134

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

14.

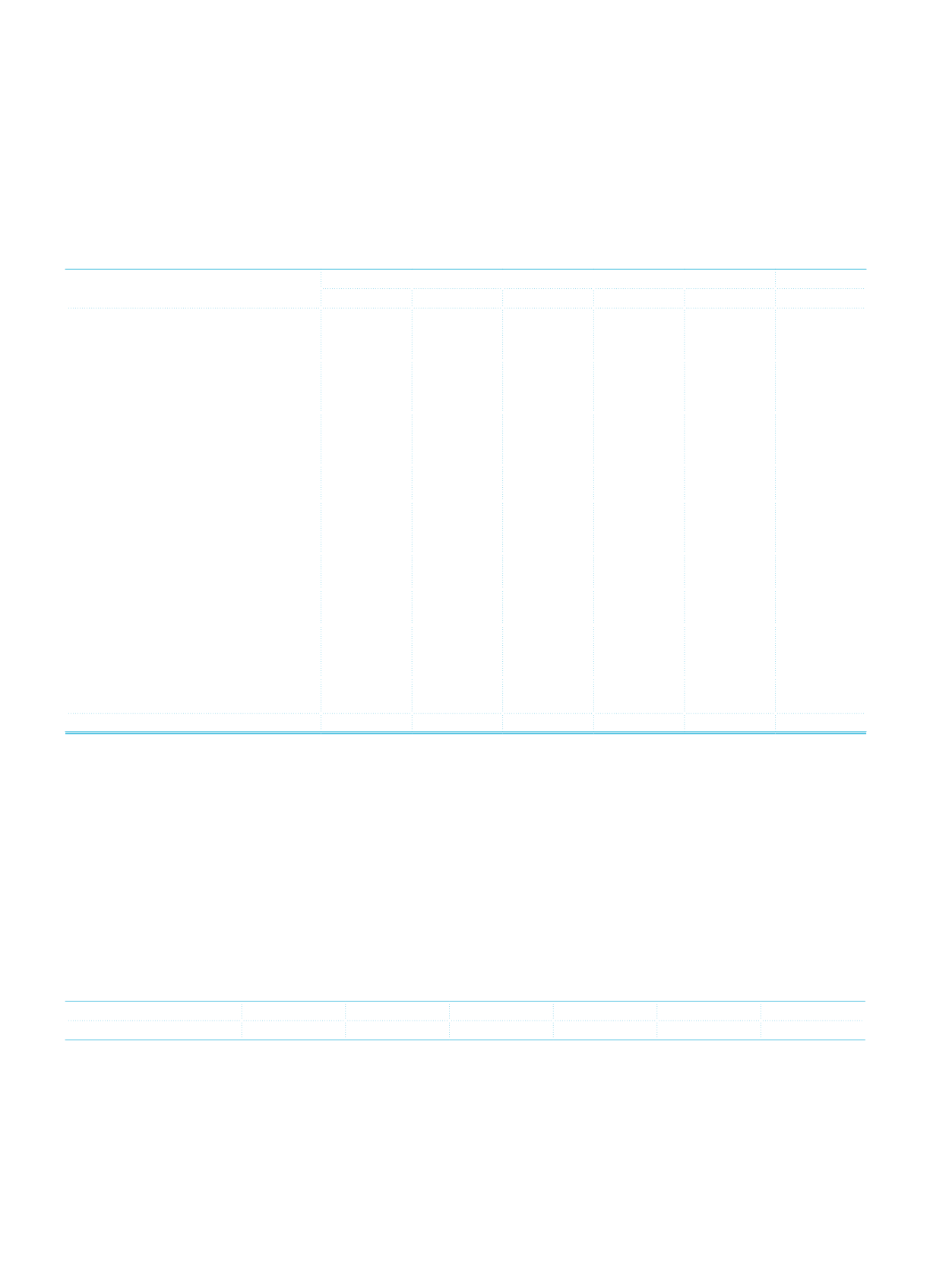

Analysis of maturity-bearing exposures according to remaining maturities:

Risk Groups

Time to Maturity

1 Month 1-3 Months 3-6 Months 6-12 Months Over 1 Year

Total

Contingent and Non-Contingent

Receivables from Central Governments

or Central Banks

1,394,391 1,338,452 2,018,261 7,797,315 24,816,699 37,365,118

Contingent and Non-Contingent

Receivables from Regional Governments

or Domestic Governments

2,066

11,602

2,694

10,840

30,708

57,910

Contingent and Non-Contingent

Receivables from Administrative Units

and Non-Commercial Enterprises

5,031

74,266

6,471

9,010 104,225 199,003

The multilateral development banks and

non-contingent receivables

102

634

71

314

1,121

Contingent and Non-Contingent

Receivables from Banks and

Intermediaries

3,393,061

311,061

575,626 344,028 3,020,122 7,643,898

Contingent and Non-Contingent

Corporate Receivables

6,892,155 6,888,625 10,208,854 15,198,526 50,679,232 89,867,392

Contingent and Non-Contingent Retail

Receivables

7,050,122 4,089,038 4,526,213 6,466,856 7,812,756 29,944,985

Contingent and Non-Contingent

Collateralized Receivables with Real

Estate Mortgages

257,252 387,310 565,844 1,116,546 8,918,769 11,245,721

Receivables are identified as High Risk

by the Board

447,964 755,255 1,112,521 3,355,513 9,717,328 15,388,581

Total

19,442,042 13,855,711 19,017,118 34,298,705 105,100,153 191,713,729

15.

