135

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

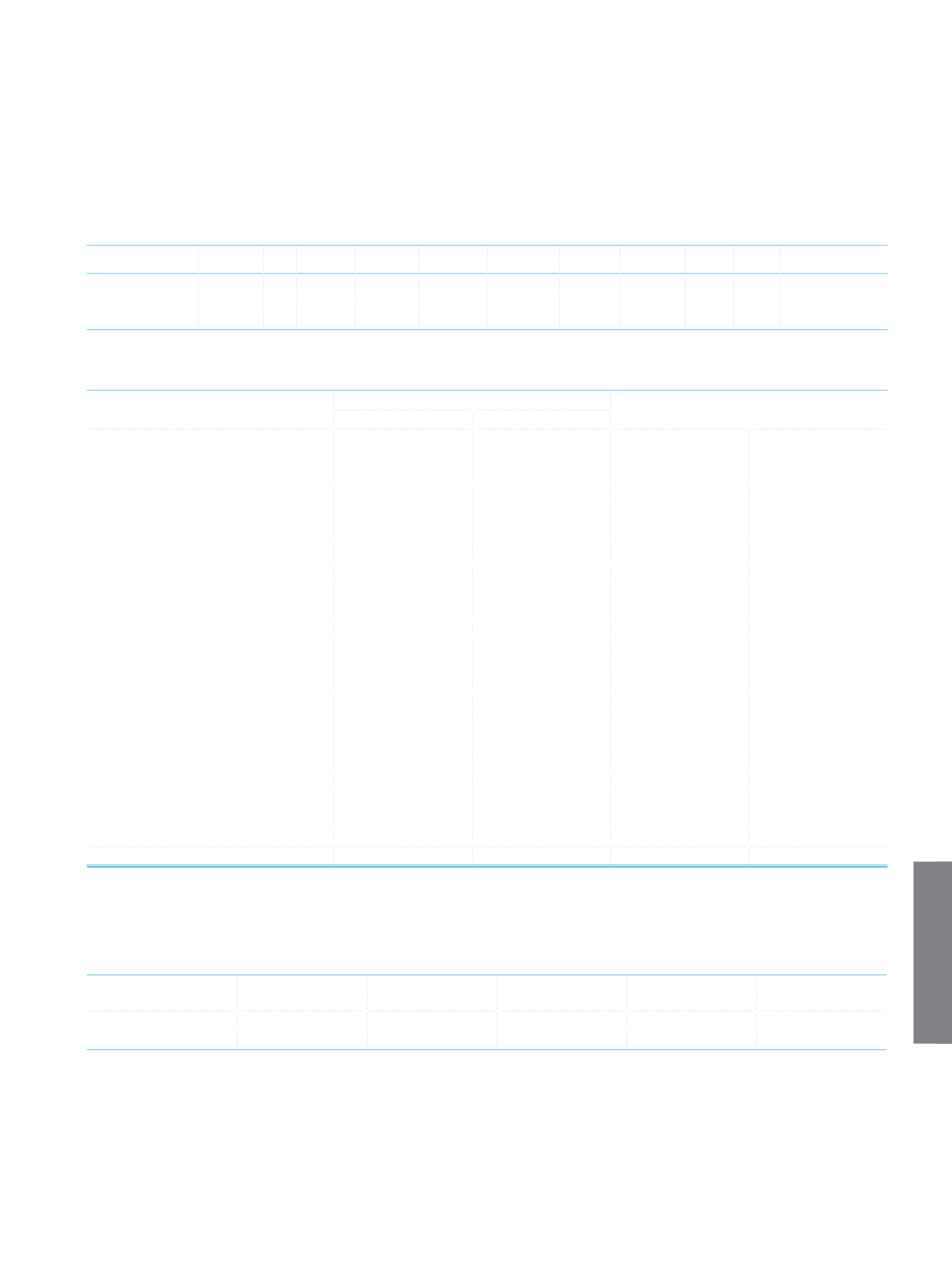

Risk Weight

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Mitigation in

Shareholders’ Equity

Amount Before Credit

Risk Mitigation

54,243,527

3,536,723 24,861,620 35,004,914 106,648,610 3,208,604 12,031,089 148,946

379,160

Amount After Credit

Risk Mitigation

(1)

54,243,527

3,536,723 24,861,620 35,004,914 106,648,610 3,208,604 12,031,089 148,946

379,160

(1)

The effect of credit risk mitigation techniques for the determination of the capital adequacy ratio are excluded

