İŞBANK

ANNUAL REPORT 2014

18

BANKING

SECTOR

Developments in the Banking Sector

in 2014

Slowdown in loan volume growth

The banking sector continued to achieve

stable growth in 2014 with increasing

asset size, rising employee numbers and

expanding branch networks. The total

assets of the banking sector grew by 15.5%

on a year-on-year basis, to TL 1,890

(*)

billion by the end of 2014.

The moderate course of domestic demand

in 2014 was the main factor that pressured

loan volume growth. Measures taken by the

BRSA led to slower growth in retail loans in

particular. In addition, the CBRT’s decision to

raise interest rates in January 2014 resulted

in an increase in the sector’s funding costs

in the first quarter of the year. However,

the interest rate cuts carried out in the

following periods paved the way for sector-

wide decreases in funding costs again.

Despite fluctuations in international markets, the banking

sector did not experience difficulties in obtaining funds

from abroad in 2014.

(*)

Calculated using monthly sector data published by the Banking Regulation and Supervision Agency. Interest accruals and rediscounts are not taken into

account. Participation banks are excluded from sector numbers.

15.5%

Total asset volume of the banking

sector increased by 15.5% year-

on-year, to TL 1,890

(*)

billion.

16.4%

The sector’s capital adequacy

ratio increased from 15.3%

(*)

at end-2013 to 16.4%

(*)

as of

December 2014.

Source: BRSA Monthly Bulletin

(*)

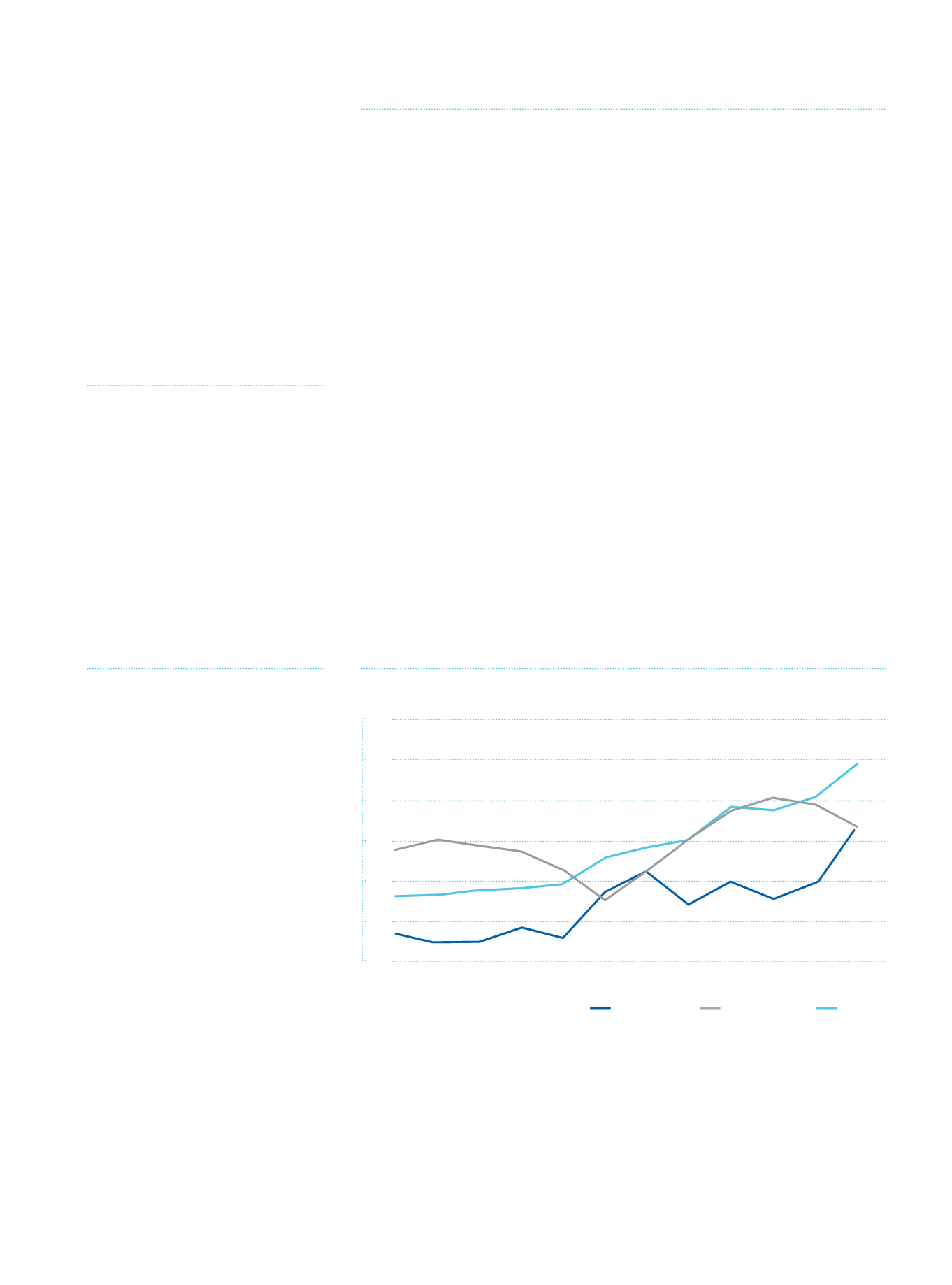

Deposits and Loans in 2014

(Change Compared to 2013) (%)

0

5

10

15

20

25

TL Deposits

FC Deposits

Loans

-5

January

April

November

September

February

June

May

October

March

August

July

December