Information on Risk Classes

In the calculation of the amount subject to credit risk, determining the risk weights related to risk classes stated on the sixth

article of “Regulation on Measurement and Evaluation of Capital Adequacy Of Banks”, is based on the Fitch Ratings’ international

rating with the Banking Regulation and Supervision Board’s decision numbered 4577 dated 10 February 2012. While receivables

from resident banks in abroad which is assessed in the risk class of “Contingent and Non-Contingent Receivables from Banks

and Brokerage Agencies” and receivables from central governments which is assessed in the risk class of “Contingent and Non-

Contingent Receivables from Central Governments or Central Banks” will be subjected to risk weights with the scope of ratings;

therefore domestic resident banks accepted as unrated, the risk weight is applied according to receivables from relevant banks, type

of exchange and remaining maturity.

If a receivable-specific rating is performed, risk weights to be applied on the receivable are determined by the relevant credit rating.

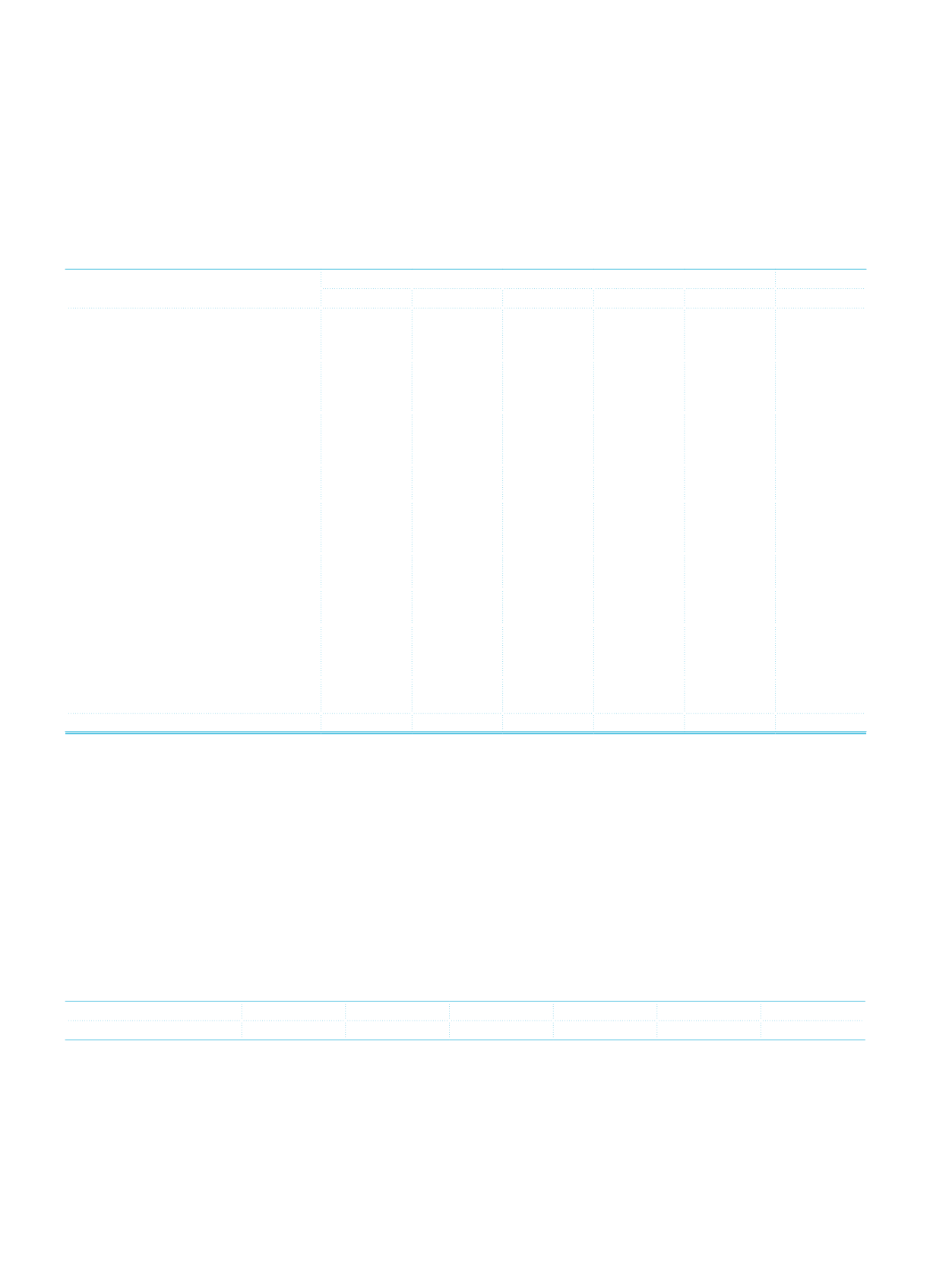

The table related to mapping the ratings used in the calculations and credit quality grades, which is stated in the Annex of

Regulation on Measurement and Assessment of Capital Adequacy of Banks, is given below

Credit Quality Grades

1

2

3

4

5

6

Risk Rating

AAA via AA-

A+ via A-

BBB+ via BBB- BB+ via BB-

B+ via B-

CCC+ and lower

There is no credit rating and credit export agency has been assigned for the items that are not included to trading accounts.