TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements for the Year Ended

31 December 2014

201

İŞBANK

ANNUAL REPORT 2014

FINANCIAL INFORMATION AND

RISK MANAGEMENT

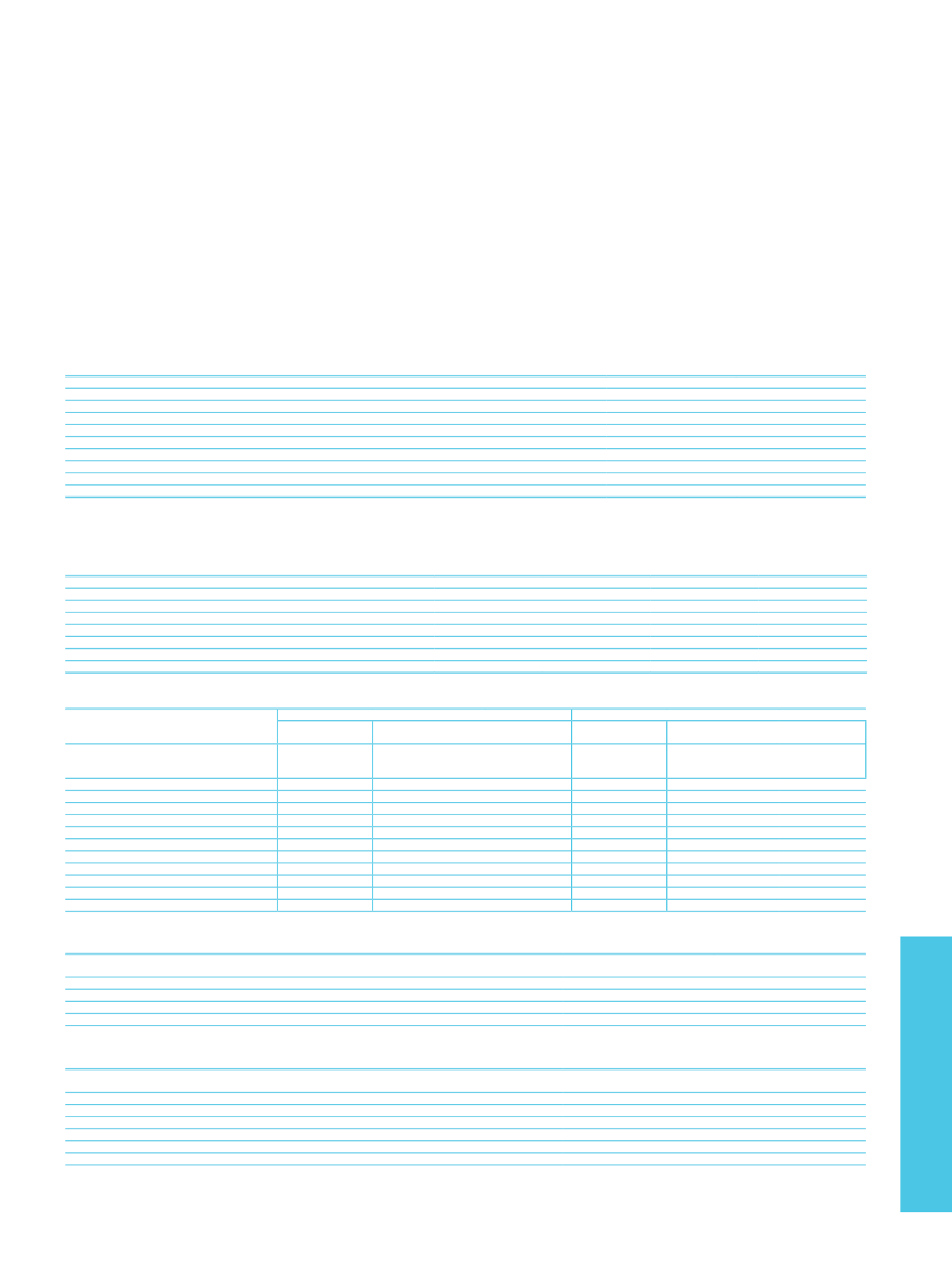

d. Information on Financial Assets Available for Sale:

d.1. Information on financial assets available for sale, which are given as collateral or blocked:

Financial assets available for sale, which are given as collateral or blocked amount to TL 10,083,896 as of 31 December 2014 (31 December 2013: TL 5,576,279).

d.2. Information on financial assets available for sale, which are subject to repurchase agreements:

Financial assets available for sale which are subject to repurchase agreements amount to TL 20,785,043 as of 31 December 2014 (31 December 2013: TL 18,383,911).

d.3. Information on financial assets available for sale:

Current Period

Prior Period

Debt Securities

45,237,578

34,622,480

Quoted on a Stock Exchange

37,708,258

24,819,843

Not-Quoted

(1)

7,529,320

9,802,637

Share Certificates

110,846

111,856

Quoted on a Stock Exchange

38,687

23,119

Not-Quoted

72,159

88,737

Value Increases / Impairment Losses (-)

115,565

678,757

Other

444,270

219,824

Total

45,677,129

34,275,403

(1)

Refers to the debt securities, which are not quoted on the Stock Exchange or which are not traded, although quoted, on the Stock Exchange at the end of the related period.

e. Information related to loans:

e.1. Information on all types of loans and advances given to shareholders and employees of the group:

Current Period

Prior Period

Cash

Non-Cash

Cash

Non-Cash

Direct Lending to Shareholders

Corporate Shareholders

Individual Shareholders

Indirect Lending to Shareholders

Loans to Employees

225,850

261

218,120

204

Total

225,850

261

218,120

204

e.2. Information about the first and second group loans and other receivables including loans that have been restructured or rescheduled:

Cash Loans

Standard Loans and Other Receivables

Loans and Other Receivables Under Close Monitoring

Loans and Other

Receivables

Amendments on Conditions

of Contract

Loans and Other

receivables

Amendments on Conditions

of Contract

Amendments related

to the extension of the

payment plan

Other

Amendments related

to the extension of the

payment plan

Other

Non-specialized loans

164,745,201

2,725,429 1,821,940

2,888,091

711,175 112,423

Corporation loans

81,425,368

1,105,425

1,081,263

240,399

(1)

45,654

Export loans

8,123,264

10,956

58,156

2,697

Import loans

Loans Given to Financial Sector

4,011,488

Consumer loans

32,687,224

1,434,548 1,779,568

904,684

84,911

30,920

Credit Cards

9,667,375

438,143

250,261

Other

28,830,482

174,500 42,372

405,845

132,907 35,849

Specialized Loans

Other Receivables

Total

164,745,201

2,725,429 1,821,940

2,888,091

711,175 112,423

(1)

The amount of TL 32,808 loans provided to maritime sector which have extended payment plans within the scope of Temporary 6. Substance of the “Regulation on Procedures and Principles for Determination of

Qualifications of Loans and Other Receivables by Banks and Provisions to be Set Aside.

Standard Loans and

Other Receivables

Loans and Other Receivables

Under Close Monitoring

Number of Amendments Related to the Extension of the Payment Plan

Extended for 1 or 2 Times

2,658,922

697,728

(1)

Extended for 3,4 or 5 Times

65,899

13,384

(1)

Extended for More than 5 Times

608

63

(1)

The amount of TL 32,808 loans provided to maritime sector which have extended payment plans within the scope of Temporary 6. Substance of the “Regulation on Procedures and Principles for Determination of

Qualifications of Loans and Other Receivables by Banks and Provisions to be Set Aside.

Standard Loans and

Other Receivables

Loans and Other Receivables

Under Close Monitoring

The Time Extended via the Amendment on Payment Plan

0-6 Months

658,082

37,136

6 Months - 12 Months

292,853

69,029

1-2 Years

674,061

200,730

2-5 Years

811,575

259,214

(1)

5 Years and More

288,858

145,066

(1)

(1)

The amount of TL 32,808 loans provided to maritime sector which have extended payment plans within the scope of Temporary 6. Substance of the “Regulation on Procedures and Principles for Determination of

Qualifications of Loans and Other Receivables by Banks and Provisions to be Set Aside.