225

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

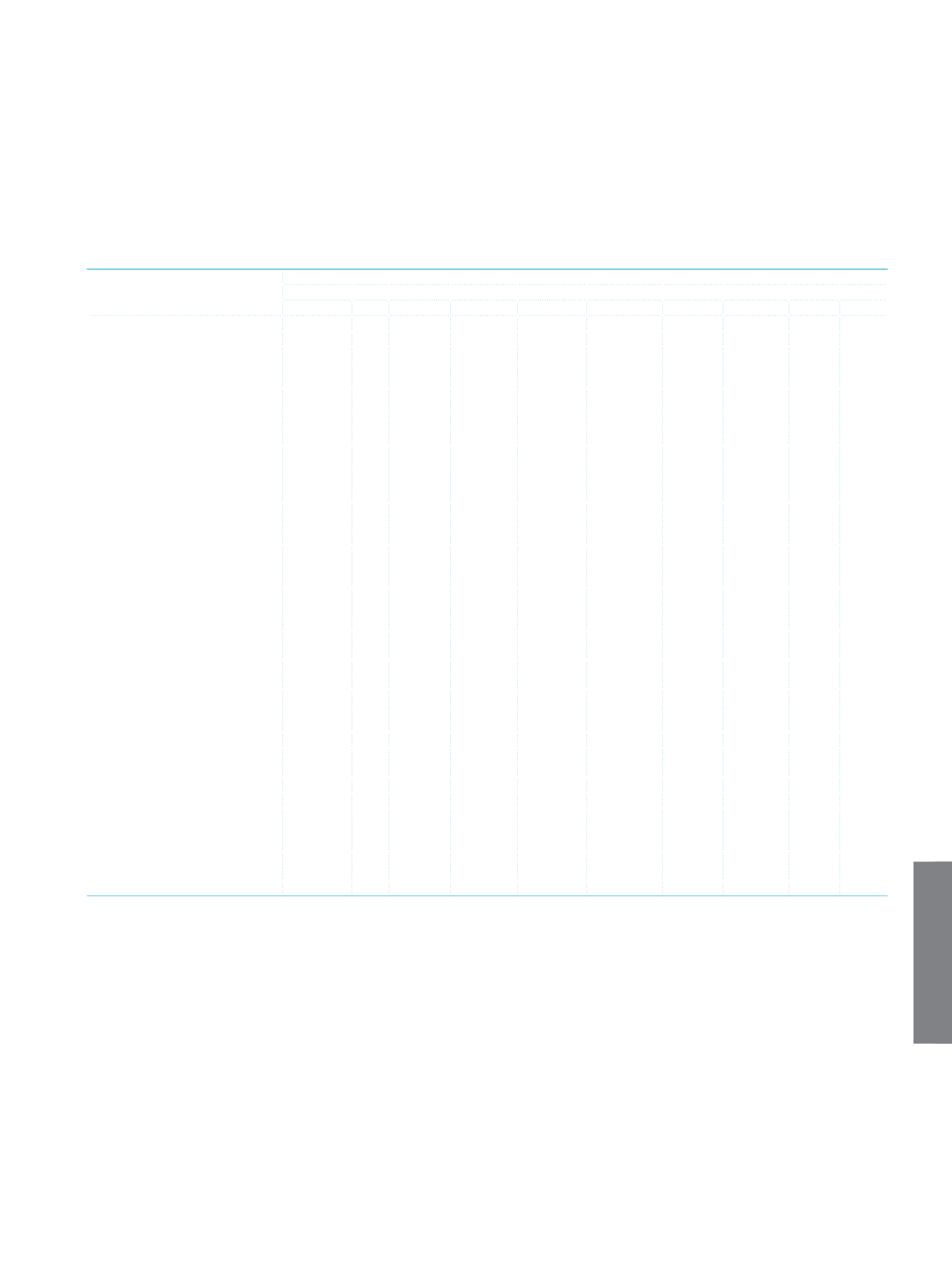

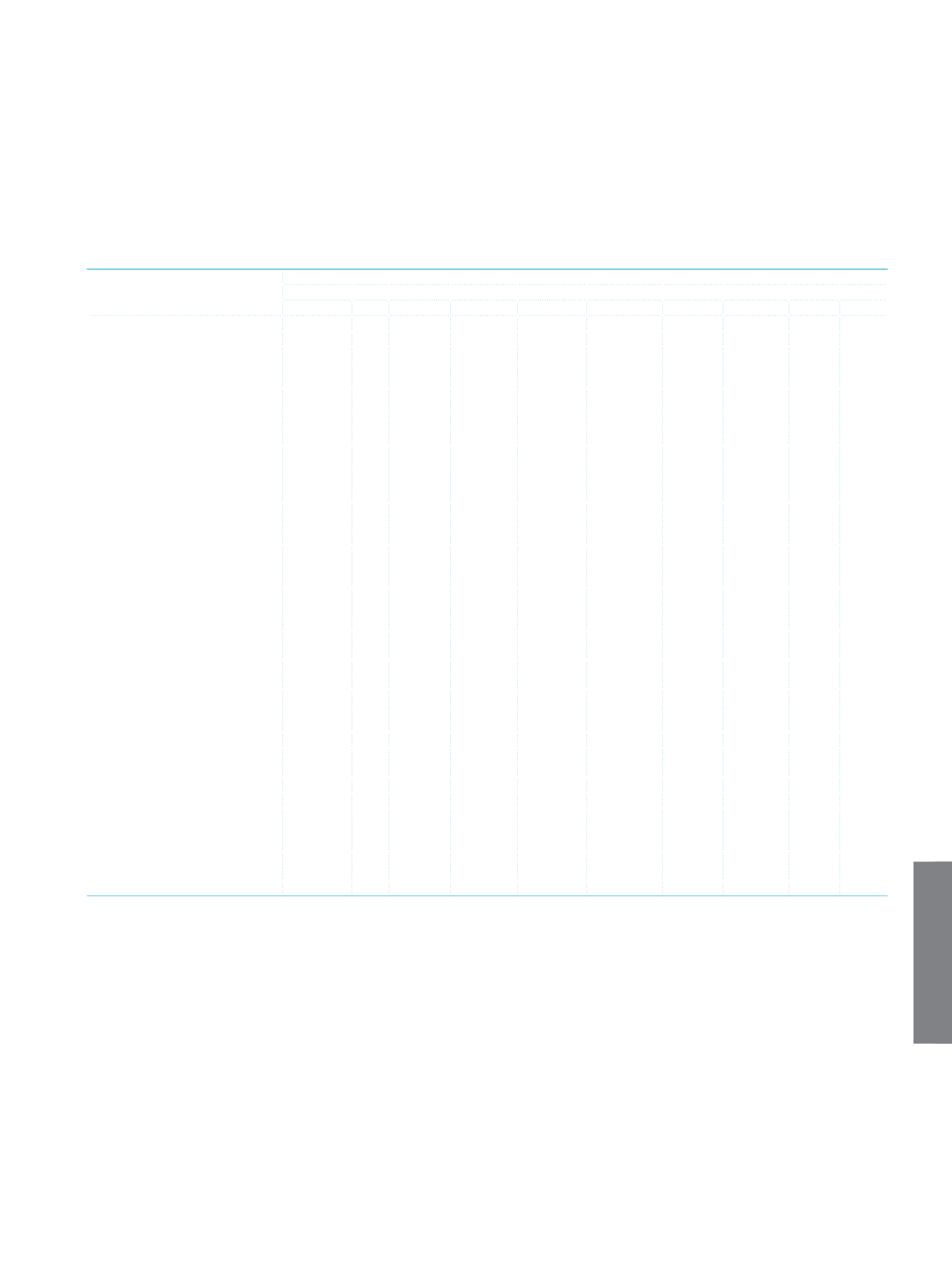

Information related to consolidated capital adequacy ratio:

Risk Weights

Consolidated

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Value at Credit Risk

Risk Classes

Contingent and Non-Contingent

Receivables from Central

Governments or Central Banks

56,877,986

7,518,059

341,211

Contingent and Non-Contingent

Receivables from Regional

Governments or Domestic

Governments

16,352 42,445

2

Contingent and Non-Contingent

Receivables from Administrative

Units and Non-Commercial

Enterprises

254,626

Contingent and Non-Contingent

Receivables fromMultilateral

Development Banks

1,121

Contingent and Non-Contingent

Receivables from International

Organizations

Contingent and Non-Contingent

Receivables from Banks and

Intermediaries

519,957

5,528,629 8,157,879

161,180

58

Contingent and Non-Contingent

Corporate Receivables

148,145 1,999,917

106,712,068 16,705

Contingent and Non-Contingent

Retail Receivables

5,239,480

12

5,464 35,738,580 3,066,665

Contingent and Non-Contingent

Collateralized Receivables with Real

Estate Mortgages

11,245,721

Non-performing Receivables

(1)

546,352

Receivables are identified as high

risk by the Board

3,270,962 12,031,124 148,946

Secured Marketable Securities

Securitization Positions

Short-term Receivables and Short-

term Corporate Receivables from

Banks and Intermediaries

Investments as Collective

Investment Institutions

57,419

118,403

Other Receivables

2,257,084

6

9,801,746

(1)

In accordance “Regulation on Measurement and Assessment of Capital Adequacy Ratios of Banks”, credits and other receivables which are monitoring in the non-

performing loans and receivables and represents the net of value after the offsetting with the specific provisions for those.

(2)

The amount includes blocked financial investments with risks on saving life policyholders and receivables from individual pension operations of Anadolu Hayat Emeklilik

A.Ş. which is one of the Group companies.