226

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

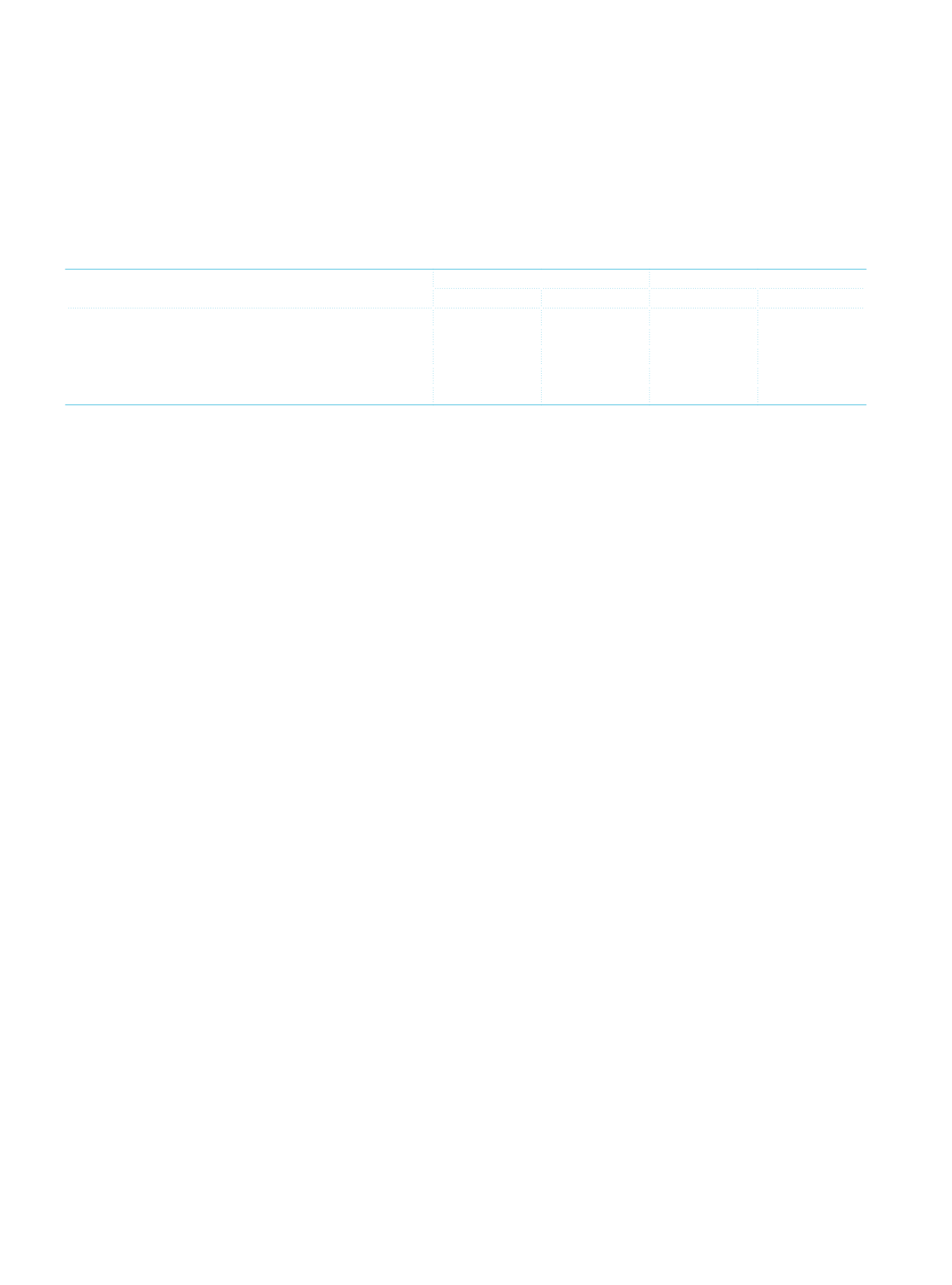

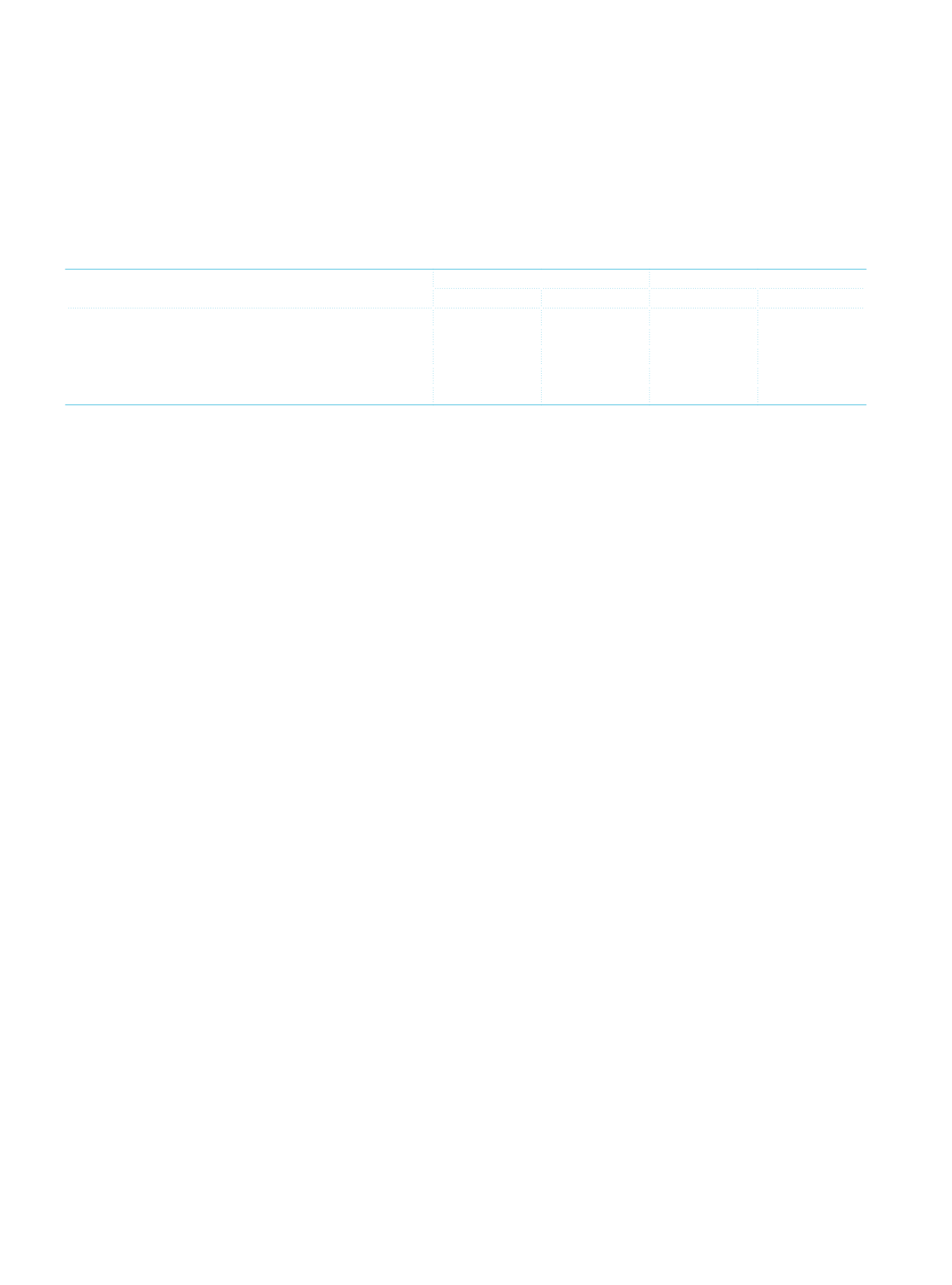

Summary information about the Parent bank’s capital adequacy ratio and consolidated capital adequacy ratio:

Bank-Only

Consolidated

Current Period Prior Period Current Period Prior Period

Capital Requirement for Credit Risk (VaCR*0.08) (CRCR)

14,023,032 10,945,847 15,423,661

11,953,017

Capital Requirement for Market Risk (CRMR)

410,935

281,182

538,117

449,795

Capital Requirement for Operational Risk (CROR)

971,452

894,118 1,090,380

1,021,396

Equity

27,689,806 24,739,690 30,567,360 27,325,571

Equity/((CRCR+CRMR+CROR)*12.5*100)

14.38

16.33

14.34

16.28