249

Financial Information and Risk

Management

İş Bankası

Annual Report 2013

TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements

for the Year Ended 31 December 2013

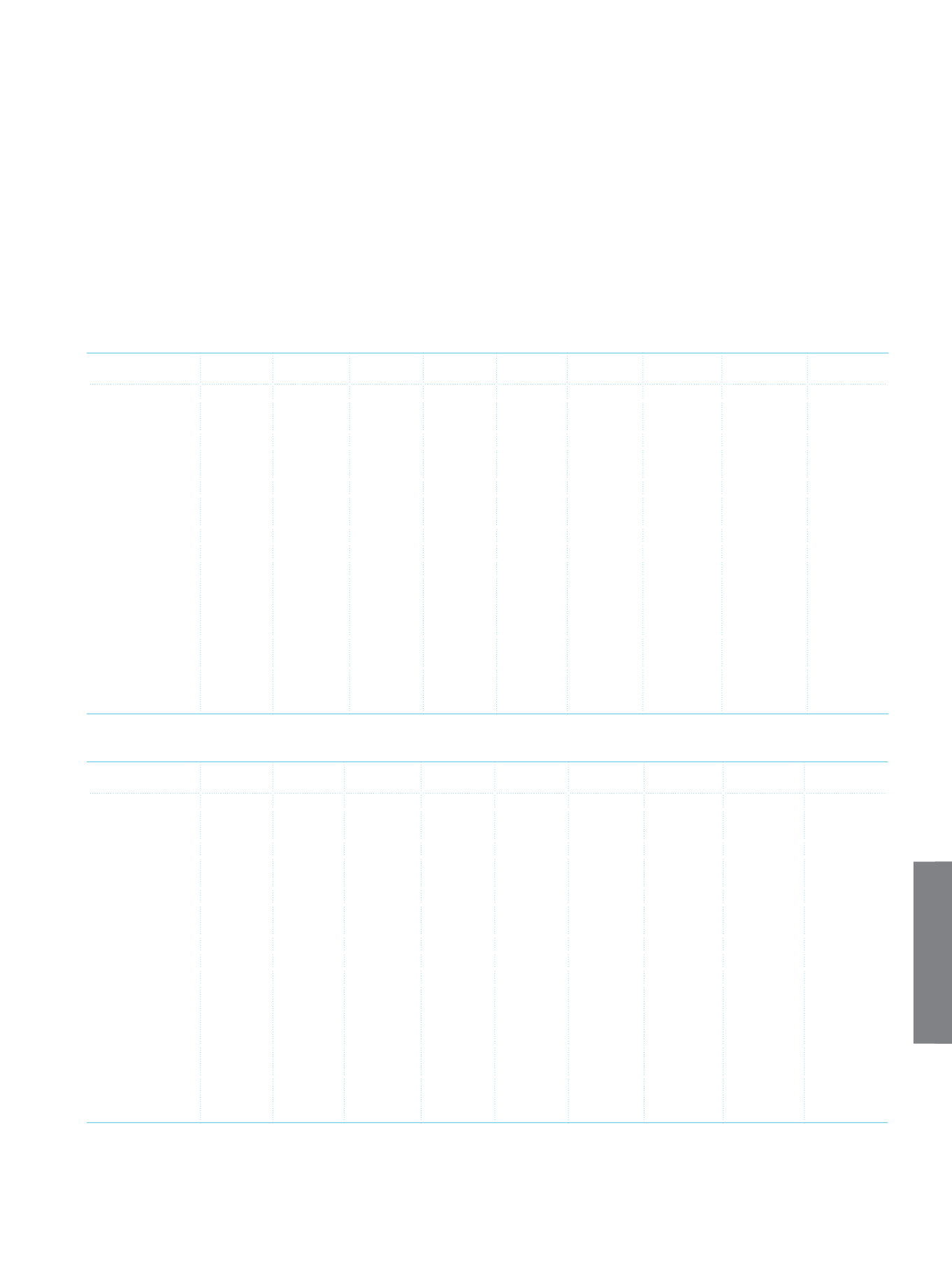

In compliance with the TFRS 7 “Financial Instruments: Disclosures”, the following table indicates the maturities of the Group’s major

