245

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

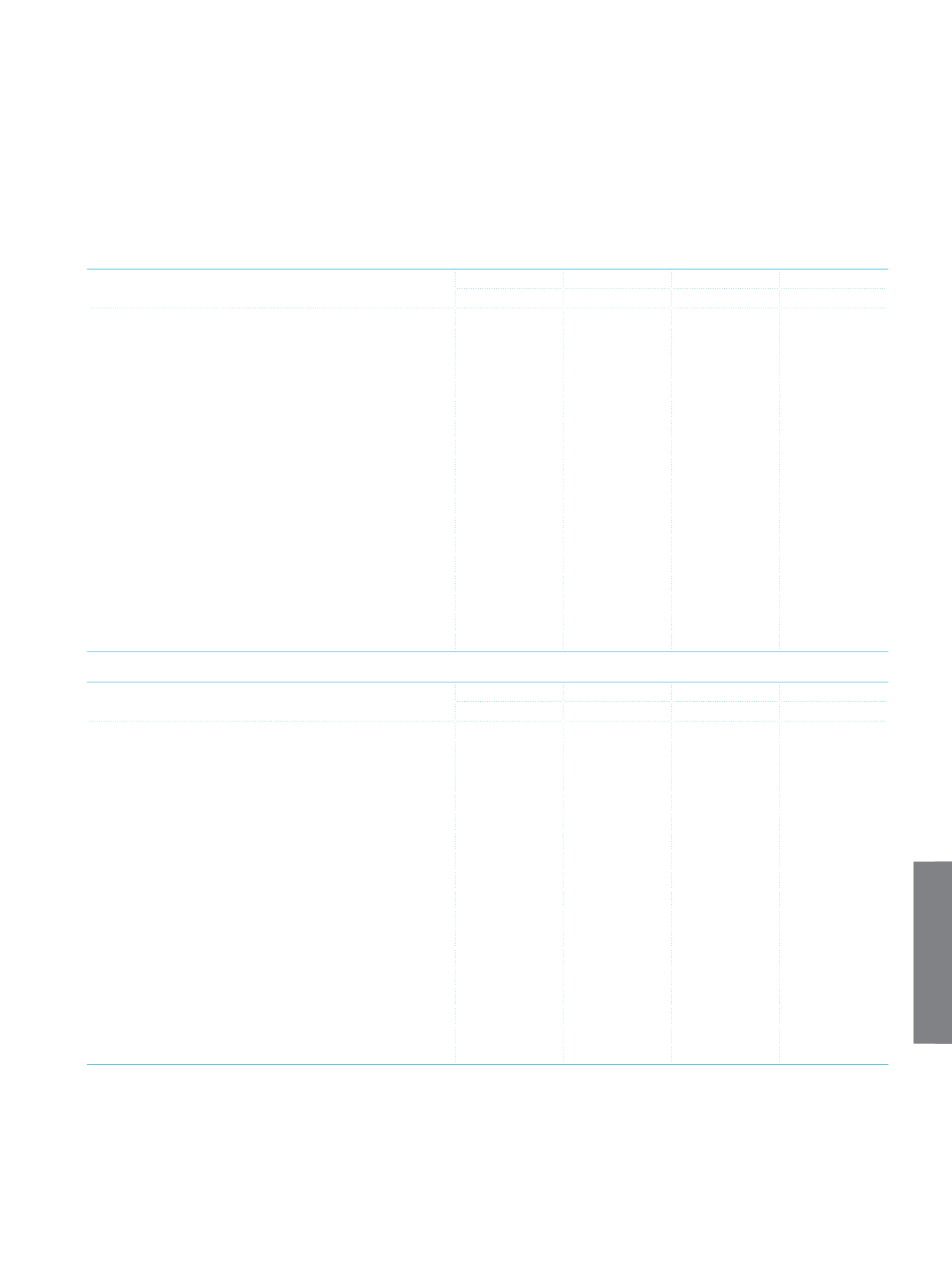

b.

Average interest rates applied to monetary financial instruments:

Current Period

EUR

USD

JPY

TL

%

%

%

%

Assets

Cash (Cash in Vault, Foreign Currency Cash, Money in

Transit, Cheques Purchased) and Balances with the

Central Bank of Turkey

Banks

2.61

2.40

8.67

Financial Assets at Fair Value through Profit/Loss

3.15

6.15

10.92

Money Market Placements

6.83

Financial Assets Available for Sale

4.73

4.51

8.32

Loans

4.63

4.40

3.47

11.64

Held to Maturity Investments

1.29

0.05

11.78

Liabilities

Bank Deposits

1.71

0.94

6.65

Other Deposits

2.02

2.08

0.05

6.38

Money Market Funds

1.53

1.18

7.38

Miscellaneous Payables

(1)

Marketable Securities Issued

5.25

8.46

Funds

0.50

0.50

4.00

Funds Provided from Other Financial Institutions

1.27

1.77

2.49

8.82

(1)

Secondary subordinated issued bonds having credit quality, which are classified on the balance sheet under the subordinated loans, are also included.

