TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements for the Year Ended

31 December 2014

193

İŞBANK

ANNUAL REPORT 2014

FINANCIAL INFORMATION AND

RISK MANAGEMENT

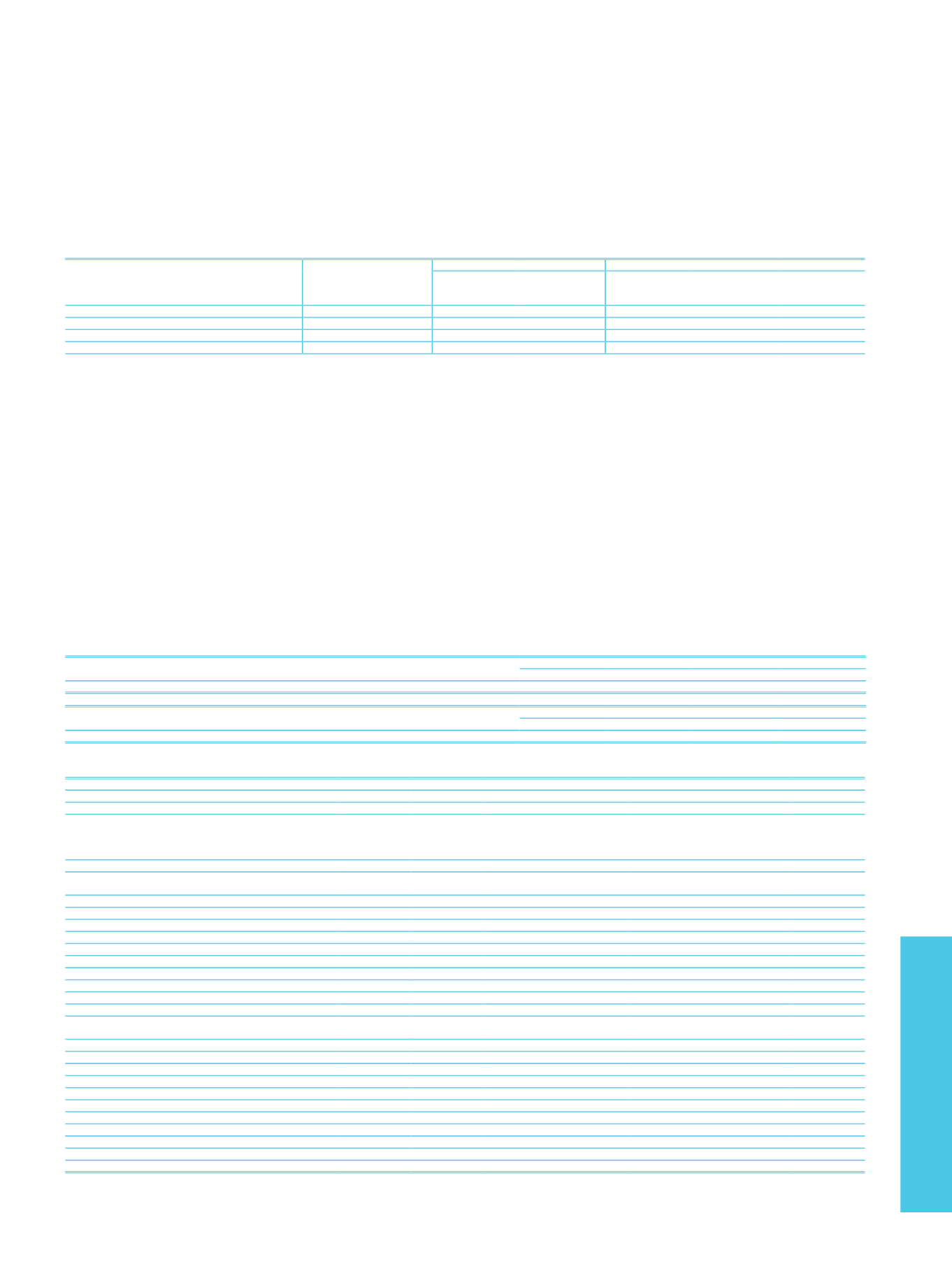

c. Unrealized gains and losses on investment in stocks, revaluation increases with the amounts of main and additive capital:

Portfolio

Realized Gains/losses

During the period

Revaluation Increases

Unrealized Gains

Total

Including to

the Capital

Contribution

Total

Including in to the

main capital

Including to

the Capital

Contribution

Private Equity Investments

Shares Traded on a Stock Exchange

2,493,159

2,493,159

Other Stocks

Total

2,493,159

2,493,159

VIII. Explanations on Consolidated Liquidity Risk

Liquidity risk may arise as a result of funding long-term assets with short-term resources. Utmost care is taken to maintain the consistency between the maturities of assets and

liabilities; strategies are used to acquire funds over longer terms.

The Parent Bank’s main source of funding is deposits. While the average maturity of deposits is shorter than the average maturity of assets as a result of the market conditions, the

Parent Bank’s wide network of branches and steady core deposit base are its most important safeguards of the supply of funds. The Parent Bank also borrows medium and long-term

funds from institutions abroad.

