270

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

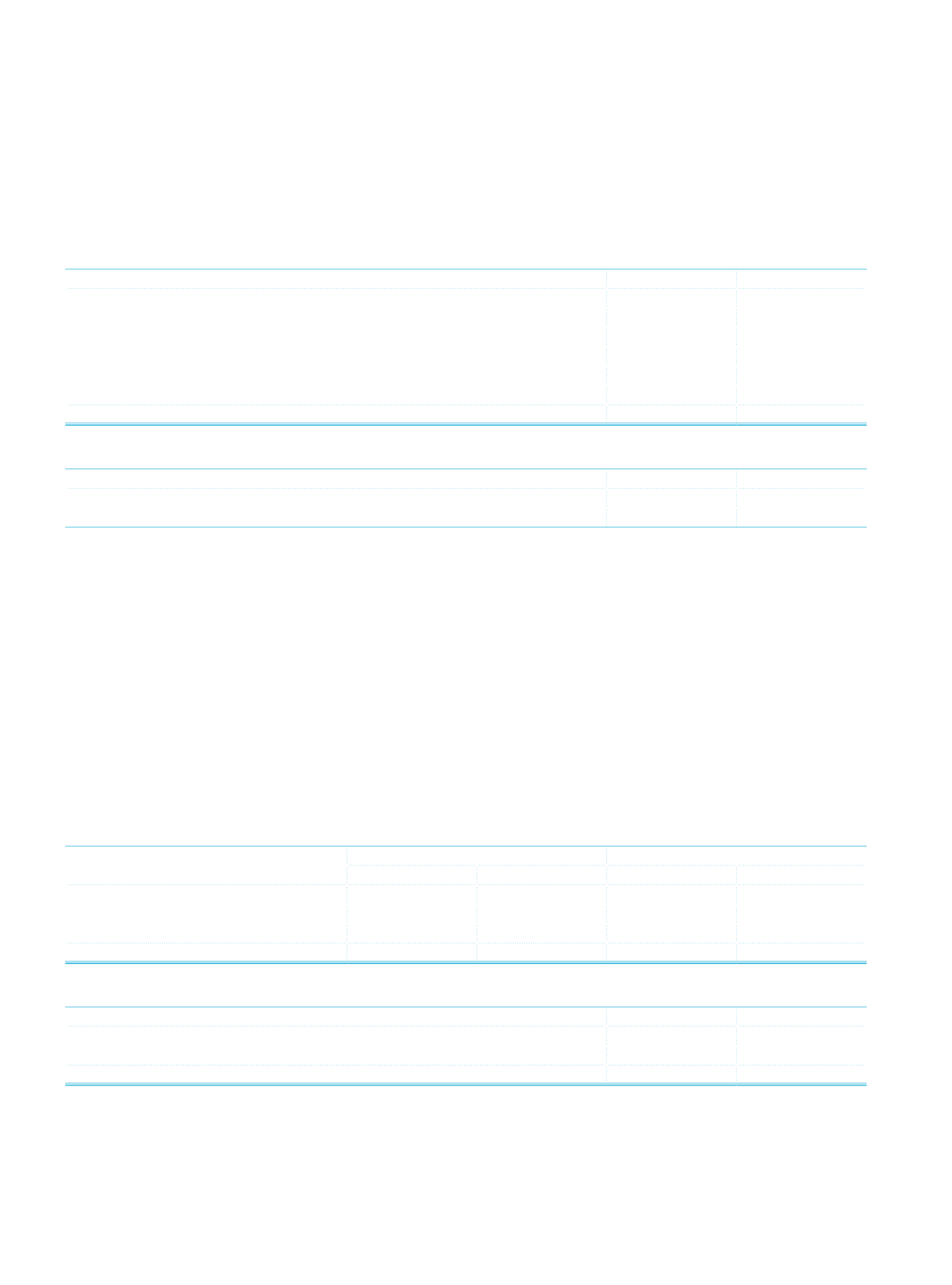

h.5. Sectoral information on consolidated subsidiaries and the related carrying amounts:

Current Period

Prior Period

Banks

1,369,683

1,386,942

Insurance Companies

1,592,835

1,230,445

Factoring Companies

Leasing Companies

112,051

110,282

Finance Companies

Other Financial Subsidiaries

620,139

692,465

Total

3,694,708

3,420,134

h.6. Consolidated subsidiaries traded on stock exchange:

Current Period

Prior Period

Traded on domestic stock exchanges

2,829,152

2,609,034

Traded on foreign stock exchanges

h.7. Consolidated subsidiaries disposed of in the current period: None.

h. 8. Subsidiaries acquired in the current period: None.

h. 9. Other issues on subsidiaries:

The Bank owned 86.90% shares, which equals to TL 77,776, of the Bayek Tedavi Sağlık Hizmetleri ve İşletmeciliği A.Ş.’s capital with

the amount of TL 89,500, All shares, and The Bank owned 99.98% shares, which equals to TL 18,627, of the Mipaş Mümessillik

İthalat İhracat ve Pazarlama A.Ş.’s capital with the amount of TL 18,630, all shares, owned by the Bank, has been sold to Nemtaş

Nemrut Liman İşletmeleri A.Ş. with the value of TL 127,315 and TL 87,010 the sales amount has been paid in advance, As a result of

this sales process, sales profit has been made with the amount of TL 913 and TL 55,663.

i.