financial assets and liabilities which are not qualified as derivatives. The following tables have been prepared by referencing the

earliest dates of collections and payments without discounting the assets and liabilities. The interest to be collected from and paid

to the related assets and liabilities is included in the following table. Adjustments column shows the items that may cause possible

cash flows in the following periods. The values of the related assets and liabilities registered in balance sheet do not include these

amounts.

Current Period

Demand

Up to 1

Month

1-3

Months

3-12

Months 1-5 Years

5 Years and

Over

Total Adjustments

Balance

Sheet Value

Assets

Financial Assets

Held for Trading

220,273

17,535 73,636 312,502 896,481 586,110 2,106,537

459,346 1,647,191

Banks

984,061 3,547,565 361,667 314,857

1,027

5,209,177

23,166 5,186,011

Financial Assets

Available for Sale 316,606 957,975 1,352,218 5,923,638 17,732,945 22,156,782 48,440,164 14,164,761 34,275,403

Loans

(1)

6,946,486 14,078,414 12,597,889 45,593,375 70,328,130 16,679,462 166,223,756 20,087,726 146,136,030

Investments Held

to Maturity

3,327 841,371 6,153,786 1,334,129

6,507 8,339,120

610,673 7,728,447

Liabilities

Deposits

26,161,926 66,607,230 20,358,257 8,618,391 587,059 23,266 122,356,129

518,331 121,837,798

Funds Provided

from Other

Financial

Institutions

1,579,427 1,628,539 10,694,975 8,984,762 5,851,899 28,739,602 1,409,147 27,330,455

Money Market

Funds

23,629,319 101,075 299,797 623,117 446,744 25,100,082 (100,207) 24,999,875

Marketable

Securities Issued

(Net)

(2)

1,028,289 1,383,400 3,080,272 5,503,231 4,881,459 15,876,651 2,815,664 13,060,987

(1)

The balances include factoring receivables. Non-performing loans are not included.

(2)

Secondary subordinated issued bonds having credit quality, which are classified on the balance sheet under the subordinated loans are also included.

