287

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

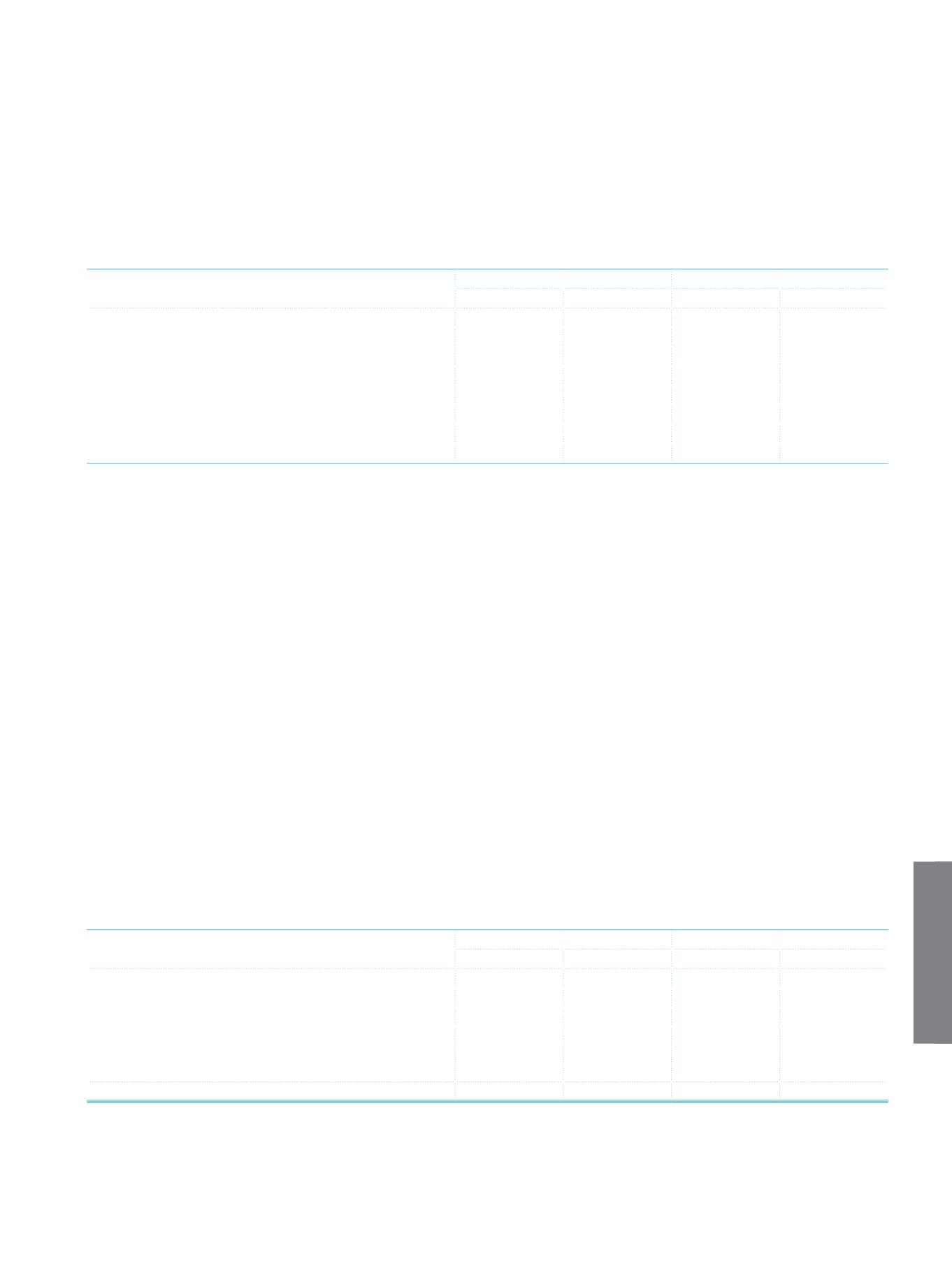

a.7. Non-cash Loans classified under Group I and Group II:

Group I

Group II

TL

FC

TL

FC

Non-cash Loans

16,002,659 23,582,800

107,404

77,189

Letters of Guarantee

15,845,025 14,600,435

107,404

62,386

Bank Acceptances

4,262

1,490,314

370

Letters of Credit

6,888,724

14,433

Endorsements

Underwriting Commitments of the Securities Issued

Factoring Related Guarantees

59,639

12,808

Other Guaranties and Warranties

93,733

590,519

b.

Information on Derivative Financial Instruments:

Majority of the Group’s derivative transactions comprise foreign currency and interest rate swaps, forward foreign exchange trading,

currency and interest rate options. Even though some derivative transactions economically provide risk hedging, since all necessary

conditions to be defined as items suitable for financial risk hedging accounting are not met, they are recognized as “held for trading

purposes” within the framework of TAS 39 “Financial Instruments: Recognition and Measurement”.

c.

