İşbank and its Activities in 2011

İşbank continued to create value for its stakeholders in 2011.

At year-end 2011, İşbank’s total assets reached TL 161.7 billion.

İşbank has internalized an approach which is mindful of customer satisfaction, vigilantly manages risks and attentive to its financial structure.

İşbank constantly reviews its corporate structure, strategy and goals along these same lines to ensure that market realities are properly reflected both in business processes and in products and services.

İşbank performed strongly in terms of both financial and operational results in 2011 while also successfully maintaining the growth in business volumes.

At the end of 2011, İşbank was Turkey’s biggest privately-owned bank as measured by assets, loans, deposits and shareholders’ equity.

In 2011 İşbank increased the number of its domestic branches with the addition of 65 new ones, reaching a total of 1,184. The Bank also continued to expand its international service network by opening two new branches one in Turkish Republic of Northern Cyprus and one in Iraq and by acquiring a bank in Russia.

A leading player in Turkey’s capital market transactions, İşbank controlled a mutual fund portfolio totaling TL 6.4 billion in value and a 21.6% share of the same market at 2011 end.

In 2011 İşbank continued to keep its customers supplied with innovative and high added-value products and services.

Asset Composition (%) |

|

|

|

2010 |

2011 |

Cash and Banks |

8.9 |

9.9 |

Securities |

34.5 |

26.5 |

Loans |

48.7 |

56.7 |

Associates & Subsidiaries |

4.8 |

3.9 |

Other Assets |

3.1 |

3.0 |

Total |

100 |

100 |

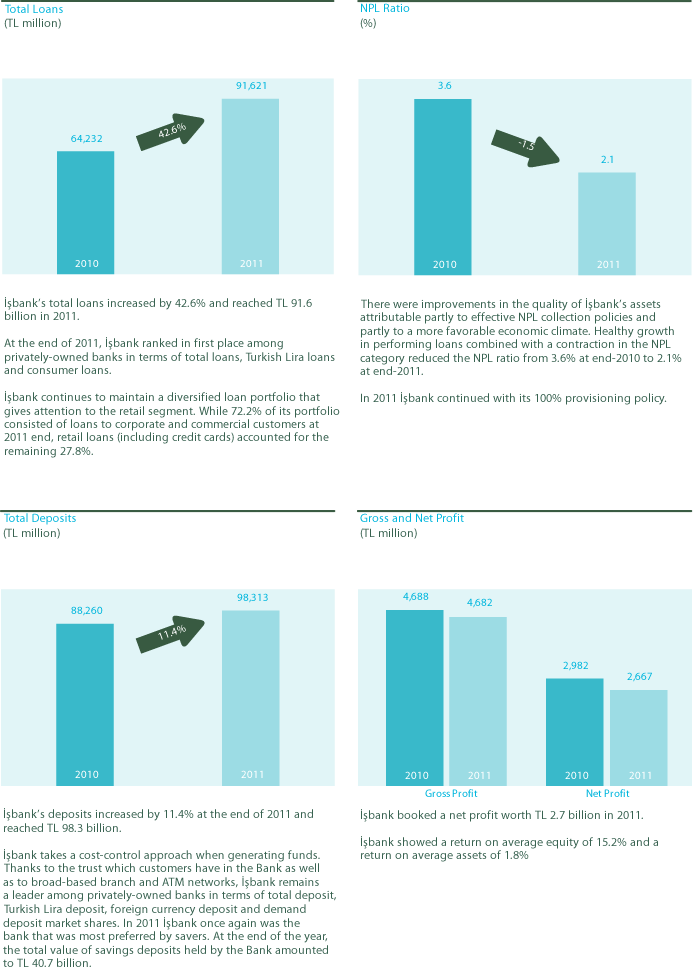

In the year to end-2011, İşbank increased its total assets by 22.7% to TL 161.7 billion, thereby defending its standing as Turkey’s biggest privately-owned bank as measured by assets.

At end of 2011, İşbank’s total loans amounted to TL 91.6 billion. This corresponded to 56.7% of the Bank’s total assets and represents an eight-point rise in that percentage as compared with the previous year.

Liability Composition (%) |

|

|

|

2010 |

2011 |

Deposits |

67.0 |

60.8 |

Funds Borrowed and Money Market Funds(*) |

13.8 |

21.3 |

Other Liabilities |

6.3 |

6.8 |

Shareholders’ Equity |

12.9 |

11.1 |

Total |

100 |

100 |

As of 2011 end İşbank’s total deposits were up by 11.4% as compared with the previous year and stood at TL 98.3 billion.

In 2011 İşbank also focused attention on non-deposit funding as a way both of diversifying its funding structure and increasing its cost-effectiveness. The total value of such funds, consisting of bonds, syndications, securitizations, repo contracts and the like reached TL 34.4 billion as of year-end.

The search for alternative sources of funding resulted in greater attention being given to private sector bond and bill issues in 2011. In order to diversify its existing funding structure and create long-term funding for itself, last year İşbank sold debt instruments with a total nominal value of TL 4.8 billion to the domestic market and it also sold debt instruments worth USD 500 million to international markets.

One result of these developments in the Bank’s funding was to diversify liabilities while also extending overall maturities. A second was to reduce the share of deposits in total liabilities to 60.8% and bring that of funds borrowed and money market funds(*) to 21.3%.

Shareholders’ equity increased by 5.3% year-on and reached TL 17.9 billion in 2011.

(*) Including TL and Foreign Exchange debt instrument issues