281

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

h.5.2. Liabilities arising from retirement benefits:

Liabilities of pension funds founded as per the Social Security Institution:

Within the scope of the explanations given in Section Three Note XVIII, in the actuarial report which was prepared as of 31 December

2013 for Türkiye İş Bankası A.Ş. Emekli Sandığı Vakfı (İşbank Pension Fund), of which each Bank employee is a member, and which

has been established according to the provisional Article 20 of the Social Security Act numbered 506, the amount of actuarial and

technical deficit stands at TL 1,7785,839. The Bank, provide provision in the related period for the foundation which is situated

in the financial statements for the current year. As a result of the actuarial valuation of Milli Reasürans T.A.Ş., besides the Parent

Bank, as of 31 December 2013, the amount of actuarial and technical deficit was determined to be TL 36,316. (31 December 2012:

TL 31,095). In this content, the difference between current period and prior period’s overall deficit which is TL 2,400 has been

reflected in the financial statement as additional provision.

The above mentioned actuarial audit, which was made in accordance with the principles of the related law, measures the cash value

of the liability as at 31 December 2013, in other words, it measures the amount to be paid to the Social Security Institution by the

Parent Bank. Actuarial assumptions used in the calculation are given below.

• 9.8% technical interest rate is used.

• After the date of 1 September 2013 taking into account the short term insurance premium is fixed by 2% and the total premium

rate is 34.5%

• CSO 1980 woman/man mortality tables are used.

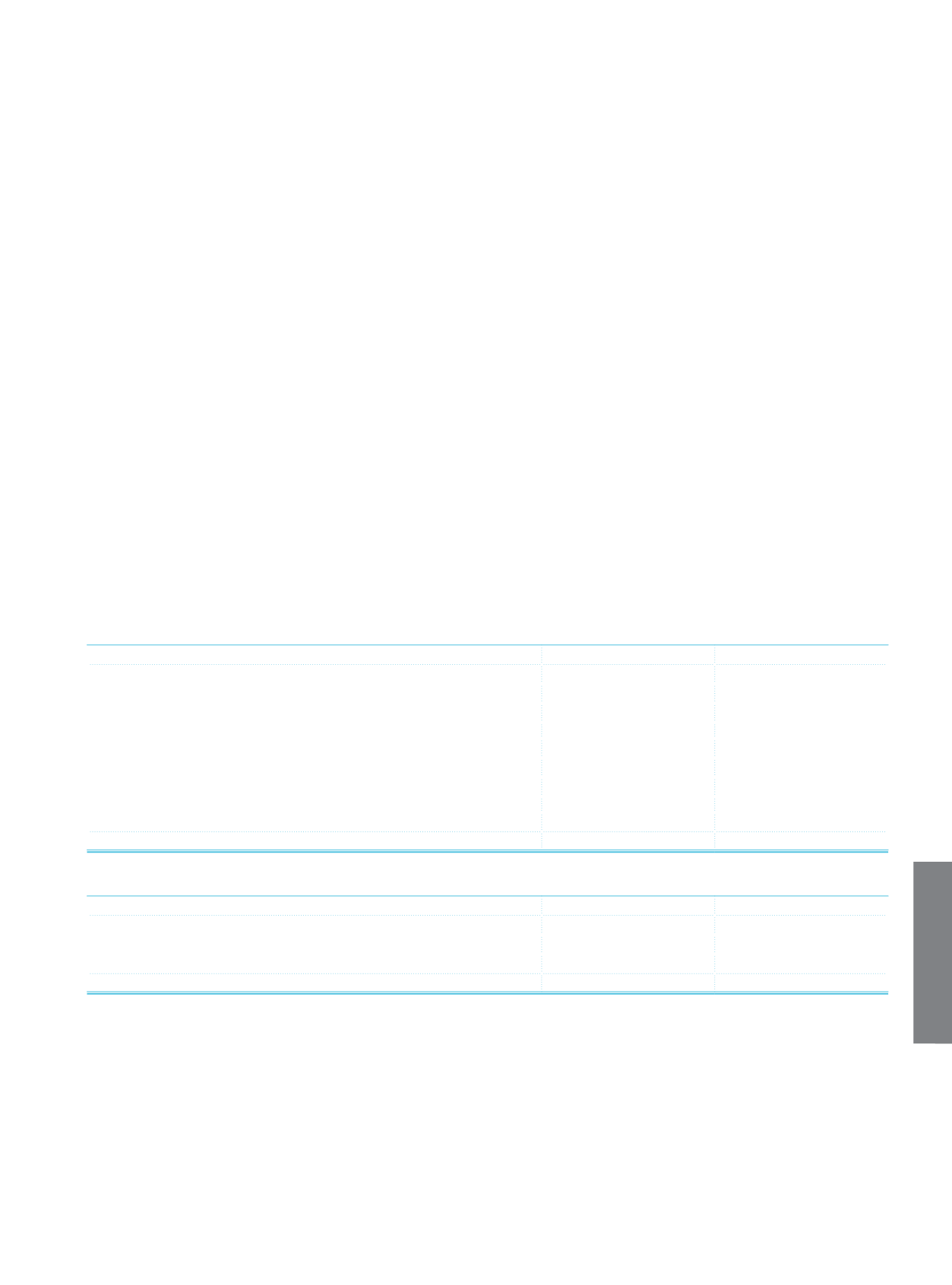

Below table shows the cash values of premium and salary payments of the Parent Bank as of 31 December 2013, taking the health

expenses within the Social Security Institution limits into account.