Information on jointly controlled entities (Net):

There are no jointly controlled entities of the Parent Bank.

j.

Information regarding finance lease receivables (Net):

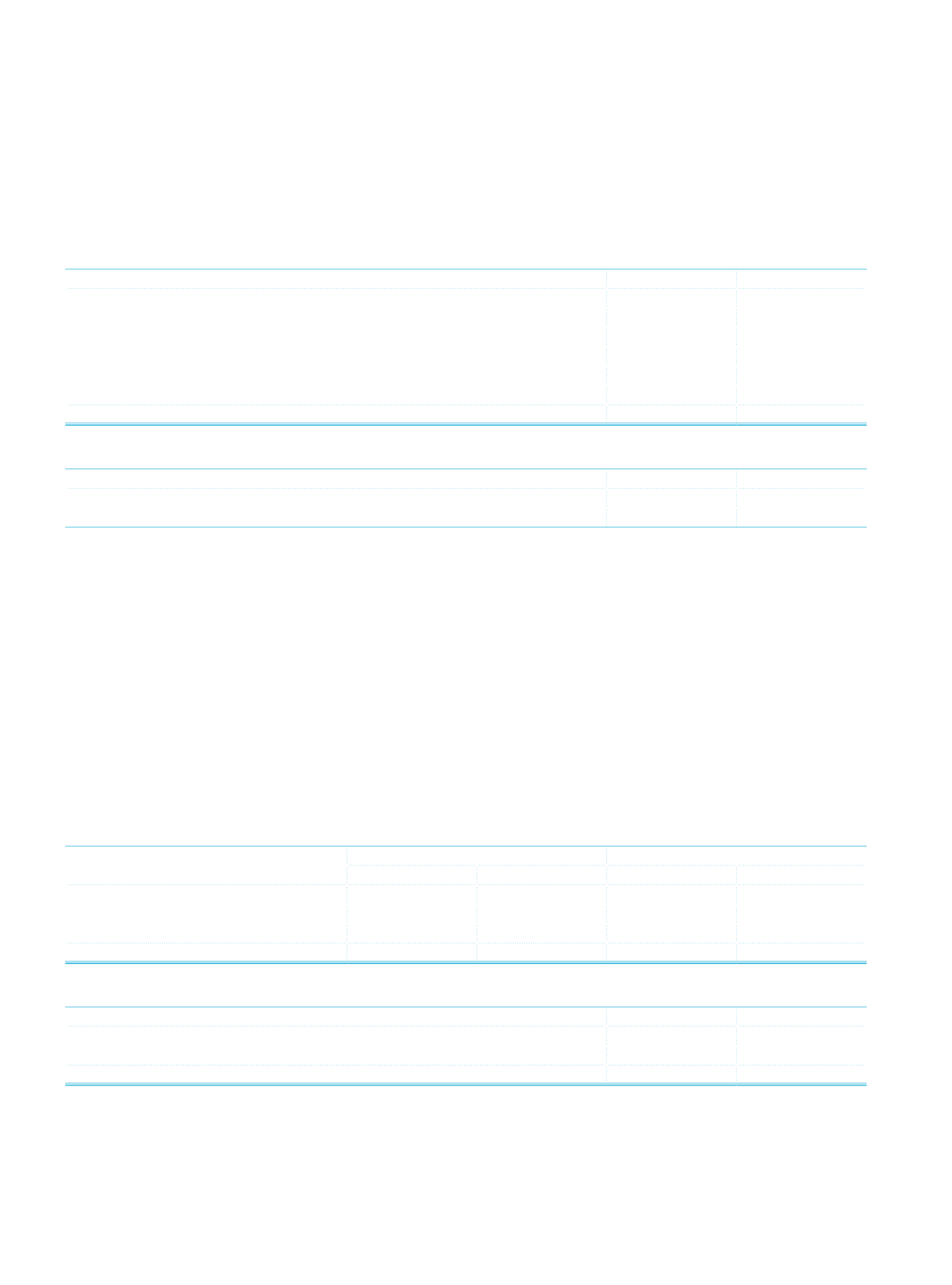

j.1. Presentation of finance lease receivables according to their remaining maturities:

Current Period

Prior Period

Gross

Net

Gross

Net

Less than 1 Year

860,283

729,537

560,948

462,386

1-4 Years

1,202,497

1,052,078

839,058

724,509

More than 4 Years

264,641

251,750

206,619

194,435

Total

2,327,421

2,033,365

1,606,625

1,381,330

j.2. Information regarding net investments made on finance lease:

Current Period

Prior Period

Gross Finance Lease Investment

2,327,421

1,606,625

Unearned Finance Revenue from Finance Lease (-)

294,056

225,295

Net Finance Lease Investment

(1)

2,033,365

1,381,330

(1)

The Group’s portfolio of non performing lease receivables in the current year, part of the TL 11,884 transferred to Türksasset Varlık Yönetim A.Ş. as a value of TL 96 and

part of TL 5,580 receivables previously written off transferred to the LBT Varlık Yönetim A.Ş. as a value of TL 189.

j.3. Presentation of operating lease receivables according to their remaining maturities:

The Group’s short term operating lease receivables is TL 757 as of 31 December 2013. (31 December 2012: TL 3,125)