TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements for the Year Ended

31 December 2014

186

İŞBANK

ANNUAL REPORT 2014

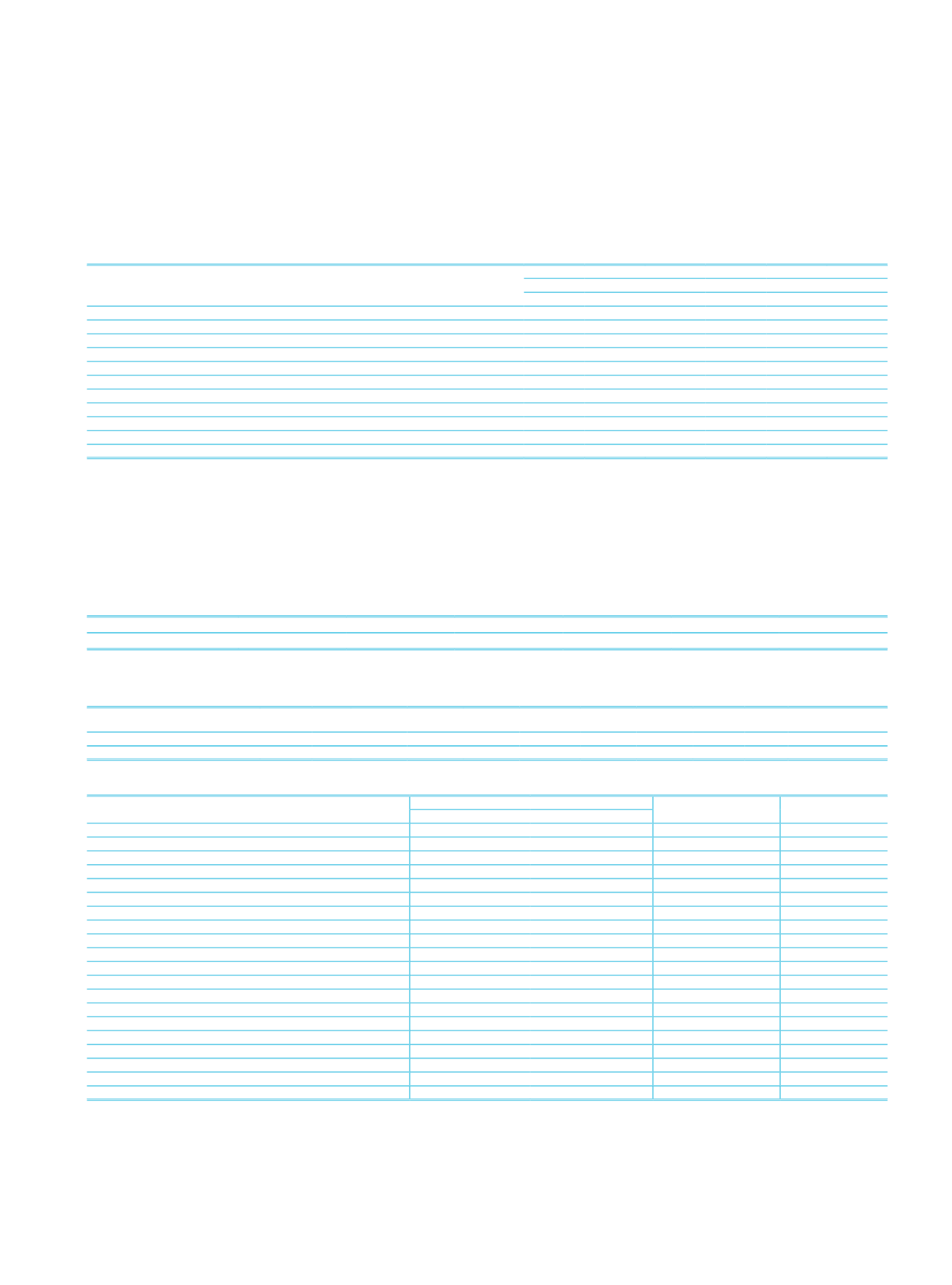

14. Analysis of Maturity-Bearing Exposures According to Remaining Maturities:

CurrentPeriod

RemainingMaturities

1Month 1-3Months 3-6Months 6-12Months Over1Year

Total

RiskGroups

ContingentandNon-ContingentReceivablesfromCentralGovernmentsorCentralBanks

672,137 830,914 1,505,234 1,471,597 41,078,306 45,558,188

ContingentandNon-ContingentReceivablesfromRegionalGovernmentsorDomesticGovernments

800

1,851

1,502

1,851

32,237

38,241

ContingentandNon-ContingentReceivablesfromAdministrativeUnitsandNon-CommercialEnterprises

