136

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

The market risk measurements are carried out by applying the Standard Method at the end of each month and the results are

included in the statutory reports as well as being reported to the Bank’s top management.

The Value at Risk Model (VAR) is another alternative for the Standard Method used for measuring and monitoring market risk. This

model is used to measure the market risk on a daily basis in terms of interest rate risk, currency risk and equity share risk and is a

part of the Bank’s daily internal reporting. Further retrospective testing (back-testing) is carried out on a daily basis to determine the

reliability of the daily risk calculation by the VAR model, which is used to estimate the maximum possible loss for the following day.

Scenario analyses which support the VAR model used to measure the losses that may occur in the ordinary market conditions are

practiced, and the possible impacts of scenarios that are developed based on the future predictions and the past crises, on the value

of the Bank’s portfolio are determined and the results are reported to the Bank’s top management.

The limits set for the market risk management within the framework of the Bank’s asset liability management risk policy, are

monitored by the Risk Committee and reviewed in accordance with the market conditions.

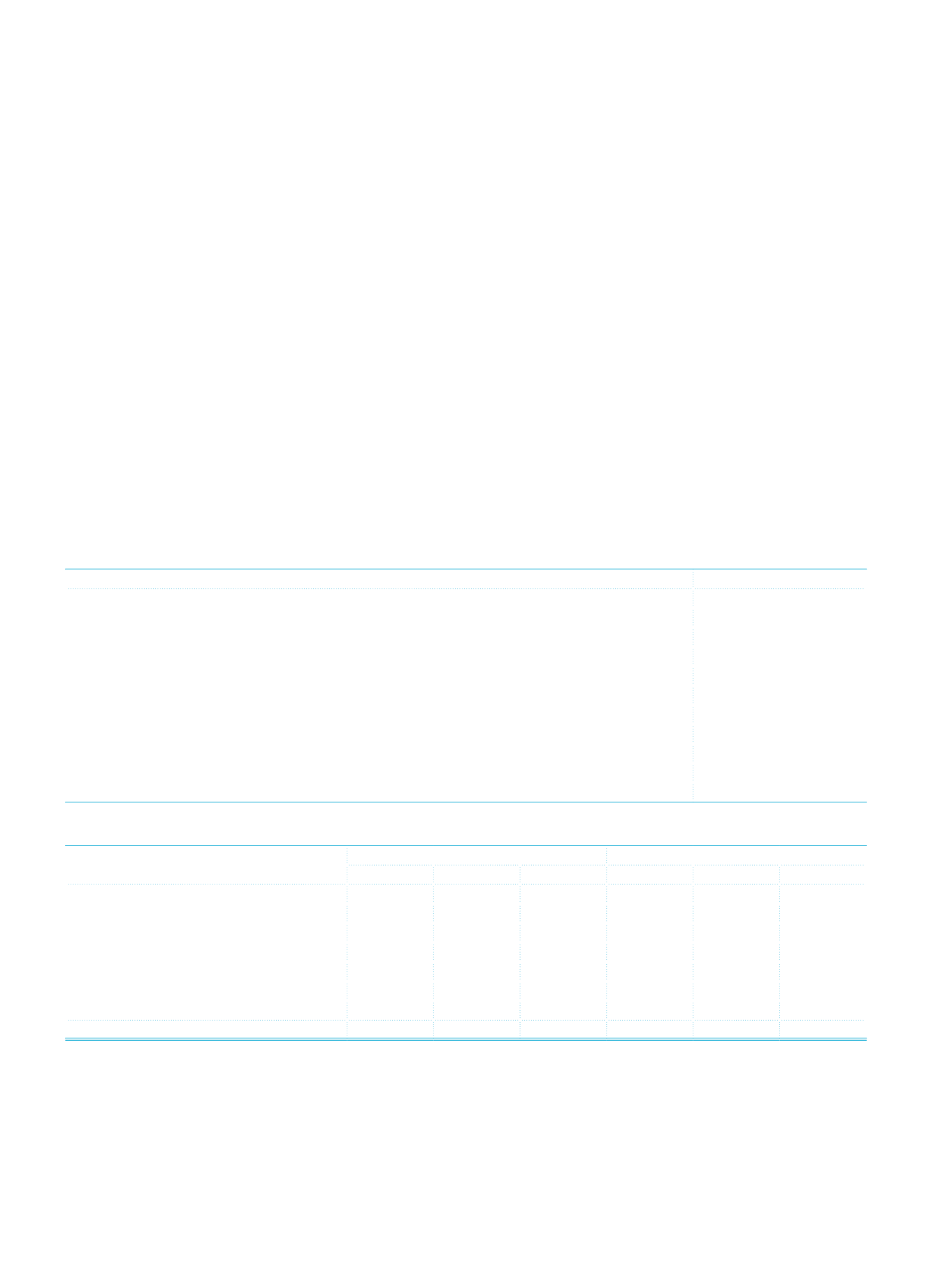

The following table shows details of the market risk calculations carried out within the context of “Standard Method for Market Risk

Measurement” and in compliance with “Regulation on Measurement and Assessment of Capital Adequacy Ratios of Banks” as at

31 December 2013.

1.a

Information on the market risk:

Amount

(I) Capital Requirement against General Market Risk - Standard Method

39,445

(II) Capital Requirement against Specific Risk - Standard Method

2,766

Capital Requirement Specific Risk Related to Securitization Positions-Standard Method

