129

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

(iii) The share of the Bank’s cash and non-cash receivables from the top 100 and 200 loan customers in the overall cash and non-

cash loans stands at 16%, 21%, respectively (31.12.2012: 15%, 20%).

Companies that are among the top loan customers ranked according to cash, non-cash and total risks are leaders in their own

sectors, the loans advanced to them are in line with their volume of industrial and commercial activity. A significant part of such

loans is extended on a project basis, with their repayment sources being analyzed in accordance with the banking principles to be

considered as satisfactory and associated risks are determined and duly covered by obtaining appropriate guarantees when deemed

necessary.

7.

The total value of the general provisions allocated for credit risk stands at TL 1,972,588.

8.

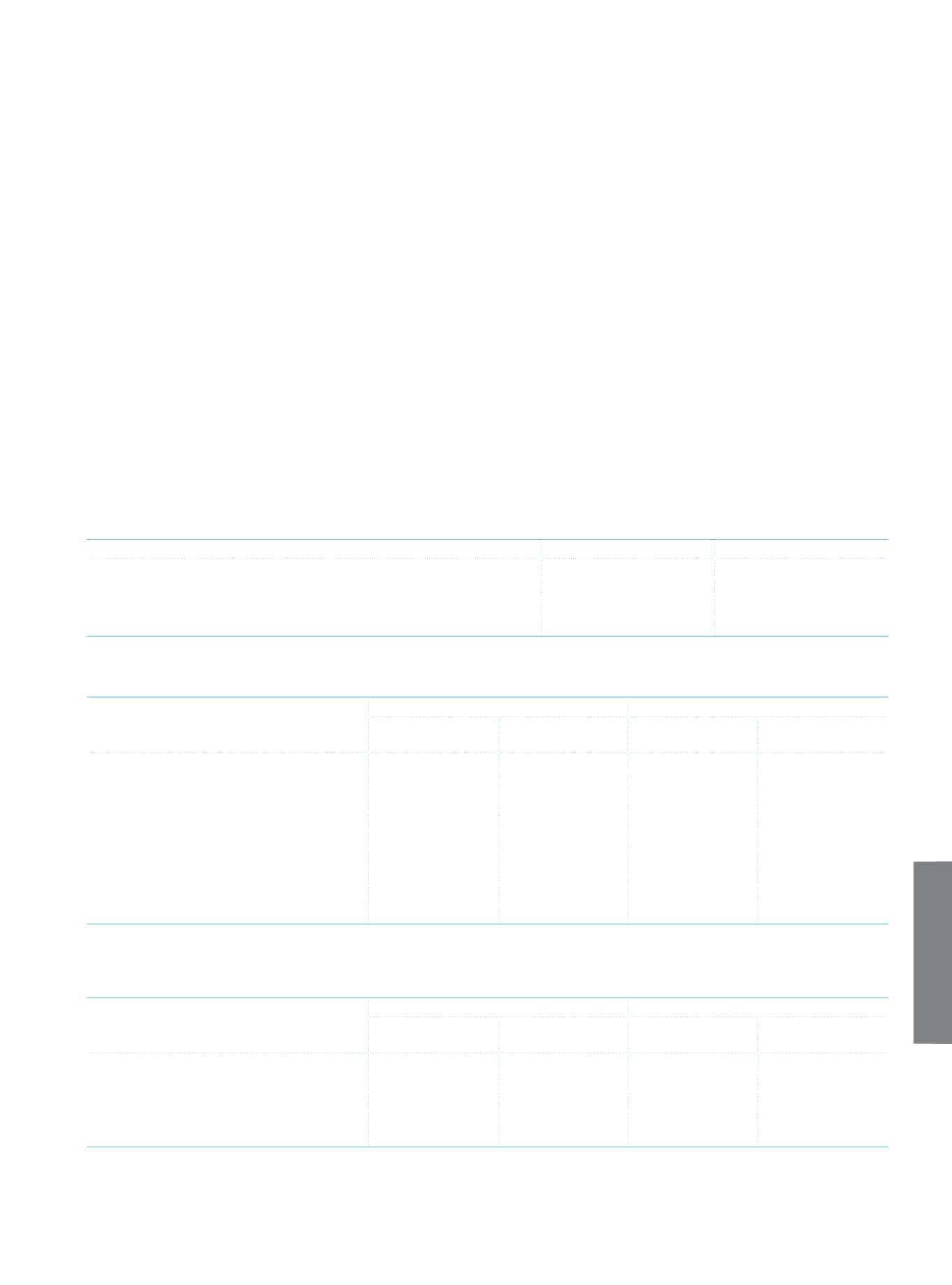

The Bank measures the quality of its loan portfolio by applying different rating/scoring models on cash commercial/corporate

loans, retail loans and credit cards. The breakdown of the rating/scoring results, which are classified as “Strong”, “Standard” and

“Below Standard” by considering their default features, is shown below.

The loans whose borrowers’ capacity to fulfill their obligations is very good, are defined as “Strong”, whose borrowers’ capacity to

fulfill its obligations in due time is reasonable, are defined as “Standard” and whose borrowers’ capacity to fulfill their obligations is

poor, are defined as “Below Standard”.

Current Period

Prior Period

Strong

49.38%

51.46%

Standard

37.02%

33.83%

Below Standard

4.71%

5.99%

Not Rated/Scored

8.89%

8.72%

The table data comprises behavior rating/scoring results

9.