18,927

5,752

9,143

57,372

77,039 168,233

Themultilateraldevelopmentbanksandnon-contingentreceivables

266

694

174

526

1,660

ContingentandNon-ContingentReceivablesfromBanksand Intermediaries

7,598,610 1,803,982 1,078,426 745,423 4,113,361 15,339,802

ContingentandNon-ContingentCorporateReceivables

9,622,250 9,454,033 10,609,073 20,917,051 72,536,409 123,138,816

ContingentandNon-ContingentRetailReceivables

7,994,974 5,601,182 6,023,665 9,359,912 9,620,891 38,600,624

ContingentandNon-ContingentCollateralizedReceivableswithRealEstateMortgages

245,249 421,449 604,964 1,184,214 10,582,337 13,038,213

Receivablesare identifiedasHighRiskbytheBoard

646,039 1,061,824 1,564,111 3,746,436 10,798,982 17,817,392

Total

26,798,986 19,181,253 21,396,812 37,484,030 148,840,088 253,701,169

15. Information on Risk Classes:

In the calculation of the amount subject to credit risk, determining the risk weights related to risk classes stated on the sixth article of “Regulation on Measurement and Evaluation of

Capital Adequacy of Banks”, is based on the Fitch Ratings’ international rating. While receivables from resident banks in abroad which is assessed in the risk class of “Contingent and

Non-Contingent Receivables from Banks and Brokerage Agencies” and receivables from central governments which is assessed in the risk class of “Contingent and Non-Contingent

Receivables from Central Governments or Central Banks” will be subjected to risk weights with the scope of ratings; therefore domestic resident banks accepted as unrated, the risk

weight is applied according to receivables from relevant banks , type of exchange and remaining maturity.

If a receivable-specific rating is performed, risk weights to be applied on the receivable are determined by the relevant credit rating.

The table related to mapping the ratings used in the calculations and credit quality grades, which is stated in the Annex of Regulation on Measurement and Evaluation of Capital

Adequacy of Banks, is given below:

Credit Quality Grades

1

2

3

4

5

6

Risk Rating

AAA via AA-

A+ via A-

BBB+ via BBB-

BB+ via BB-

B+ via B-

CCC+ and lower

There is no credit rating and credit export agency has been assigned for the items that are not included to trading accounts.

Risk Amounts according to Risk Weights

RiskWeight

0% 10% 20% 50% 75% 100% 150% 200% 250% 1250%

Mitigation in

Shareholders’Equity

Amount Before Credit Risk Mitigation 72,774,624

7,970,602 31,814,843 42,350,580 137,615,818 4,398,980 13,312,903 855,398

571,133

Amount After Credit Risk Mitigation

74,927,114

7,964,972 31,795,046 41,974,414 135,885,911 4,393,928 13,296,965 855,398

571,133

16. Miscellaneous Information According to Type of Counterparty of Major Sectors

Significant Sectors/Counterparty

(1)

Loans

Value Adjustments

(3)

Provisions

(4)

Impaired

Non-performing

(2)

Agricultural

47,702

19,960

450

38,867

Farming and Raising Livestock

40,555

18,507

404

32,721

Forestry

5,304

1,295

31

4,596

Fishing

1,843

158

15

1,550

Industry

525,371

143,574

28,129

409,975

Mining

65,699

4,673

112

62,460

Production

456,185

90,700

5,609

345,067

Electricity, gas, and water

3,487

48,201

22,408

2,448

Construction

381,523

90,141

7,060

334,061

Services

737,381

188,779

9,552

577,560

Wholesale and Retail Trade

467,208

106,943

4,797

382,674

Hotel, Food and Beverage Services

29,830

11,155

617

25,178

Transportation and Telecommunication

72,159

30,640

2,379

51,520

Financial Institutions

11,345

1,016

23

10,314

Real Estate and Renting Services

88,774

14,065

816

61,817

Self-Employment Services

49,140

14,016

475

32,905

Education Services

4,671

7,799

195

2,923

Health and Social Services

14,254

3,145

250

10,229

Other

1,167,263

783,949

91,760

748,732

Total

2,859,240

1,226,403

136,951

2,109,195

(1)

Amount includes finance lease and factoring receivables.

(2)

Refers to loans overdue up to 90 days and financial leasing receivables overdue up to 150 days. Related items included in the commercial installment loans and installment consumer loans are given only in the

overdue amounts, the payment of these loans outstanding principal amounts of TL 739,040 and TL 1,393,240 respectively.

(3)

Refers to the general provisions for non-performing loans.

(4)

Refers to specific provision for impaired loans.