TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements for the Year Ended

31 December 2014

172

İŞBANK

ANNUAL REPORT 2014

The difference between the sales proceeds arising from the disposal of tangible assets or the inactivation of a tangible asset and the book value of the tangible asset are recognized

in the income statement.

Regular maintenance and repair costs incurred for tangible assets are recorded as expense.

There are no restrictions such as pledges, mortgages on tangible assets.

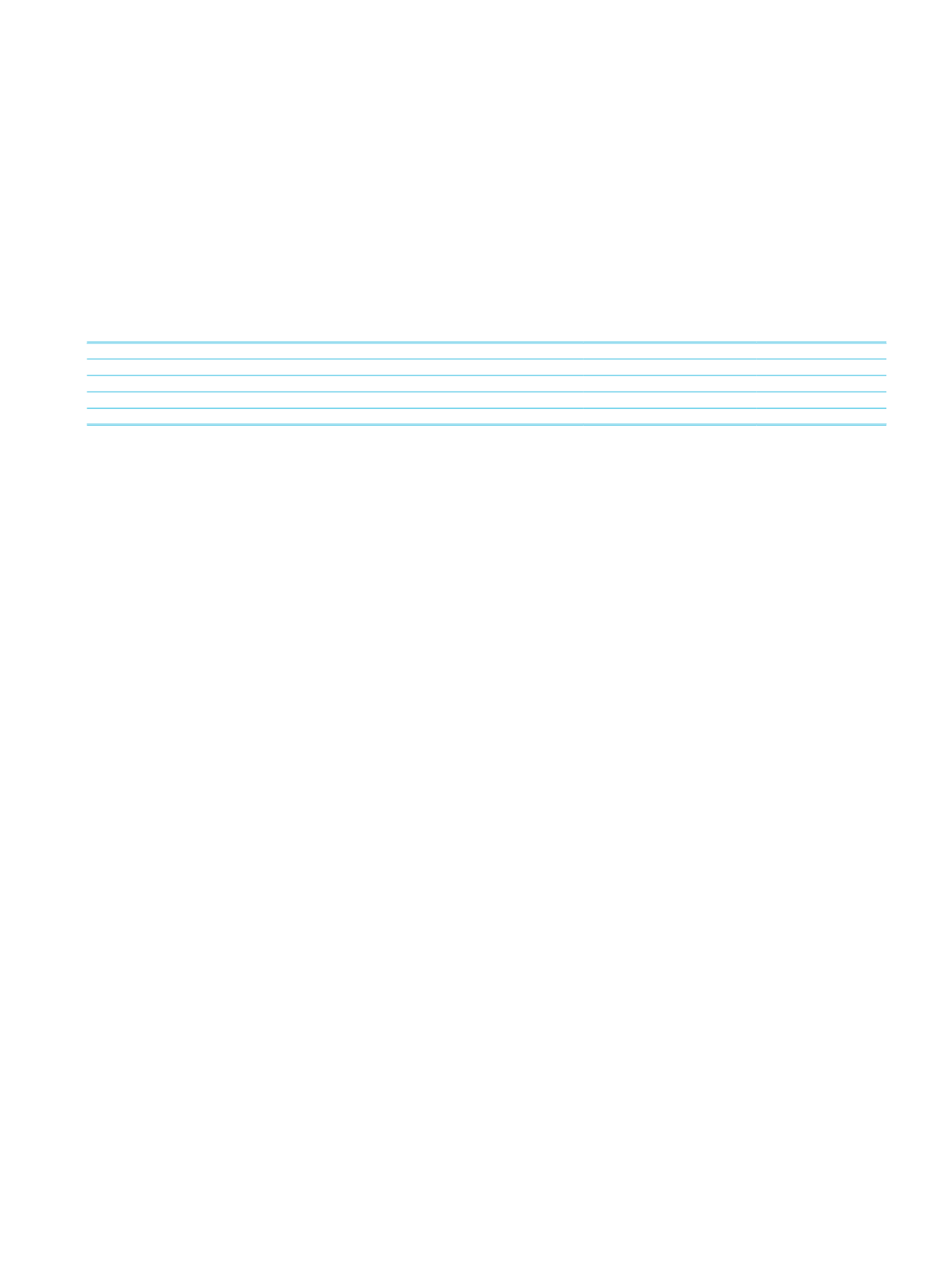

The depreciation rates used in amortization of tangible assets and their estimated useful lives are as follows:

Estimated Economic Life (Year)

Depreciation Rate

Buildings

4-50

2% - 25%

Safe Boxes

2-50

2% - 50%

Other Movables

2-25

4% - 50%

Leased Assets

4-15

6.66% - 25%

XIV. Investment Property

Investment property is kind of property which is held by the Group to earn rent. These are listed in the attached consolidated financial statements at acquisition costs less

accumulated amortization and impairment provisions. The accounting policies mentioned for tangible assets are also valid for investment property.

