233

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

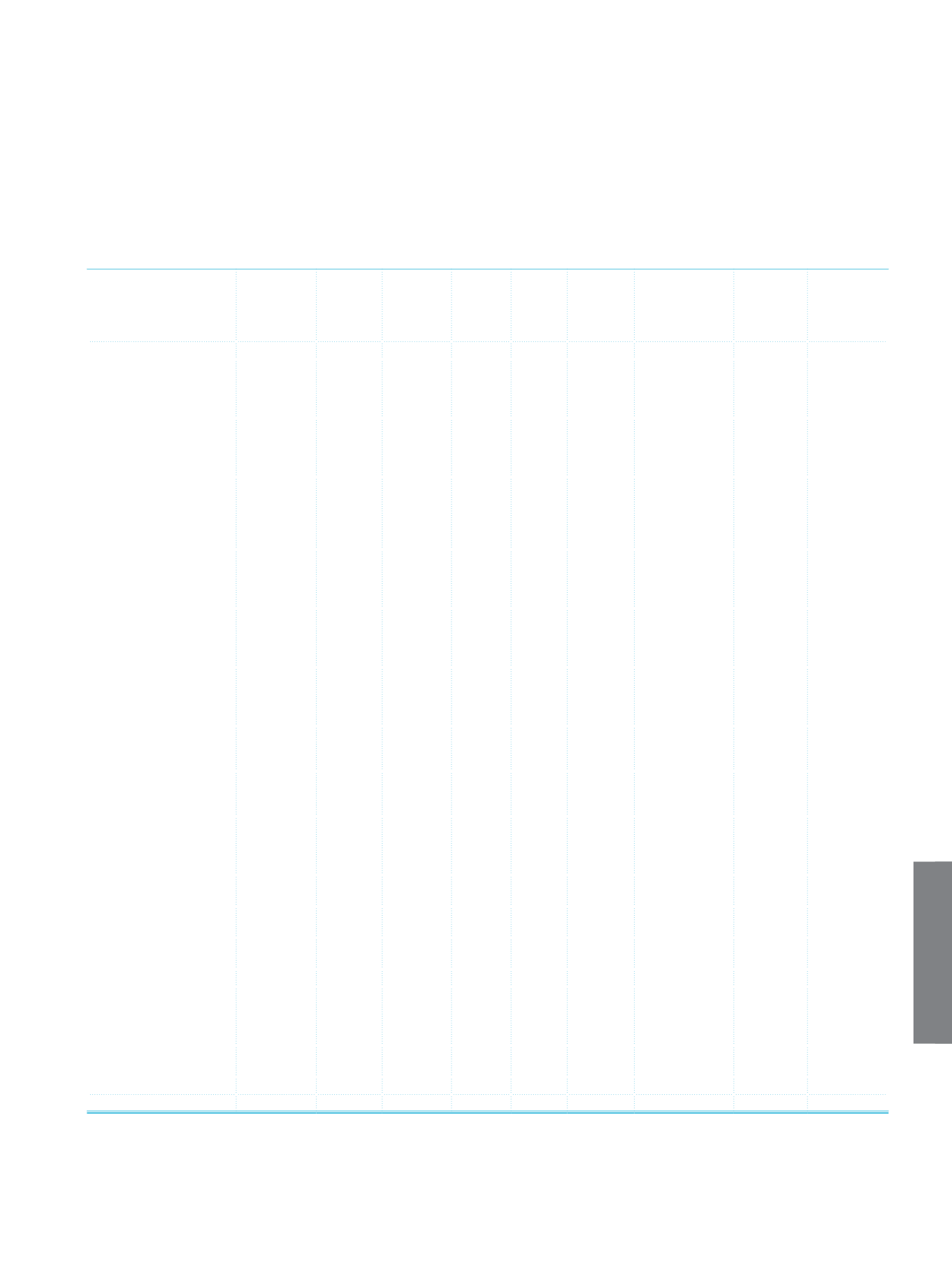

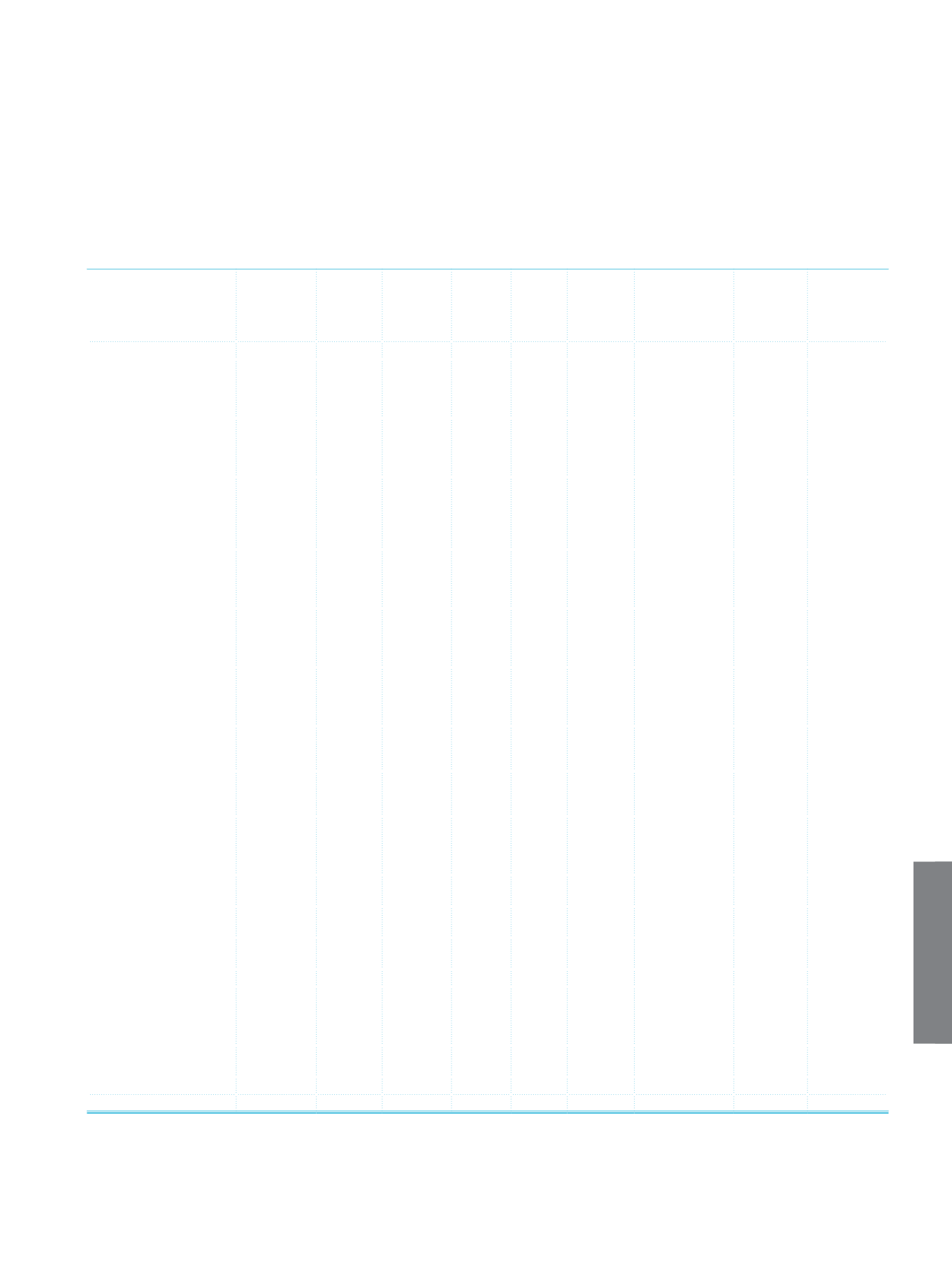

12. Profile of Significant Risk Exposures in Major Regions:

Current Period

Domestic

European

Union

OECD

Countries

(1)

Off-Shore

Banking

Regions

USA,

Canada

Other

Countries

Investments

in Associates,

Subsidiaries and

Jointly Controlled

Entities

Unallocated

Assets/

Liabilities

(2)

Total

Risk Groups

Contingent and Non-

Contingent Receivables

from Central Governments

or Central Banks

64,691,365

6,473

39,418

64,737,256

Contingent and Non-

Contingent Receivables

from Regional Government

or Domestic Government

58,799

58,799

Contingent and Non-

Contingent Receivables

from Administrative Units

and Non-Commercial

Enterprises

235,196 19,422

8

254,626

Contingent and Non-

Contingent Receivables

fromMultilateral

Development Banks

106

1,015

1,121

Contingent and Non-

Contingent Receivables

from International

Organizations

Contingent and Non-

Contingent Receivables

from Banks and

Intermediaries

10,496,899 3,324,875 148,100 14,771 183,343 199,715

14,367,703

Contingent and Non-

Contingent Corporate

Receivables

105,696,261 1,388,111

17,217 30,213 51,107 1,693,926

108,876,835

Contingent and Non-

Contingent Retail

Receivables

43,111,309 423,371

6,986

25 1,174 507,336

44,050,201

Contingent and Non-

Contingent Receivables

Secured by Residential

Property

11,153,523 26,787

3,692

2,164 59,555

11,245,721

Non-Performing

Receivables

546,215

58

8

3

1

67

546,352

Receivables are identified

as high risk by the Board

15,241,646 12,968

1,304

1

755 194,358

15,451,032

Secured Marketable

Securities

Securitization Positions

Short-term Receivables

and Short-term Corporate

Receivables from Banks

and Intermediaries

Investments as Collective

Investment Institutions

171,815

4,007

175,822

Other Receivables

7,884,285

4,174,551

12,058,836

Total

259,291,426 5,203,080 177,307 45,013 238,544 2,694,383

4,174,551

271,824,304

(1)

EU Countries, USA and Canada except the OECD Countries

(2)

Assets and liabilities are allocated on a consistent basis