250

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

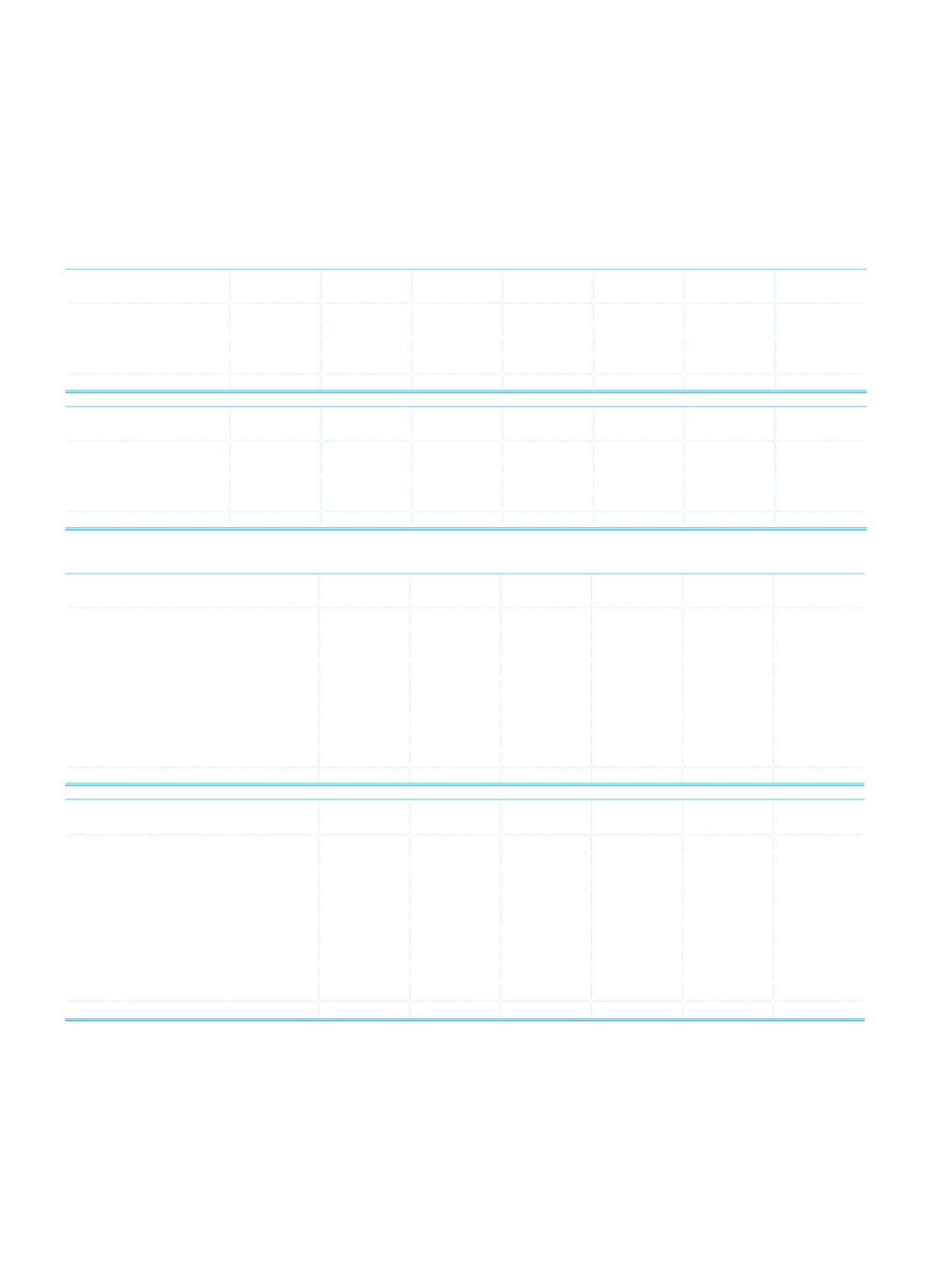

The following table shows the remaining maturities of non-cash loans of the Group.

Current Period

Demand

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Letters of Credit

3,049,754 389,595 772,079 2,344,750 149,655 197,324 6,903,157

Letters of Guarantee

17,598,231

620,831 1,653,869 5,632,291 4,233,410 876,618 30,615,250

Acceptances

26,160 282,825

191,936 964,702

29,323

1,494,946

Other

9,235

62,808 64,494

77,049

50,385 492,728 756,699

Total

20,683,380 1,356,059 2,682,378 9,018,792 4,462,773 1,566,670 39,770,052

Prior Period

Demand

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Letters of Credit

2,043,692 454,640 657,179 1,604,296 144,711

315,968 5,220,486

Letters of Guarantee 13,506,229 664,166 1,349,647 3,997,469 3,025,066 404,884 22,947,461

