2011 Economic Review

Problems in the peripheral countries of Euro Zone also began to affect central countries such as Italy and France in 2011.

The World Economy

Developments in 2011

Global economic risks have begun to increase once again.

The expansive monetary and fiscal policies that were put into effect in the developed countries in the wake of the crisis failed to be as effective as expected in bringing about economic recovery. Meanwhile, national budget balances in the same countries worsened significantly and risk perceptions about the global economy began to increase once again. The rise in macroeconomic risks was driven especially by worries over the sustainability of the high levels of public indebtedness in Euro Zone countries.

3.3%

The IMF expects that global economic growth, which it puts at about 3.8% in 2011, will contract to around 3.3% in 2012.

For the first time in history the US government’s credit rating was lowered.

Uncertainties experienced with increasing the national debt ceiling in the US in 2011 exacerbated concerns about the future direction of the economy and for the first time in history the credit rating of the US was lowered. In response to growing doubts about economic activity in the US which is in the face of continuing weak demand, policy-makers announced that they would be keeping interest rates at their currently low levels for quite a long time and that they would go on supporting the economy with additional measures in the period ahead.

The Euro Zone is struggling with a public debt crisis.

Spreading through the banking system, problems arising from high levels of public debt and/or budget deficits in peripheral countries of Euro Zone such as Portugal, Ireland, Greece and Spain began to affect central countries such as Italy and France as well in 2011. Paralleling the economic downturn, banks throughout the Euro Zone found themselves confronted by shortages of liquidity with which to fulfill their short-term obligations.

5.4%

An average growth rate of 5.4% is projected for emerging countries' economies in 2012.

Measures taken to counter inflationary pressures constricted growth in emerging countries.

In the emerging countries which remained the engines of global growth, belt-tightening measures taken to counter inflationary pressures constricted economic activity in the first half of the year as compared with 2010. However, for the rest of the year, the global economy agenda was dominated by “double-dip” worries that led many emerging countries to suspend the tightening of their monetary policies and even to begin loosening them. Meanwhile, the worsened economic outlook in developed countries began to depress economic activity in the emerging countries as it spreads through foreign trade and finance channels.

Expectations

According to IMF projections, the global economy will grow by 3.3% in 2012.

In view of the delays that are being experienced in dealing with the developed countries’ existing problems and the likely impact that this situation will have on emerging countries, we can expect that the macroeconomic risks to which the global economy is exposed will persist. The IMF expects that global economic growth, which it puts at about 3.8% in 2011, will contract to around 3.3% in 2012. What is particularly noteworthy is the downward revisions in Euro Zone country growth rate projections.

It is estimated that weak demand and high unemployment will cause inflation to remain flat in the short and medium term throughout the world. Concordantly, we may expect that monetary policy will remain loose and consequently, interest rates will remain low for quite a long time in the leading developed countries. As a matter of fact, the Fed has already announced that it will not be changing its currently low policy rate any time before late 2014.

The Euro Zone’s problems will remain on the world’s agenda.

The slowdown in global economy can be expected to continue in parallel with what is taking place in Euro Zone economies. Markets’ worries will be kept fresh both by persistent Euro Zone structural difficulties and by the problems that may crop up when the decisions made are applied. Owing to the delays involved in public authorities’ decision taking that are needed to deal with problems, it is likely that it will take some time before Euro Zone economic activity returns to pre-crisis levels.

It is also estimated that uncertainties will persist over the high levels of refinancing that will be required to cope with public debt in developed economies. This situation and the possibility of having to undergo some sort of restructuring process may increase the tendency to expand banking system capitalization or to reduce overall indebtedness in developed countries. It is likely that as the effects of the worsened economic outlook in developed countries spread through foreign trade and finance channels, economic activity in the emerging countries will slow down as well. In line with this, it is expected that the average 6.2% rate of growth estimated to have been achieved in the emerging economies in 2011 will lose momentum and slip to around 5.4% or so in 2012.

The Turkish Economy

Developments in Real Economy in 2011

The Turkish economy is thought to have grown by 8.3%.

Having grown by 9% in 2010, the Turkish economy continued to perform strongly in the first three quarters of 2011, growing by 9.6% compared with the same period of the previous year. The biggest contributor to that nine-month growth was services followed in turn by manufacturing, construction and agriculture. Overall growth in 2011 is estimated to have been on the order of 8.3%.

Exports increased by 19% in 2011 while the rise in imports was 30%. Because imports grew so much faster than did exports, the foreign trade deficit expanded rapidly. Throughout the year, our country’s export performance was adversely affected by ongoing problems in the Euro Zone–which is its biggest export market–and by political developments in the Middle Eastern and North African countries that might serve as its alternative markets. Strong domestic demand and high energy prices brought about rapid growth in imports. In the post-crisis recovery process, the current account deficit continued to expand, in parallel with an appreciating Turkish Lira, strong domestic demand and a growing foreign trade deficit. This trend continued in 2011. The contributions which foreign direct investment was able to make to finance the current account deficit remained limited and the demand for external resources was met largely by means of short-term capital movements. The result was the increase in fragility of the economy. The current account deficit amounted to about USD 77.1 billion in 2011.