-

(III) Capital Requirement against Currency Risk - Standard Method

229,510

(IV) Capital Requirement against Commodity Risk - Standard Method

53,138

(V) Capital Requirement against Exchange Risk - Standard Method

678

(VI) Capital Requirement against Market Risk of Options - Standard Method

111

(VII) Capital Requirement against Counterparty Credit Risk-Standard Method

85,287

(VIII) Capital Requirement against Market Risks of Banks Applying Risk Measurement Models

-

(IX) Total Capital Requirement against Market Risk (I+II+III+IV+V+VI+VII)

410,935

(X) Value at Market Risk (12.5 x VIII) or (12.5 x IX)

5,136,688

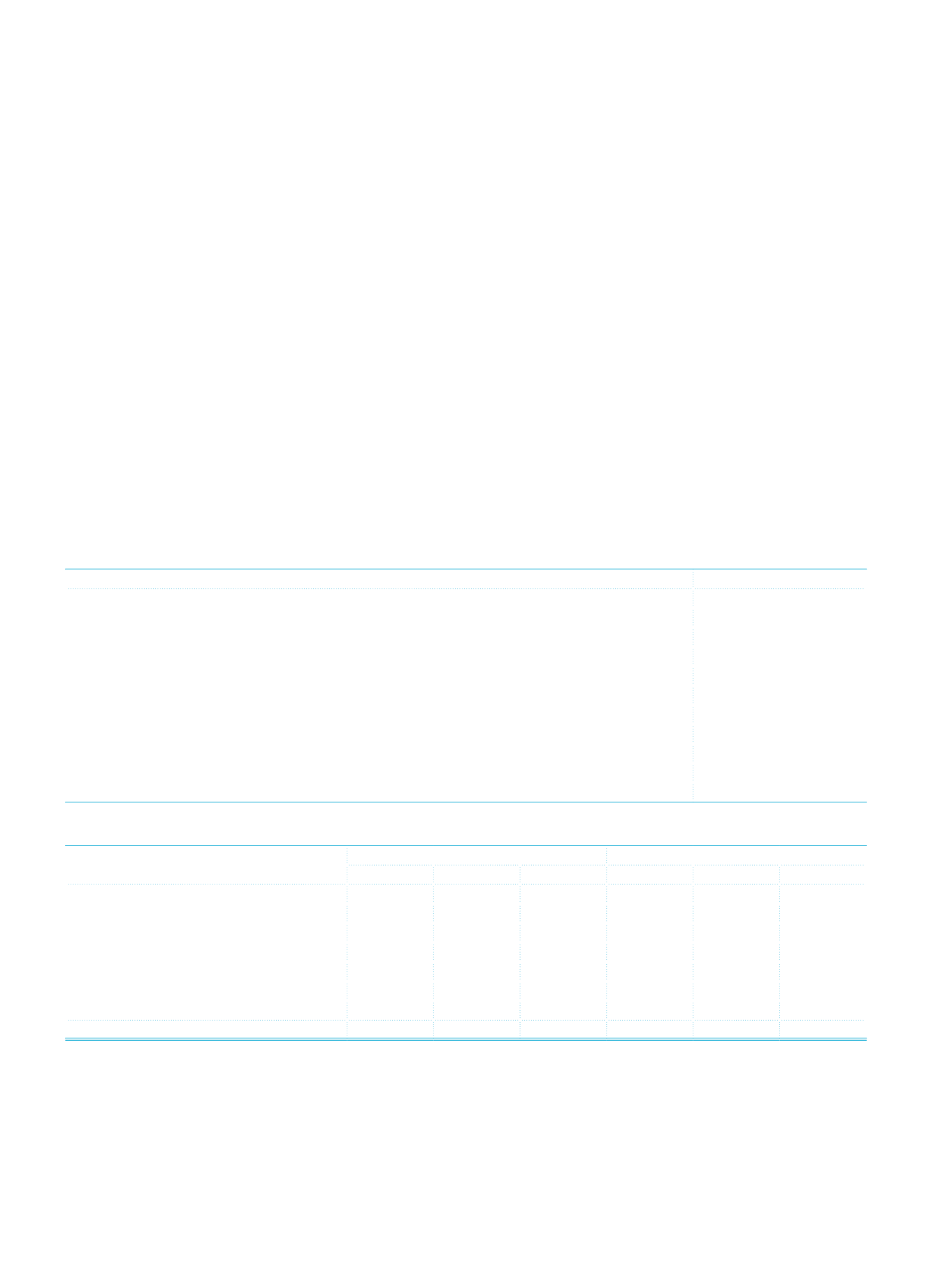

1.b

Table of the average market risk related to the market risk calculated quarterly during the period:

Current Period

Prior Period

(1)

Average Highest

Lowest

Average Highest

Lowest

Interest Rate Risk

38,951

35,383

52,533

27,851

30,814 23,130

Share Certificate Risk

6,645

5,616

5,646 14,486

13,622

15,475

Currency Risk

202,401 285,802 112,206 212,856 234,256 208,179

Commodity Risk

22,407

44,956 24,750

4,719

5,239

1,290

Settlement Risk

603

422

361

406

294

Options Risk

2,282

762

4,707

1,165

2,274

1,673

Counterparty Credit Risk

46,010

53,272

39,126 33,085

33,041

31,435

Total Value at Risk

3,991,238 5,327,663 2,991,613 3,682,100 3,994,250 3,514,775

(1)

As per the legislation on capital adequacy effective from 1 July 2012, due to the calculation of Value At Market Risk methodology, the table is regulated for considering

the period after the date of the above-mentioned.