242

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

VI. Explanations on Consolidated Interest Rate Risk

“Interest Rate Risk” is defined as the decrease that can arise in the value of the interest sensitive assets, liabilities and off-balance

sheet operations a result of interest rate fluctuations. The method of average maturity gap according to the repricing dates is used

for measuring the interest rate risk arising from the banking accounts, whereas the interest rate risk related to interest sensitive

financial instruments followed under trading accounts is assessed within the scope of market risk.

Potential effects of interest rate risk on the Parent Bank’s assets and liabilities, market developments, the general economic

environment and expectations are regularly followed in meetings of the Asset-Liability Committee, where further measures to

reduce risk are taken when necessary.

The Parent Bank’s on and off-balance sheet interest sensitive accounts other than the assets and liabilities exposed to market risk

are monitored and controlled by the limits above the average maturity gaps according to the repricing periods determined by the

Board within the scope of asset-liability management risk policy. Moreover, scenario analyses formed in line with the historical data

and expectations are also used in the management of the related risk.

Interest rate sensitivity:

In this part, the sensitivity of the Bank’s assets and liabilities to the interest rates has been analyzed assuming that the year-end

balance figures were the same throughout the year. Mentioned analysis shows how the FC and TL changes in interest rates by

one point during the one-year period affect the Group’s income accounts and shareholders’ equity under the assumption maturity

structure and balances are remain the same all year round at the end of the year.

During the measurement of the Bank’s interest rate sensitivity, the profit/loss on the asset and liability items that are evaluated with

market value are determined by adding to/deducting from the difference between the expectancy value of the portfolio after one

year in case there is no change in interest rates and the value of the portfolio one year later, which is measured after the interest

shock, the interest income to be additionally earned/to be deprived of during the one year period due to the renewal or reprising of

the related portfolio at the interest rates formed after the interest shock.

On the other hand, in the profit/loss calculation of assets and liabilities that are not evaluated by the current market prices, it is

assumed that assets and liabilities with fixed interest rates will be renewed at maturity date and the assets and liabilities having

variable interest rates will be renewed at the end of repricing period with the market interest rates generated after the interest

shock.

Within this context, ceteris paribus, the possible changes that may occur in the Bank’s profit and shareholders’ equity in case of 1

point increase/decrease in TL and FC interest rates on the reporting day are given below.

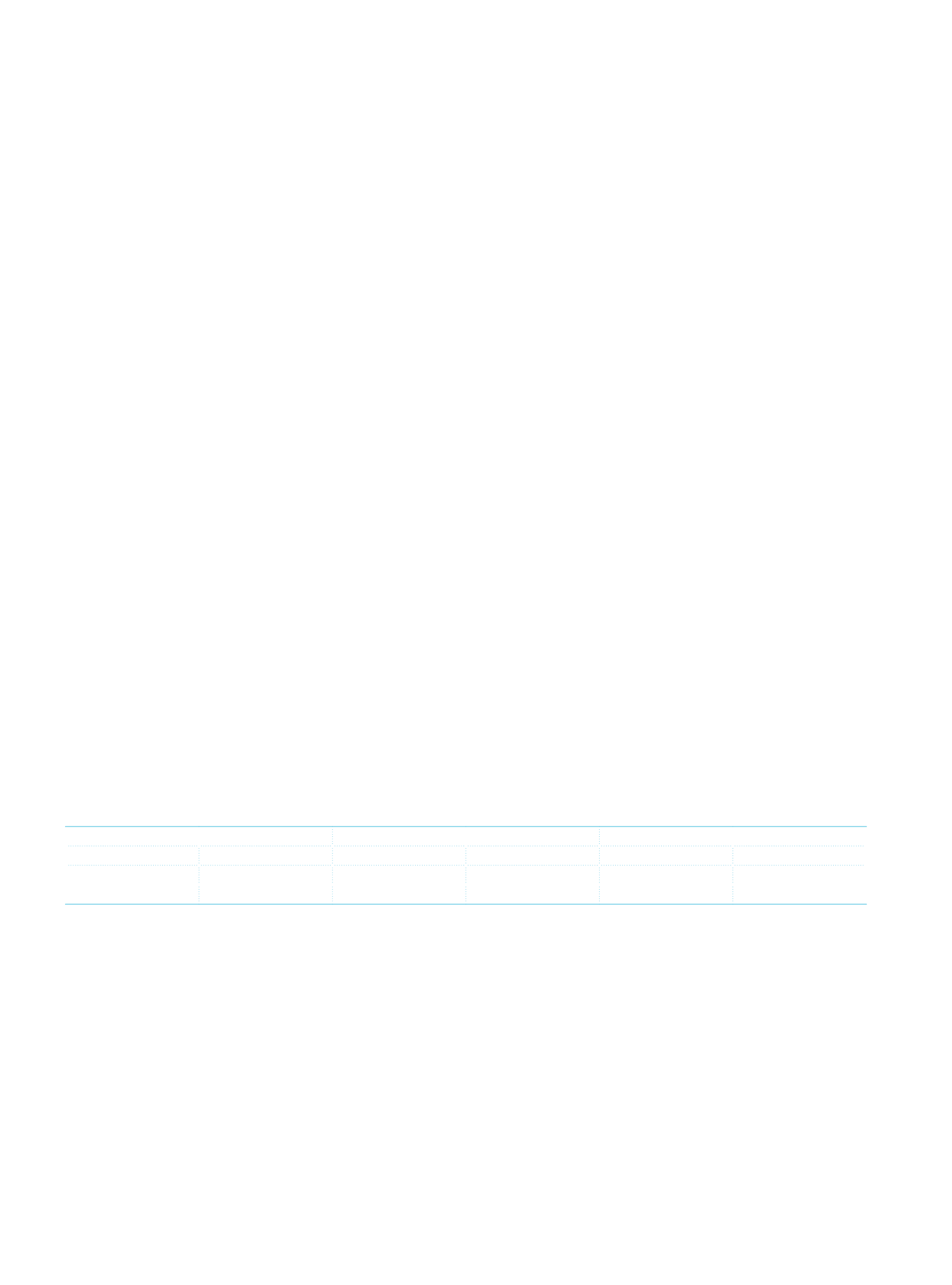

%Change in the Interest Rate

(1)

Effect On Profit/Loss

(2)

Effect on Equity

(3)

TL

FC

(4)

Current Period

Prior Period

Current Period

Prior Period

1 point increase 1 point increase

(165,600)

(42,333)

(622,653)

(613,617)

1 point decrease 1 point decrease

184,304

64,876

673,953

672,686

(1)

The effects on the profit/loss and shareholders’ equity are stated with their before tax values.

(2)

The effect on the profit/loss is mainly arising from the fact that the average maturity of the Bank’s fixed rate liabilities is shorter than the average maturity of its fixed

rate assets.

(3)

The effect on the shareholders’ equity is arising from the change of the fair value of securities followed under Financial Assets Available for Sale.

(4)

Due to the reason that the LIBOR rates were at low levels in both of the periods, the negative shock imposed on FC interest rates in some maturity brackets remained

below the aforementioned rates.