TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements for the Year Ended

31 December 2014

177

İŞBANK

ANNUAL REPORT 2014

FINANCIAL INFORMATION AND

RISK MANAGEMENT

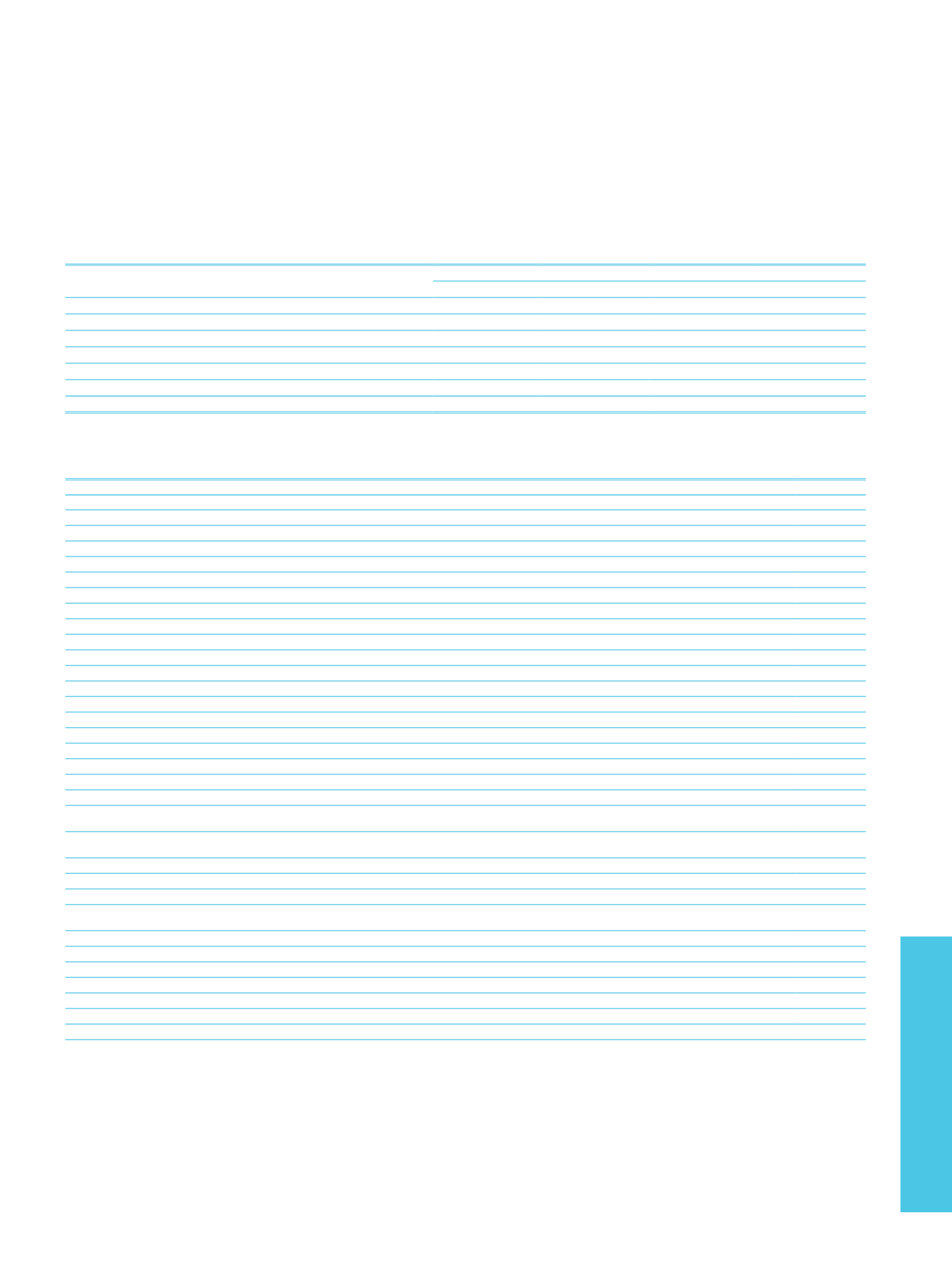

Summary information about the Parent bank’s capital adequacy ratio and consolidated capital adequacy ratio:

Bank-Only

Consolidated

Current Period

Prior Period

Current Period

Prior Period

Capital Requirement for Credit Risk ( VaCR*0.08) (CRCR)

15,976,126

14,042,367

17,614,444

15,442,996

Capital Requirement for Market Risk (CRMR)

496,364

410,919

732,008

538,100

Capital Requirement for Operational Risk (CROR)

1,131,277

971,452

1,252,503

1,090,380

Equity

(1)

35,255,300

27,689,806

37,497,307

30,567,360

Equity/((CRCR+CRMR+CROR)*12.5*100)

16.02

14.36

15.31

14.32

Total Tier I Capital/((CRCR+MRCR+OROR)*12.5)*100

13.60

12.87

Common Equity Tier I Capital /((CRCR+MRCR+OROR)*12.5)*100

13.70

12.91

(1)

Current period capital is calculated within the scope of the “Regulation on Measurement and Evaluation of Capital Adequacy of Banks” published in the Official Gazette no.28756 dated 5 September 2013 and applied

after 1 January 2014

Information on Consolidated Shareholders’ Equity:

CurrentPeriod

COMMONEQUITYTIER1CAPITAL

Paid-in Capital to be Entitled for Compensation after All Creditors

6,115,938

Share Premium

33,941

Share Cancellation Profits

Legal Reserves

14,907,428

Other Comprehensive Income according to TAS

3,798,358

Profit

3,351,828

Net Current Period Profit

3,351,828

Prior Period Profit

Provisions for Possible Losses

1,000,000

Bonus Shares fromAssociates, Subsidiaries and Joint-Ventures not Accounted in Current Period’s Profit Minority shares

(1,179)

Minority shares

2,627,216

CommonEquityTier1capitalbeforeregulatoryadjustments

31,833,530

CommonEquityTier1capital:regulatoryadjustments

Current and prior periods' losses not covered by reserves, and losses accounted under equity according to TAS (-)

Leasehold improvements on operational leases (-)

128,598

Goodwill and intangible assets and related deferred tax liabilities (-)

76,078

Net deferred tax assets / liabilities (-)

Shares Obtained against Article 56, Paragraph 4 of the Banking Law (-)

Investments in own common equity (-)

Total of Net Long Positions of the Investments in Equity Items of Consolidated Banks and Financial Institutions where the Bank does not own 10%or less of the Issued Share

Capital Exceeding the 10%Threshold of above Tier I Capital (-)

Total of Net Long Positions of the Investments in Equity Items of Consolidated Banks and Financial Institutions where the Bank owns 10%or less of the Issued Share Capital

Exceeding the 10%Threshold of above Tier I Capital (-)

Mortgage servicing rights (amount above 10%threshold) (-)

Deferred tax assets arising from temporary differences (amount above 10%threshold, net of related tax liability) (-)

Amount Exceeding the 15%Threshold of Tier I Capital as per the Article 2, Clause 2 of the Regulation onMeasurement and Evaluation of Capital Adequacy of Banks (-)

The Portion of Net Long Position of the Investments in Equity Items of Consolidated Banks and Financial Institutions where the Bank owns 10%or more of the Issued Share

Capital not deducted fromTier I Capital (-)

Mortgage servicing rights (amount above 10%threshold) (-)

Excess Amount arising fromDeferred Tax Assets fromTemporary Differences (-)

Other items to be defined by the regulator (-)

Regulatory adjustments applied to Common Equity Tier 1 due to insufficient Additional Tier 1 and Tier 2 to cover deductions (-)

TotalregulatoryadjustmentstoCommonequityTier1

204,676

CommonEquityTier1capital

31,628,854

ADDITIONALTIER1CAPITAL