125

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Unconsolidated Financial Statements

for the Year Ended 31 December 2013

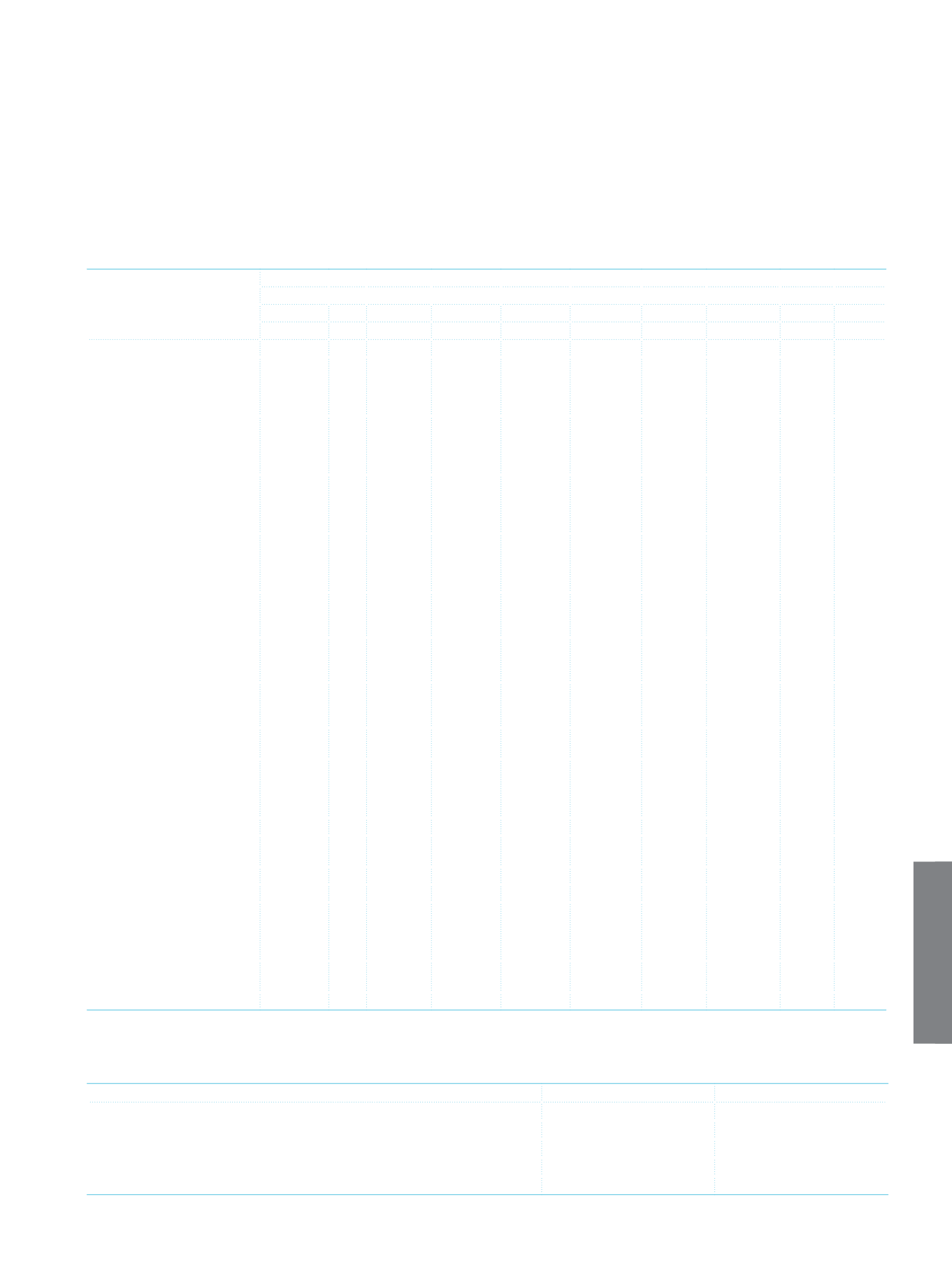

Information related to capital adequacy ratio:

Value at Credit Risk

Risk Weights

Bank Only

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Risk Groups

Contingent and Non-

Contingent Receivables from

Central Governments or

Central Banks

51,586,757

7,035,311

341,208

Contingent and Non-

Contingent Receivables from

Regional Government or

Domestic Government

16,352 42,445

2

Contingent and Non-

Contingent Receivables from

Administrative Units and Non-

Commercial Enterprises

211,846

Contingent and Non-

Contingent Receivables from

Multilateral Development

Banks

1,121

Contingent and Non-

Contingent Receivables from

International Organizations

Contingent and Non-

Contingent Receivables from

Banks and Intermediaries

435,838

3,263,247 4,003,876

139,060

58

Contingent and Non-

Contingent Corporate

Receivables

257,106 2,528,801

91,507,548

Contingent and Non-

Contingent Retail Receivables

12

5,466 35,004,914 3,067,376

Contingent and Non-

Contingent Receivables

Secured by Residential

Property

11,245,721

Non-Performing Receivables

(1)

437,647

Receivables are identified as

high risk by the Board

3,208,546 12,031,089 148,946

Secured Marketable Securities

Securitization Positions

Short-term Receivables

and Short-term Corporate

Receivables from Banks and

Intermediaries

Investments as Collective

Investment Institutions

359,208

Other Receivables

2,219,811

6

10,584,715

(1)

In accordance “Regulation on Measurement and Assessment of Capital Adequacy Ratios of Banks”, credits and other receivables which are monitoring in the non-

performing loans and receivables and represents the net of value after the offsetting with the specific provisions for those.

