132

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

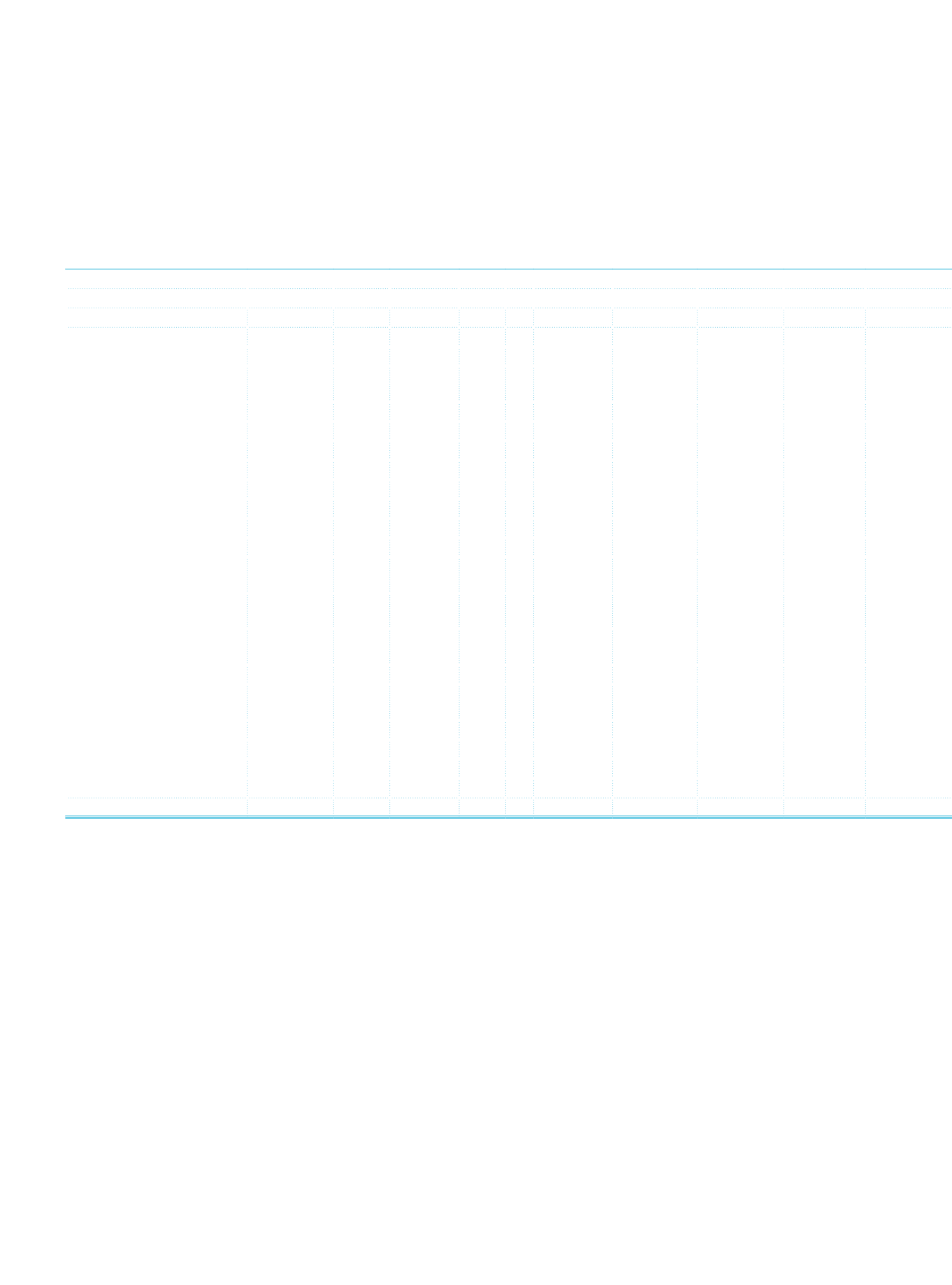

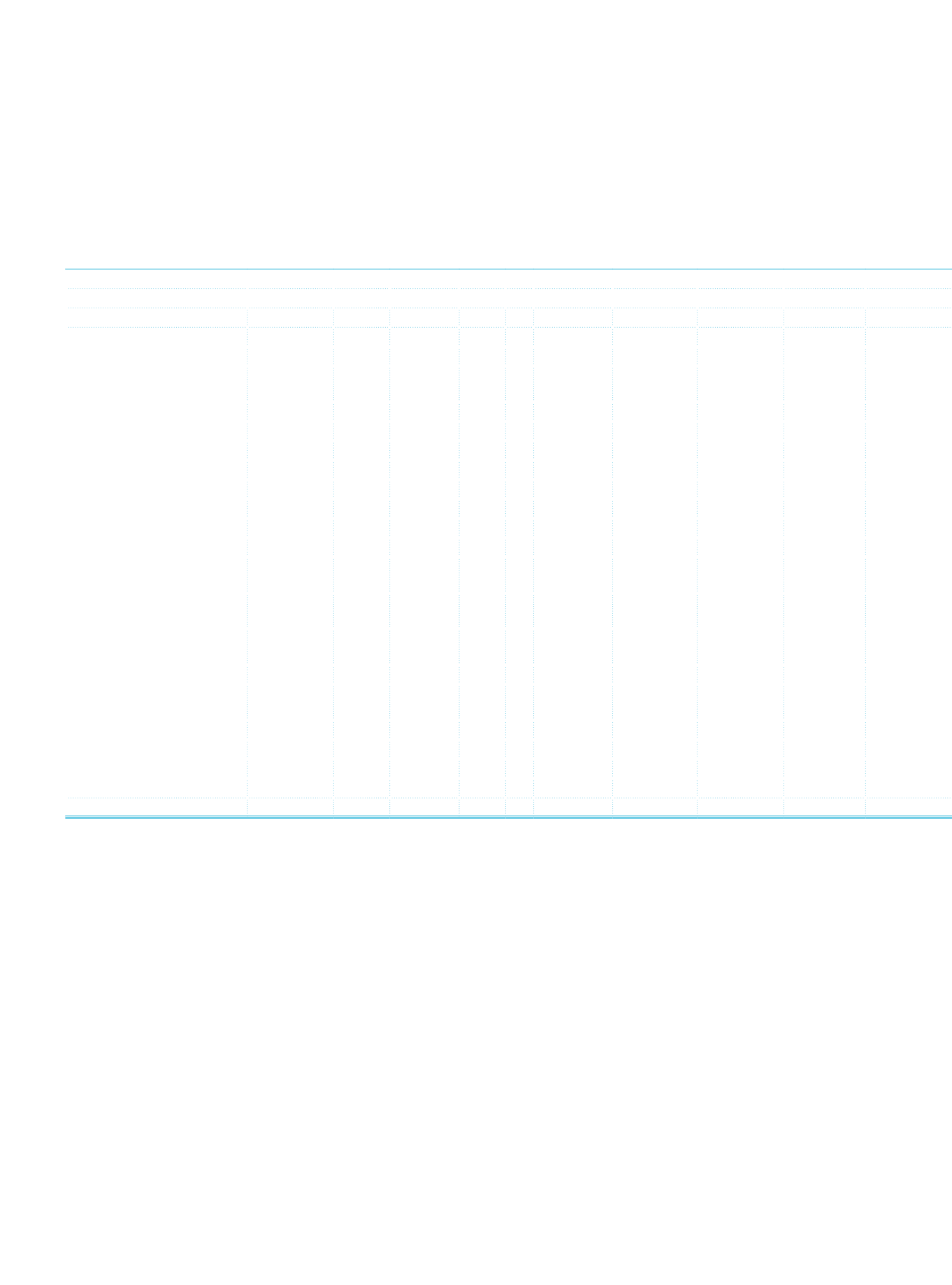

13.

Risk profile by sectors or counterparties:

Current Period

Bank

(1)

(2)

(3)

(4) (5)

(6)

(7)

(8)

(9)

Sectors/Counterparty

Agricultural

671

86

777,529 1,226,168 69,564

Farming and Raising

Livestock

671

86

421,056 1,021,430 61,575

Forestry

96,323 162,470

5,154

Fishing

260,150 42,268

2,835

Industry

220 62,376

39,743,917 5,199,342 270,680

Mining

5

1,105,104 222,364

6,955

Production

32

27,128,029 4,859,214 257,079

Electricity, gas, and water

215 62,344

11,510,784 117,764

6,646

Construction

1

11,213,902 2,781,823 136,544

Services

22,436,980 291 145,849 1,121

7,777,910 41,915,499 16,259,680 1,970,804

Wholesale and Retail

Trade

15

100

4 16,496,535 9,326,120 488,389

Hotel, Food and Beverage

Services

8

3,125,403 659,397 73,689

Transportation and

Telecommunication

152

6,794,098 3,283,053 199,994

Financial Institutions

22,436,936

24 1,121

7,722,741 4,516,377 158,489 23,479

Real Estate and Renting

Services

7,630

5 6,863,468 990,242 141,675

Self-Employment Services

20 274 122,678

55,160 2,820,060 1,250,122 926,555

Education Services

16

3,609

605,588 159,962 35,225

Health and Social Services

8

2 11,648

693,970 432,295 81,798

Other

36,526,296 57,617 3,534

64,169 642,608 12,610,755 8,798,129

Total

58,963,276 58,799 211,846 1,121

7,842,079 94,293,455 38,077,768 11,245,721

(1)

Contingent and non-contingent exposures to central governments or central banks

(2)

Contingent and non-contingent exposures to regional governments or local authorities

(3)

Contingent and non-contingent exposures to administrative bodies and non-commercial undertakings

(4)

Contingent and non-contingent exposures to multilateral development banks

(5)

Contingent and non-contingent exposures to international organizations

(6)

Contingent and non-contingent exposures to banks and brokerage houses

(7)

Contingent and non-contingent corporate receivables

(8)

Contingent and non-contingent retail receivables

(9)

Contingent and non-contingent exposures secured by real estate property

(10)

Past due items

(11)

Items in regulatory high-risk categories

(12)

Exposures in the form of bonds secured by mortgages

(13)

Securitization positions

(14)

Short term exposures to banks, brokerage houses and corporates

(15)

Exposures in the form of collective investment undertakings

(16)

Other items