131

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

12.

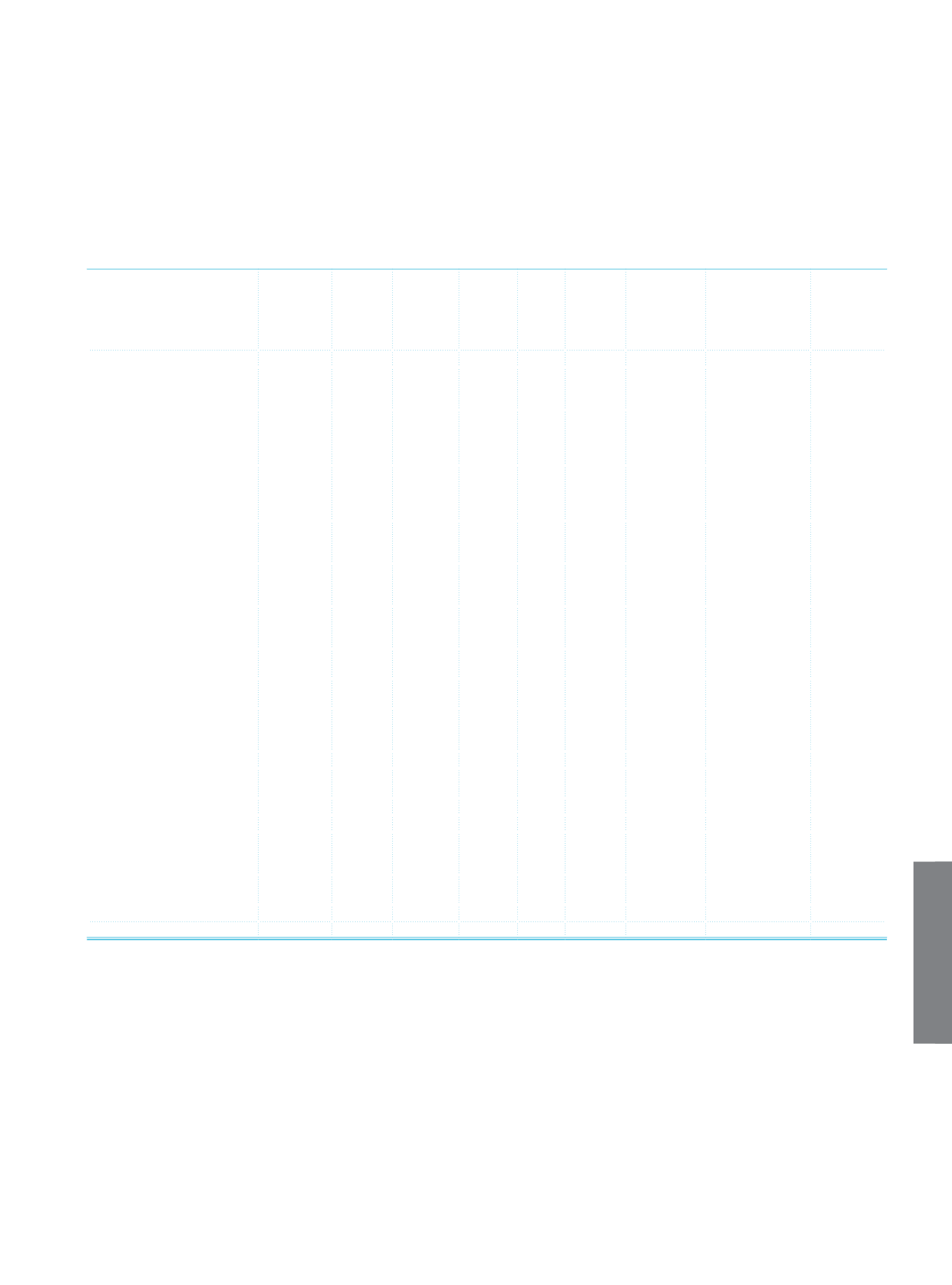

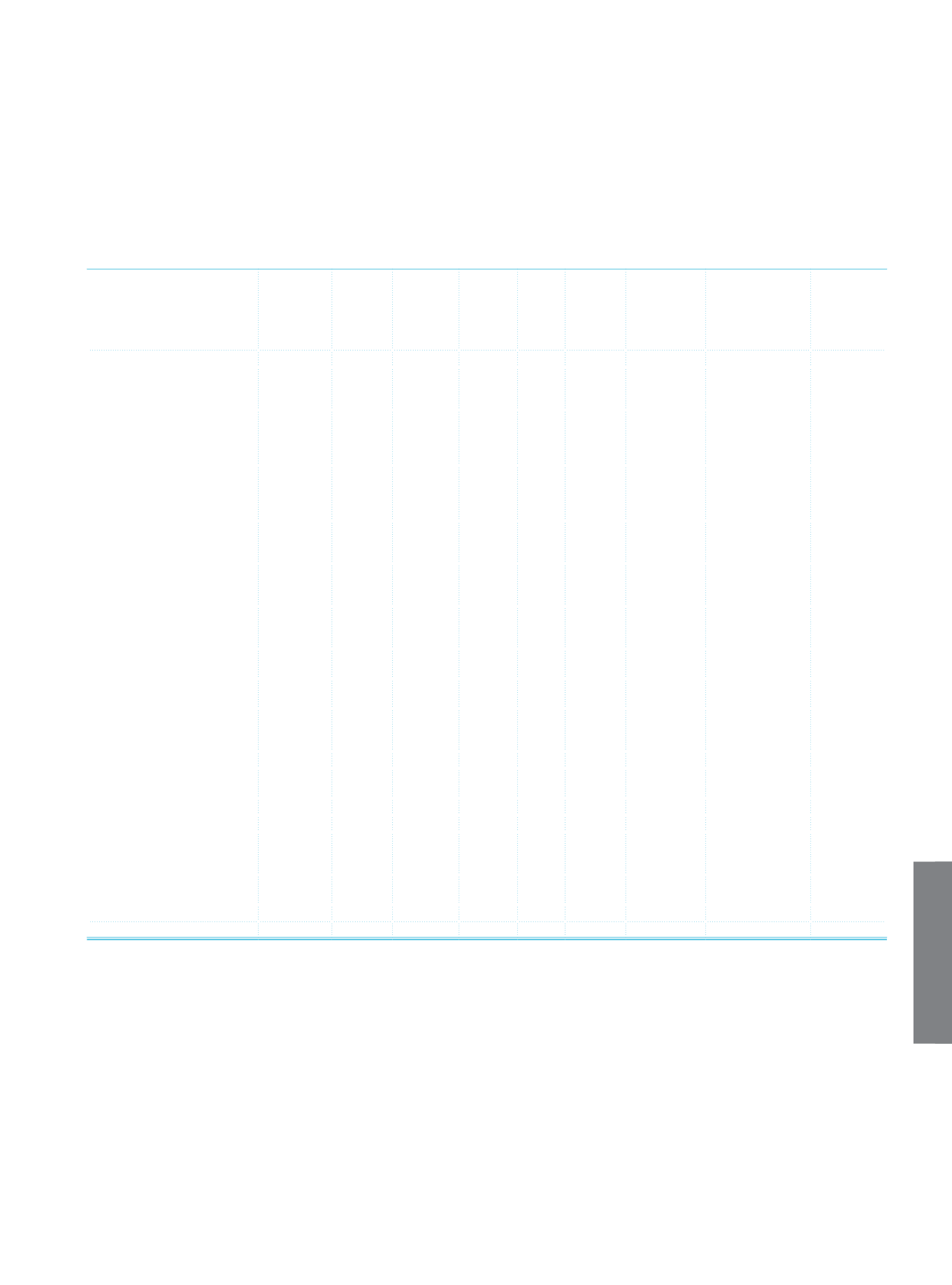

Profile of significant exposures in major regions

Current Period

Domestic

European

Union

OECD

Countries

(1)

Off-Shore

Banking

Regions

USA,

Canada

Other

Countries

Investments

in Associates,

Subsidiaries

and Jointly

Controlled

Entities

Undistributed

Assets/Liabilities

(2)

Total

Risk Groups

Contingent and Non-Contingent

Receivables from Central

Governments or Central Banks

58,963,276

58,963,276

Contingent and Non-Contingent

Receivables from Regional

Government or Domestic

Government

58,799

58,799

Contingent and Non-Contingent

Receivables from Administrative

Units and Non-Commercial

Enterprises

211,837

9

211,846

Contingent and Non-Contingent

Receivables fromMultilateral

Development Banks

106

1,015

1,121

Contingent and Non-Contingent

Receivables from International

Organizations

Contingent and Non-Contingent

Receivables from Banks and

Intermediaries

4,824,620 2,713,392 101,838

20,339 181,890

7,842,079

Contingent and Non-Contingent

Corporate Receivables

92,174,171 765,401

1,194 21,954 8,649 1,322,086

94,293,455

Contingent and Non-Contingent

Retail Receivables

37,582,266 32,228

1,384

25 1,174 460,691

38,077,768

Contingent and Non-Contingent

Receivables Secured by

Residential Property

11,153,523 26,787

3,692

2,164 59,555

11,245,721

Non-Performing Receivables

437,510

58

8

3

1

67

437,647

Receivables are identified as high

risk by the Board

15,179,195 12,968

1,304

1

755 194,358

15,388,581

Secured Marketable Securities

Securitization Positions

Short-term Receivables and

Short-term Corporate Receivables

from Banks and Intermediaries

Investments as Collective

Investment Institutions

359,208

359,208

Other Receivables

5,402,969

7,401,563

12,804,532

Total

225,988,272 3,551,849 109,420 21,983 33,082 2,218,656 7,760,771

239,684,033

(1)

EU Countries, USA and Canada except the OECD Countries

(2)

Assets and liabilities are allocated on a consistent basis