Acceptances

45,351

168,374 343,971

698,964

41,590

1,298,250

Other

28,863

88,260

39,889

54,413

42,850 376,735

631,010

Total

15,624,135 1,375,440 2,390,686 6,355,142 3,254,217 1,097,587 30,097,207

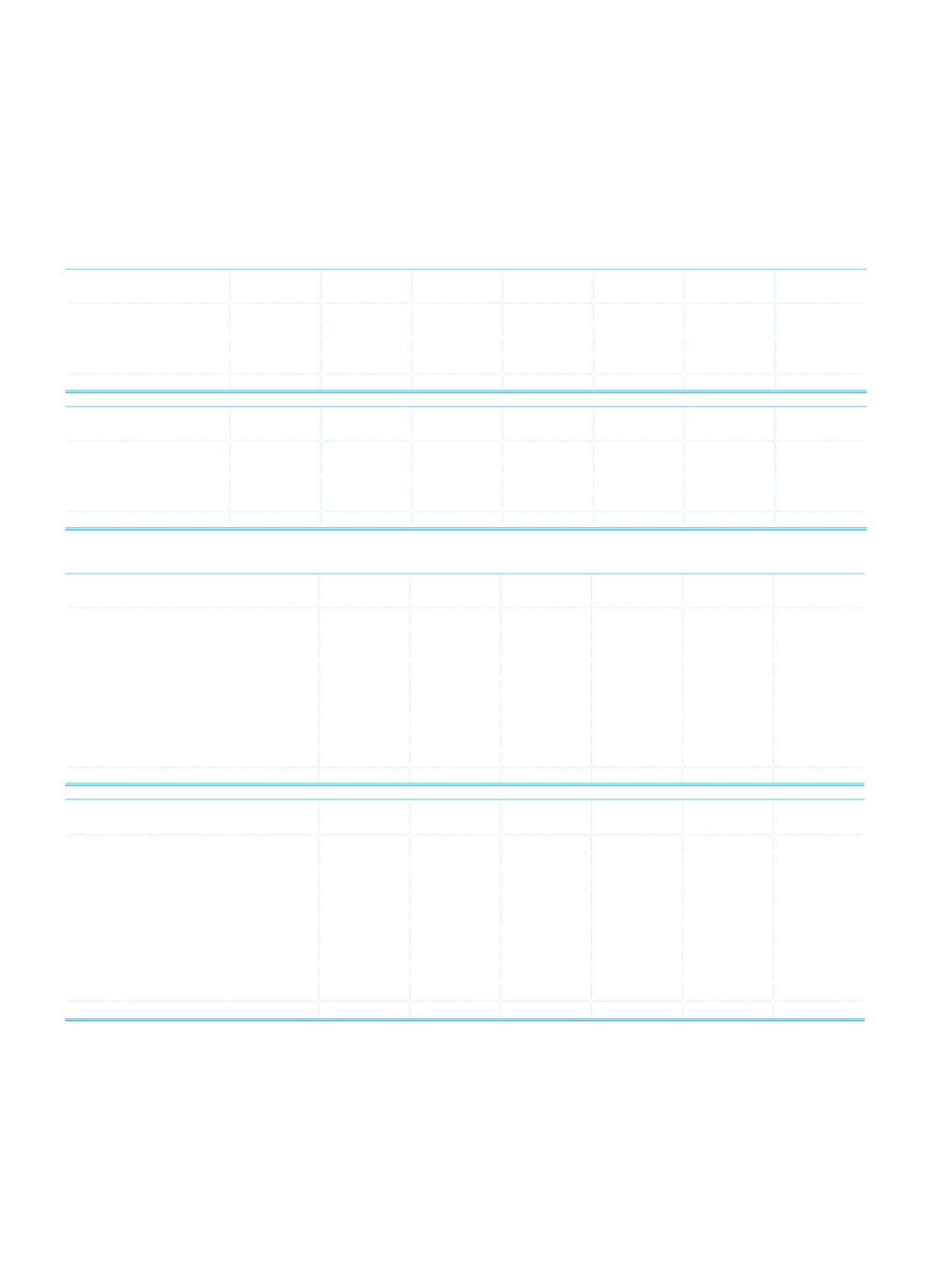

The following table shows the remaining maturities of derivative financial assets and liabilities of the Group.

Current Period

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Forwards Contracts- Buy

3,217,380 1,016,225 1,640,998 130,120

6,004,723

Forwards Contracts- Sell

3,231,421 1,036,552 1,642,433 129,205

6,039,611

Swaps Contracts -Buy

12,142,112 4,603,190 4,102,853 12,016,447 2,576,593 35,441,195

Swaps Contracts -Sell

12,138,490 4,576,290 4,109,040 11,843,280 2,576,570 35,243,670

Futures Transactions-Buy

15,802

15,802

Futures Transactions-Sell

16,276

16,276

Options-Call

1,534,622 1,222,704 3,316,450 471,158 520,828 7,065,762

Options-Put

1,523,863 1,214,926 3,317,007

471,158 520,828 7,047,782

Other

52,397 246,730 145,623

444,750

Total

33,840,285 13,948,695 18,274,404 25,061,368 6,194,819 97,319,571

Prior Period

Up to 1

Month 1-3 Months 3-12 Months 1-5 Years

5 Years and

Over

Total

Forwards Contracts- Buy

4,042,852 1,153,656 1,722,416 167,416

7,086,340

Forwards Contracts- Sell

4,020,500 1,149,326 1,721,263 166,962

7,058,051

Swaps Contracts -Buy

6,255,817 1,486,052 5,680,018 8,301,550 1,919,583 23,643,020

Swaps Contracts -Sell

5,844,119 1,475,271 5,450,278 8,253,098 1,919,537 22,942,303

Futures Transactions-Buy

19,326

19,326

Futures Transactions-Sell

17,800

17,800

Options-Call

1,205,185 597,335 2,173,464 1,089,662 444,032 5,509,678

Options-Put

1,200,462 594,987 2,161,966 1,089,663 444,032 5,491,110

Other

381,103

40,327

40,832

462,262

Total

22,950,038 6,534,080 18,950,237 19,068,351 4,727,184 72,229,890

IX. Explanations on Securitization Positions

None.

X. Explanations on Credit Risk Mitigation Techniques

Activities carried out by the Bank that give rise to credit risk and collaterals are in accordance with the provisions of the relevant

legislation. However, effect of credit risk mitigation techniques is not taken into account in the determination of the capital

adequacy ratio.