14.4%

İşbank’s capital adequacy ratio stood at 14.4%

as of 2013 year-end.

TL 3,163 million

İşbank posted a net profit of TL 3,163 million

in 2013.

Under the volatile and changing

market conditions of 2013,

İşbank continued to support the

Turkish economy by offering

high value added products and

services to its customers.

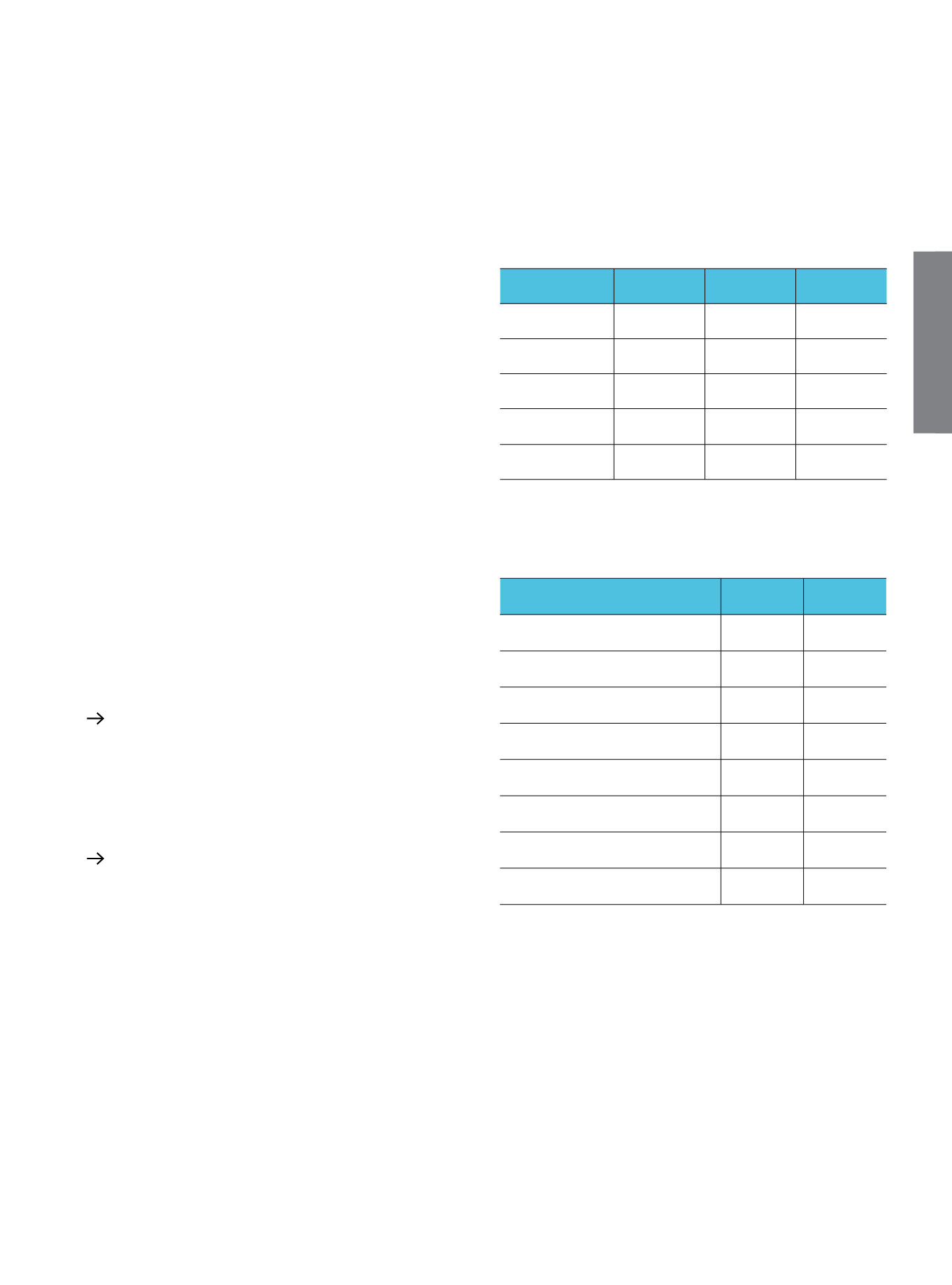

Key Financial Highlights (TL Million)

31.12.2012 31.12.2013 Change (%)

Total Assets

175,444 210,500

20.0

Loans

106,716 134,843

26.4

Deposits

105,383 120,975

14.8

Shareholders’

