237

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

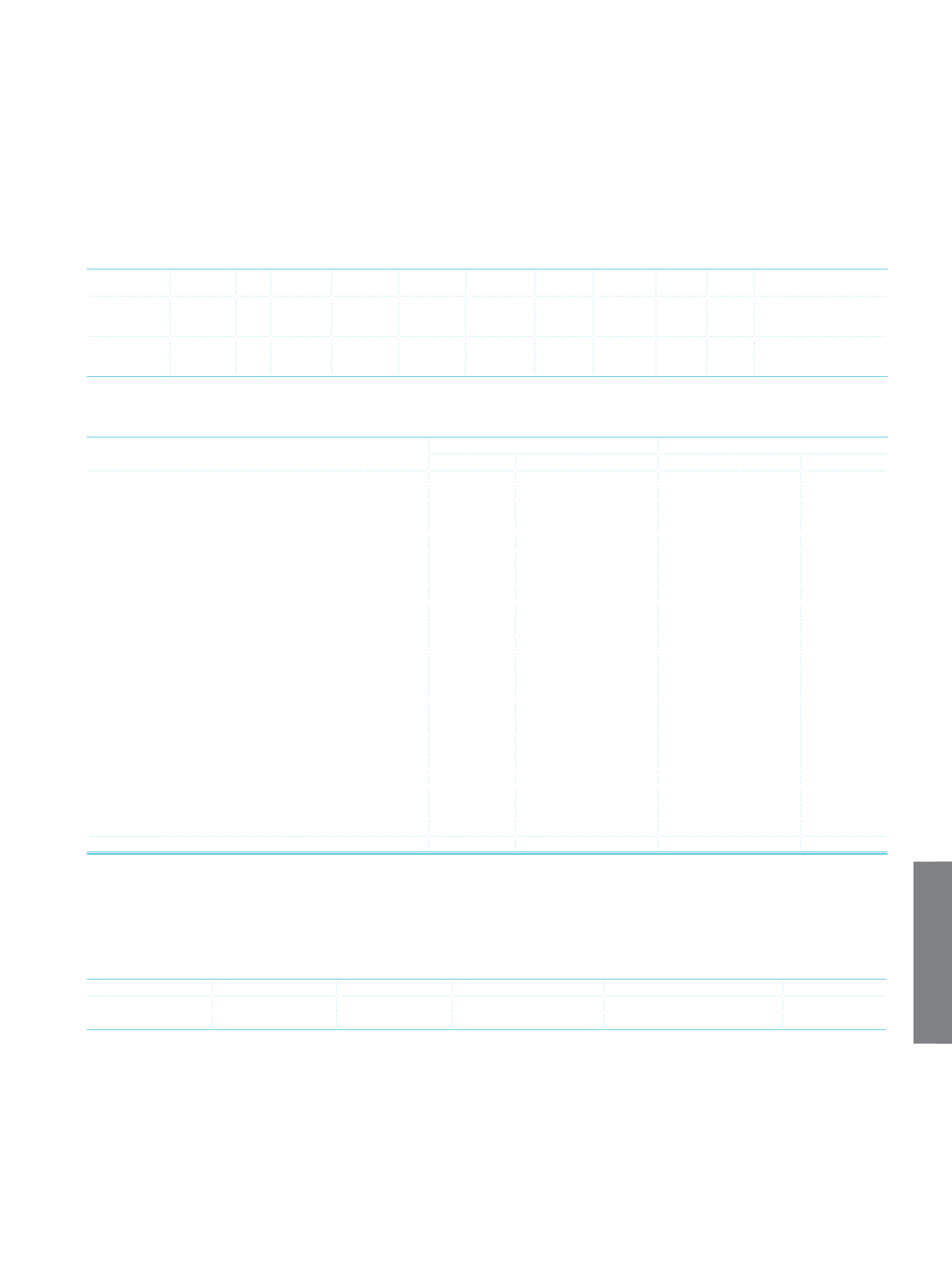

Risk Amounts according to Risk Weights

Risk Weight

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Mitigation in

Shareholders’ Equity

Amount Before

Credit Risk

Mitigation

64,953,047

5,693,144 28,969,485 35,738,580 121,002,253 3,287,725 12,031,124 148,946

596,103

Amount After

Credit Risk

Mitigation

(1)

64,953,047

5,693,144 28,969,485 35,738,580 121,002,253 3,287,725 12,031,124 148,946

596,103

(1)

The effect of credit risk mitigation techniques for the determination of the capital adequacy ratio is excluded.