Explanations Related to Contingencies and Commitments:

The balance of the “Other Irrevocable Commitments” account, which comprised the letters of guarantees, guarantees and

commitments submitted by the Group pursuant to its own internal affairs, and guarantees given to third parties by other institutions

in favor of the Parent Bank and the commitments due to housing loans extended within the scope of unfinished house projects

followed, amounts to TL 8,697,889. The cheques given to customers is presented under off balance sheet commitments, as per

the related regulations is amounting to TL 6,024,383. In case the cheques presented for payment to beneficiaries are not covered,

the Parent Bank will be obliged to pay the uncovered amount up to TL 660 (full amount expressed) for the cheques that are subject

to the Law numbered 3167 on “the Regulation of Payments by Cheque and Protection of Cheque Holders”, and up to TL 1,120 (full

amount) for the cheques that are subject to the “Cheque Law” numbered 5941. The uncollected amount will be followed under

“Indemnified Non-Cash Loans”.

d.

Explanations related to transactions made on behalf of or on the account of others:

It is explained in Note XIV under Section Four.

IV. Disclosures and Footnotes on the Consolidated Income Statement

a.

Interest Income

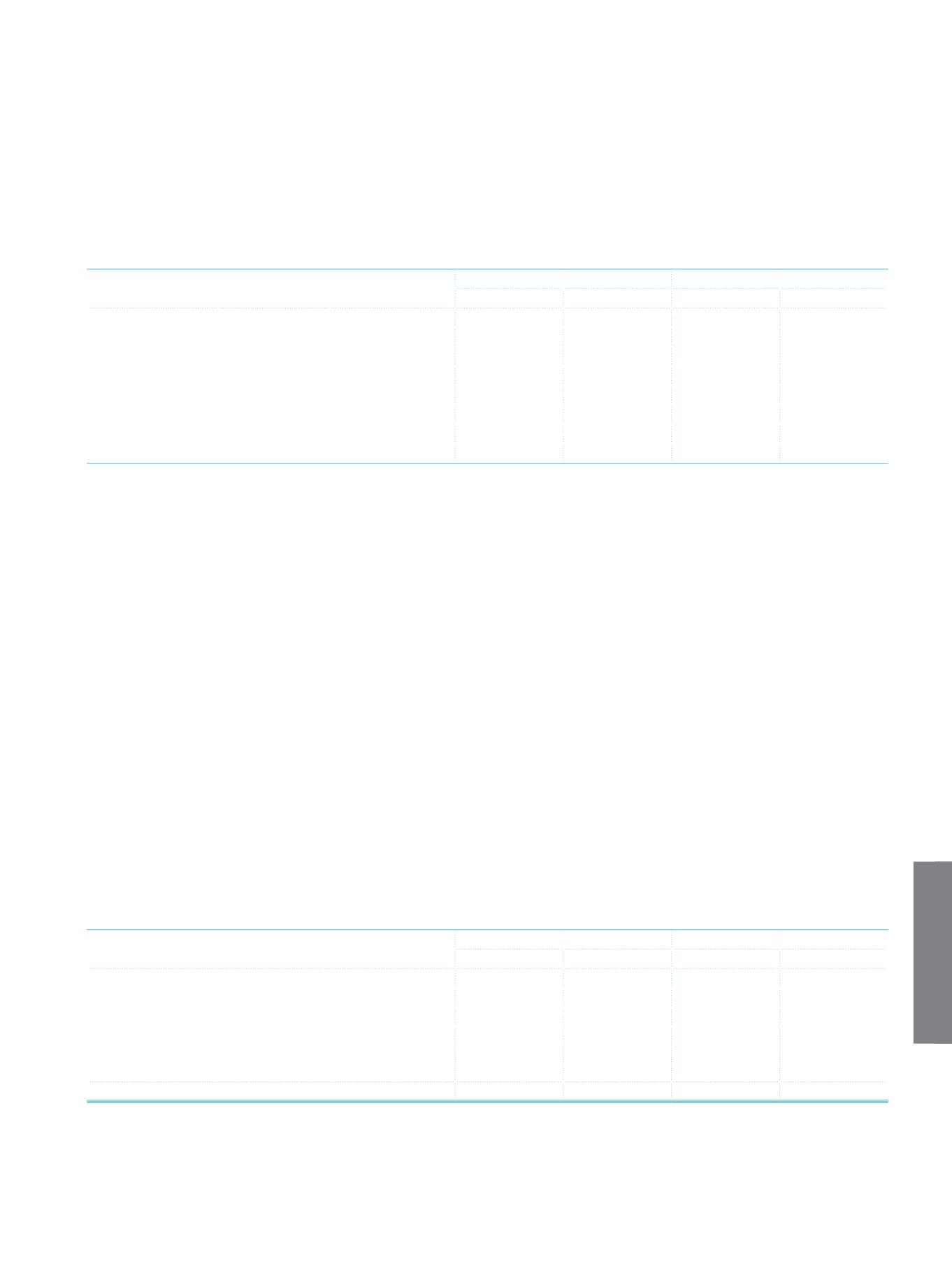

a.1. Information on interest income on loans:

Current Period

Prior Period

TL

FC

TL

FC

Interest Income on Loans

(1)

Short-term Loans

3,110,497

330,761

3,426,444

356,691

Medium and Long-term Loans

5,110,579

2,155,926 4,484,870

1,686,085

Interest on Non-performing Loans

168,569

3,453

166,915

8,958

Premiums Received from State Resource Utilization

Support Fund

Total

8,389,645

2,490,140 8,078,229 2,051,734

(1)

Includes fee and commission income on cash loans.