XV. Leasing Transactions

Assets acquired under financial leases are carried at the lower of their fair values or amortized value of the lease payments. Leasing payables are recognized as liabilities in the balance

sheet while the interest payable portion of the payables is recognized as a deferred amount of interest. Finance lease payments are separated as financial expense and principal

amount payment, which provides a decrease in finance lease liability, thus helps a fixed rate interest on the remaining principal amount of the debt to be calculated. Within the context

of the Group’s general borrowing policy, financial expenses are recognized in the income statement. Assets held under financial leases are recognized under the property, plant and

equipment (movable properties) account and are depreciated by using the straight line method.

There is one company which exclusively does finance leases (İş Finansal Kiralama A.Ş.) and one bank (Türkiye Sınai Kalkınma Bankası A.Ş.) which operates finance lease activities as per

provisional article No 4 of the Banking Law No 5411. Finance lease activities are operated according to the “Law on Financial Leasing, Factoring and Financing” No 6361.

In cases when the Group is the “lessor”, finance lease receivables are recognized by their fair values on the first entry date and in the reporting periods after the first entry date they

are carried at amortized cost by using the effective interest rate method. Interest income on finance lease is allocated to the accounting periods in order to reflect a fixed term interest

from the investments that are subject to leasing.

Operational lease transactions are recognized in line with the related agreement on an accrual basis.

XVI. Insurance Technical Income and Expense

In insurance companies premium income is obtained subsequent to the share of reinsurers in policy income is diminished.

Claims are recorded in expense on accrual basis. Outstanding loss provisions are recognized for the claims reported but not paid yet and for the claims that incurred but not reported.

Reinsurers’ share of claims paid and outstanding loss are offset in these provisions.

XVII. Insurance Technical Reserves

Effective 1 January 2005, the Group’s insurance subsidiaries adopted TFRS 4, Insurance Contracts ("TFRS 4"). TFRS 4 represents the completion of phase I and is a transitional

standard until the recognition and measurement of insurance contracts has more fully addressed. TFRS 4 requires that all contracts issued by insurance companies be classified as

either insurance contracts or investment contracts. Contracts with significant insurance risk are considered insurance contracts. Insurance risk is defined as risk, other than financial

risk, transferred from the holder of a contract to the issuer. TFRS 4 permits a company to continue with its previously adopted accounting policies with regard to recognition and

measurement of insurance contracts. Only in case of presentation of more reliable figures a change in accounting policy shall be carried out. Contracts issued by insurance companies

without significant insurance risk are considered investment contracts. Investment contracts are accounted for in accordance with TAS 39 “Turkish Accounting Standard for Financial

Instruments: Recognition and Measurement”.

Within the framework of the current insurance regulation, reserves accounted by insurance companies for unearned premium claims, unexpired risk reserves, outstanding claims and

life-mathematical reserves are presented in the consolidated financial statements.

The reserve for unearned premiums consists of the gross overlapping portion of accrued premiums for insurance contracts that are in effect to the subsequent period or periods of

balance sheet date on a daily basis without a commission or any other discount.

In case the expected loss premium ratio is over 95%, the unexpired risk reserves are recognized for the main branches specified by the Undersecretariat of Treasury. For each main

branch, the amount found by multiplying the ratio exceeding 95% by the net unearned premium provision, is added to the unearned premium provision of that main branch.

Reserve for outstanding claim is recognized for the accrued claims which are not paid in the current period or in the prior periods or for the claims realized with the expected costs but

not reported.

Mathematical reserve is recognized on actuarial bases in order to meet the requirements of policyholders and beneficiaries for life, health and personal accident insurance contracts

for a period longer than a year.

On the other hand, actuarial chain ladder method is used to estimate the reserve amount to be set aside in the current period by looking at the data of the past materialized losses. If

the reserve amount found as a result of this method exceeds the amount of reserve for the amount of uncertain indemnity, additional reserve must be set aside for the difference.

Reinsurance companies recognize for the outstanding claims that is declared by the companies, accrued and determined on account.

Insurance companies of the Group cede premium and risks in the normal course of business in order to limit the potential for losses arising from risks accepted. Insurance premiums

ceded to reinsurers on contracts that are deemed to transfer significant insurance risk are recognized as an expense in a manner that is consistent with the recognition of insurance

premium revenue arising from the underlying risks being protected.

Costs which vary and are directly associated with the acquisition of insurance and reinsurance contracts including brokerage, commissions, underwriting expenses and other

acquisition costs are deferred and amortized over the period of contract, consistent with the earning of premium.