227

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

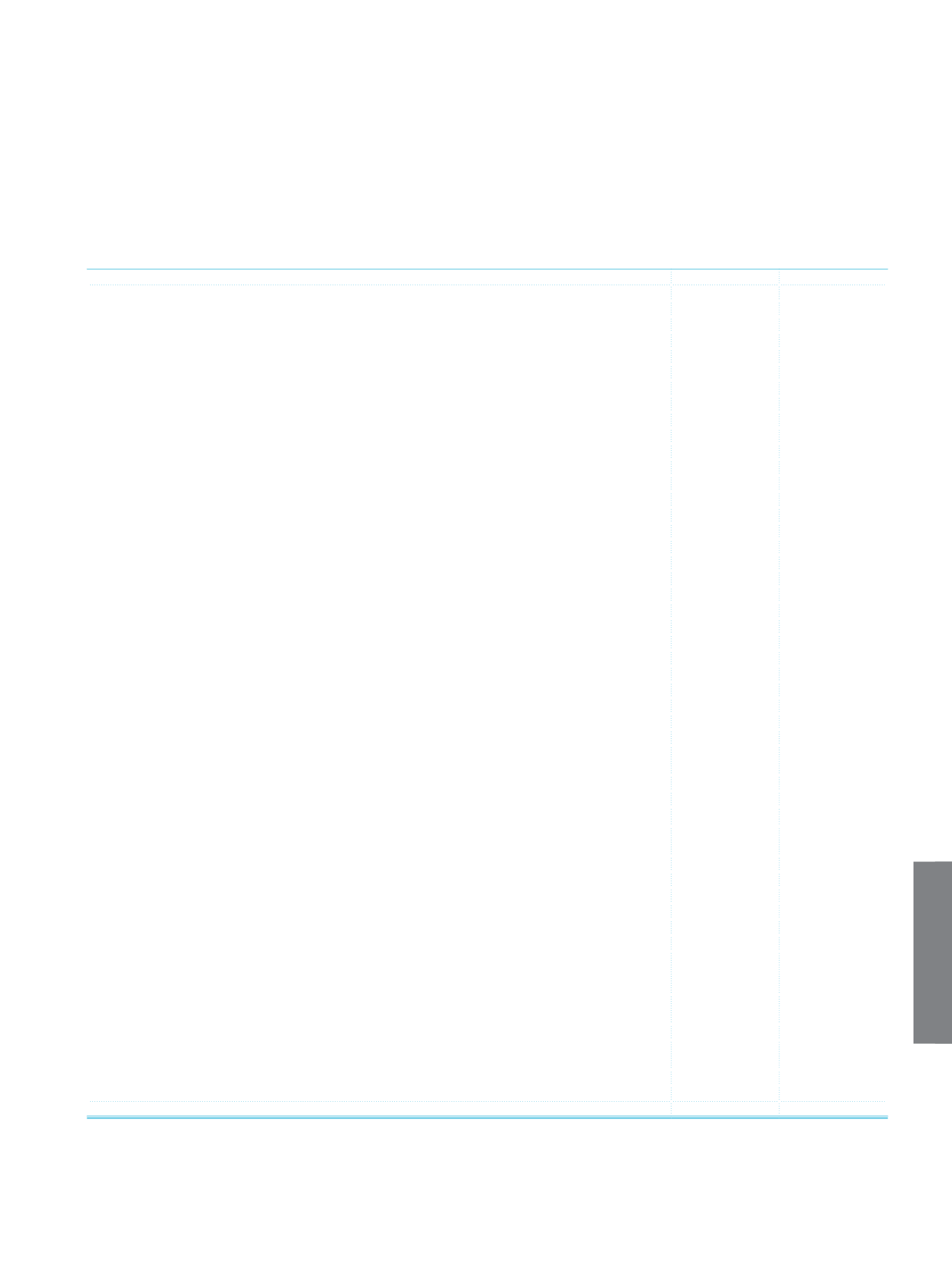

Information about the consolidated components of equity

Current Period

Prior Period

CORE CAPITAL (TIER I)

Paid-In Capital

4,500,000

4,500,000

Nominal Capital

4,500,000

4,500,000

Capital Commitments (-)

Paid-in Capital Inflation Adjustments

1,615,938

1,615,938

Share Premium

33,940

33,940

Share Cancellation Profits

Reserves

13,023,832

10,113,697

Inflation Adjustments to Reserves

Profit

2,621,162

2,802,512

Current Period Profit

3,235,921

3,412,022

Prior Periods’ Profit

(614,759)

(609,510)

Provision for Possible Losses (up to 25% of the Core Capital)

1,000,000

1,000,000

Gain on Sale of Associates, Subsidiaries and Real Estates

287,086

288,977

Primary Subordinated Debt

Non-controlling Interest

2,947,778

2,675,494

Losses Excess of Reserves (-)

Current Period Loss

Prior Periods’ Loss

Leasehold Improvements (-)

128,762

125,518

Intangible Assets (-)

257,043

153,653

Deferred Tax Asset excess of 10% of the Core Capital (-)

Limit Excesses as per Paragraph 3 of the Article 56 of the Banking Law (-)

Consolidated Surplus (Net) (-)

35,974

35,974

Total Core Capital

25,607,957

22,715,413

SUPPLEMENTARY CAPITAL (TIER II)

General Loan Loss Provision

2,100,602

1,705,153

45% of Movables’ Revaluation Reserve

45% of Immovables’ Revaluation Reserve

Bonus Shares of Associates, Subsidiaries and Jointly-Controlled Entities (Joint Ventures) and unrecognized shares

in current period

(1,179)

(1,179)

Primary Subordinated Debts Excluding the Portion included in the Core Capital

Secondary Subordinated Debts

2,999,900

1,838,040

45% of Marketable Securities and Investment Securities Value Increase Fund

(1)

(47,440)

1,175,874

Capital Reserves, Profit Reserves and Prior Periods’ Profit/Loss Inflation Adjustments (excluding the inflation

adjustments to reserves)

Non-controlling Interest

81,844

97,994

Total Supplementary Capital

5,133,727

4,815,882

TIER III CAPITAL

CAPITAL

30,741,684

27,531,295

DEDUCTIONS FROM THE CAPITAL

174,324

205,724

Investments in Unconsolidated Banks and Financial Institutions

Loans to banks, financial institutions (domestic/foreign) or qualified shareholders in the form of secondary

subordinated loan and debt instruments purchased from such parties qualified as primary or secondary

subordinated loan

Investments in Banks and Financial Institutions, to which Equity Method has been applied but whose Assets and

Liabilities are Unconsolidated

96,644

86,722

Loan Granted to Customer Against the Articles 50 and 51 of the Banking Law

2,586

1,448

Net book values of immovables exceeding 50% of the capital and of assets acquired against Overdue receivables

and Held for Sale as per the Article 57 Of the Banking Law but retained More Than Five Years

54,552

75,643

Securitization Positions Deducted from Equity

Others

(2)

20,542

41,911

TOTAL SHAREHOLDERS’ EQUITY

30,567,360

27,325,571

(1)

According to the related regulation, if the items subject to the Marketable Securities Value Increase Fund have a negative balance; total amount, and if positive 45% of

the balance is taken into consideration in supplementary capital calculation.

(2)

It includes the deductions from the capital in accordance with the decision of the Banking Regulation and Supervision Agency dated 16 December 2010 and numbered

3980, published on the Official Gazette dated 18 December 2010 and numbered 27789.