ACTIVITIES

İŞBANK

ANNUAL REPORT 2014

17

CBRTmaintains a macro-prudential

stance onmonetary policy.

At the beginning of 2014, both the

volatilities in the global markets and

domestic uncertainties led to a significant

depreciation in the Turkish Lira. In order

to eliminate price stability concerns,

CBRT made a significant change in its

policy mix and identified one-week repo

auction interest rate as the main funding

instrument once again. In addition, CBRT

opted for a strong monetary tightening by

raising one-week repo rate to 10% from

4.5% in January 2014. CBRT maintained

a cautious monetary policy stance in

the first five months of the year. In line

with the improvement in risk perception

towards Turkey, CBRT reduced the policy

interest rate by 175 basis points to 8.25%

in the May-July period. CBRT did not make

any changes in the policy interest rate in

the rest of the year. However, to ensure

balanced growth and to strengthen

domestic savings, with an announcement

made in October, CBRT restarted paying

interest on TL reserve requirements of

financial institutions.

(*)

Currency Basket (0.5*

€

+0.5*USD) is calculated using monthly average currency rates of CBRT.

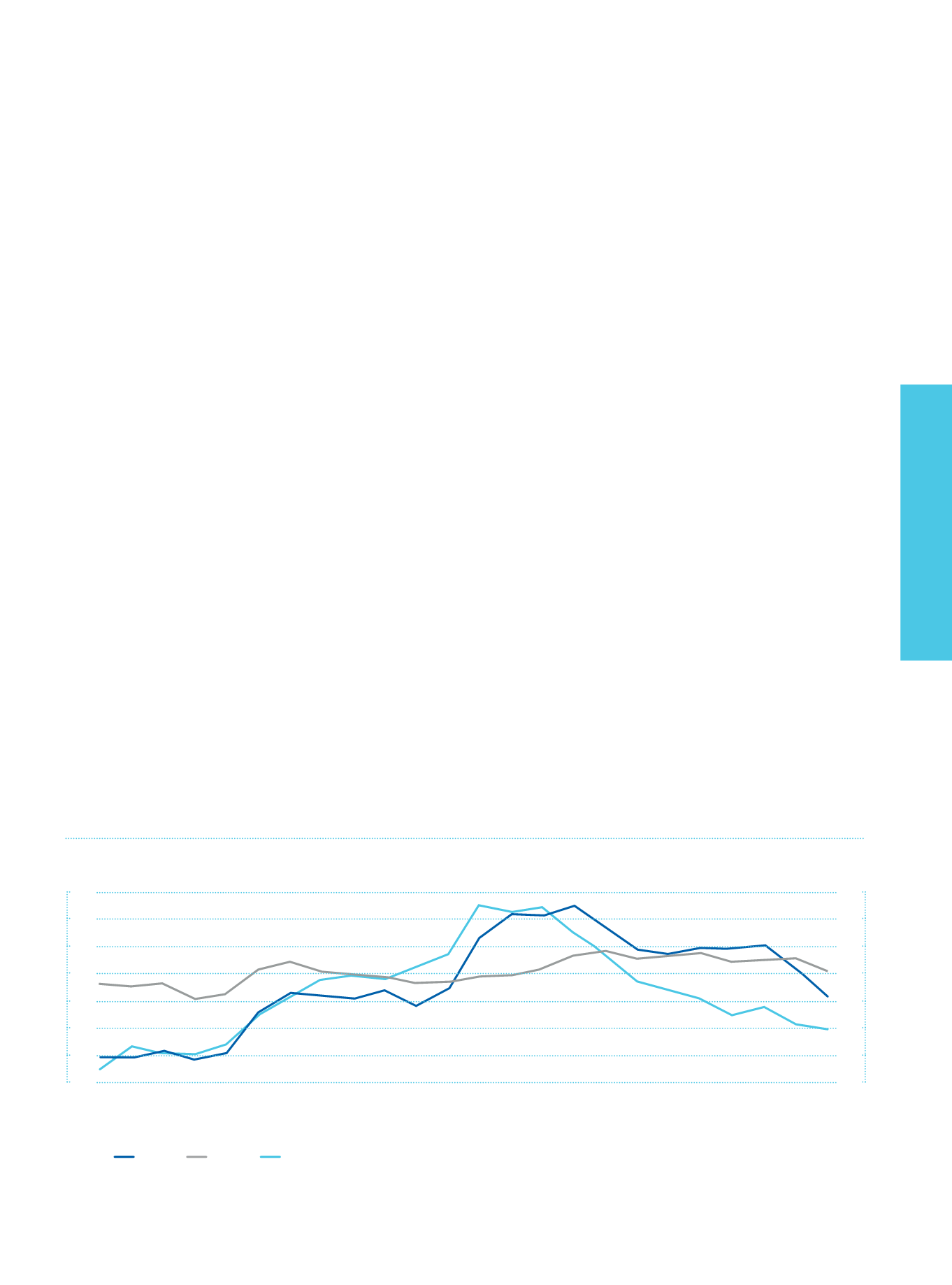

Inflation and FC Basket

(*)

(Annual Change)(%)

PPI

CPI

FC Basket

(right axis)

01/13

01/14

02/13

02/14

03/13

03/14

04/13

04/14

05/13

05/14

06/13

06/14

07/13

07/14

08/13

08/14

09/13

09/14

10/13

10/14

11/13

11/14

12/13

12/14

14

30

12

25

10

20

8

15

6

10

4

5

2

0

0

-5