240

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

V. Explanations on Consolidated Currency Risk

Foreign currency position risk for the Group is a result of the difference between the Group’s assets denominated in and indexed to

foreign currencies and liabilities denominated in foreign currencies. Furthermore, parity fluctuations of different foreign currencies

are another element of the currency risk.

The currency risk for the Parent Bank is managed by the internal currency risk limits which are established as a part of the Parent

Bank’s risk policies. The Assets and Liabilities Committee and the Assets and Liabilities Management Unit meet regularly to take the

necessary decisions for hedging exchange rate and parity risks, within framework of the determined by the “Net Foreign Currency

Overall Position/Shareholders’ Equity” ratio, which is a part of the legal requirement and the internal currency risk limits specified by

the Board of Directors. Foreign exchange risk management decisions are strictly applied.

In measuring currency risk, which the Group is exposed to, both the Standard Method and the Value at Risk Model (VAR) are used as

applied in the statutory reporting.

Measurements made for the Parent Bank within the scope of the Standard Method are carried out on a monthly basis and form the

basis of determining the capital requirement for hedging currency risk.

Risk measurements made within the context of the VAR are made on a daily basis using the historical and Monte Carlo simulation

methods. Furthermore, scenario analyses are conducted to support the calculations made within the VAR context.

The results of the measurements made on currency risk are reported to the Key Management and the risks are closely monitored by

taking into account the market and the economic conditions.

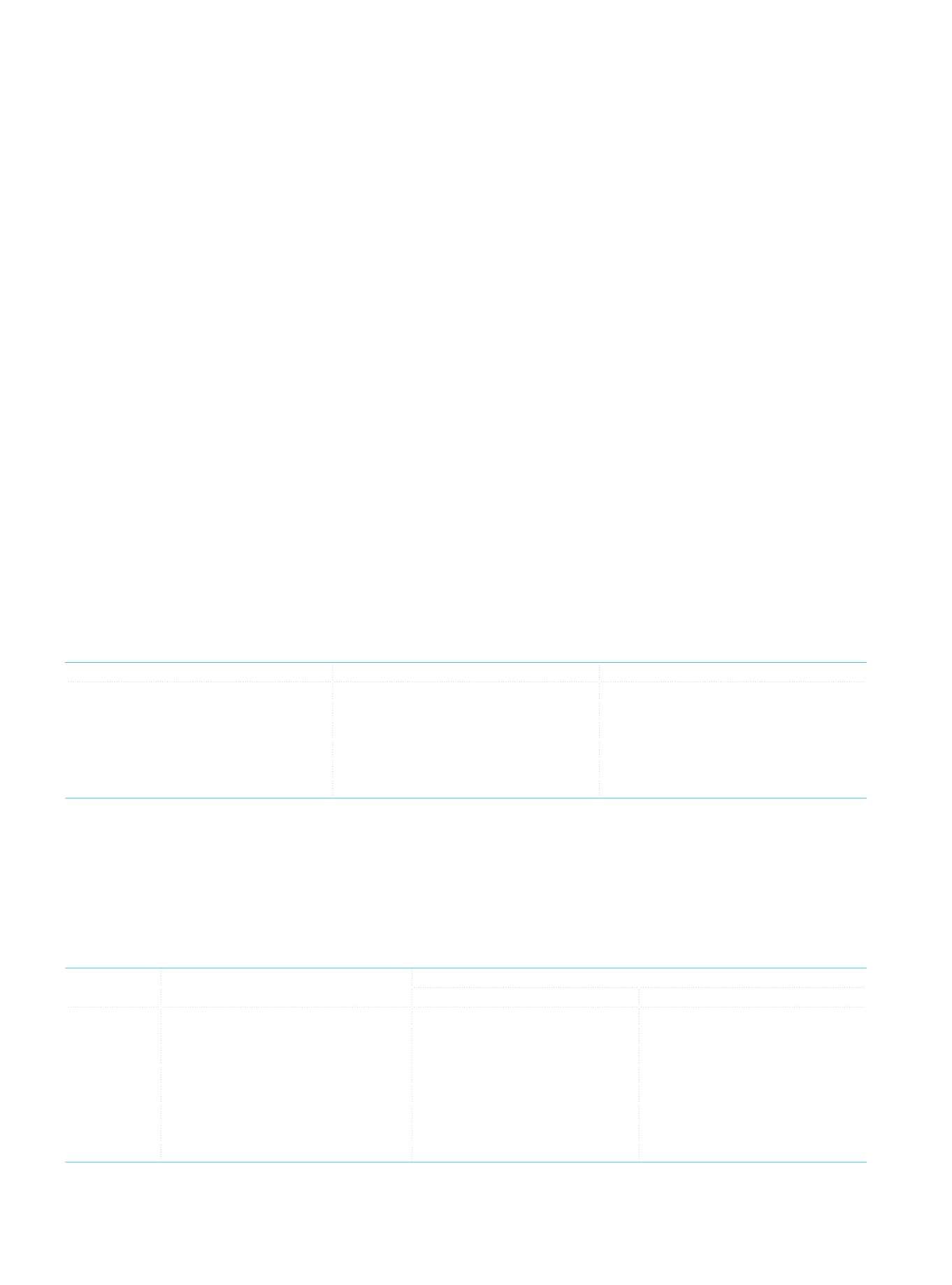

The Parent Bank’s foreign currency purchase rates at the date of balance sheet and for the last five working days of the period

announced by the Parent Bank in TL are as follows:

Date

USD

EUR

31. 12. 2013

2.1125

2.9068

30. 12. 2013

2.0942

2.8931

27. 12. 2013

2.1090

2.9100

26. 12. 2013

2.0794

2.8463

25. 12. 2013

2.0449

2.7991

24. 12. 2013

2.0400

2.7883

The Parent Bank’s last 30-days arithmetical average foreign currency purchase rates:

USD:

TL 2.0330

EUR:

TL 2.7864

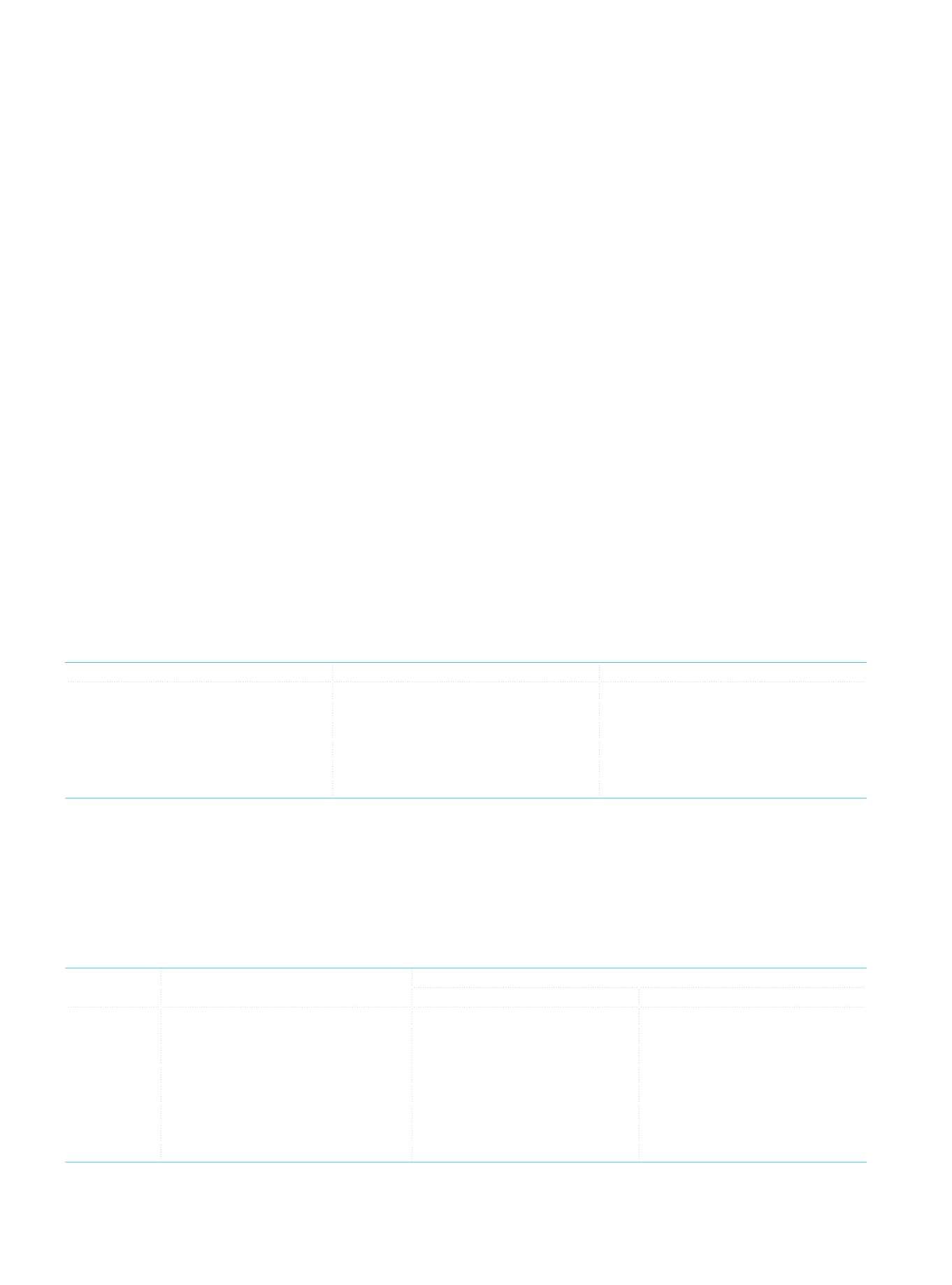

Sensitivity to currency risk:

The Group’s sensitivity to any potential change in foreign currency rates has been analyzed. Within this framework, 10% change is

anticipated in USD, EUR and GBP currencies and the possible impact of the related change is presented below. 10% is the ratio that

is used in the internal reporting of the Parent Bank.

%Change in Foreign Currency

Effects on Profit/Loss

(1)

Current Period

Prior Period

USD

10% increase

65,831

228,999

10% decrease

(65,831)

(228,999)

EUR

10% increase

(252,233)

(202,894)

10% decrease

252,233

202,894

GBP

10% increase

26,756

76,740

10% decrease

(26,756)

(76,740)

CHF

10% increase

(42,602)

(18,664)

10% decrease

42,602

18,664

(1)

Indicates the values before tax.