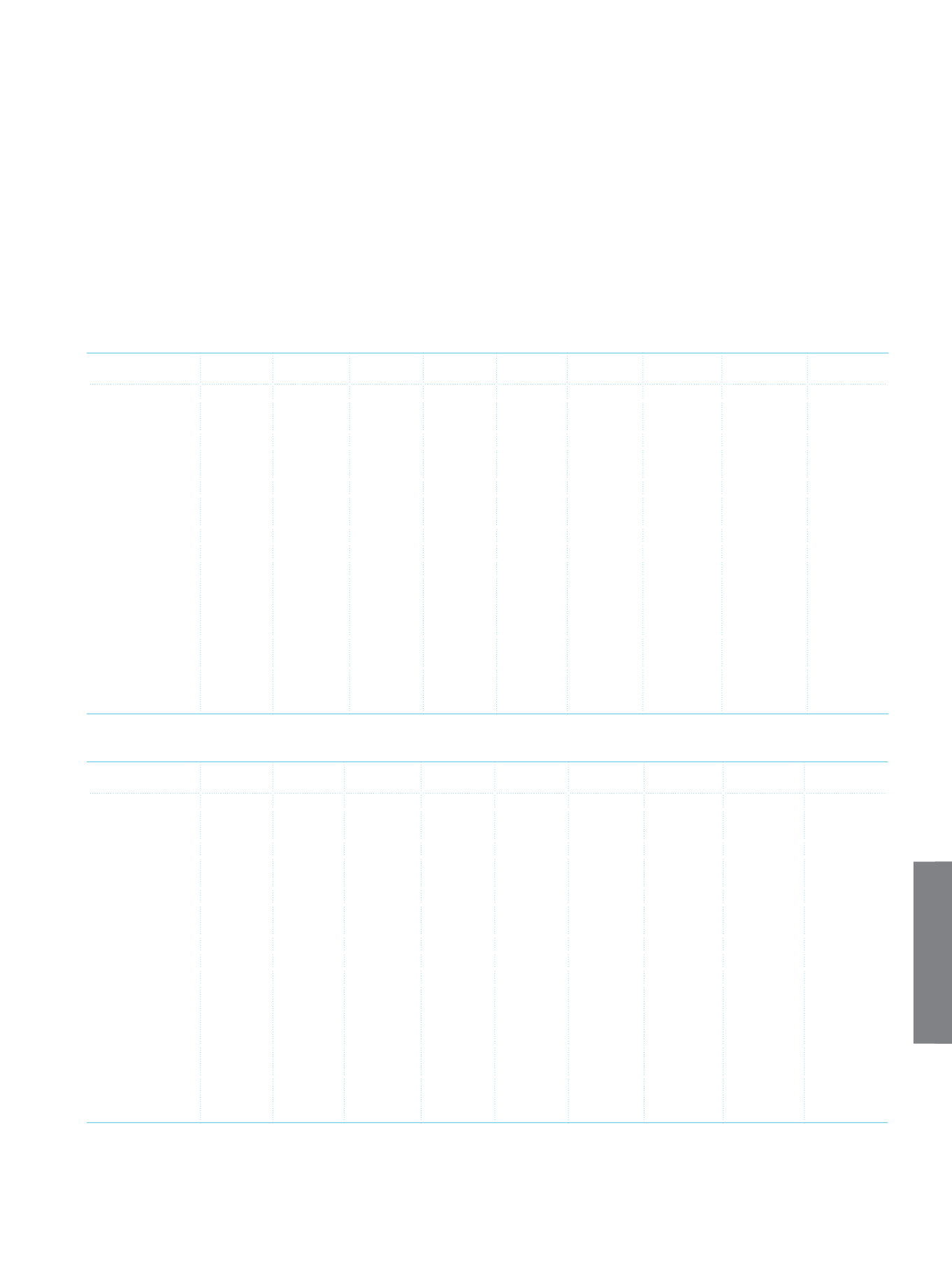

Prior Period

Demand

Up to 1

Month

1-3

Months

3-12

Months 1-5 Years

5 Years and

Over

Total Adjustments

Balance

Sheet Value

Assets

Financial Assets

Held for Trading

341,789 17,943 146,505 473,946 599,396 285,509 1,865,088 304,970 1,560,118

Banks

932,706 2,867,150 694,645 83,603

4,578,104

26,211 4,551,893

Financial Assets

Available for Sale 256,734 1,720,751

754,763 5,806,943 16,866,584 14,000,825 39,406,600 7,232,775 32,173,825

Loans

(1)

12,371,747 14,563,509 9,413,666 30,150,364 52,276,053 12,118,768 130,894,107 15,160,388 115,733,719

Investments Held

to Maturity

515,270 292,581 3,750,520 8,193,582

6,755 12,758,708 1,709,929 11,048,779

Liabilities

Deposits

21,346,638 56,998,136 20,769,477 6,744,323 651,164 35,322 106,545,060 534,200 106,010,860

Funds Provided

from Other

Financial

Institutions

1,221,152 743,744 7,868,901 5,920,205 4,616,780 20,370,782 1,208,870 19,161,912

Money Market

Funds

15,515,373 291,971 395,322 544,922 411,281 17,158,869 128,038 17,030,831

Marketable

Securities Issued

(Net)

(2)

979,535 1,672,266 2,201,888 2,585,699 2,320,500 9,759,888 1,479,074 8,280,814

(1)

The balances include factoring receivables. Non-performing loans are not included.

(2)

Secondary subordinated issued bonds having credit quality, which are classified on the balance sheet under the subordinated loans are also included.