In order to meet the liquidity requirements that may arise due to market fluctuations, the Group analyses TL and FC cash flows projections to preserve liquid assets. The term structure

of TL and FC deposits, their costs and movements in the total amounts are monitored on a daily basis, also accounting for developments in former periods and expectations for the

future. Based on cash flow projections, prices are differentiated for different maturities and thereby measures are taken to meet liquidity requirements; moreover liquidity that may

be required for extraordinary circumstances is estimated and alternative liquidity sources are determined for possible utilization.

Furthermore, foreign currency and total liquidity adequacy ratios, which are subject to weekly legal reporting and calculated separately for 7 and 31 days following the reporting date,

and the liquidity adequacy ratios that are calculated based on the stress scenarios built internally by the Parent Bank, are used effectively to manage the liquidity risk.

Evaluated within the framework of the Parent Bank’s asset-liability management risk policy, the limits determined related to the liquidity risk management are monitored by the Risk

Committee and to avoid extraordinary situations where a quick action should be taken due to the unfavorable market conditions, emergency measures and funding plans related to

liquidity risk are put into effect.

As per the Communiqué on “Measurement and Assessment of the Adequacy of Banks’ Liquidity”, the liquidity ratios that are measured for terms of 7 and 31 days should not be less

than 80% and 100%, respectively. Foreign currency liquidity adequacy ratio means the ratio of foreign currency assets to foreign currency liabilities and the total liquidity adequacy

ratio mean the ratio of total assets to total liabilities. Average liquidity adequacy ratios of the Parent Bank for the period ended of year 2014 with their prior year comparatives are

given below.

Current Period

First Maturity Bracket (Weekly) Second Maturity Bracket (Monthly)

FC

FC + TL

FC

FC + TL

Average (%)

168.19

145.18

127.64

109.12

Prior Period

First Maturity Bracket (Weekly) Second Maturity Bracket (Monthly)

FC

FC + TL

FC

FC + TL

Average (%)

149.64

142.48

103.54

107.25

Presentation of assets and liabilities according to their remainingmaturities:

Demand Up to 1 Month 1-3 Months 3-12 Months

1-5 Years 5 Years and Over Unallocated

(1)

Total

Current Period

Assets

Cash (Cash in Vault, Foreign Currency

Cash, Money in Transit, Cheques

Purchased) and Balances with the Central

Bank of Turkey

8,348,057 16,795,490

25,143,547

Banks

1,106,197

3,632,011

1,077,869

190,380

6,006,457

Financial Assets at Fair Value through

Profit/Loss

377,124

390,399

416,709

503,649

456,871

115,418

2,260,170

Money Market Placements

224,303

39,256

263,559

Financial Assets Available for Sale

342,189

299,848

693,568 2,175,799 17,933,831

24,231,894

45,677,129

Loans

(2)

2,770,944 15,567,883 14,888,894 50,980,763 67,411,170

17,446,848

694,795 169,761,297

Held to Maturity Investments

40,639

229,916

929,542

184,683

7,080

1,391,860

Other Assets

453,025 1,891,992

198,456

608,648 1,745,596

156,950 20,217,747 25,272,414

Total Assets

13,397,536 38,842,565 17,544,668 55,388,781 87,732,151

41,958,190 20,912,542 275,776,433

Liabilities

Bank Deposits

653,743 4,411,535 1,259,887

317,910

46,217

6,689,292

Other Deposits

29,448,116 67,158,505 23,469,411

6,333,332 1,401,224

1,346

127,811,934

Funds Provided from Other Financial

Institutions

2,431,036 2,219,205 12,109,087 10,100,376

7,316,368

34,176,072

Money Market Funds

20,691,382

305,634

224,153 1,083,600

22,304,769

Marketable Securities Issued

(3)

1,755,173

2,701,821

4,216,810 5,657,808

7,534,264

21,865,876

Miscellaneous Payables

8,450,806 5,794,860

61,286

19,358

69,190

14,395,500

Other Liabilities

(4)

17,748 1,983,992

726,385 1,106,886

91,655

21,685 44,584,639 48,532,990

Total Liabilities

38,570,413 104,226,483 30,743,629 24,327,536 18,450,070

14,873,663 44,584,639 275,776,433

Liquidity Gap

(25,172,877) (65,383,918) (13,198,961)

31,061,245 69,282,081

27,084,527 (23,672,097)

Prior Period

Total Assets

17,556,666 35,651,517 14,061,458 52,250,669 75,607,084

29,618,456 16,873,290 241,619,140

Total Liabilities

32,437,831 99,321,273 24,367,409 24,339,303 13,569,744

10,039,685 37,543,895 241,619,140

Liquidity Gap

(14,881,165) (63,669,756) (10,305,951)

27,911,366 62,037,340

19,578,771 (20,670,605)

(1)

Assets, such as Tangible Assets, Subsidiaries and Associates, Office Supply Inventory, Prepaid Expenses and Non-Performing Loans, which are required for banking operations and which cannot be converted into

cash in short-term, other liabilities such as Provisions which are not considered as payables and Shareholders’ Equity, are shown in ‘Unallocated” column.

(2)

The balances include factoring receivables.

(3)

The amount of TL 3,268,784 of Includes subordinated bonds which are classified on the balance sheet as subordinated loans.

(4)

The borrower funds are presented in “Up to 1 month” column in other liabilities.