4

İŞBANK

ANNUAL REPORT

2010

(1)

Interest earning assets include TL and FX legal reserves.

İşbank in Figures

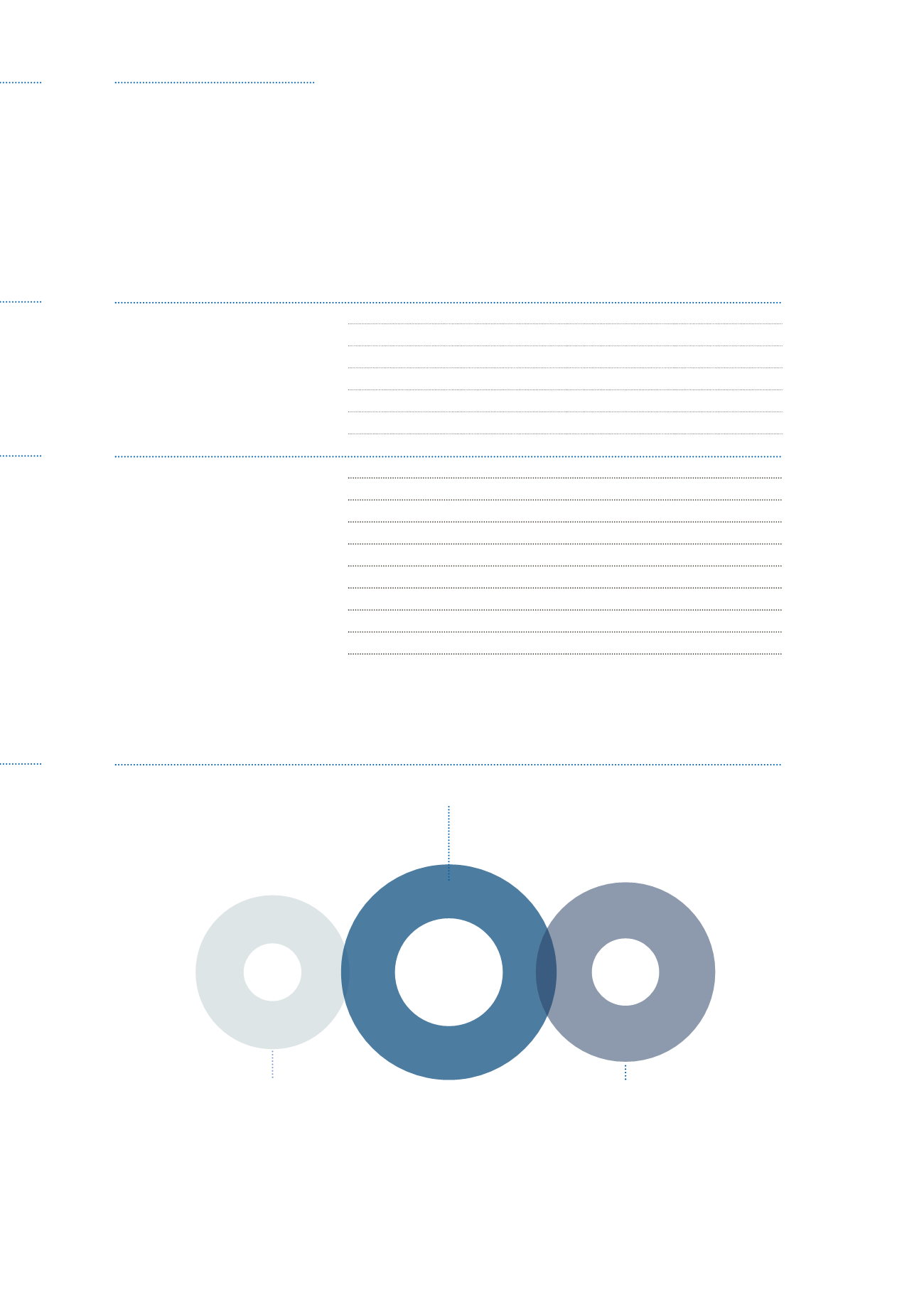

Shareholder Structure as of 31 December 2010

(%)

(1)

Key Financial Ratios

(%)

31.12.2009

31.12.2010

Interest Earning Assets

(1)

/ Total Assets

91.7

91.1

Loans / Total Assets

42.7

48.7

Loans / Deposits

67.0

72.8

NPL Ratio

5.4

3.6

NPL Coverage Ratio

100.0

100.0

Demand Deposits / Total Deposits

15.6

16.4

Shareholders’ Equity / Total Liabilities

11.9

12.9

Capital Adequacy Ratio

18.3

17.5

Key Financial Highlights

(TL million)

31.12.2009

31.12.2010

Change (%)

Total Assets

113,223

131,796

16.4

Loans

48,335

64,232

32.9

Deposits

72,177

88,260

22.3

Shareholders’ Equity

13,494

17,014

26.1

Net Profit

2,372

2,982

25.7

28.1

39.3

İşbank Personnel Supplementary

Pension Fund

Free Float

32.6

Atatürk Shares

(Republican People’s Party)

(1)

Source: Central Registry Agency (As of 31.12.2010)