TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements for the Year Ended

31 December 2014

FINANCIAL INFORMATION AND

RISK MANAGEMENT

129

İŞBANK

ANNUAL REPORT 2014

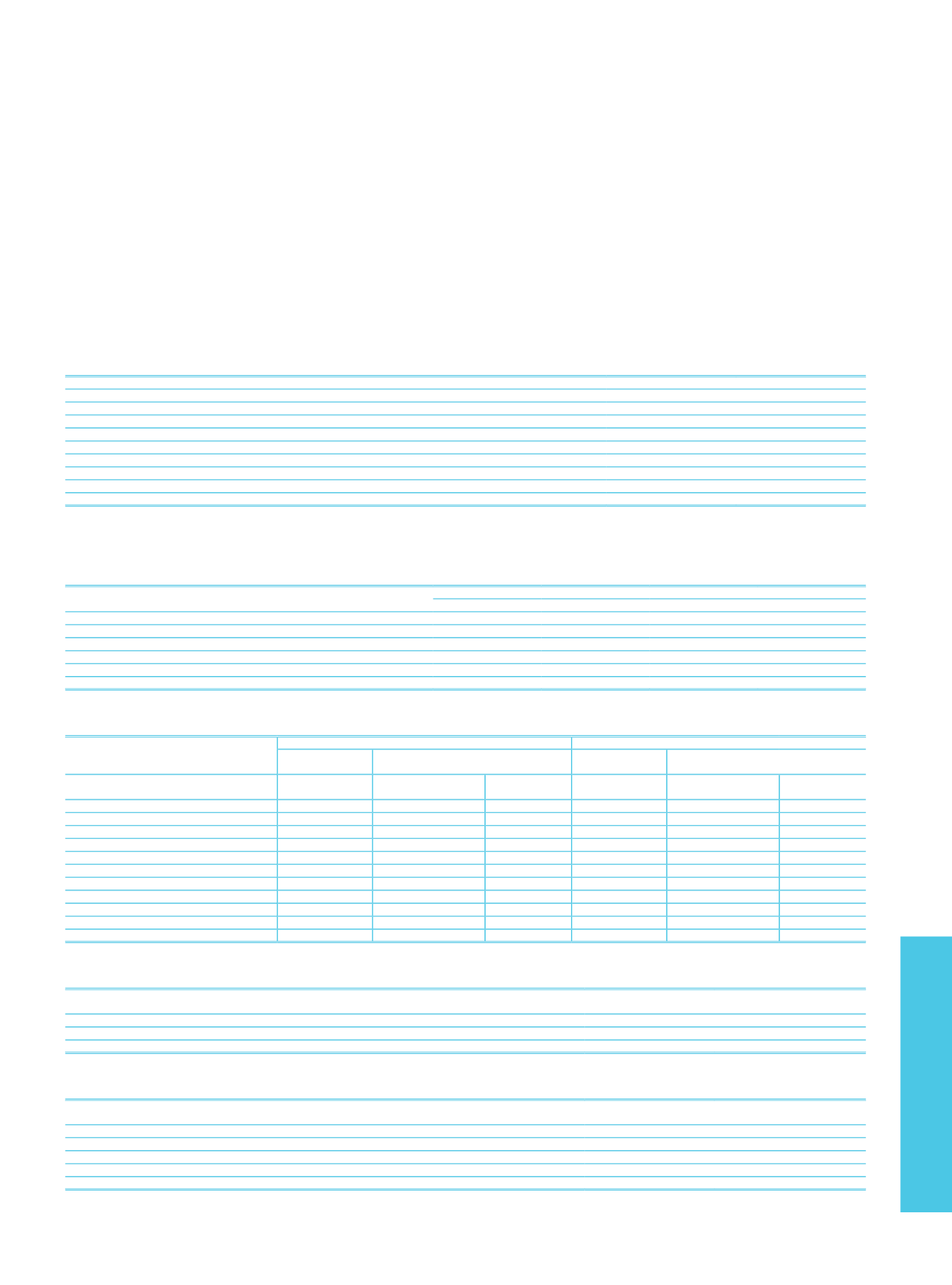

e. Information on Financial Assets Available for Sale:

e.1. Information on financial assets available for sale, which are given as collateral or blocked:

Financial assets available for sale, which are given as collateral or blocked, amount to TL 8,085,742 as of 31 December 2014 (31 December 2013: TL 3,466,708).

e.2. Information on financial assets available for sale, which are subject to repurchase agreements:

Financial assets available for sale, which are subject to repurchase agreements amount to TL 18,411,810 as of 31 December 2014 (31 December 2013: TL 16,621,455).

f. Information on financial assets available for sale:

Current Period

Prior Period

Debt Securities

39,195,200

28,930,590

Quoted on a Stock Exchange

32,105,851

19,483,445

Not-Quoted

(1)

7,089,349

9,447,145

Share Certificates

33,915

28,085

Quoted on a Stock Exchange

Not-Quoted

33,915

28,085

Value Increase / Impairment Losses (-)

104,980

654,847

Other

165,826

44,002

Total

39,289,961

28,347,830

(1)

Refers to the debt securities, which are not quoted on the Stock Exchange or which are not traded, although quoted, on the Stock Exchange at the end of the related period.

g. Information related to loans:

g.1. Information on all types of loans and advances given to shareholders and employees of the Bank:

Current Period

Prior Period

Cash

Non-Cash

Cash

Non-Cash

Direct Lending to Shareholders

Corporate Shareholders

Individual Shareholders

Indirect Lending to Shareholders

Loans to Employees

220,861

78

213,084

39

Total

220,861

78

213,084

39

g.2. Information about the first and second group loans and other receivables including loans that have been restructured or rescheduled, loans and receivables amended on

conditions of contract:

Cash Loans

Standard Loans and Other Receivables

Loans and Other Receivables Under Close Monitoring

Loans and Other

Receivables (Total)

Amendments

on Conditions of Contract

Loans and Other

receivables (Total)

Amendments

on Conditions of Contract

Extension of the

payment plan

Other

Extension of the

payment plan

Other

Non-specialized loans

152,625,439

2,569,017

1,781,607

2,690,059

608,862

76,574

Corporation Loans

77,688,211

1,105,425

1,070,795

235,067

(1)

45,654

Export Loans

8,054,924

10,956

58,156

2,697

Import Loans

Loans Given to Financial Sector

3,040,514

Consumer Loans

32,414,634

1,432,434

1,778,884

901,584

83,091

30,920

Credit Cards

9,667,375

438,143

250,261

Other

21,759,781

20,202

2,723

221,381

37,746

Specialized Loans

Other Receivables

Total

152,625,439

2,569,017

1,781,607

2,690,059

608,862

76,574

(1)

The amount of TL 32,808 loans provided to maritime sector which have extended payment plans with the scope of Temporary 6. Substance of the “Regulation on Procedures and Principles for Determination of

Qualifications of Loans and Other Receivables by Banks and Provisions to be Set Aside.”

Number of Amendments Related to the Extension of the Payment Plan

Standard Loans and Other

Receivables

Loans and Other Receivables

Under Close Monitoring

Extended for 1 or 2 Times

2,502,510

595,415

(1)

Extended for 3,4 or 5 Times

65,899

13,384

(1)

Extended for More than 5 Times

608

63

(1)

The amount of TL 32,808 loans provided to maritime sector which have extended payment plans with the scope of Temporary 6. Substance of the “Regulation on Procedures and Principles for Determination of

Qualifications of Loans and Other Receivables by Banks and Provisions to be Set Aside.”

The Time Extended via the Amendment on Payment Plan

Standard Loans and

Other Receivables

Loans and Other Receivables

Under Close Monitoring

0-6 Months

658,082

37,122

6 Months – 12 Months

289,497

69,029

1 – 2 Years

667,907

116,493

2 –5 Years

741,686

259,214

(1)

5 Years and More

211,845

127,004

(1)

(1)

The amount of TL 32,808 loans provided to maritime sector which have extended payment plans with the scope of Temporary 6. Substance of the “Regulation on Procedures and Principles for Determination of

Qualifications of Loans and Other Receivables by Banks and Provisions to be Set Aside.”