232

İş Bankası

Annual Report 2013

Financial Information and Risk Management

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

10.

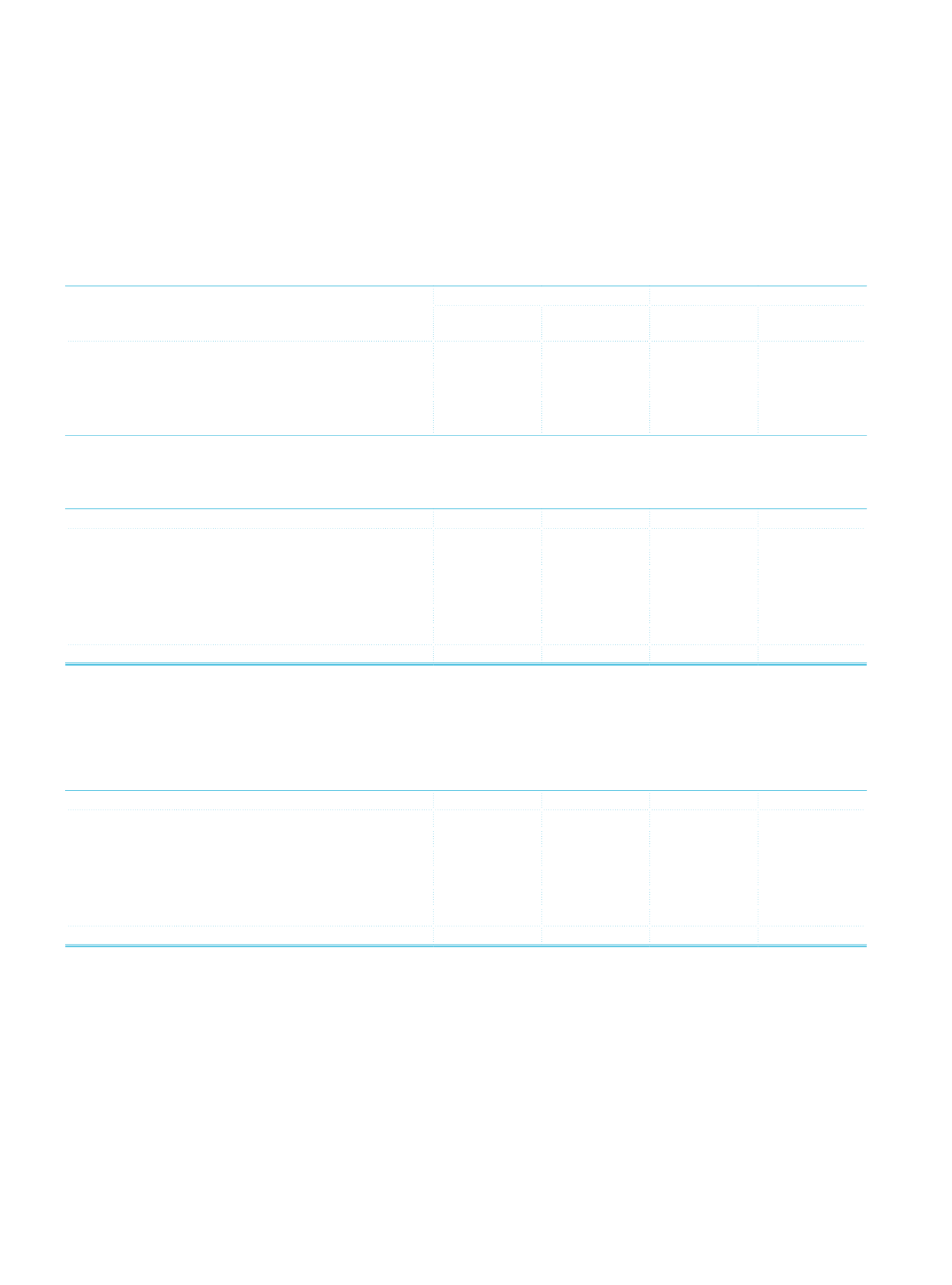

The net values of the collaterals of the Group’s non-performing loans are given below in terms of collateral types and risk

matches.

Current Period

Prior Period

Type of Collateral

Net Value of

the Collateral

Loan Balance

Net Value of

the Collateral

Loan Balance

Real Estate Mortgage

(1)

450,738

450,738

444,835

444,835

Cash Collateral

2,235

2,235

36

36

Vehicle Pledge

86,766

86,766

61,440

61,440

Other (suretyships, commercial enterprise under pledge,

commercial papers, etc.)

72,600

72,600

47,708

47,708

(1)

The mortgage and/or pledge amounts on which third parties have priorities are deducted from the fair values of collaterals in expertise reports, and after comparing the

results to the mortgage/pledge amounts and loan balances the smallest figures are considered to be the net value of collaterals.

