247

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

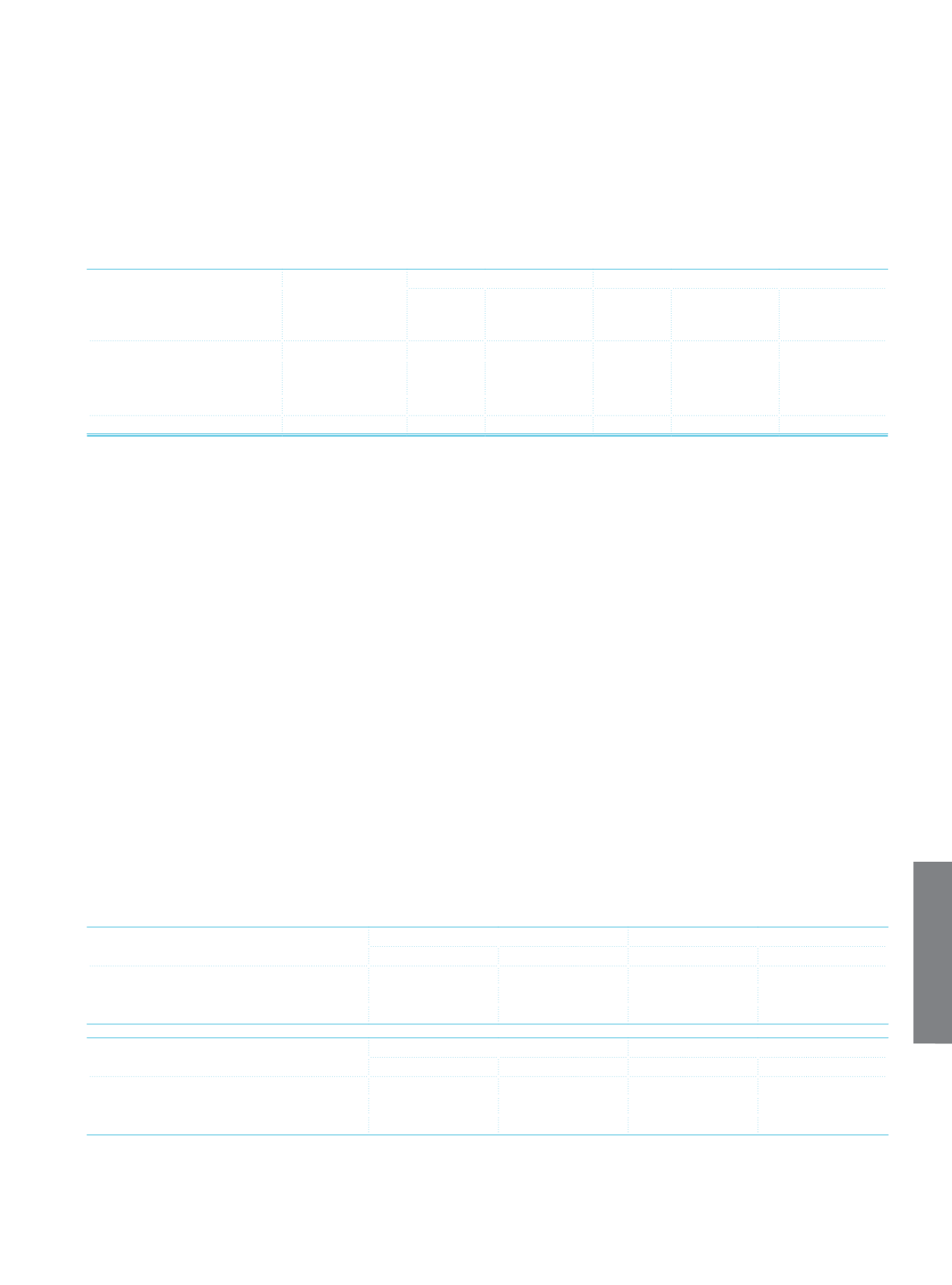

c.

Unrealized gains and losses on investment in stocks, revaluation increases with the amounts of main and additive capital:

Portfolio

Realized

Gains/losses

During the period

Revaluation Increases

Unrealized Gains

Total

Including to

the Capital

Contribution

Total

Including in to

themain capital

Including to

the Capital

Contribution

Private Equity Investments

Shares Traded on a Stock

Exchange

1,512,118

680,453

Other Stocks

Total

1,512,118

680,453

VIII. Explanations on Consolidated Liquidity Risk

Liquidity risk may arise as a result of funding long-term assets with short-term resources. Utmost care is taken to maintain the

consistency between the maturities of assets and liabilities; strategies are used to acquire funds over longer terms.

The Parent Bank’s main source of funding is deposits. While the average maturity of deposits is shorter than the average maturity

of assets as a result of the market conditions, the Parent Bank’s wide network of branches and steady core deposit base are its most

important safeguards of the supply of funds. The Parent Bank also borrows medium and long-term funds from institutions abroad.

In order to meet the liquidity requirements that may arise due to market fluctuations, the Group analyses TL and FC cash flows

projections to preserve liquid assets. The term structure of TL and FC deposits, their costs and movements in the total amounts

are monitored on a daily basis, also accounting for developments in former periods and expectations for the future. Based on cash

flow projections, prices are differentiated for different maturities and thereby measures are taken to meet liquidity requirements;

moreover liquidity that may be required for extraordinary circumstances is estimated and alternative liquidity sources are

determined for possible utilization.