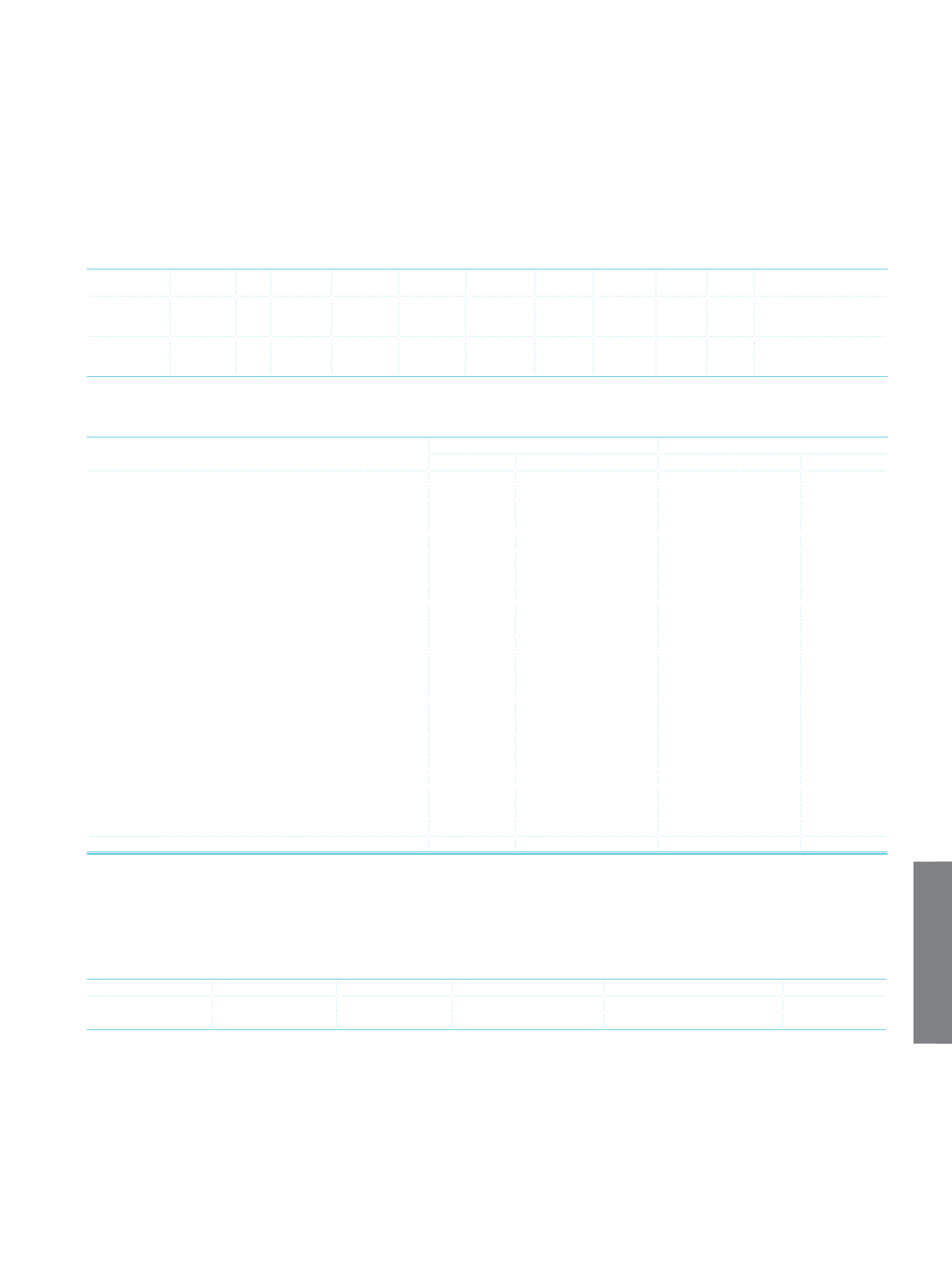

16. Miscellaneous Information According to Type of Counterparty of Major Sectors

Significant Sectors/Counterparty

(1)

Loans

Impaired Non-performing

(2)

Value Adjustments

(3)

Provisions

(4)

Agricultural

66,048

19,475

362

55,481

Farming and Raising Livestock

55,604

15,785

308 46,860

Forestry

7,924

2,895

34

6,521

Fishing

2,520

795

20

2,100

Industry

478,882

79,575

4,852 384,984

Mining

26,755

2,437

78 24,099

Production

431,751

74,691

4,615 341,109

Electricity, gas, and water

20,376

2,447

159

19,776

Construction

377,727

46,231

1,436 335,716

Services

559,415

151,585

7,278 475,606

Wholesale and Retail Trade

316,637

72,122

3,113 304,425

Hotel, Food and Beverage

Services

35,986

8,958

463 24,844

Transportation and

Telecommunication

79,844

24,386

1,858 55,209

Financial Institutions

9,926

339

24

7,219

Real Estate and Renting Services

38,258

34,365

905

28,176

Self-Employment Services

47,083

8,584

523

30,936

Education Services

4,867

1,066

151

4,178

Health and Social Services

26,814

1,765

241

20,619

Other

994,261

796,937

57,790 678,194

Total

2,476,333

1,093,803

71,718 1,929,981

(1)

Amount includes finance lease and factoring receivables.

(2)

Refers to loans overdue up to 90 days. Related items included in the commercial installment loans and installment consumer loans are given only in the overdue

amounts, the payment of these loans outstanding principal amounts of TL 606,313 and TL 1,044,945 respectively.

(3)

Refers to the general provisions for non-performing loans.

(4)

Refers to specific provision for impaired loans.

17. Information on Value Adjustments and Change in Credit Provisions

Beginning Balance

Provisions Reversal of Provisions Other Value Adjustments

(1)

Ending Balance

Specific Provisions

1,654,778

934,178

(665,071)

6,096 1,929,981

General Provisions

1,705,153

433,531

(39,920)

1,838 2,100,602

(1)

Stating foreign exchange gains and losses.

III. Explanations on Consolidated Market Risk:

1. Explanations on Consolidated Market Risk:

The market risk carried by the Group is measured by two separate methods known respectively as the Standard Method and the

Value at Risk (VAR) Method in accordance with the local regulations adopted from internationally accepted practices. In this context,

currency risk emerges as the most important component of the market risk. The consolidated market risk measurements are carried

out on a quarterly basis, using the Standard Method. The results are accounted in the legal reporting and evaluated with the top

management.