605

86,271 43,003

66,403 (55,791)

2-

7,908,679

540,143 26,684 232,141 33,851

84,706 80,952

3-

17,031

2,912

615

1,238

517

(285)

(903)

4-

483,610

103,625 47,921

29,518

185 (16,040)

(2,479)

5-

110,660

15,923

3,909

17,188

1,644 (4,231)

6-

1,823

1,699

229

(41)

61

7-

261,877

260,683

102

5,308 4,946

4,377

47,527

8-

971,615

69,461

648 53,491

1,505

11,944

4,574

9-

3,492,581

603,638 2,958 188,495

2,573

42,189 41,801

10- 1,668,720 1,156,086 1,379,950

5,630 1,109 116,157

65,408

11-

420,681

268,703 84,272

8,004 2,841

66,919

51,676

12-

80,906

75,181

1,968

4,690

403

10,472

9,578

13- 4,935,366

917,423 95,408 194,142 139,022 125,312 137,364

14- 2,643,785

378,985 52,444 100,712

3,001

2,476

15,188

15-

95,805

15,922

739

8,225

2,917

897

16- 1,847,224 702,006 43,700 65,176 20,412

22,639 98,349

17-

376,188 208,995 335,484

1,117

-26,167

17,047

18- 13,439,216 2,017,534 248,941 657,490 23,443 295,154 325,151

19-

733,968

73,195

4,242

24,802 21,792

2,924

2,851

(1)

Includes interest income on securities.

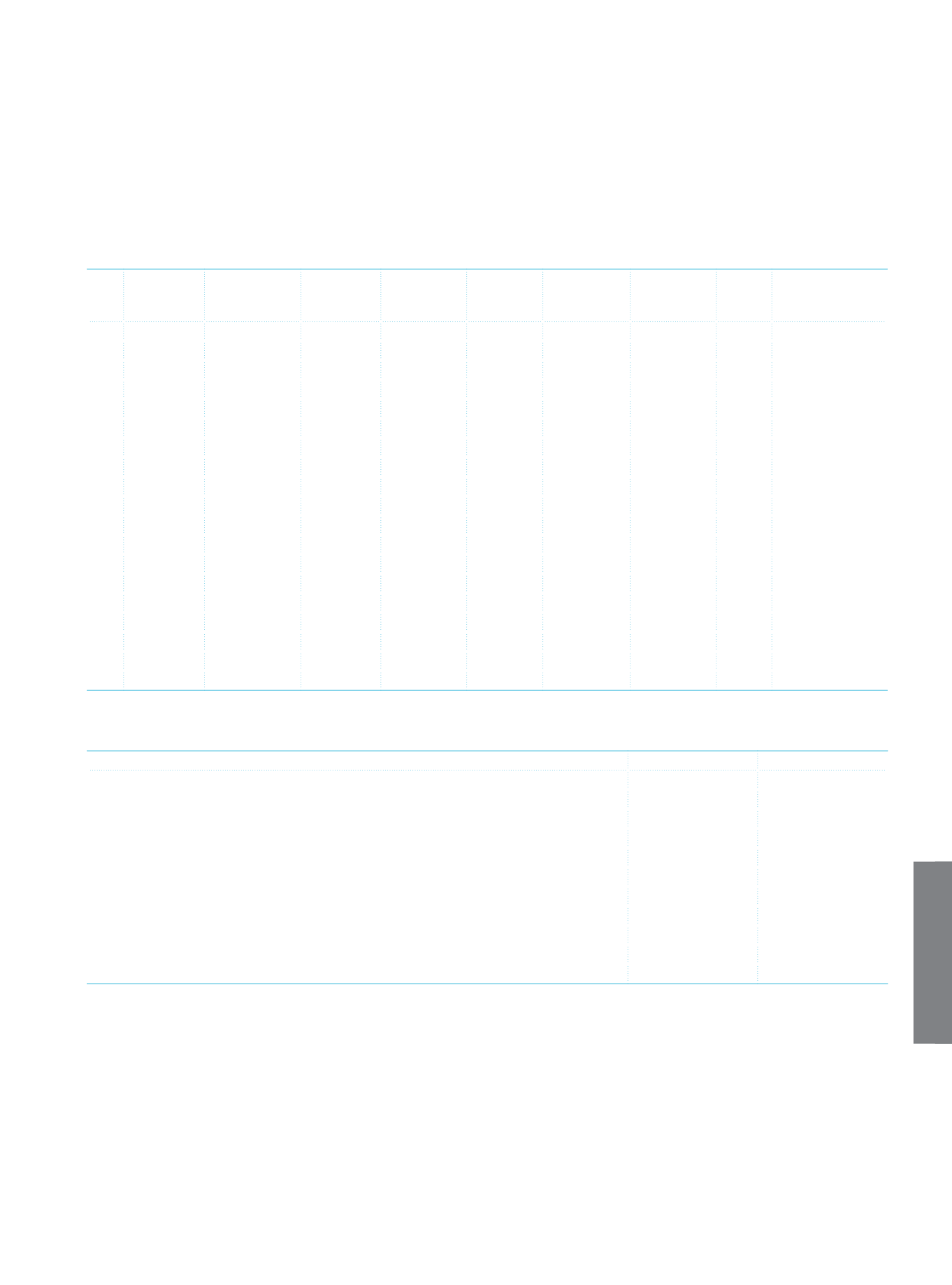

h.4. Movement of investments in subsidiaries:

Current Period

Prior Period

Balance at the Beginning of the Period

3,420,134

2,369,463

Movements in the Period

Purchases

(1)

205,075

225,428

Bonus Shares Acquired

Dividends Received from the Current Year Profit

Sales

Revaluation Surplus

(2)

69,499

825,243

Impairment

Balance at the End of the Period

3,694,708

3,420,134

Capital Commitments

Contribution in equity at the end of the period (%)

(1)

Balances in the current period, the consolidated profit of the subsidiaries have realized that stems from acquisitions related to capital increases

(2)

The relevant amounts represent the increases and decreases in the market value of subsidiaries quoted on the stock exchange.