285

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

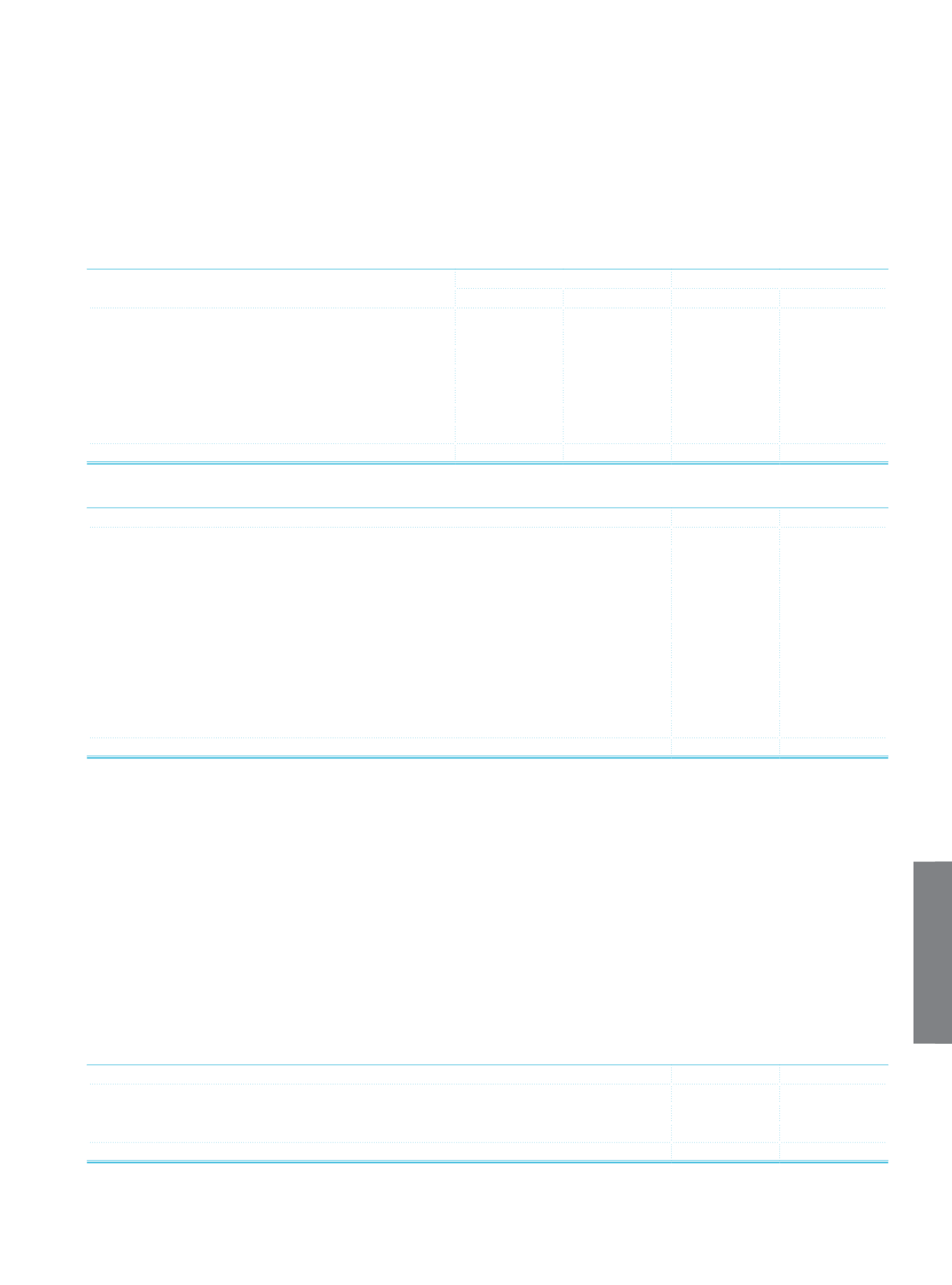

l.9. Information on marketable securities value increase fund:

Current Period

Prior Period

TL

FC

TL

FC

Associates, Subsidiaries and Jointly Controlled Entities

1,323,340

1,556,431

Valuation Difference

1,323,340

1,556,431

Foreign Exchange Differences

Financial Assets Available for Sale

(611,153)

(31,790)

582,156

474,466

Valuation Difference

(760,743)

(32,045)

735,080

475,221

Deferred Tax Effect on Valuation

149,590

255

(152,924)

(755)

Foreign Exchange Differences

Total

712,187

(31,790)