Equity

22,719

23,579

3.8

Net Profit

3,310

3,163

-4.4

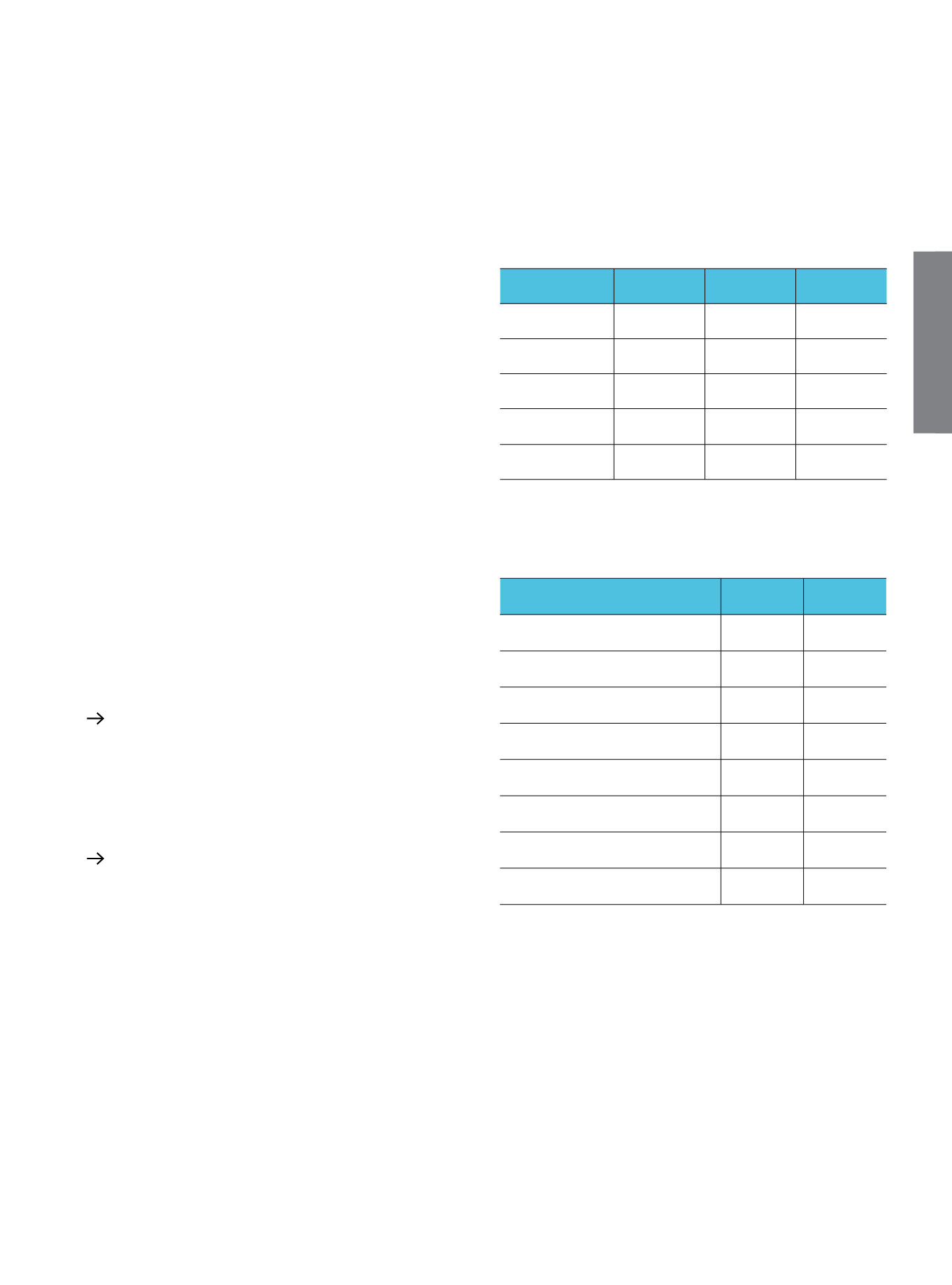

Key Financial Ratios (%)

31.12.2012 31.12.2013

Interest Earning Assets

(*)

/ Total

Assets

91.4

92.2

Loans / Total Assets

60.8

64.1

Loans / Deposits

101.3

111.5

NPL Ratio

1.9

1.6

NPL Coverage Ratio

78.9

80.4

Demand Deposits / Total Deposits

19.9

21.2

Shareholders’ Equity / Total

Liabilities

12.9

11.2

Capital Adequacy Ratio

16.3

14.4

(*)

Interest earning assets include TL and FC legal reserves.

Introduction

5

İşbank

Annual Report 2013