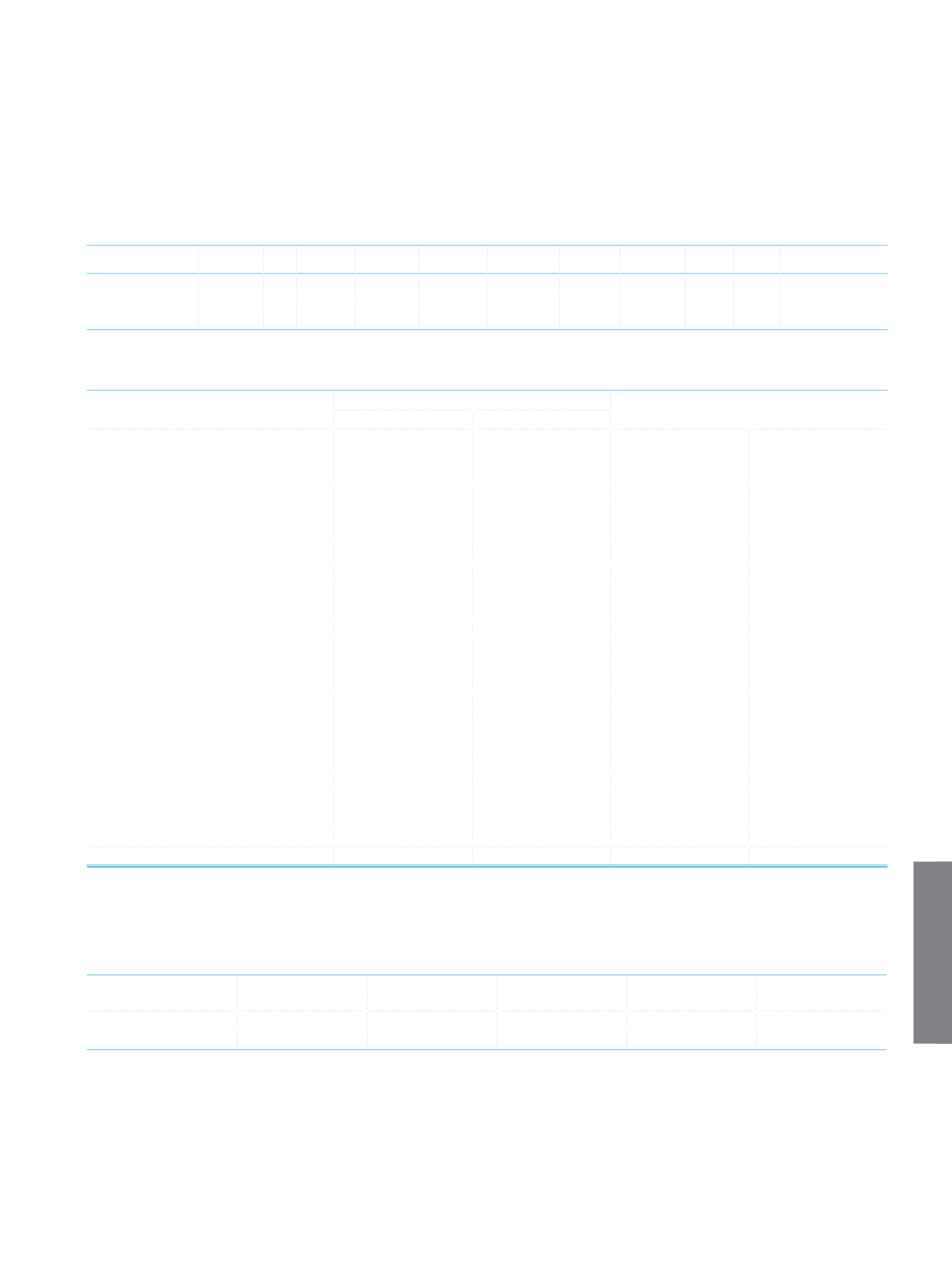

16.

Miscellaneous Information According to Type of Counterparty or Major Sectors

Significant Sectors/Counterparty

Loans

Impaired Non-Performing

(1)

Value Adjustment

(2)

Provisions

(3)

Agricultural

55,477

17,235

362

47,929

Farming and Raising Livestock

45,336

15,648

308

39,579

Forestry

7,621

794

34

6,250

Fishing

2,520

793

20

2,100

Industry

365,631

71,298

2,403

312,423

Mining

22,596

1,887

78

21,448

Production

340,204

68,113

2,166

288,673

Electricity, gas, and water

2,831

1,298

159

2,302

Construction

351,564

43,433

1,436

319,499

Services

581,419

142,564

7,278

470,325

Wholesale and Retail Trade

396,377

68,123

3,113

327,019

Hotel, Food and Beverage

Services

27,866

7,835

463

20,825

Transportation and

Telecommunication

59,775

21,469

1,858

46,707

Financial Institutions

8,216

339

24

5,569

Real Estate and Renting Services

37,770

34,351

905

27,880

Self-Employment Services

31,947

7,697

523

25,898

Education Services

4,803

1,066

151

4,114

Health and Social Services

14,665

1,684

241

12,313

Other

883,701

783,092

57,790

649,969

Total

2,237,792

1,057,622

69,269

1,800,145

(1)

Refers to loans overdue up to 90 days. Related Items included in the commercial installment loans and installment consumer loans are given only in the overdue

amounts, the payment of these loans outstanding principal amounts of TL 606,313 and TL 1,004,945 respectively.

(2)

Refers to the general provisions for non-performing loans.

(3)

Refers to specific provision for impaired loans.

17.

Information on Value Adjustments and Change in Credit Provisions:

Beginning Balance

Provisions

Reversal of

Provisions

Other Value

Adjustment

Ending Balance

Specific Provisions

1,598,883

833,562

(632,300)

1,800,145

General Provisions

1,613,677

385,633

(26,722)

1,972,588

III. Explanations on Market Risk:

1. Information on Market Risk:

The market risk carried by the Bank is measured by two separate methods known respectively as the Standard Method and the

Value at Risk Model in accordance with the local regulations adopted from internationally accepted practices. In this context,

currency risk emerges as the most important component of the market risk.