TÜRKİYE İŞ BANKASI A.Ş.

Notes to the Consolidated Financial Statements for the Year Ended

31 December 2014

205

İŞBANK

ANNUAL REPORT 2014

FINANCIAL INFORMATION AND

RISK MANAGEMENT

e.10.4.

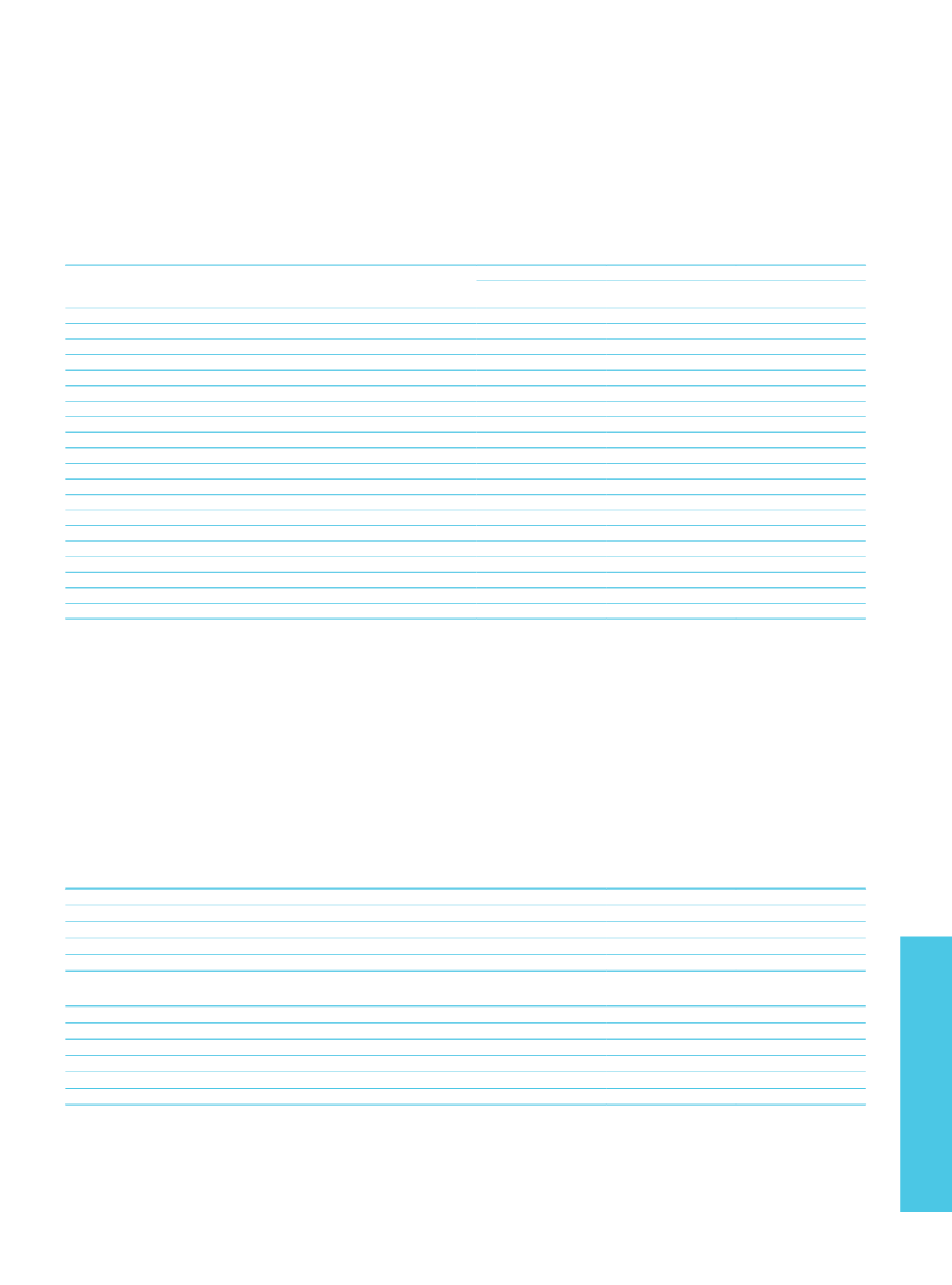

Information on gross and net non-performing loans and receivables as per customer categories:

Group III

Group IV

Group V

Loans and Receivables with

Limited Collectability

Loans and Receivables with

Doubtful Collectability

Uncollectible Loans and

Other Receivables

Current Period (Net)

305,900

264,183

124,713

Loans to Individuals and Corporate (Gross)

384,519

533,476

1,726,580

Specific Provisions (-)

78,619

269,293

1,601,867

Loans to Individuals and Corporate (Net)

305,900

264,183

124,713

Banks (Gross)

87

Specific Provisions (-)

87

Banks (Net)

Other Loans and Receivables (Gross)

54,839

Specific Provisions (-)

54,839

Other Loans and Receivables (Net)

Prior Period (Net)

232,953

247,678

65,721

Loans to Individuals and Corporate (Gross)

292,263

498,340

1,634,949

Specific Provisions (-)

59,310

250,662

1,569,228

Loans to Individuals and Corporate (Net)

232,953

247,678

65,721

Banks (Gross)

91

Specific Provisions (-)

91

Banks (Net)

Other Loans and Receivables (Gross)

50,690

Specific Provisions (-)

50,690

Other Loans and Receivables (Net)

e.11. Main principles of liquidating for uncollectible loans and other receivables:

In order to ensure the liquidation of non-performing loans, all possibilities evaluated to ensure maximum collection according to the legislation. First of all, administrative initiatives are

taken to deal with the borrower. Collection through legal proceedings used if there is no possibility of collection and configuration with the interviews for other receivables.

e.12. Explanations on write-off policy:

When the failure to obtain due to lack of legal follow-up, because of the absence of redeemable assets of debtors or although conversion of all the assets of debtors with the scope

of legal follow-up, there is a remaining receivable balance, receivable, by such evidence is available on borrowers, reduced to one. Such evidence cannot be obtained, uncollectible

receivables are written-off by the destruction

f. Held to Maturity Investments:

f.1. Information on held to maturity investments, which are given as collateral or blocked:

As of 31 December 2014, held to maturity investments, which are given as collateral or blocked amount to TL 447,605 (31 December 2013: TL 1,205,865).

f.2. Information on held to maturity investments, which are subject to repurchase agreements:

As of 31 December 2014, assets held to maturity, which are subject to repurchase agreements amount to TL 348,913 (31 December 2013: TL 5,492,696).

f.3. Information on government securities held to maturity:

Current Period

Prior Period

Government Bonds

1,307,192

7,704,816

Treasury Bills

Other Public Debt Securities

Total

1,307,192

7,704,816

f.4. Information on held-to-maturity investments:

Current Period

Prior Period

Debt Securities

1,391,860

7,728,447

Quoted on a Stock Exchange

1,169,369

7,704,816

Not Quoted

(1)

222,491

23,631

Impairment Losses (-)

Total

1,391,860

7,728,447

(1)

Indicates unlisted debt securities, and debt securities that have not been traded at the end of the related periods although they are listed.