267

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

g.

Information on Associates (Net):

g.1. Information on unconsolidated associates: None.

g.2. Information on consolidated associates:

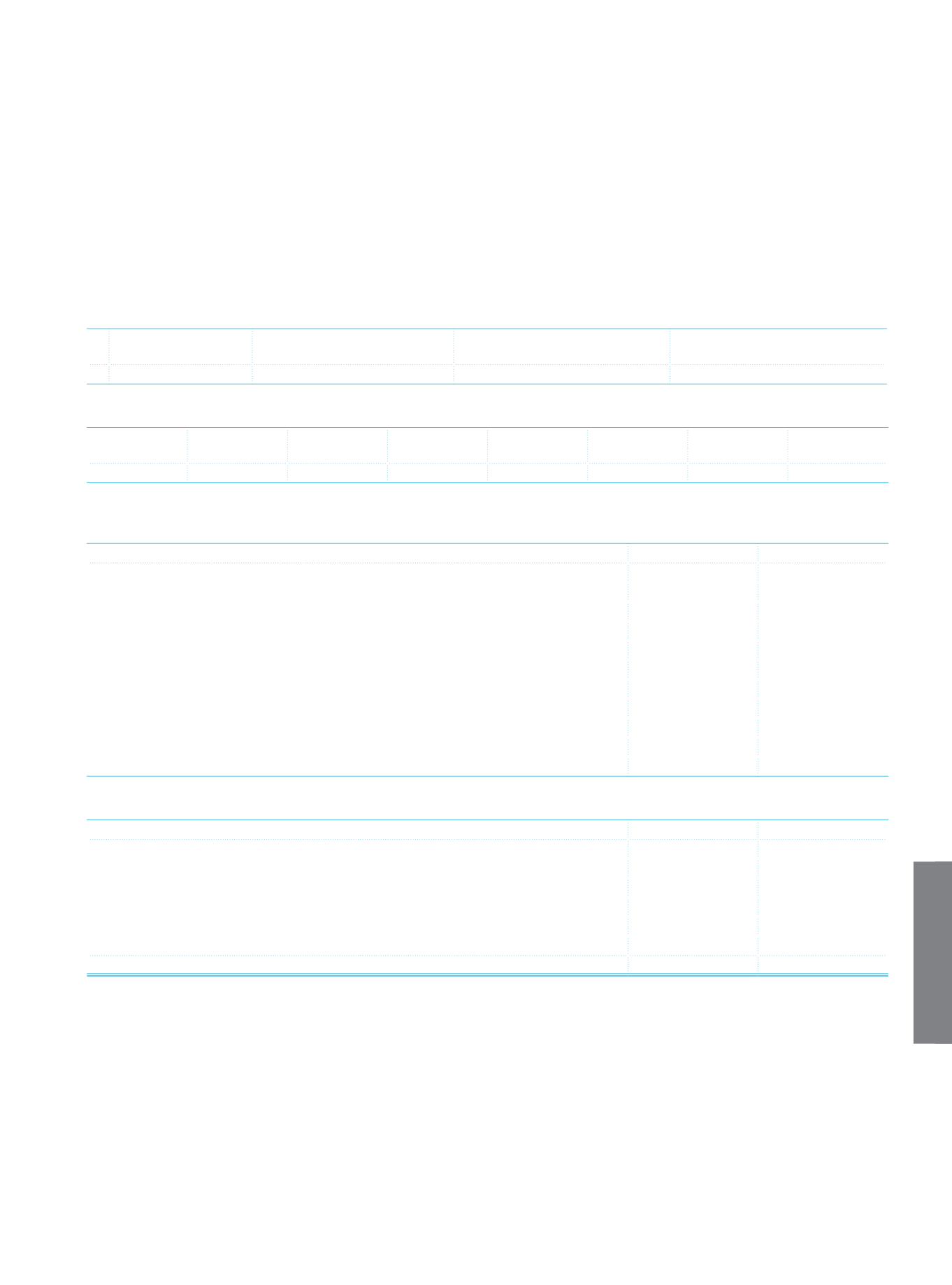

Title

Address (City/Country)

Bank’s Share Percentage-If

Different, Voting Percentage (%)

Bank’s Risk Group Share

Percentage (%)

1- Arap Türk Bankası A.Ş. İstanbul/TURKEY

20.58

79.42

Information on financial statements of associates in the above order:

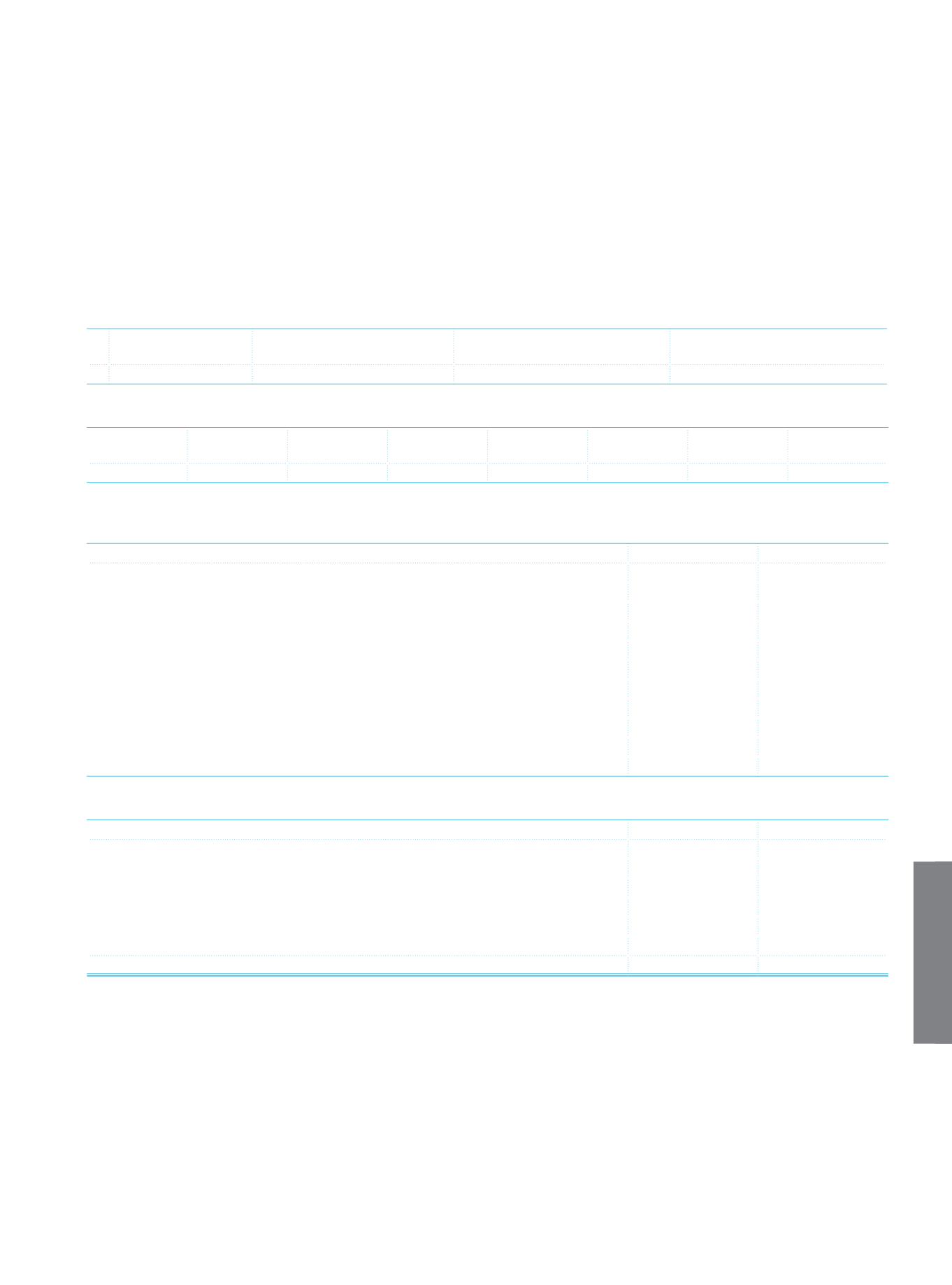

Total Assets

Shareholders’

Equity

Total Tangible

Assets

Interest

Income

(1)

Securities

Income

Current Period

Profit/Loss

Prior Period

Profit/Loss

Fair Value

3,466,934 469,698

27,850

115,593

66

48,534

59,860

(1)

Includes interest income on securities.

g.3. Movement of investments in consolidated associates:

Current Period

Prior Period

Beginning balance

85,295

85,295

Movements during the period

Purchases

Bonus shares acquired

Dividends received from the current year profit

Sales

Revaluation Increase

Impairment

Balance at the end of the period

85,295

85,295

Capital commitments

Contribution in equity at the end of the period (%)

g.4. Sectoral information on consolidated associates and the related carrying amounts:

Current Period

Prior Period

Banks

85,295

85,295

Insurance Companies

Factoring Companies

Leasing Companies

Finance Companies

Other Financial Participations

Total

85,295

85,295

g.5. Consolidated associates traded on a stock exchange: None.

g.6. Consolidated associates disposed of in the current period: None.

g.7. Consolidated associates acquired in the current period: None.

g.8. Other issues related to associates:

İş Girişim Sermayesi Yatırım Ortaklığı A.Ş. sold all the shares of Aras Kargo A.Ş., to Post 206 Beteiligungs GmbH with the value of

TL 100,000 and sold all the shares of Türkmed Diyaliz Böbrek Sağlığı Kurumları A.Ş. to Basri Yılmaz with the value of TL 500. As a

result of these sales transactions, TL 80,084 profit was obtained.