Central budget performance, which was strong in 2010, remained strong in 2011 thanks to ongoing fiscal discipline and improvements in tax collections resulting from strong domestic demand.

While the Turkish banking industry's growing need for financing was met largely by means of deposits, bond issues and borrowing from abroad, the proceeds from the sale of securities portfolio assets as well as repo income also made a contribution.

Movements in exchange rates and commodity prices spurred a rise in CPI that became particularly evident in the last quarter of the year. The result was that the twelve-month rise in the CPI was realized as 10.45%, nearly double CBRT’s 5.5% target. Similarly, the rise in producer prices was 13.33%

Having focused on policies aimed at financial stability for most of the year, CBRT began tightening its monetary policy stance.

In August CBRT loosened its tight monetary policy in order to minimize the adverse impact that unfavorable developments in international markets might have on the Turkish economy. In the last quarter of the year, rapid depreciation of the Turkish Lira against the US dollar spurred a rise in inflation. Seeking to limit the secondary affects that this increase in inflation might have, CBRT had recourse to a new multi-vehicle policy mix that focused on price stability.

2011 Developments in the Turkish Banking Industry

12.7%

Deposits (excluding interbank deposits), which are the banking sector's most important source of funding, increased by 12.7% in 2011.

The Turkish banking industry’s assets grew by 21% in 2011.

In parallel with the rise in economic activity in 2011, the banking industry continued to grow in terms of assets, number of new branches and number of people employed. In 2011, the sector’s total assets increased by 21% compared to 2010 and reached TL 1,218 billion.

Despite increases that CBRT made in banks’ reserve requirements in late 2010 and early 2011 in its efforts to buttress financial stability, the rapid expansion in the volume of credit continued in the first half of the year. Economic growth and the fact that loan interest rates did not exactly reflect rising costs also contributed to this. In the second half of the year, BRSA measures that made use of general and specific loan provisions and capital adequacy credit risk weightings did cause the acceleration in credit (particularly consumer credit) growth to slow down and this had the desired effect of dampening the overall growth in credit.

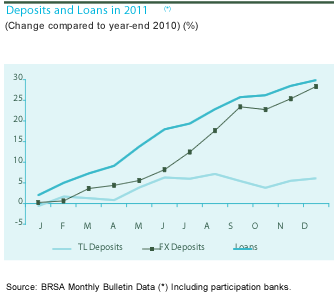

Deposits (excluding interbank deposits), which are the banking sector’s most important source of funding, increased by 12.7% in 2011. As it’s considered that the sector’s total liabilities also increased by 21% during the same period, it is apparent that the sector must have been having recourse to alternative sources as well. CBRT’s decision to link reserve requirement rates to deposit maturities caused a modest prolongation in average deposit term. In 2011, Turkish banking industry’s growing need for financing was met largely by means of deposits, bond issues and borrowing from abroad, right along with the proceeds from the sale of securities portfolio assets and funds from repo transactions.

The banking sector is expected to continue growing in 2012.

Expectations

Developments in Turkey’s main export markets will play a role in any slowdown in Turkey’s economic activity that takes place in 2012.

It is estimated that developments in Turkey’s main export markets, particularly in the EU, will shape the course of the country’s economic activity. In line with this, Turkey’s economic growth can also be expected to lose momentum in the new year. Furthermore any contraction in Turkey’s capital inflows will likewise constrict growth more.

Along with such a slowdown in the economy, it is anticipated that domestic demand will not exert any upward pressure on inflation. Paralleling to the high rate of inflation registered in the last quarter of 2011 having been reined in by means of other monetary policy tools, it seems likely that CBRT will be shaping its monetary policy in such a way as to support growth. Thus while no rises in policy interest rates are expected in 2012, it is thought that other policy tools will continue to be employed actively in parallel with developments that take place in international markets.

The drop in domestic demand in 2012 could cause budget revenues to lose some momentum. However the percentage of domestic debt that the Treasury must roll over is expected to continue falling and by reducing potential pressure on the borrowing costs that means it will be easier to keep budget expenditures under control. The likely outcome of all this is that budget discipline will be maintained.

It is also to be expected the Turkish banking industry as a whole will continue growing in 2012 by exploiting capital inflow opportunities arising from expectations of economic growth. It will likely achieve this by taking advantage of opportunities to create resources through different channels such as bond issues and capital inflows along with any rises in deposits that will be supported by the policies which CBRT is currently following. Another expectation is that CBRT will continue, this year just as it did last year, to make use of reserve requirement rates as an active policy tool in parallel with developments taking place in international markets. Besides, in keeping with the expectation that domestic demand will tend to rise only gradually in 2012, the growth in the volume of loans will probably be more moderate than it was in 2011.