ACTIVITIES

İŞBANK

ANNUAL REPORT 2014

23

By the end of 2014, the Bank’s NPL ratio

remained below the sector average, at

1.5%.

İşbank maintained a leadership position

among private banks in terms of total

deposits in 2014. The Bank increased its

total deposits by 10.4% year-on-year, to TL

133.6 billion.

As of end-2014, İşbank continued to hold

a leading position among private banks in

TL-denominated, FC-denominated, demand

and total deposits.

İşbank maintains an industry-leading position in terms

of total loans and shareholders’ equity; the Bank is also

the leader among private banks in terms of total assets,

deposits and branch network.

Having the highest market share among

private banks with Turkish Lira savings

deposits amounting to TL 50.0 billion,

İşbank played an active role in the process

of channeling savings to the country’s

economy in 2014.

In order to create long-term funds and

diversifying the Bank’s funding structure,

İşbank continued to effectively deploy non-

deposit funds in 2014. As a result of the

domestic and foreign bond issues carried

out in 2014 the sum of securities issued by

the Bank increased 69.9%, and comprised

7.2% of total liabilities at year’s end.

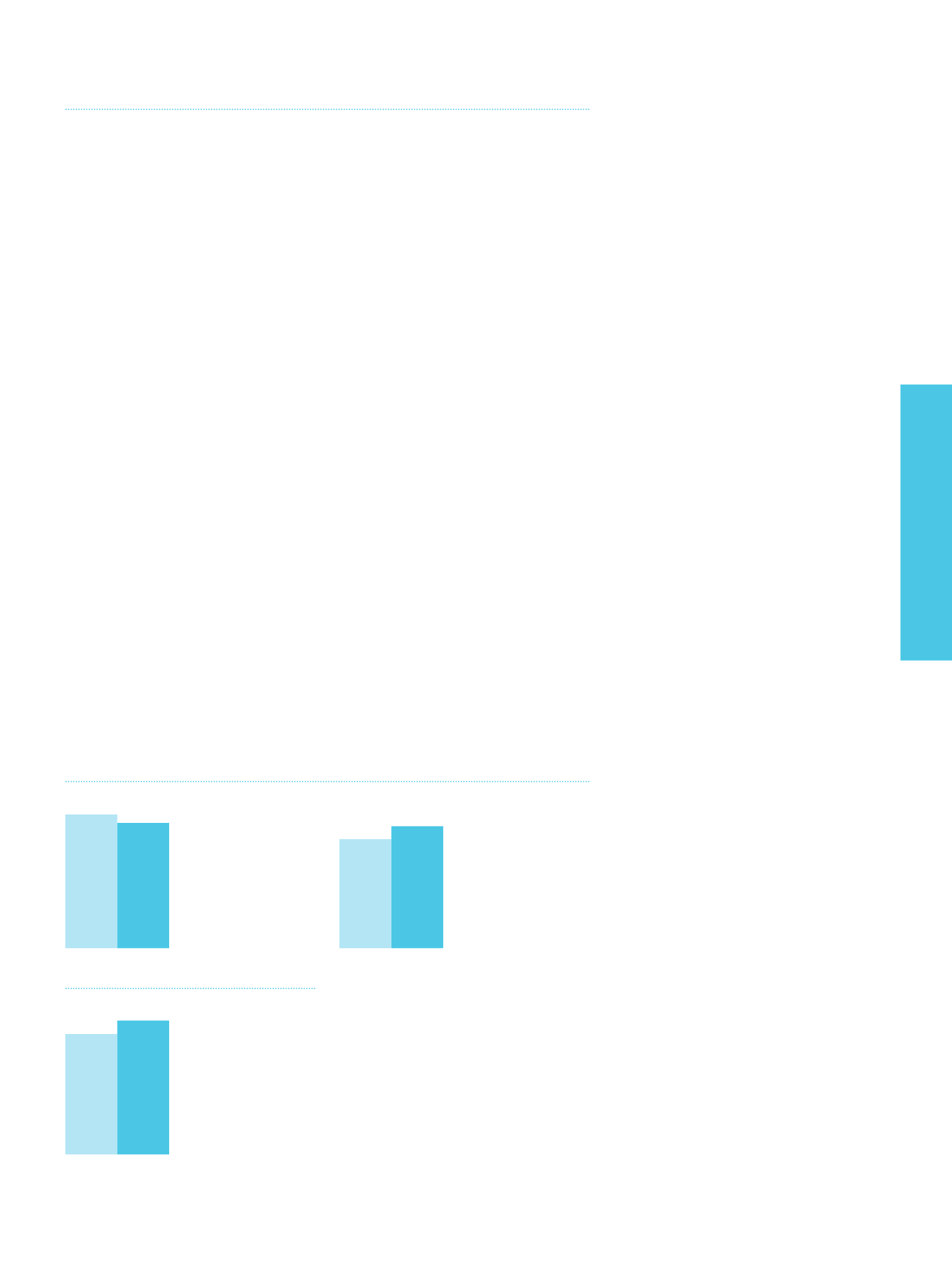

2013

6,655

2014

7,454

14.4

16.0

2013 2014

Net Interest Income

(TL million)

12.0%

İşbank’s net interest

income increased

12.0% in 2014.

Capital Adequacy Ratio

(%)

16.0%

During the year, İşbank’s

capital adequacy ratio

increased 1.6 points to

16.0%.

1.6

1.5

2013 2014

NPL Ratio

(%)

1.5%

In 2014, İşbank reduced

its NPL ratio by 0.1

points, to 1.5%.

İşbank also maintained a leading position

in the Turkish banking sector in terms of

shareholders’ equity, which increased

24.3% year-on-year, climbing to TL 29.3

billion by end-of-year 2014.

İşbank’s capital adequacy ratio stood

at 16.0% at end-2014, well above the

regulatory requirements.

In 2014, İşbank’s net interest income

increased 12.0% compared to the previous

year.