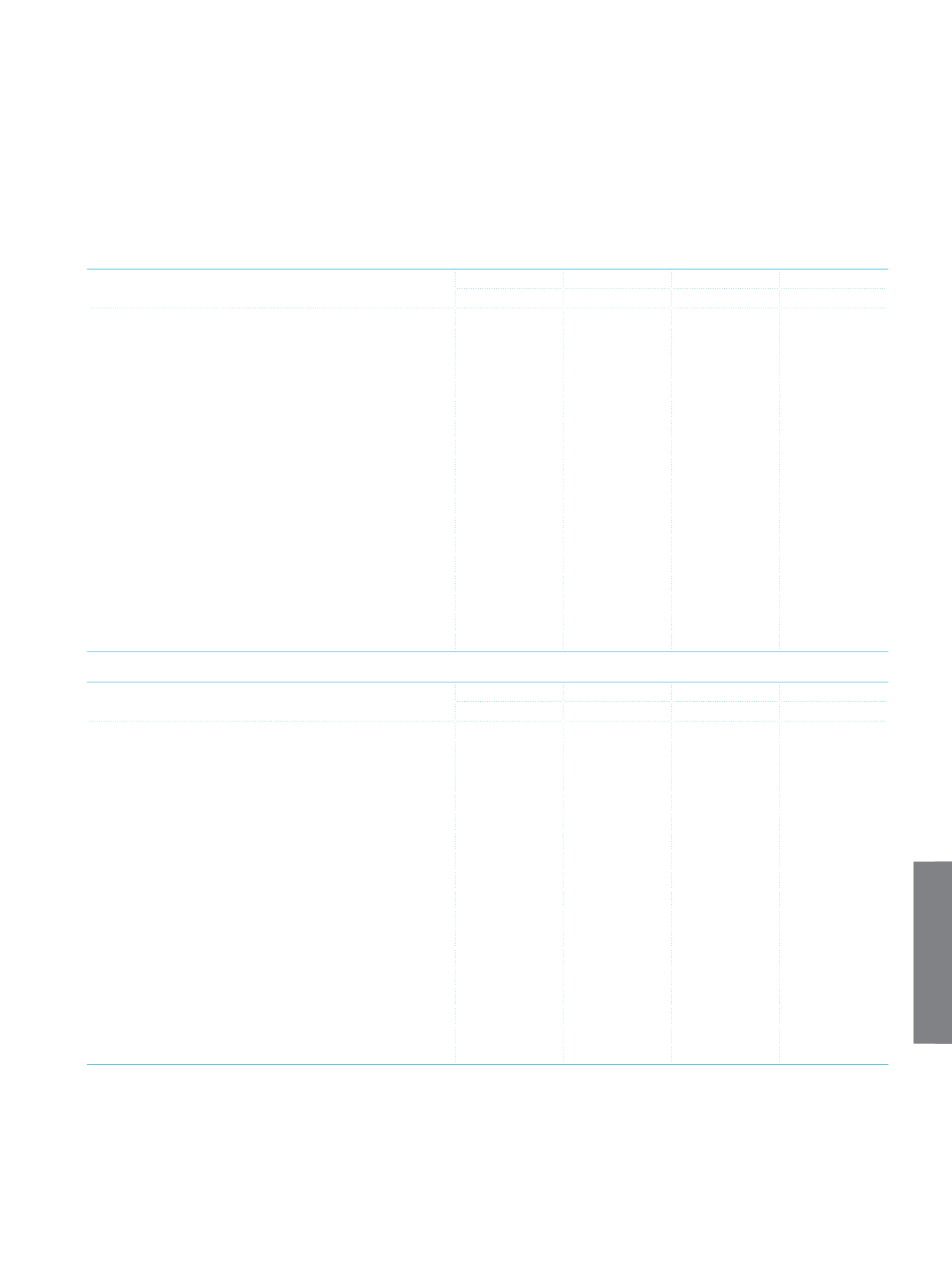

Prior Period

EUR

USD

JPY

TL

%

%

%

%

Assets

Cash (Cash in Vault, Foreign Currency Cash, Money in

Transit, Cheques Purchased) and Balances with the

Central Bank of Turkey

Banks

0.75

1.26

8.36

Financial Assets at Fair Value through Profit/Loss

2.31

5.24

8.04

Money Market Placements

5.90

Financial Assets Available for Sale

4.86

4.79

8.34

Loans

5.33

4.83

3.31

12.91

Held to Maturity Investments

0.75

0.05

12.51

Liabilities

Bank Deposits

1.80

1.99

6.16

Other Deposits

2.22

2.26

0.01

6.40

Money Market Funds

1.96

1.41

5.72

Miscellaneous Payables

Marketable Securities Issued

5.33

8.10

Funds

1.00

1.00

6.50

Funds Provided from Other Financial Institutions

1.48

1.96

7.95