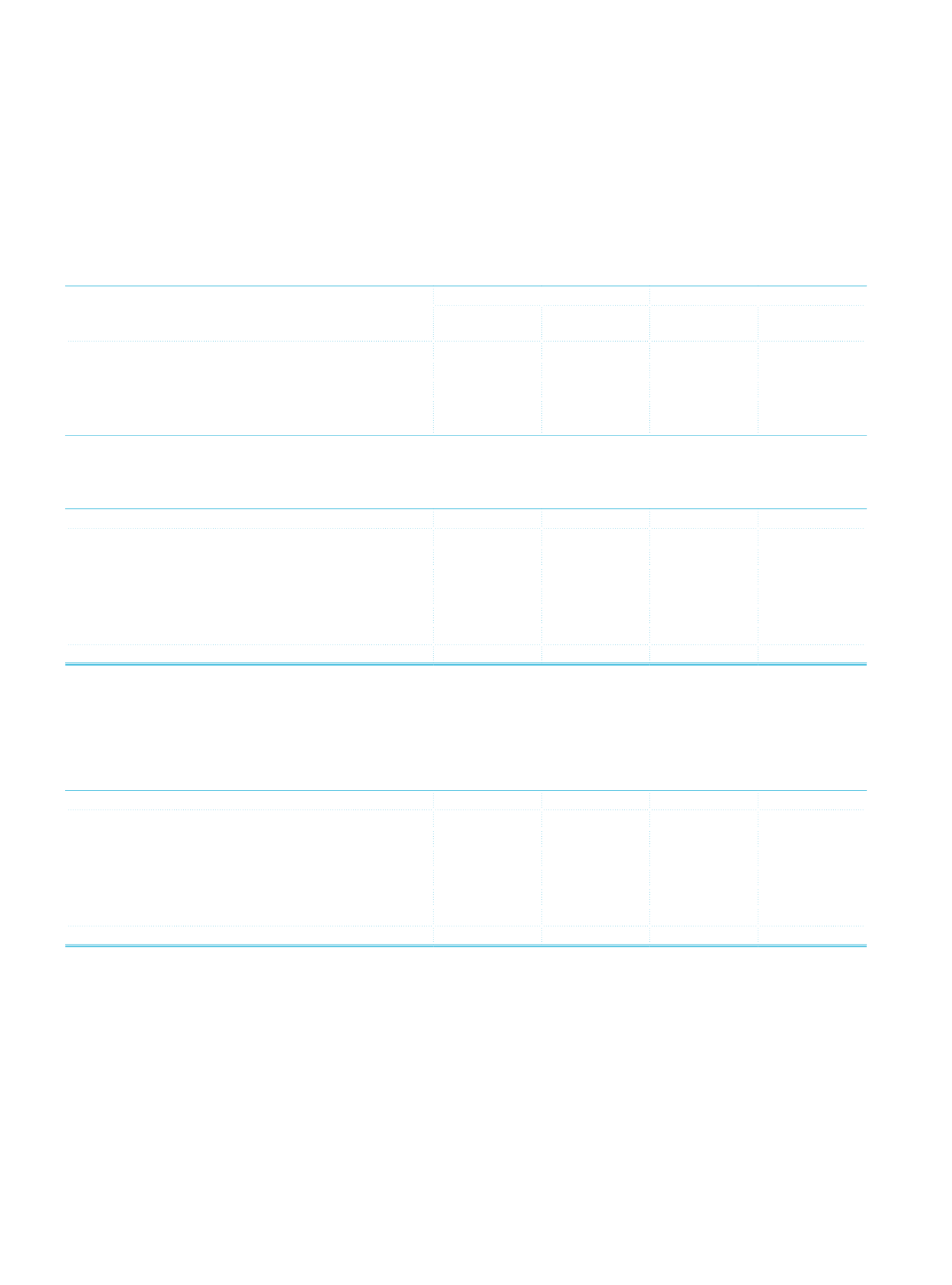

11.

The aging analysis of the loans past due but not impaired in terms of financial asset classes, is as follows:

Current Period

(1)

1-30 Days

(2)

31-60 Days

(3)

61-90 Days

(3)

Total

Loans

783,000

200,897

96,139

1,080,036

Corporate/Commercial Loans

(4)

200,996

46,847

24,338

272,181

Consumer Loans

82,906

35,748

17,839

136,493

Credit Cards

499,098

118,302

53,962

671,362

Lease Receivables

(5)

8,916

3,345

1,506

13,767

Insurance Receivables

77,880

12,545

4,096

94,521

Total

869,796

216,787

101,741

1,188,324

(1)

The balance of loans, which are not past due or which are classified under closely monitored although being past due for less than 31 days, stands at TL 1,429,843.

(2)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are

not due as of the balance sheet date are equal to TL 393,028 and TL 705,078 respectively.

(3)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are

not due as of the balance sheet date are equal to TL 213,285 and TL 299,867 respectively.

(4)

The balance includes factoring receivables

(5)

Includes only overdue installments, the principal amount which is not due as of the balance sheet date is TL 176,616.

Prior Period

(1)

1-30 Days

(2)

31-60 Days

(3)

61-90 Days

(3)

Total

Loans

866,521

178,713

87,553

1,132,787

Corporate/Commercial Loans

(4)

361,218

29,669

23,771

414,658

Consumer Loans

83,474

33,801

15,509

132,784

Credit Cards

421,829

115,243

48,273

585,345

Lease Receivables

(5)

11,291

3,087

2,251

16,629

Insurance Receivables

78,027

13,001

5,815

96,843

Total

955,839

194,801

95,619 1,246,259

(1)

The balance of loans, which are not past due or which are classified under closely monitored although being past due for less than 31 days, stands at TL 1,201,982.

(2)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are

not due as of the balance sheet date are equal to TL 406,160 and TL 586,342 respectively.

(3)

Related figures show only overdue amounts of installment based commercial loans and installment based consumer loans; the principal amounts of the loans which are

not due as of the balance sheet date are equal to TL 218,097 and TL 258,242 respectively.

(4)

The balance includes factoring receivables

(5)

Includes only overdue installments, the principal amount which is not due as of the balance sheet date is TL 165,972.