Current Period

Prior Period

Net Present Value of Total Liabilities Other Than Health

(4,900,737)

(4,323,548)

Net Present Value of Long Term Insurance Line Premiums

2,173,772

1,779,033

Net Present Value of Total Liabilities Other Than Health

(2,726,965)

(2,544,515)

Net Present Value of Health Liabilities

(660,534)

(581,57)

Net Present Value of Health Premiums

1,235,098

1,014,295

Net Present Value of Health Liabilities

574,564

432,724

Pension Fund Assets

376,562

333,581

Amount of Actuarial and Technical Deficit

(1,775,839)

(1,778,210)

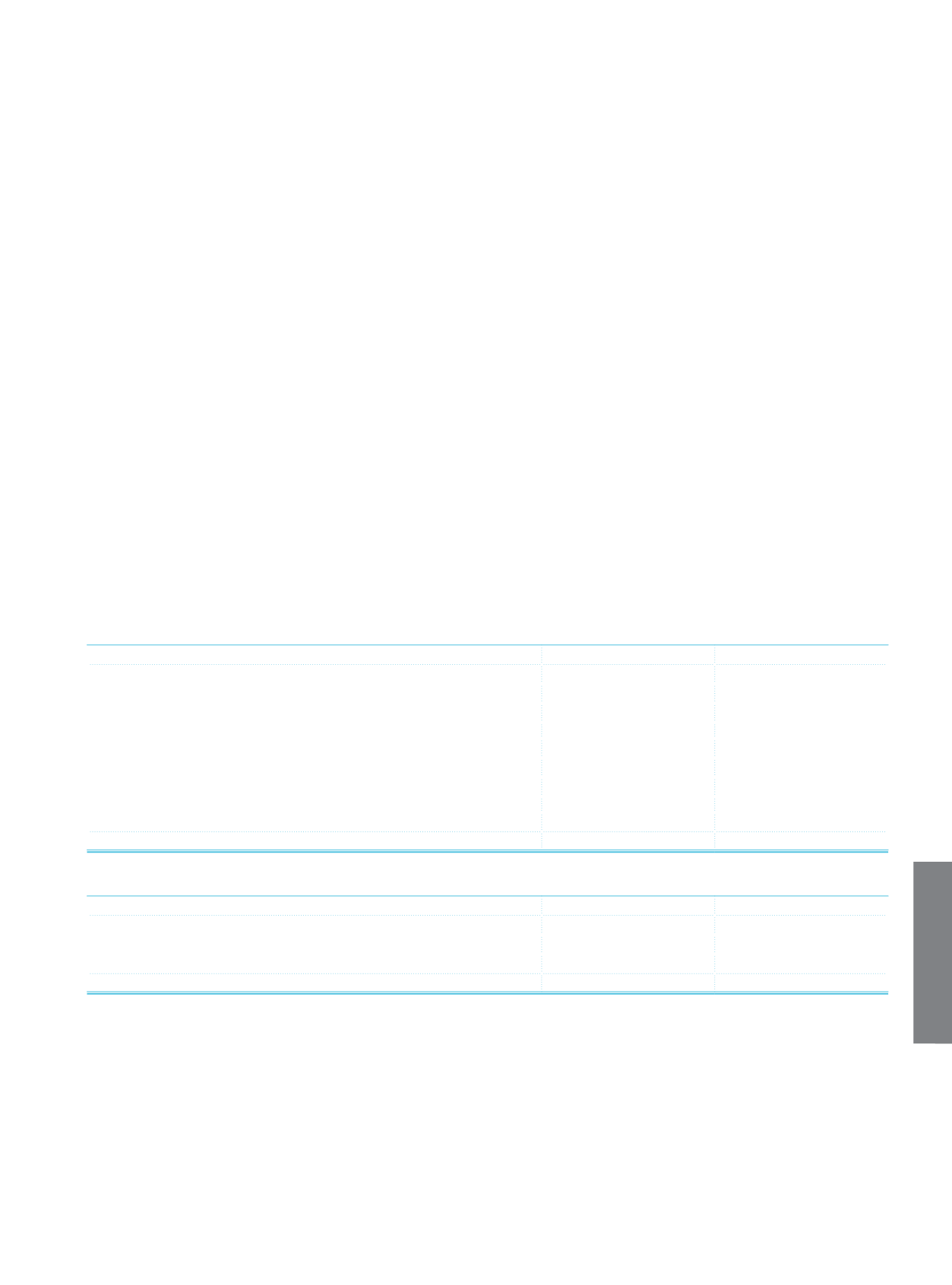

The assets of the pension fund are as follows.

Current Period

Prior Period

Cash

253,716

210,692

Securities Portfolio

96,722

96,928

Other

26,124

25,961

Total

376,562

333,581

On the other hand, after the transfer, the currently paid health benefits will be revised within the framework of the Social Security

Institution legislation and related regulations.