2,138,587

474,466

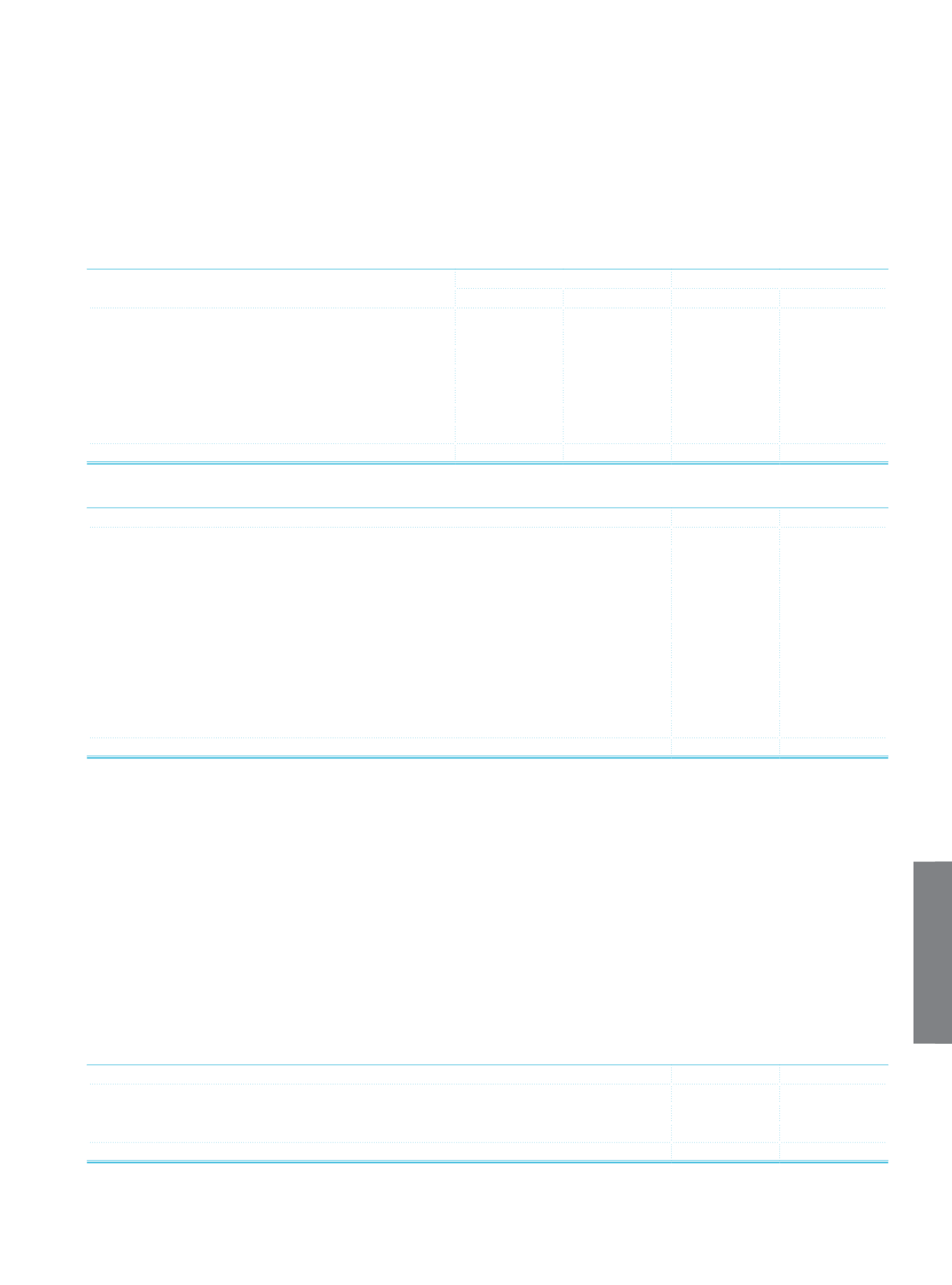

m.

Explanations on Non-controlling Interest:

Current Period Prior Period

Paid-in Capital

2,006,558 1,846,726

Share Premium

5,406

5,406

Marketable Securities Revaluation Reserve

184,493

215,145

Bonus Shares Obtained from Associates, Subsidiaries and Jointly Controlled Entities (Joint

Ventures)

1,179

1,179

Legal Reserves

200,402

170,317

Statutory Reserves

47,289

40,389

Extraordinary Reserves

273,045

279,587

Other Profit Reserves

(864)

517

Prior Years’ Profit/Loss

(7,881)

(2,011)

Current Year Profit/Loss

(1)

423,823

334,562

Period Ending Balance

3,133,450 2,891,817

(1)

Difference between effective and direct shareholding rate was TL 52,885 in the current period (31 December 2012: TL 31,851).

III. Disclosures and Footnotes on Consolidated Off-Balance Sheet Items

a.

Explanations to Liabilities Related to Off-balance Sheet Items:

a.1. Types and amounts of irrevocable loan commitments:

Commitment for customer credit card limits amounts to TL 17,679,967 and commitment to pay for cheque leaves amounts to

TL 6,024,383. The amount of commitment for the forward purchase of assets is TL 1,957,163 and for the forward sale of assets is

TL 2,033,333.

a.2. The structure and amount of probable losses and commitments resulting from off-balance sheet items, including those

below:

There are no probable losses related to off-balance sheet items. Commitments are shown in the table of “Off-Balance Sheet Items”.

a.3. Guarantees, bank acceptances, collaterals that qualify as financial guarantees, and non-cash loans including other letters of

credit:

Current Period Prior Period

Bank Acceptances

1,494,946

1,298,250

Letters of Credit

6,903,157

5,220,486

Other Guarantees

756,699

631,010

Total

9,154,802

7,149,746