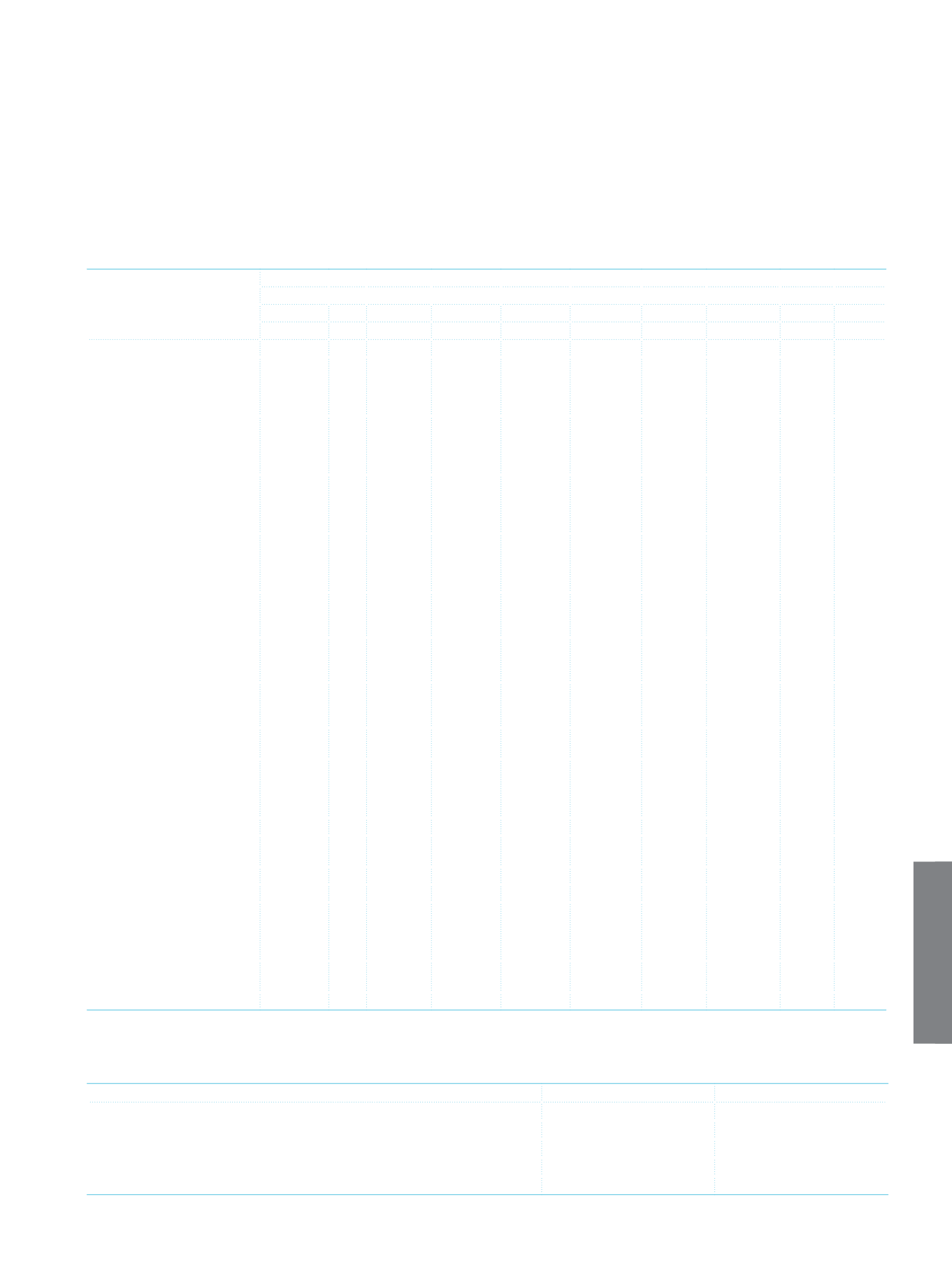

Summary information about the Bank only standard capital adequacy ratio:

Current Period

Prior Period

Capital Requirement for Credit Risk (VaCR*0.08) (CRCR)

14,023,032

10,945,847

Capital Requirement for Market Risk (CRMR)

410,935

281,182

Capital Requirement for Operational Risk (CROR)

971,452

894,118

Equity

27,689,806

24,739,690

Equity/((CRCR+CRMR+CROR)*12.5*100)

14.38

16.33