Furthermore, foreign currency and total liquidity adequacy ratios, which are subject to weekly legal reporting and calculated

separately for 7 and 31 days following the reporting date, and the liquidity adequacy ratios that are calculated based on the stress

scenarios built internally by the Parent Bank, are used effectively to manage the liquidity risk.

Evaluated within the framework of the Parent Bank’s asset-liability management risk policy, the limits determined related to the

liquidity risk management are monitored by the Risk Committee and to avoid extraordinary situations where a quick action should be

taken due to the unfavorable market conditions, emergency measures and funding plans related to liquidity risk are put into effect.

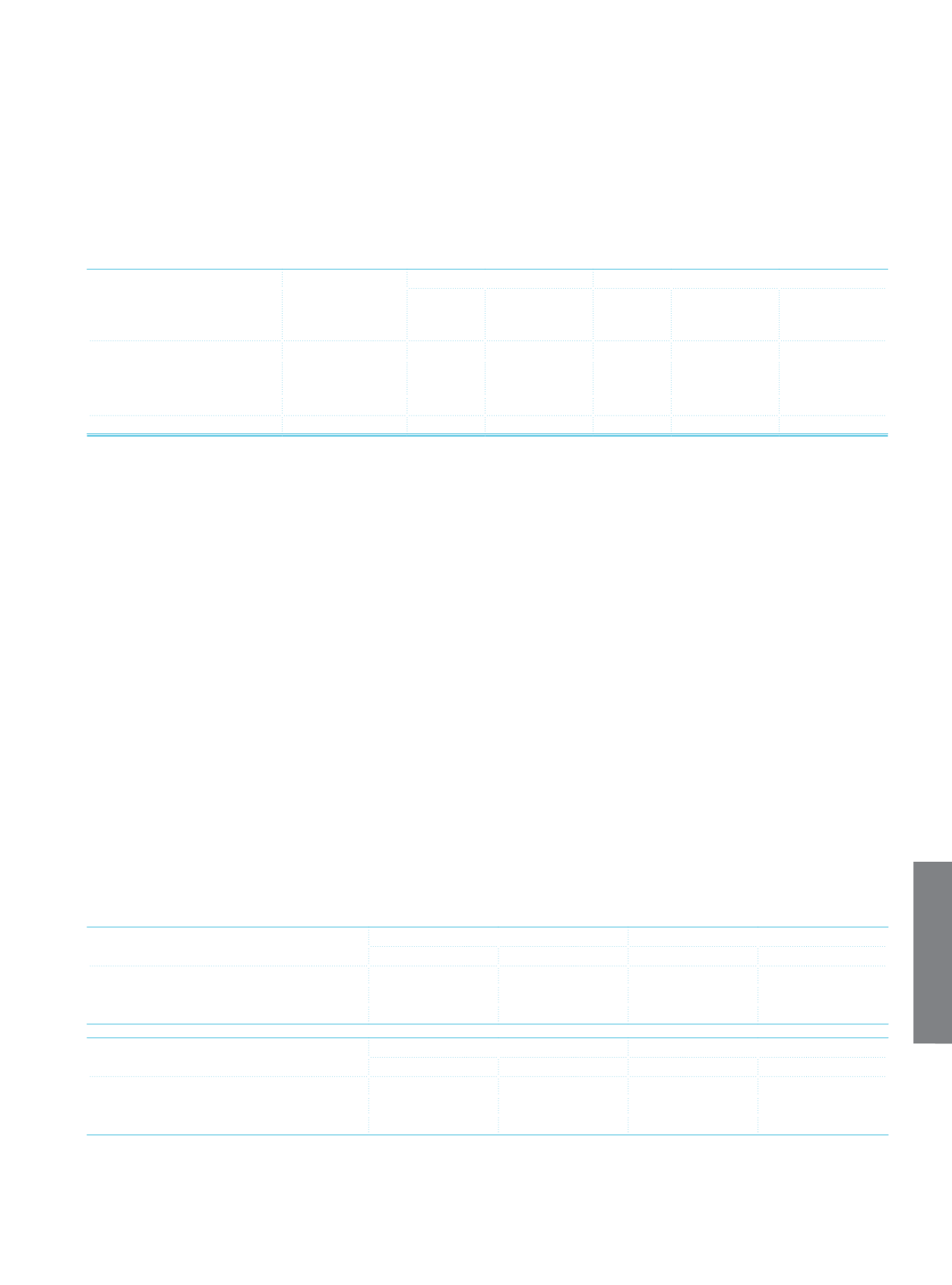

As per the Communiqué on “Measurement and Assessment of the Adequacy of Banks’ Liquidity”, the liquidity ratios that are

measured for terms of 7 and 31 days should not be less than 80% and 100%, respectively. Foreign currency liquidity adequacy ratio

means the ratio of foreign currency assets to foreign currency liabilities and the total liquidity adequacy ratio mean the ratio of total

assets to total liabilities. The highest, lowest and average liquidity adequacy ratios of the Parent Bank for the year ended 2013 with

their prior year comparatives are given below.

Current Period

First Maturity Bracket (Weekly)

Second Maturity Bracket (Monthly)

FC

FC + TL

FC

FC + TL

Average (%)

149.64

142.48

103.54

107.25

Highest (%)

179.14

179.34

126.04

116.66

Lowest (%)

100.23

114.61

86.59

100.52

Prior Period

First Maturity Bracket (Weekly)

Second Maturity Bracket (Monthly)

FC

FC + TL

FC

FC + TL

Average (%)

150.28

150.51

97.72

109.76

Highest (%)

172.36

175.69

113.42

125.15

Lowest (%)

125.96

119.19

88.25

103.75