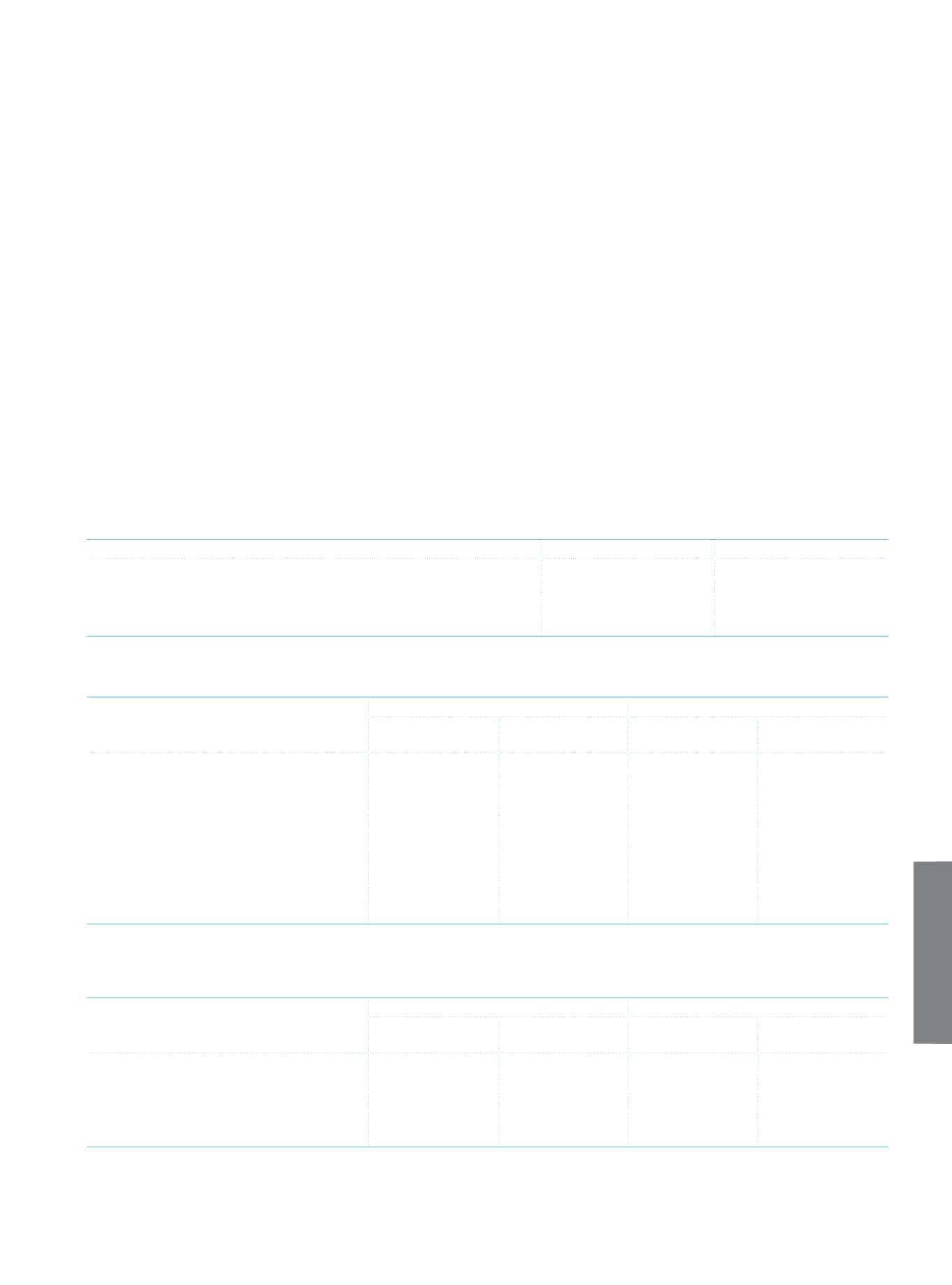

The net values of the collaterals of the closely monitored loans are given below in terms of collateral types and risk matches.

Type of Collateral

Current Period

Prior Period

Net Value of the

Collateral

Loan Balance

Net Value of the

Collateral

Loan Balance

Real Estate Mortgage

(1)

582,828

582,828

574,296

574,296

Vehicle Pledge

109,493

109,493

140,164

140,164

Cash Collateral (Cash, securities pledge, etc.)

10,645

10,645

19,074

19,074

Pledge on Wages

185,229

185,229

126,458

126,458

Cheques & Notes

40,562

40,562

30,673

30,673

Other (Suretyship, commercial enterprise

under pledge, commercial papers, etc.)

308,302

308,302

173,691

173,691

Non-collateralized

847,602

827,175

Total

1,237,059

2,084,661

1,064,356

1,891,531

(1)

The mortgage and/or pledge amounts on which third parties have priorities are deducted from the fair values of collaterals in expertise reports; and after comparing the

results to the mortgage/pledge amounts and loan balances, the smallest figures are considered to be the net value of collaterals.

10.

The net values of the collaterals of non-performing loans are given below in terms of collateral types and risk matches.

Type of Collateral

Current Period

Prior Period

Net Value of the

Collateral

Loan Balance

Net Value of the

Collateral

Loan Balance

Real Estate Mortgage

(1)

354,879

354,879

417,804

417,804

Cash Collateral

157

157

36

36

Vehicle Pledge

53,749

53,749

59,204

59,204

Other (suretyship, commercial enterprise

under pledge, commercial papers, etc.)

23,247

23,247

30,474

30,474

(1)

The mortgage and/or pledge amounts on which third parties have priorities are deducted from the fair values of collaterals in expertise reports, and after comparing the

results to the mortgage/pledge amounts and loan balances the smallest figures are considered to be the net value of collaterals.