278

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

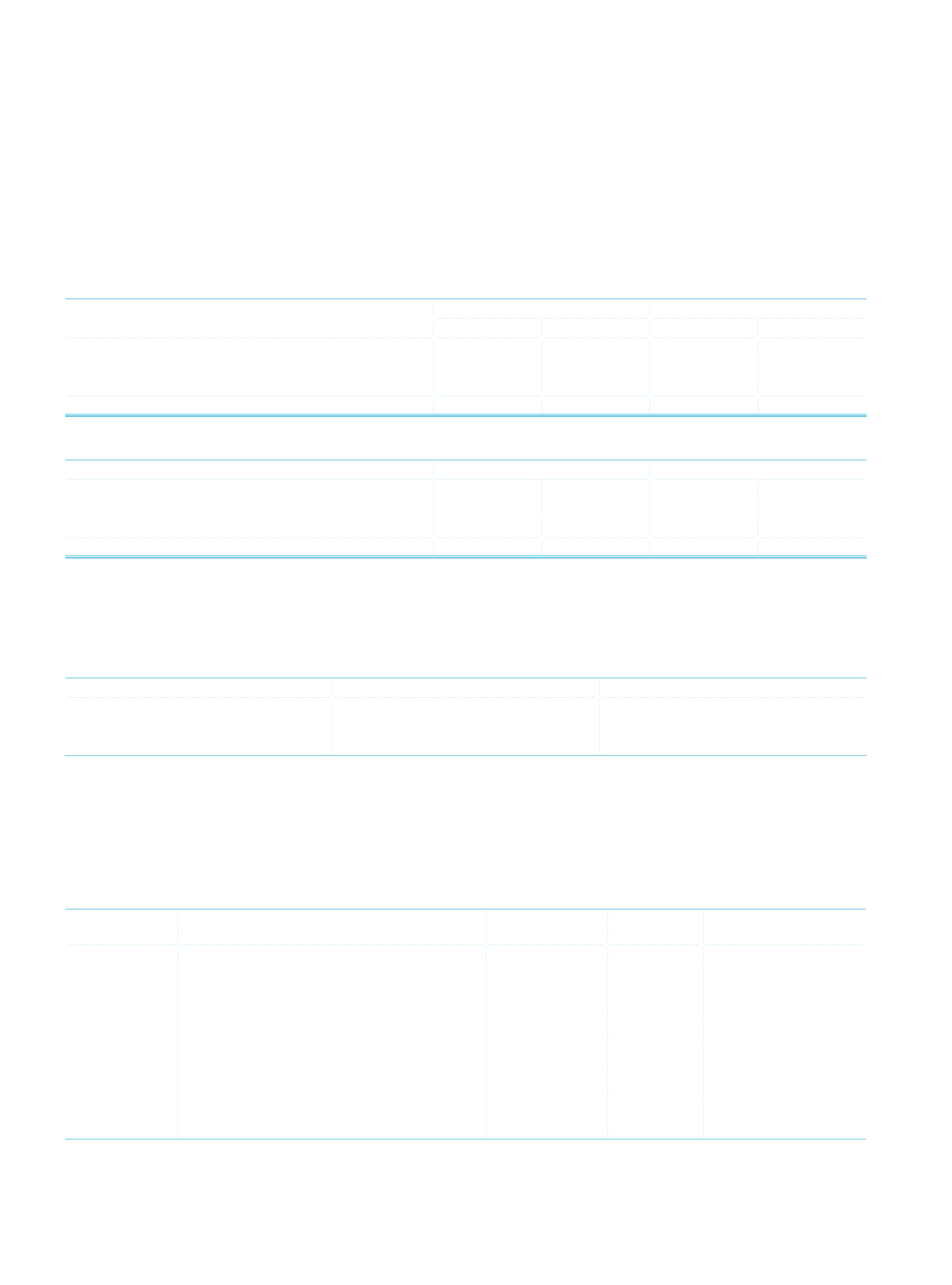

c.

Information on Funds Borrowed:

c.1. Information on banks and other financial institutions:

Current Period

Prior Period

TL

FC

TL

FC

Funds borrowed from the Central Bank of Turkey

Domestic banks and institutions

1,363,090

707,257

1,003,219

548,672

Foreign banks, institutions and funds

1,748,243 23,405,106

843,131

16,677,765

Total

3,111,333 24,112,363

1,846,350 17,226,437

c.2. Maturity analysis of funds borrowed:

Current Period

Prior Period

TL

FC

TL

FC

Short-term

2,796,848

8,615,258

1,790,826

5,976,423

Medium and Long-term

314,485 15,497,105

55,524 11,250,014

Total

3,111,333 24,112,363

1,846,350 17,226,437

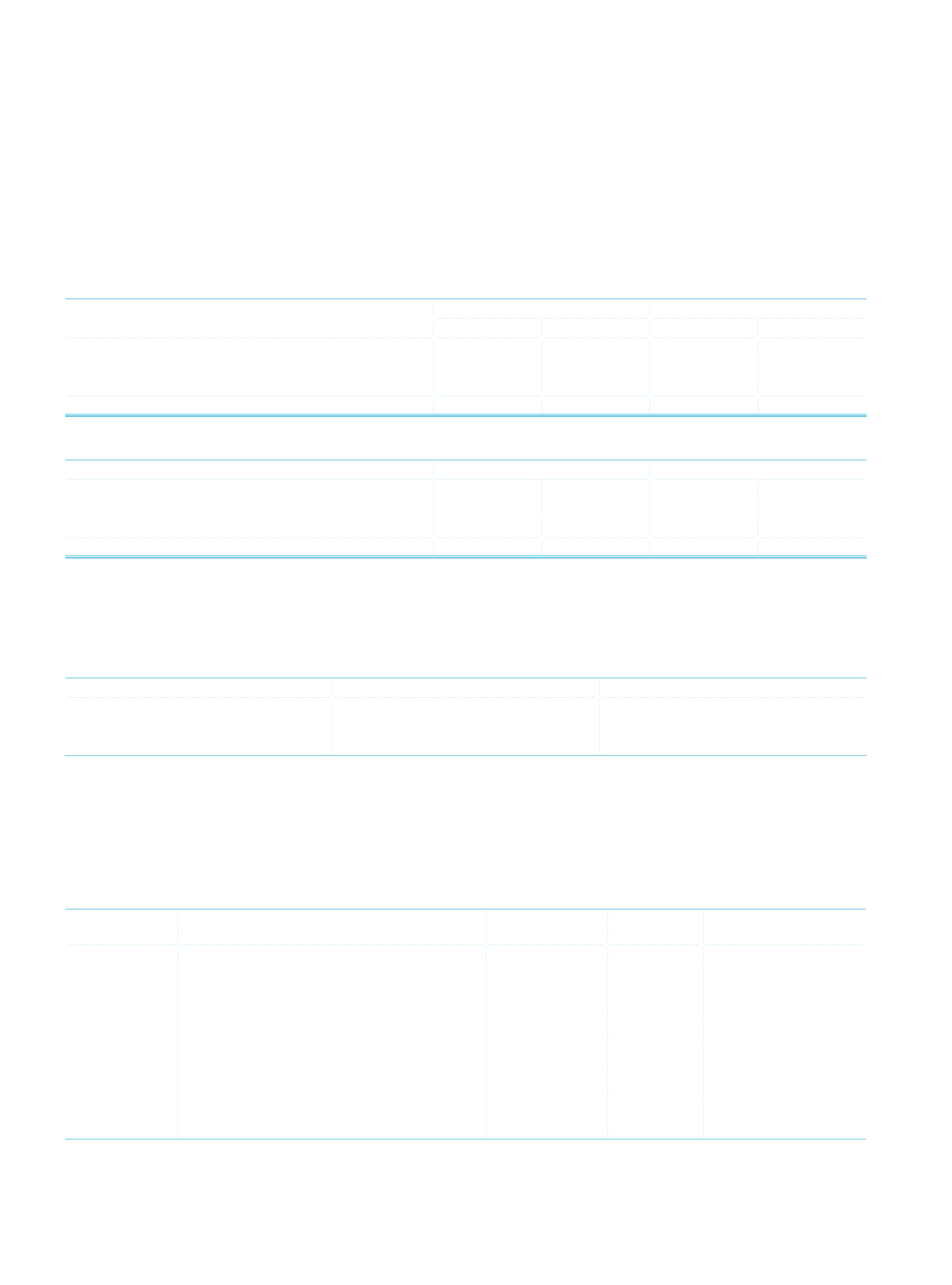

c.3. Information on funds borrowed:

Information on funds received through syndicated loans and securitization deals, which take a significant place among funds

borrowed, are given below.

Syndicated loans:

Date of Use

Funds Borrowed

Maturity

May 2013

USD 441,000,000 + EUR 631,000,000 1 year (with 1 year extension option)

July 2013

USD 15,000,000 + EUR 90,000,000

1 year

September 2013

USD 391,000,000 + EUR 651,500,000 1 year (with 1 year extension option)

Securitization deals:

The Parent Bank obtained funds by way of putting on securitization deals all its claims and receivables based on diversified payment

rights in USD, EUR and GBP through TIB Diversified Payment Rights Finance Company, and all its claims and receivables based on FC

debit and credit card receivables through TIB Card Receivables Funding Company Limited, both of which are special purpose vehicles

established abroad.

Information on funds received through securitization is given below.

Date

Special Purpose Vehicle (SPV)

Amount

Final Maturity

Remaining Debt Amount

as of 31 December 2013

November 2004 TIB Diversified Payment Rights Finance Company USD 600,000,000 7-10 years USD 16,000,000

December 2005 TIB Card Receivables Funding Company Limited USD 350,000,000 8 years

(1)

USD 9,462,517

June 2006

TIB Diversified Payment Rights Finance Company USD800,000,000 5-8 years

USD 43,000,000

March 2007

TIB Diversified Payment Rights Finance Company USD 550,000,000 7-8 years

USD 29,880,000

October 2011 TIB Diversified Payment Rights Finance Company USD 75,000,000 5 years

USD 75,000,000

October 2011 TIB Diversified Payment Rights Finance Company EUR 160,000,000 5-7 years

EUR 160,000,000

June 2012

TIB Diversified Payment Rights Finance Company USD 225,000,000 5 years

USD 225,000,000

June 2012

TIB Diversified Payment Rights Finance Company EUR 125,000,000 12 years

EUR 125,000,000

December 2013 TIB Diversified Payment Rights Finance Company USD 50,000,000 5 years

USD 50,000,000

December 2013 TIB Diversified Payment Rights Finance Company EUR 185,000,000 5-12 years EUR 185,000,000

(1)

The maturity date is 6 January 2014.